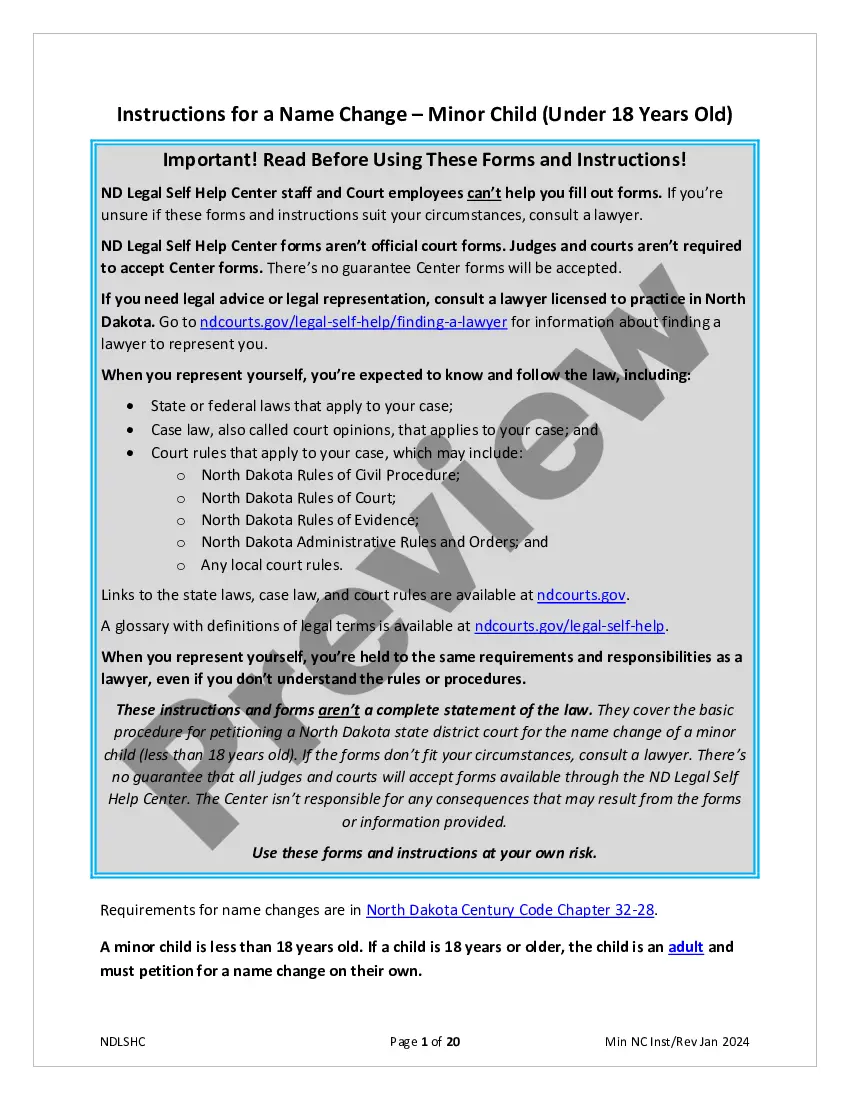

A Stock Unit Award Agreement is a contract between an employer and an employee that outlines the conditions under which the employee will receive company stock units. This type of agreement is common for incentive programs that are designed to reward employees for their performance. There are two types of Stock Unit Award Agreements: Non-Qualified Stock Unit Awards and Incentive Stock Unit Awards. Non-Qualified Stock Unit Awards are taxable upon grant and vesting, whereas Incentive Stock Unit Awards are not taxable until the employee sells the stock. Both types of agreements typically include provisions for vesting, taxation, and forfeiture. The agreement also outlines the administrative procedures for granting and tracking stock units, as well as the employee's responsibilities with respect to the units.

Stock Unit Award Agreement

Description

How to fill out Stock Unit Award Agreement?

If you’re looking for a way to properly prepare the Stock Unit Award Agreement without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of documentation you find on our web service is created in accordance with federal and state laws, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to get the ready-to-use Stock Unit Award Agreement:

- Ensure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Stock Unit Award Agreement and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

RSUs are currently the most common type of equity award. They are a promise from the employer to grant company shares to their employees at a future date (or series of dates). RSUs typically vest over a period of time. Some awards may be contingent on meeting specific performance marks (Performance Shares noted below).

Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock.

The Stock Award is an unfunded and unsecured promise by the Company to deliver shares in the future. Capitalized terms used and not otherwise defined herein are used with the same meanings as in the Plan.

Each RSU will correspond to a certain number and value of employer stock. For example, suppose your RSU agreement states that one RSU corresponds to one share of company stock, which currently trades for $20 per share. If you're offered 100 RSUs, then your units are worth 100 shares of stock with a value of $2,000.

RSUs are taxed as income to you when they vest. If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes. If instead, the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

A good RSU offer is one that should incentivize you to put your best foot forward. One of the primary purposes of offering employees company equity is to encourage them to feel as though they have a stake in the company.

A stock option award is a type of compensation contract that companies use to incentivize employees. This contract is an agreement between the company and employee that gives them the right, but not the obligation, to purchase shares of company stock at a set price in the future (usually for pennies on the dollar).

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.