Federal Consumer Leasing Act Disclosure Form

Description Consumer Act

How to fill out Consumer Disclosure Form Agreement?

When it comes to drafting a legal form, it is better to delegate it to the specialists. Nevertheless, that doesn't mean you yourself cannot find a template to utilize. That doesn't mean you yourself cannot find a sample to use, however. Download Federal Consumer Leasing Act Disclosure Form right from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you’re signed up with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Federal Consumer Leasing Act Disclosure Form promptly:

- Be sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the appropriate subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Federal Consumer Leasing Act Disclosure Form is downloaded it is possible to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Leasing Act Form popularity

Federal Leasing Act Other Form Names

Consumer Leasing Paper FAQ

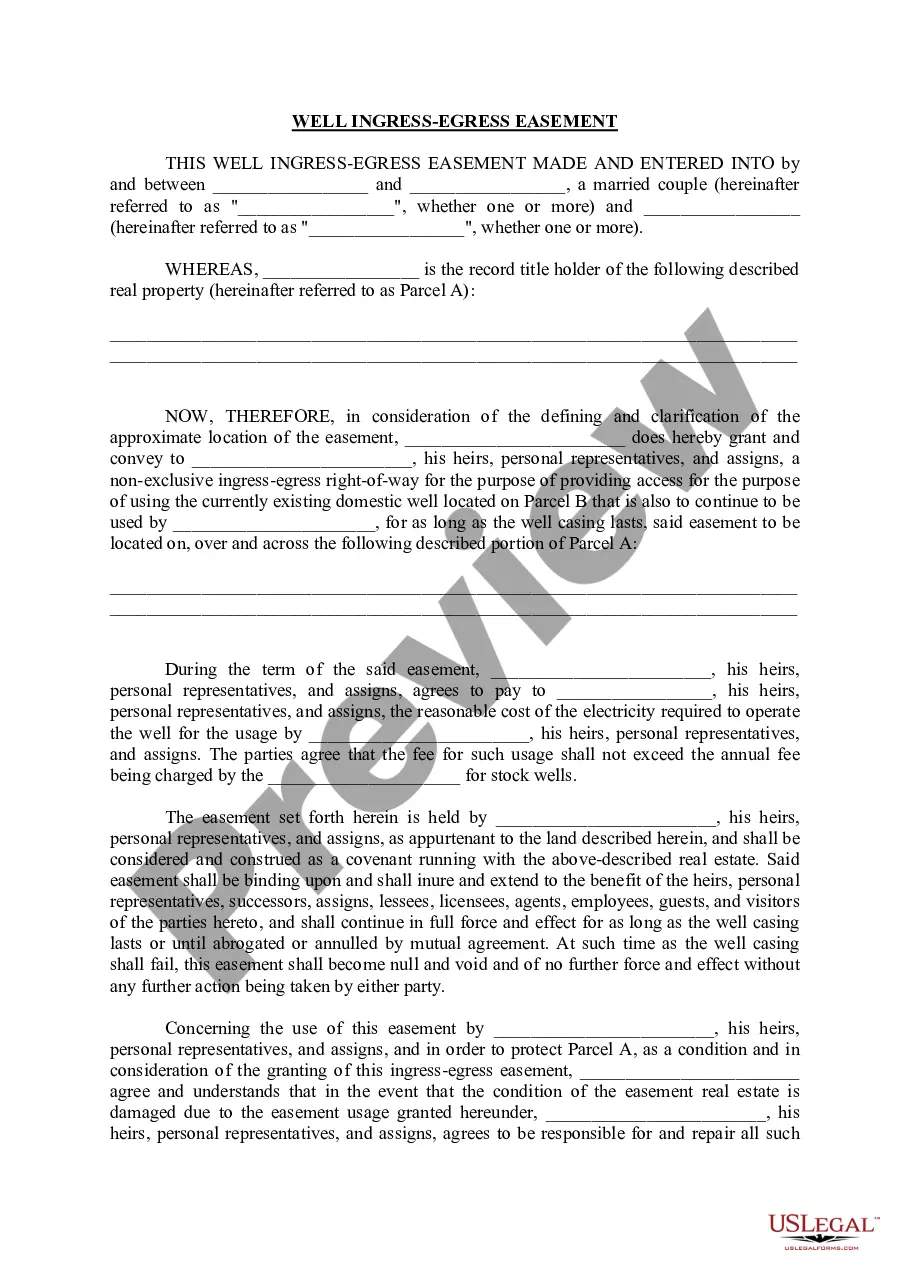

Regulation M, Consumer Leasing, implements the Consumer Leasing Act (15 USC 1667 et seq.), which was enacted in 1976. A major purpose of the act is to ensure that consumers receive meaningful and accurate disclosure of the terms of a lease before entering into a contract to lease personal property.

"Mineral rights" entitle a person or organization to explore and produce the rocks, minerals, oil and gas found at or below the surface of a tract of land. The owner of mineral rights can sell, lease, gift or bequest them to others individually or entirely.

The OCC regulation treats a lease as a loan or extension of credit, and paragraph (iii)(A) is intended to cover most credit transactions.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

Selling means that you can receive a large cash payment upfront, regardless of minerals found on your land. A company who leases your land may deplete the mineral supply substantially before returning the land back to you. Selling reduces overall risk of handling mineral rights.

A mineral lease is a property conveyance because the mineral owner grants a transfer of possession, easements or other property rights through the document.

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for money or other assets. The two most common types of leases in accounting are operating and financing (capital leases). Advantages, disadvantages, and examples. Lessor vs Lessee.

A consumer lease is a lease contract where someone (a lessee) is leasing goods for personal use and either has an option to purchase the leased goods, or the term of the lease is over 1 year.

Mineral Leasing Act of 1920, as amended (30 U.S.C. 181 et seq.) authorizes and governs leasing of public lands for development of deposits of coal, oil, gas and other hydrocarbons, sulphur, phosphate, potassium and sodium.