Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description Hamp Application

How to fill out Rma Hamp?

When it comes to drafting a legal document, it’s easier to leave it to the specialists. Nevertheless, that doesn't mean you yourself cannot find a template to utilize. That doesn't mean you yourself can not find a template to use, however. Download Request for Loan Modification RMA Under Home Affordable Modification Program HAMP from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. As soon as you’re registered with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have provided an 8-step how-to guide for finding and downloading Request for Loan Modification RMA Under Home Affordable Modification Program HAMP promptly:

- Be sure the form meets all the necessary state requirements.

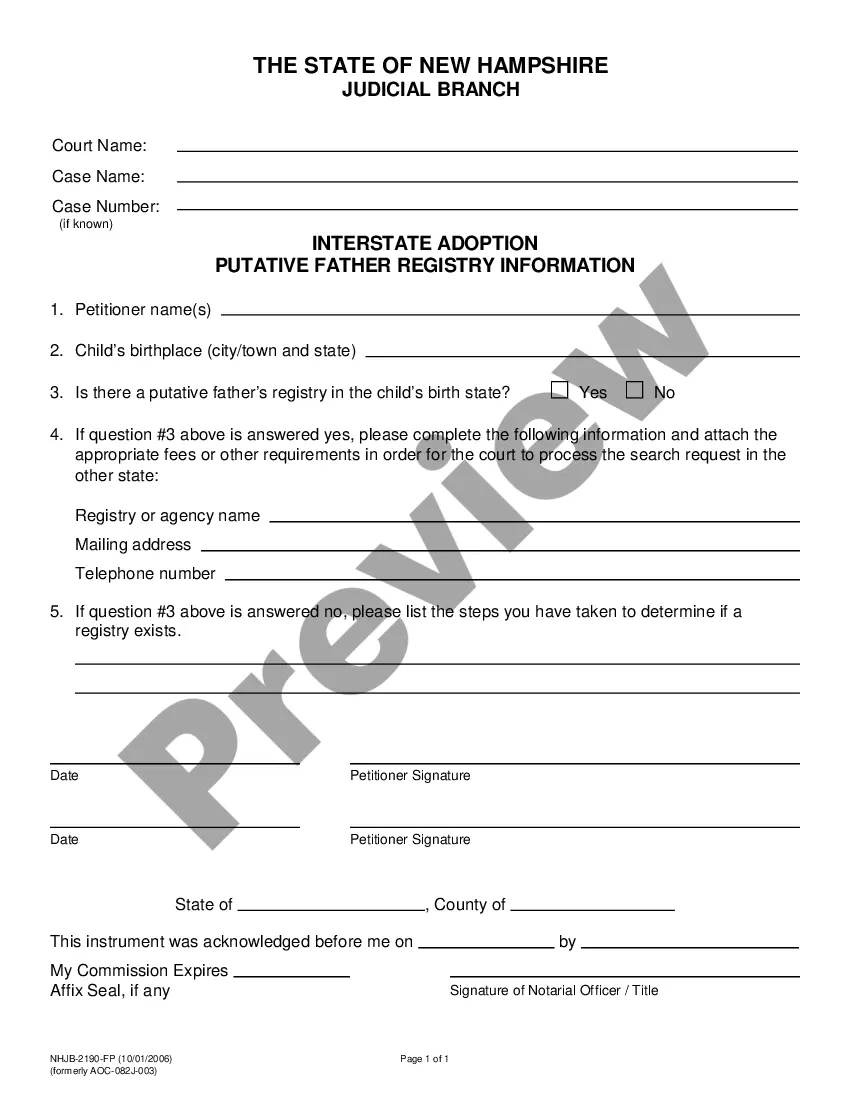

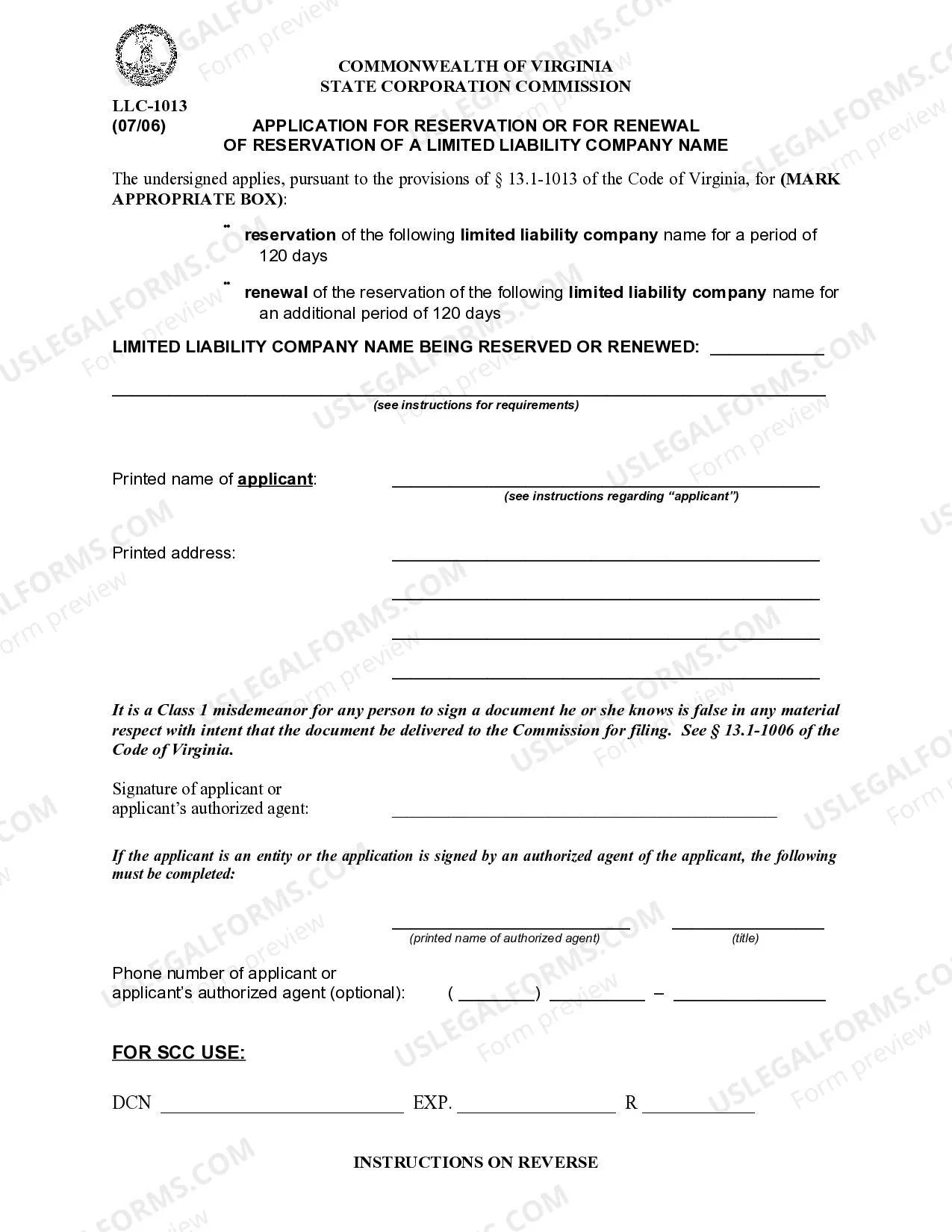

- If available preview it and read the description before buying it.

- Press Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

As soon as the Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is downloaded you are able to fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Hamp Application Forms Form popularity

Making Home Affordable Forms Other Form Names

Loan Modification Application Form FAQ

Homeowners go through the process of a loan modification to stay afloat in times that their mortgage payments are becoming too difficult to maintain. It is possible to refinance the loan again in the future, but do not expect it to come without challenges.

