Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust

Description Hardship Loans 401k

How to fill out Sample 401k Statement?

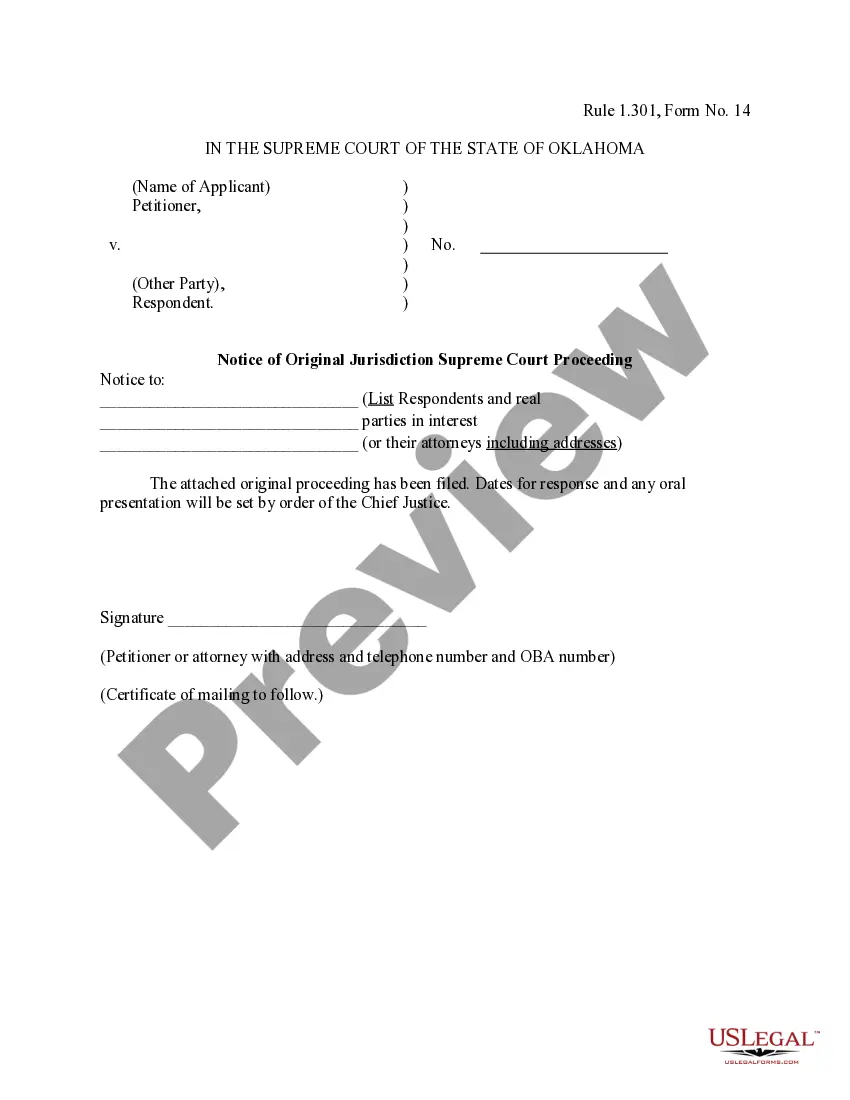

When it comes to drafting a legal form, it is better to leave it to the professionals. However, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself can not find a template to utilize, however. Download Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you’re signed up with an account, log in, find a certain document template, and save it to My Forms or download it to your device.

To make things easier, we have included an 8-step how-to guide for finding and downloading Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust promptly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

When the Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust is downloaded you are able to fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of minutes in a preferable format with US Legal Forms!

Retirement Form Letter Form popularity

Example Of Hardship Letter For 401k Withdrawal Other Form Names

Hardship For 401k FAQ

1Paying for Account Management.2Contribute the Max for the Match.3Learn the Basics of Investing.4Be Sure to Rebalance.5Learn to Love the Index Fund.6Be Wary of Target Date Funds.7Go Beyond Your 401(k)8The Bottom Line.

Call Your Old Employer. Use an Old 401(k) Plan Statement. Ask Former Employees. Be a Sleuth. Use Additional Government Document Recovery Tools. Leverage the National Registry. Looked for Unclaimed Money.

1Leave It With Your Former Employer.2Roll It Over to Your New Employer.3Roll It Over Into an IRA.4Take Distributions.5Cash It Out.6The Bottom Line.

Call 800-FIDELITY or 800-343-3548. Contact us to determine which retirement options would work best for you. I have a specific question about my 401(k) plan. Where can I learn more?

Since your 401(k) is tied to your employer, when you quit your job, you won't be able to contribute to it anymore. But the money already in the account is still yours, and it can usually just stay put in that account for as long as you want with a couple of exceptions.

The amount of cash that's in the fund when you retire is what you will receive as a pension. Thus, there is no guarantee that you will receive anything from this defined-contribution plan. The fund may lose all (or a substantial part) of its value in the markets just as you're ready to start taking distributions.

If you already have a 401(k) and want to check the balance, it's pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account.

Also, 401(k) money is protected from creditors in the event you had to file for personal bankruptcy, and by cashing it out, you will lose this protection. 1feff You will also be eroding your nest egg and would be better off using an IRA rollover or making a transfer to a new 401(k) plan instead of cashing in this money.