Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

Description Management Llc Company

How to fill out Between Liability Company?

When it comes to drafting a legal document, it is easier to leave it to the specialists. However, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself cannot get a sample to utilize, however. Download Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you are signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve provided an 8-step how-to guide for finding and downloading Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC quickly:

- Make sure the document meets all the necessary state requirements.

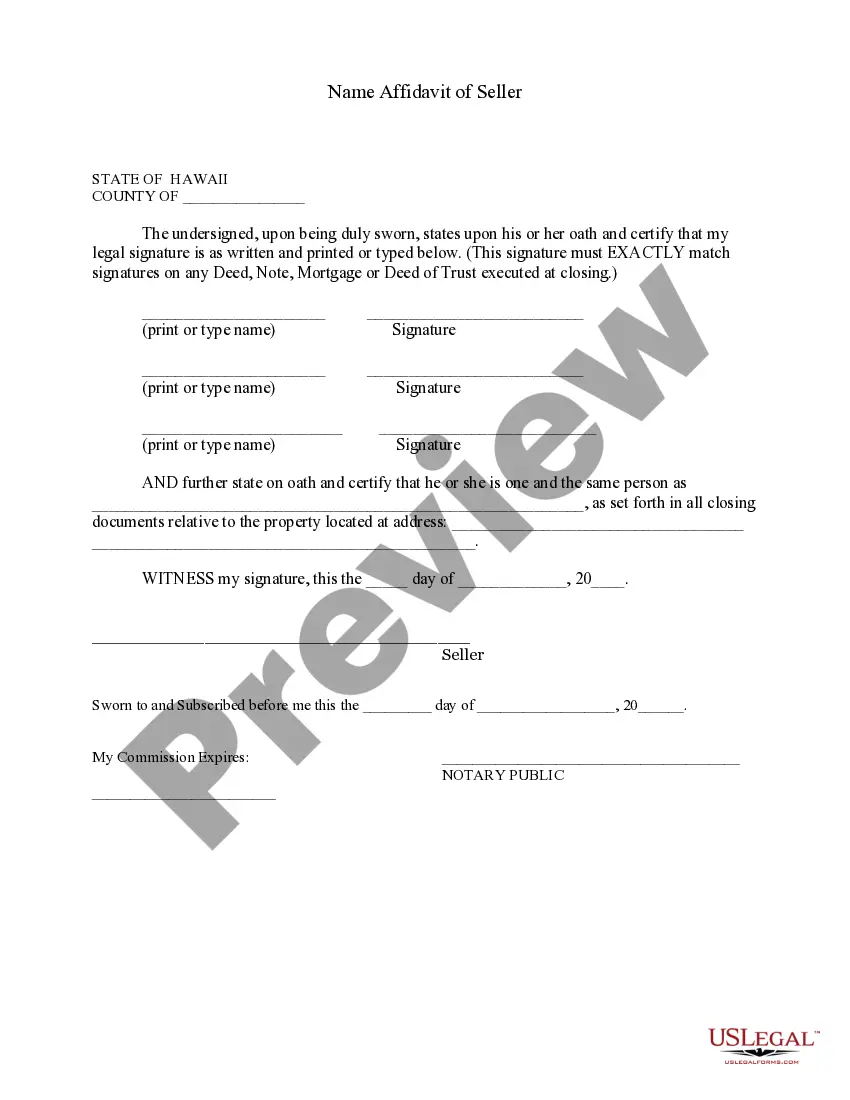

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Choose the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

Once the Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC is downloaded you may complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Management Agreement Llc Form popularity

Llc Company Form Other Form Names

Llc Limited Liability Agreement FAQ

If you form an LLC, you will remain personally liable for any wrongdoing you commit during the course of your LLC business. For example, LLC owners can be held personally liable if they: personally and directly injure someone during the course of business due to their negligence.

Understanding an LLC's Limited Liability Protection. Obtain LLC Insurance. Maintain Your LLC as an Independent Entity. Establish LLC Credit. Keep Just Enough Money in the Company.

Limited liability is a form of legal protection for shareholders and owners that prevents individuals from being held personally responsible for their company's debts or financial losses.Keep finances separate from the owners' personal finances.

Limited liability companies (LLCs) are common ways for real estate owners and developers to hold title to property.In other words, only an LLC member's equity investment is usually at risk, not his or her personal assets. However, this does not mean personal liability never exists for the LLC's debts and liabilities.

Limited liability is a legal status where a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership.Although a shareholder's liability for the company's actions is limited, the shareholders may still be liable for their own acts.

Like shareholders of a corporation, all LLC owners are protected from personal liability for business debts and claims.Because only LLC assets are used to pay off business debts, LLC owners stand to lose only the money that they've invested in the LLC. This feature is often called "limited liability."

A limited liability company, commonly referred to as an LLC, is a type of business structure commonly used in the United States. LLCs can be seen as a hybrid structure that combines features of both a corporation and a partnership.

Personal Liability for Actions by LLC Co-Owners and Employees. In all states, having an LLC will protect owners from personal liability for any wrongdoing committed by the co-owners or employees of an LLC during the course of business.

Contracts. First and foremost is my favorite tool in business, Contracts. Insurance. The next layer of protection is Insurance. Entity Formation. Once your contracts and insurance are in place, be sure everything is done through your entity. Record Keeping. Watch who you work with.