Recapitalization Agreement

Description Food Adulteration Paragraph

How to fill out Recapitalization Definition?

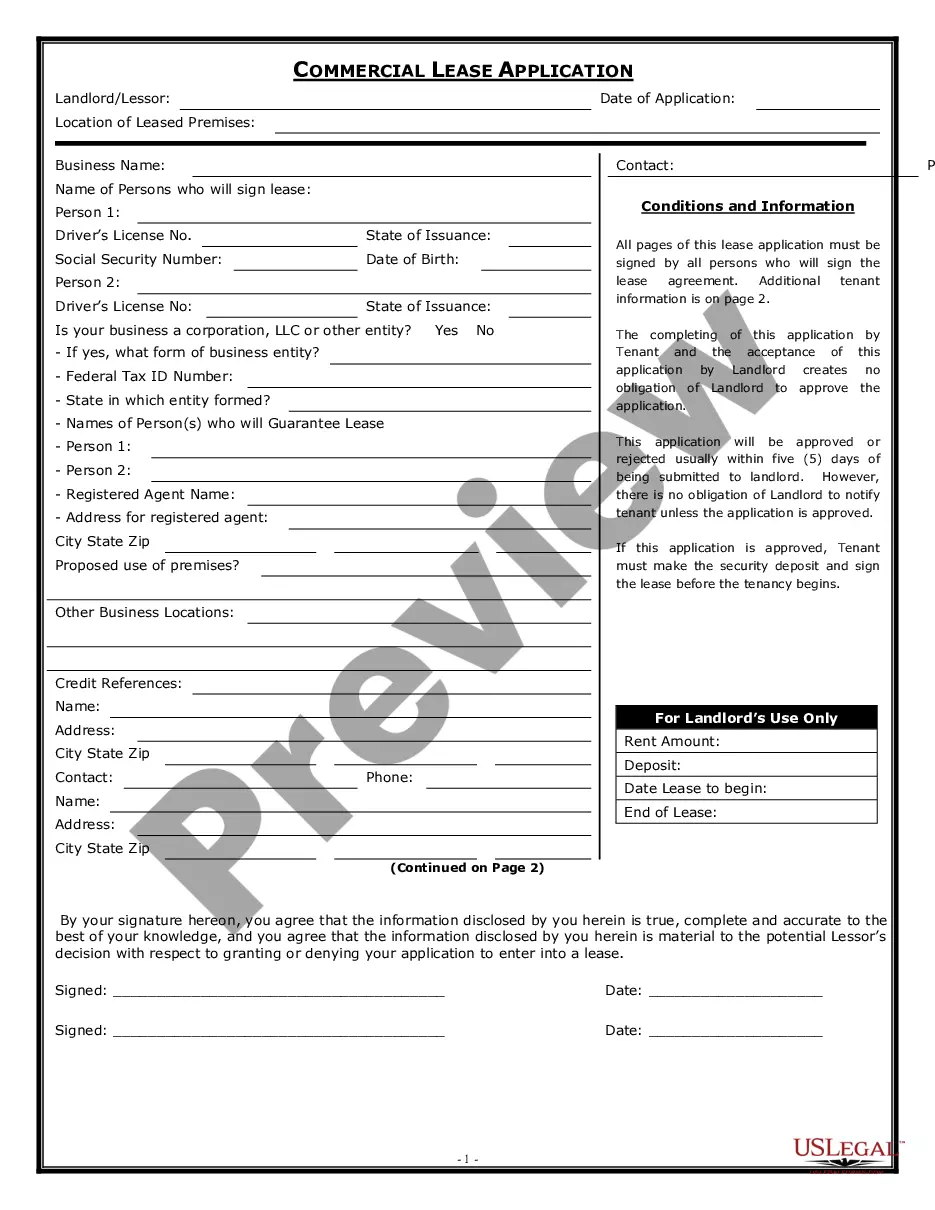

When it comes to drafting a legal document, it is better to delegate it to the experts. However, that doesn't mean you yourself can not get a template to utilize. That doesn't mean you yourself can’t get a template to use, however. Download Recapitalization Agreement straight from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. Once you’re signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have incorporated an 8-step how-to guide for finding and downloading Recapitalization Agreement quickly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Recapitalization Agreement is downloaded you are able to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Recapitalization Agreement Online Form popularity

Agree Merge Purchase Other Form Names

Sample Letter To Irs To Waive Penalty FAQ

A dividend recapitalization is often undertaken as a way to free up money for the PE firm to give back to its investors, without necessitating an IPO, which might be risky. A dividend recapitalization is an infrequent occurrence, and different from a company declaring regular dividends, derived from earnings.

Recapitalization is the process of restructuring a company's debt and equity mixture, often to stabilize a company's capital structure. The process mainly involves the exchange of one form of financing for another, such as removing preferred shares from the company's capital structure and replacing them with bonds.

An equity recapitalization represents an alternative to a complete sale of a company. The original owner can continue as a partner and/or manager of the company, while the new partner is a private equity firm that shares the business owner's culture and vision for the future.

Recapitalization is the process of restructuring a company's debt and equity mixture, often to stabilize a company's capital structure. The process mainly involves the exchange of one form of financing for another, such as removing preferred shares from the company's capital structure and replacing them with bonds.

Consequently, a recapitalization is only good news for investors willing to take the special dividend and run, or in those cases where it is a prelude to a deal that is actually worthy of the debt load and the risks it brings. (To learn more, see Evaluating a Company's Capital Structure.)

Verb. to provide (a bank, financial institution, or corporation) with more capital.

The term 'recapitalisation' refers to a company changing the proportions of its debt and equity, something which can be achieved in a variety of ways.