All modifications be in writing. All parties involved sign the modification. In appropriate cases, the modification should be recorded. The title company and attorneys be involved early in the process to properly structure the modification to protect the lender's interest at the lowest cost.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one.Loan term changes: If you're having trouble making your monthly payments, your lender may modify your loan and extend your term.

An income and expenses financial worksheet. tax returns (often, two years' worth) recent pay stubs or a profit and loss statement. proof of any other income (including alimony, child support, Social Security, disability, etc.) recent bank statements, and.

HAMP borrowers can also refinance if there is a clear benefit. "A borrower who has applied for or received a loan modification is eligible to refinance under DU Refi Plus" (this is Fannie's name for the HARP program).The terms of the modified loan (trial or permanent) must be used for this comparison.

HAMP is designed specifically to help homeowners impacted by financial hardship. With HAMP, the loan is modified to make the monthly mortgage payment no more than 31% of the Borrower's Gross (pre-tax) Monthly Income. If eligible, the modification permanently changes the original terms of the mortgage.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

A loan modification can result in an initial drop in your credit score, but at the same time, it's going to have a far less negative impact than a foreclosure, bankruptcy or a string of late payments.If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.

HAMP's goal is to offer homeowners who are at risk of foreclosure reduced monthly mortgage payments that are affordable and sustainable over the long-term.HAMP was designed to help families who are struggling to remain in their homes and show: Documented financial hardship.