A Summary of Your Rights Under the Fair Credit Reporting Act

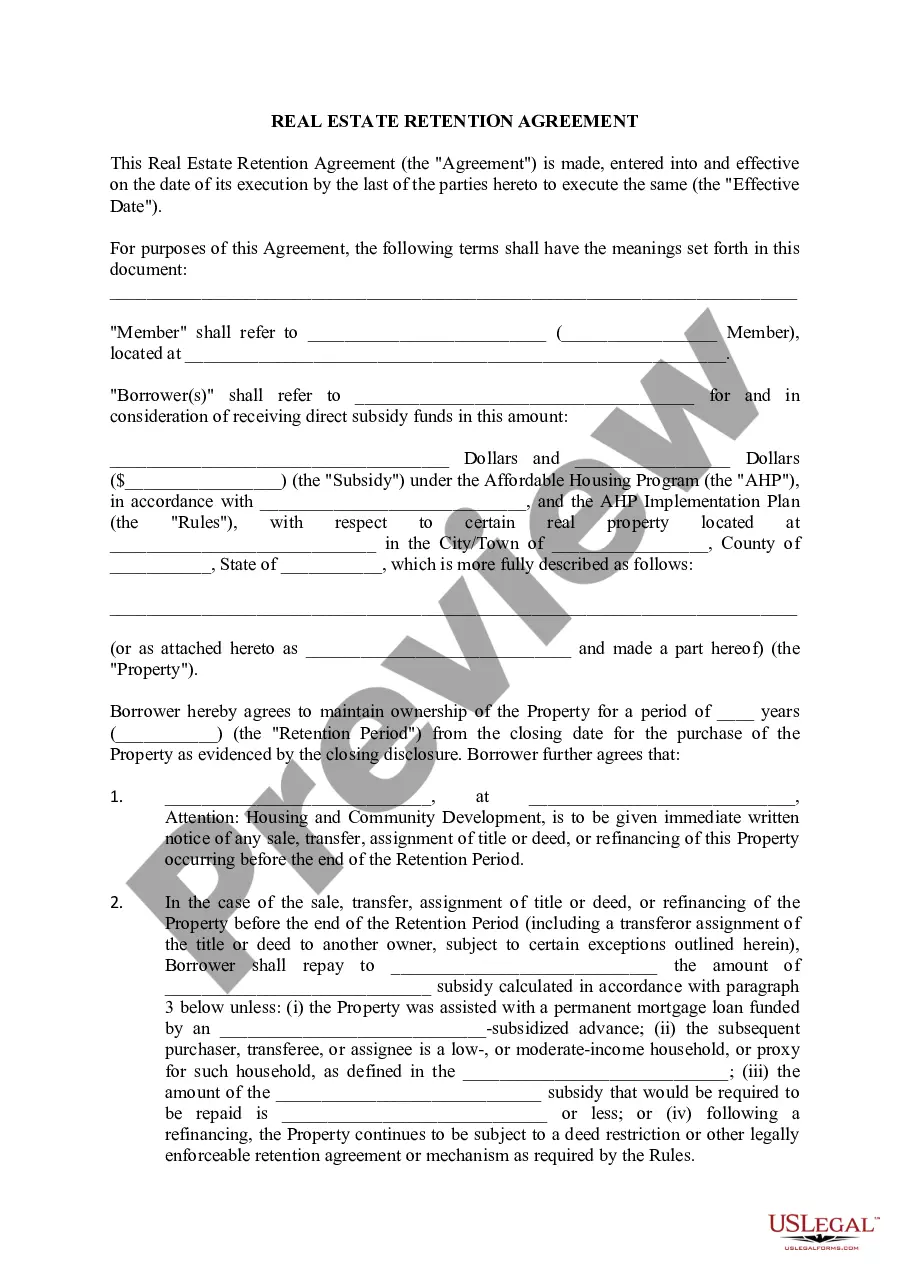

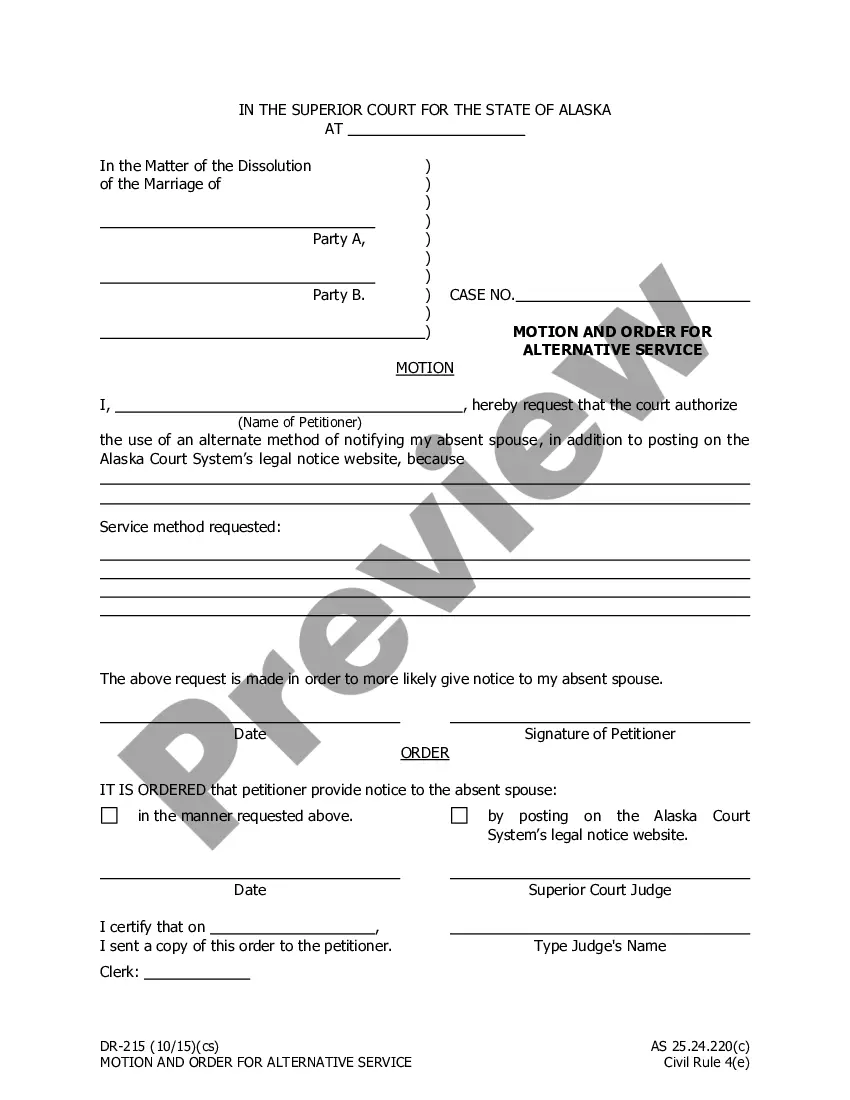

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

When it comes to drafting a legal document, it is better to leave it to the experts. Nevertheless, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself can not get a template to utilize, nevertheless. Download A Summary of Your Rights Under the Fair Credit Reporting Act straight from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. As soon as you’re registered with an account, log in, find a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading A Summary of Your Rights Under the Fair Credit Reporting Act quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Click Buy Now.

- Select the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

After the A Summary of Your Rights Under the Fair Credit Reporting Act is downloaded it is possible to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.

2022 You have the right to know what is in your file.report; 2022 you are the victim of identity theft and place a fraud alert in your file; 2022 your file contains inaccurate information as a result of fraud; 2022 you are on public assistance; 2022 you are unemployed but expect to apply for employment within 60 days.

You have the right to know what's in your credit reports. The act requires credit reporting agencies to give you free access to the information they have collected about you and your financial habits once every 12 months.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

Under the Equal Credit Opportunity Act: You cannot be denied credit based on your race, sex, marital status, religion, age, national origin, or receipt of public assistance. You have the right to have reliable public assistance considered in the same manner as other income.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

The Summary of Consumer Rights explains certain major consumer rights under the FCRA, including the right to obtain a copy of a consumer report, the frequency and circumstances under which a consumer is entitled to receive a free consumer report, the right to dispute information in a consumer's file, and the right to

The Fair Credit Reporting Act (FCRA) is a federal law that regulates credit reporting agencies and compels them to insure the information they gather and distribute is a fair and accurate summary of a consumer's credit history.The law is intended to protect consumers from misinformation being used against them.

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.