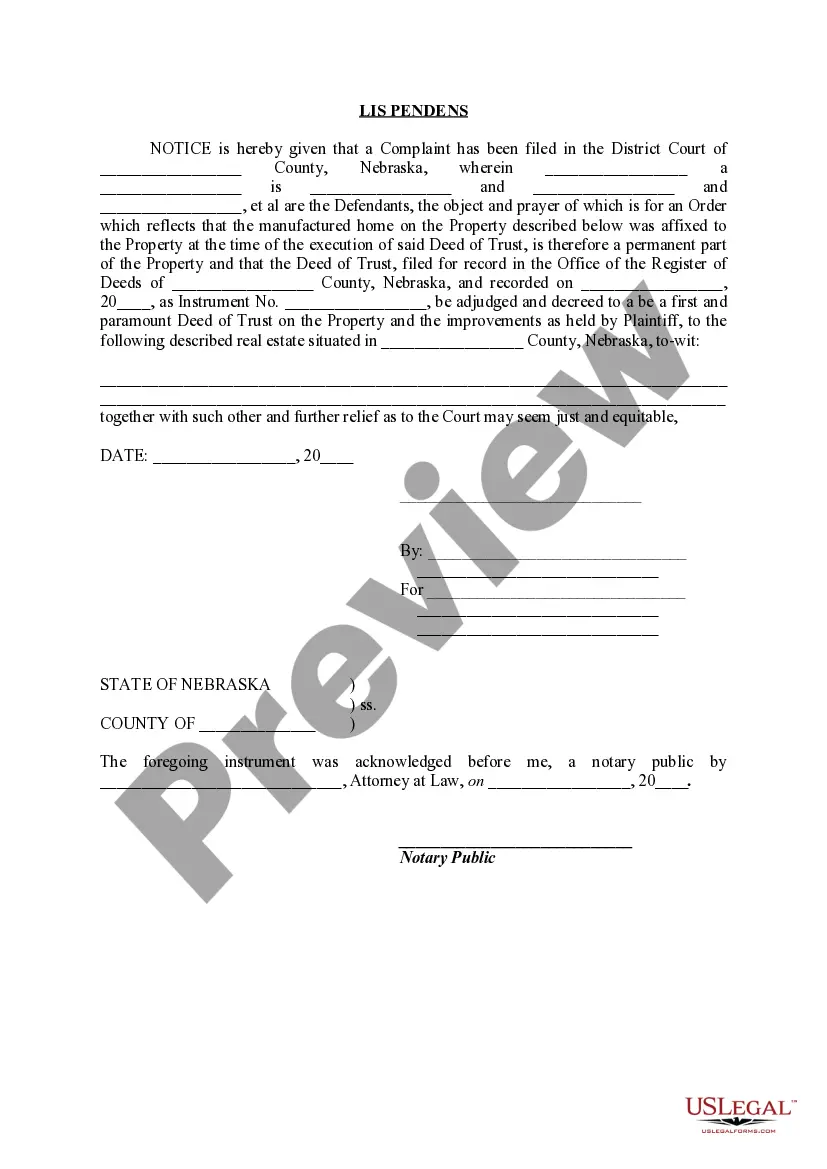

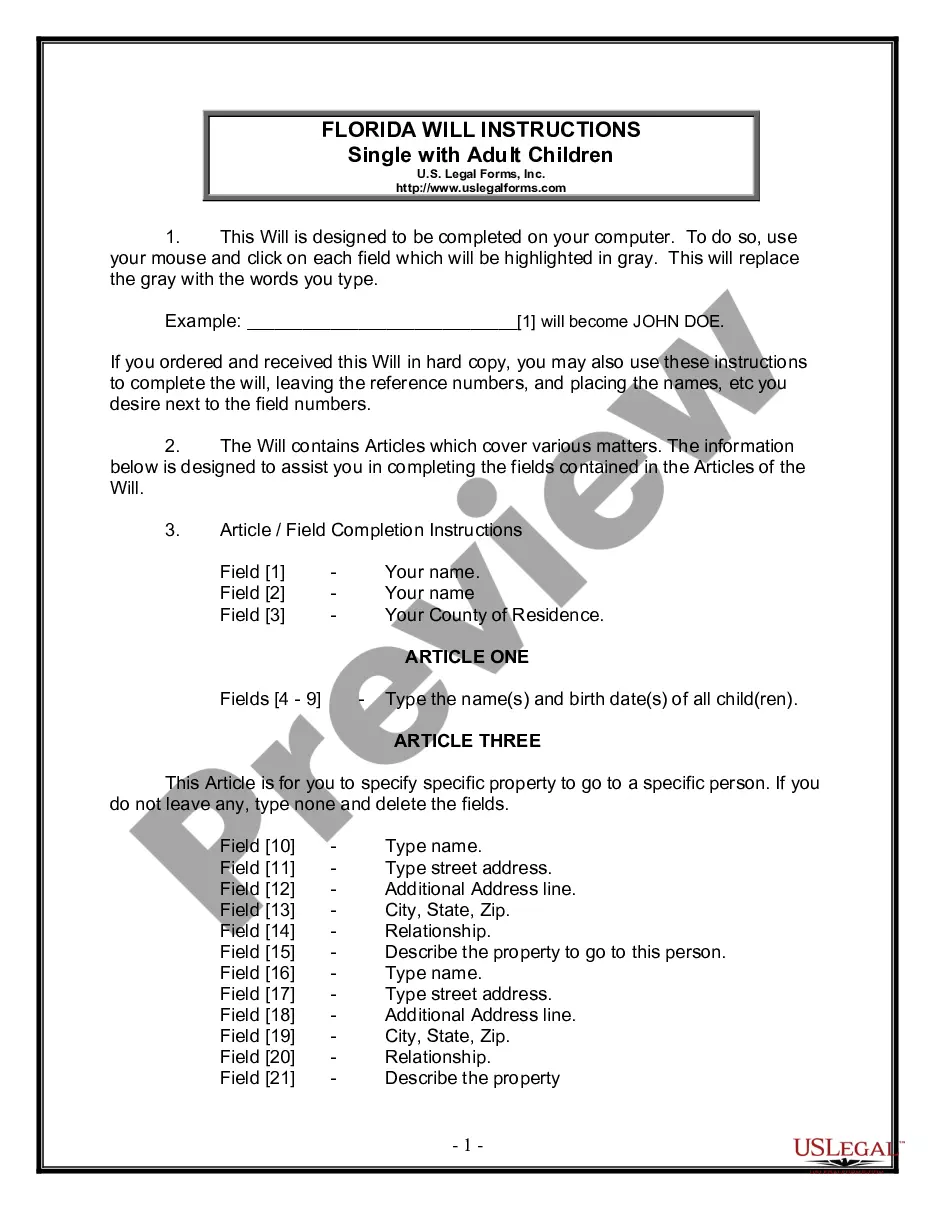

"Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance" is a American Lawyer Media form. This form servesnotice to special hazards availability of Federal Disaster Relief Assistance.

Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance

Description Notice Of Special Flood Hazards

How to fill out Notice Of Special Flood Hazards Availability Of Federal Disaster Relief Assistance?

When it comes to drafting a legal form, it is better to leave it to the specialists. However, that doesn't mean you yourself can’t get a template to use. That doesn't mean you yourself cannot get a template to use, nevertheless. Download Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you are registered with an account, log in, find a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we’ve included an 8-step how-to guide for finding and downloading Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance fast:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Notice of Special Flood Hazards Availability of Federal Disaster Relief Assistance is downloaded you are able to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

The SBA requires all borrowers to obtain flood insurance if any collateral is located in a special flood hazard area.It is the responsibility of lenders and CDCs to notify borrowers if flood insurance must be maintained for the life of the loan.

If a bank makes, increases, extends, or renews a loan secured by a residential property, and the property is required to have flood insurance under the National Flood Insurance Act, then the bank, or servicer acting on its behalf, is required to escrow all premiums and fees for the flood insurance, unless the bank or

