Amendment No. 3 to Managed Network Agreement between Sprint Communications Company, LP and Bridge Data Company

Description Agreement Lp

How to fill out Amendment No. 3 To Managed Network Agreement Between Sprint Communications Company, LP And Bridge Data Company?

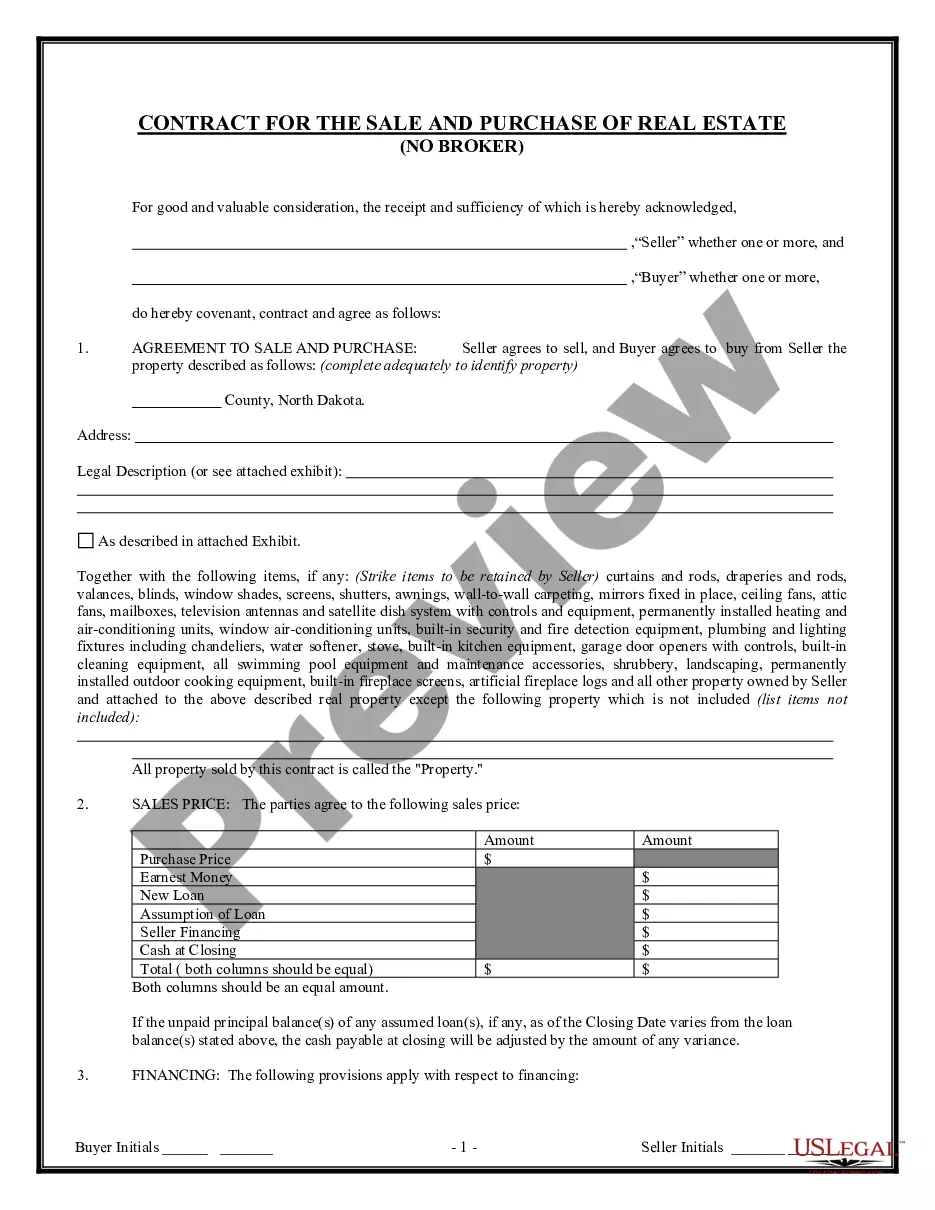

When it comes to drafting a legal document, it’s better to delegate it to the professionals. However, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself can’t get a template to utilize, nevertheless. Download Amendment No. 3 to Managed Network Agreement between Sprint Communications Company, LP and Bridge Data Company right from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. Once you are signed up with an account, log in, search for a specific document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Amendment No. 3 to Managed Network Agreement between Sprint Communications Company, LP and Bridge Data Company quickly:

- Be sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Click Buy Now.

- Select the appropriate subscription for your requirements.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Amendment No. 3 to Managed Network Agreement between Sprint Communications Company, LP and Bridge Data Company is downloaded you can fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Managed Agreement Form popularity

Managed Agreement Between Other Form Names

FAQ

A limited partnership (LP)not to be confused with a limited liability partnership (LLP)is a partnership made up of two or more partners. The general partner oversees and runs the business while limited partners do not partake in managing the business.

An LP, also referred to as a limited partnership, consists of limited partners, which is unlike the general partnership that consists of general partners. An LLC, or limited liability company, consists of members (owners).

A limited partnership (LP) is where two or more people own a business, but there are two classes of partners: general partners (who own and operate the business), and limited partners (who invest their money or property in the business, do not have the right to make decisions regarding the operation of the business,

An LLC is a hybrid of a corporation and a partnership. All members of an LLC receive limited liability and the company can be exempt from double taxation.Company assets are owned by the LP. Ownership interests in the LP can be assigned freely subject to the approval of the general partner, in this case the LLC.

What Is a Limited Partnership (LP)? A limited partnership (LP)not to be confused with a limited liability partnership (LLP)is a partnership made up of two or more partners. The general partner oversees and runs the business while limited partners do not partake in managing the business.

What Is a Limited Partnership (LP)? A limited partnership (LP)not to be confused with a limited liability partnership (LLP)is a partnership made up of two or more partners. The general partner oversees and runs the business while limited partners do not partake in managing the business.

Liability Protection Differences If you're operating as a limited partnership, the general partner has unlimited liability for company losses and debts, while a limited partner has limited liability protection against company debts and losses.

Limited Partnership (LP) This business structure can be seen as a cross between a general partnership and a corporation, where limited liability protection exists for some partners.At least one partner must be a limited partner.

An LP, also referred to as a limited partnership, consists of limited partners, which is unlike the general partnership that consists of general partners. An LLC, or limited liability company, consists of members (owners).