Lenders are permitted to require more flood insurance coverage than the minimum amount required by the National Flood Insurance Act (Act). If the flood insurance requested by the lender is greater than $250,000, then you or the lender may have to seek such coverage from a private insurance company.

The Standard Flood Hazard Determination Form (SFHDF) identifies whether a property is located in a special flood hazard area, if the borrower is required to obtain flood insurance, and if federal flood insurance is available.SFHDF are generated by a Flood Zone Determination Company.

Lenders are permitted to require more flood insurance coverage than the minimum amount required by the National Flood Insurance Act (Act). If the flood insurance requested by the lender is greater than $250,000, then you or the lender may have to seek such coverage from a private insurance company.

If a bank makes, increases, extends, or renews a loan secured by a residential property, and the property is required to have flood insurance under the National Flood Insurance Act, then the bank, or servicer acting on its behalf, is required to escrow all premiums and fees for the flood insurance, unless the bank or

If you are successful in obtaining the LOMA, give it to the lender and they will usually waive the flood insurance requirement by making a redetermination or simply writing you a letter. Give the lender's letter or form to your insurance agent and ask for a cancellation of your policy.

#1 Get an Elevation Certificate. Flood insurance is based on the flood zone you are in and how much water will get into your house. #2 Get a Letter of Map Amendment (LOMA) #3 Structural Improvements. #4 Community Involvement. #5 Compare Rates.

Fannie Mae does not require an escrow deposit for property or flood insurance premiums for an individual unit in a condo, co-op, or PUD when the project in which the unit is located is covered by a blanket insurance policy purchased by the homeowners' association or co-op corporation.