Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

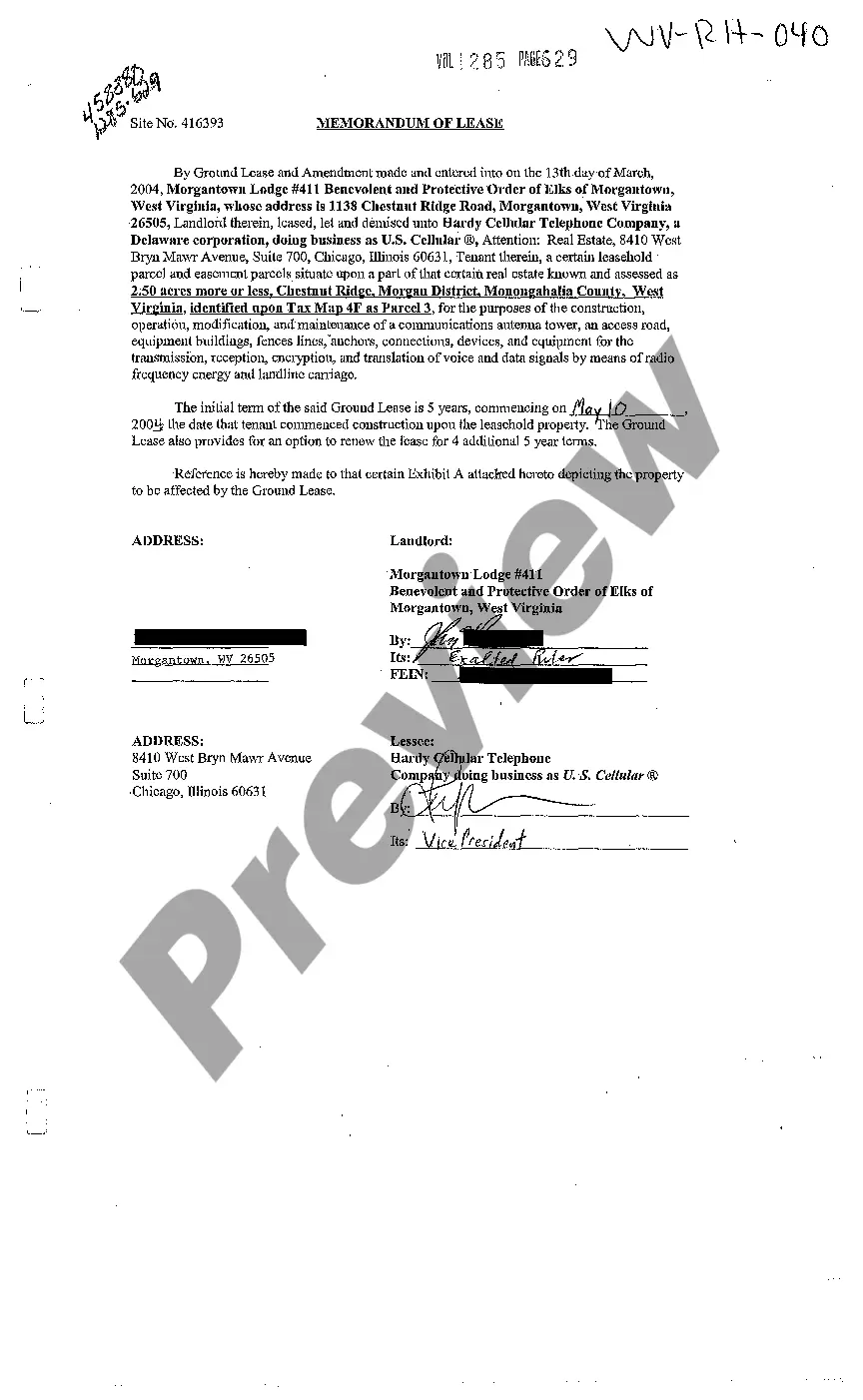

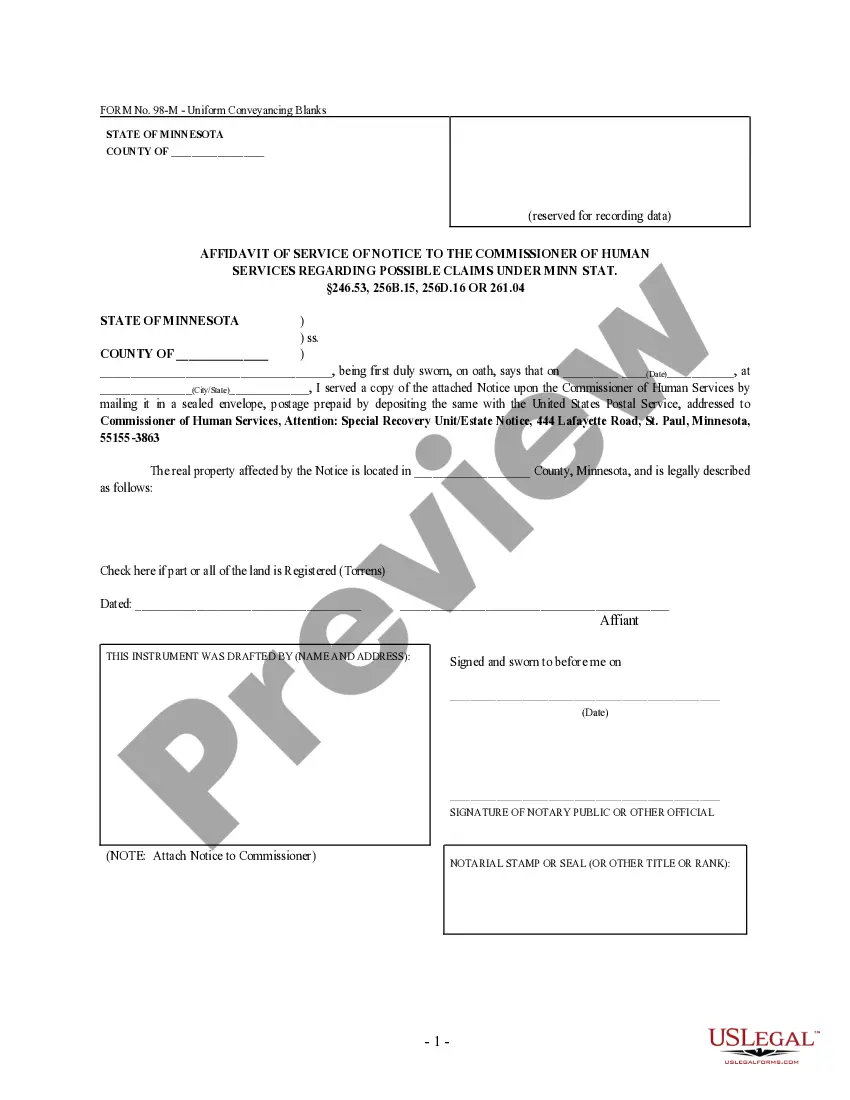

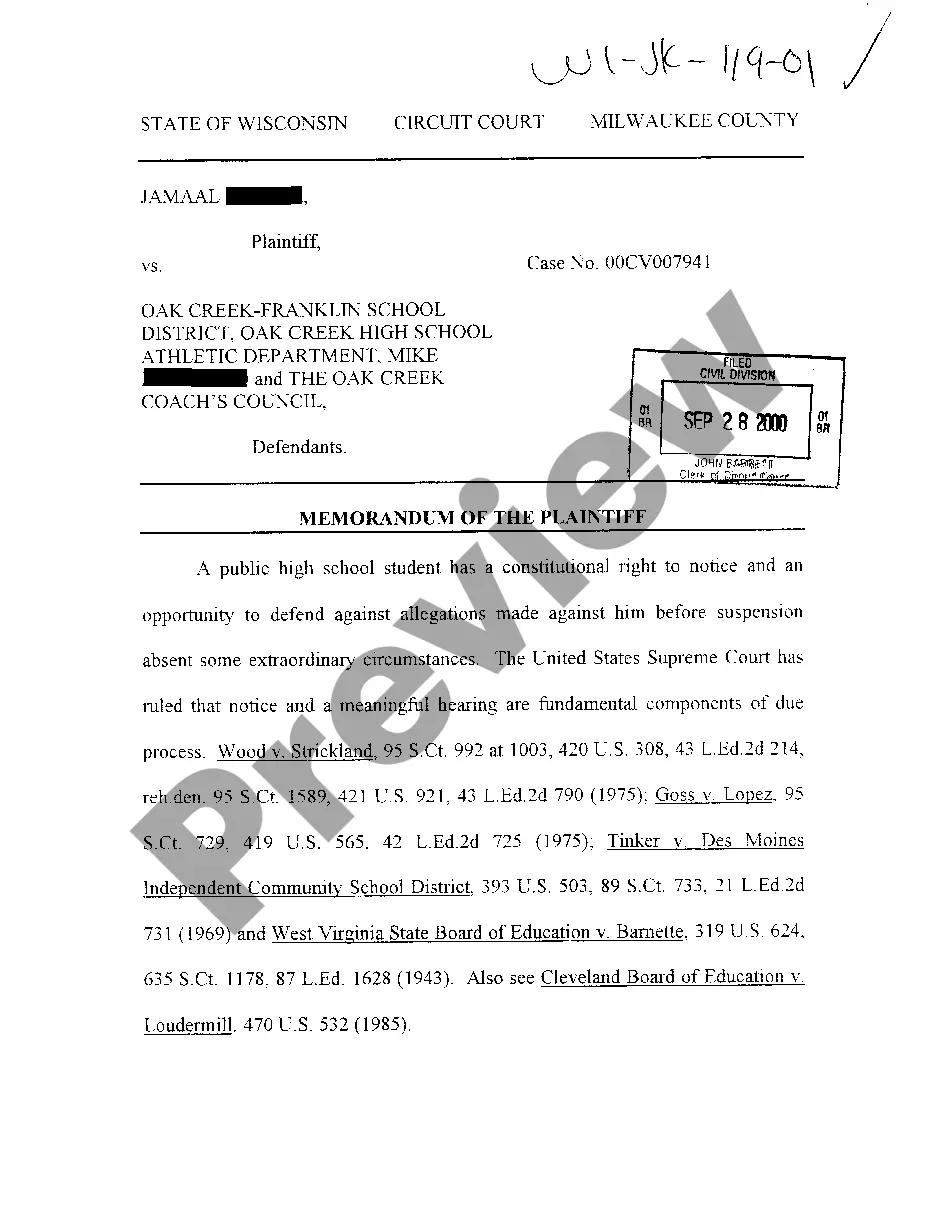

When it comes to drafting a legal form, it is easier to leave it to the experts. Nevertheless, that doesn't mean you yourself cannot get a template to use. That doesn't mean you yourself cannot get a sample to utilize, nevertheless. Download Instructions for Completing Request for Loan Modification and Affidavit RMA Form from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. As soon as you’re signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Instructions for Completing Request for Loan Modification and Affidavit RMA Form quickly:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Instructions for Completing Request for Loan Modification and Affidavit RMA Form is downloaded you are able to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A loan modification can result in an initial drop in your credit score, but at the same time, it's going to have a far less negative impact than a foreclosure, bankruptcy or a string of late payments.If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

There is no legal limit on how many modification requests you can make to your lender. The rules will vary from lender to lender and on a case-by-case basis. That said, lenders are generally more willing to grant a modification if it's the first time you're asking for one.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one.Loan term changes: If you're having trouble making your monthly payments, your lender may modify your loan and extend your term.

All modifications be in writing. All parties involved sign the modification. In appropriate cases, the modification should be recorded. The title company and attorneys be involved early in the process to properly structure the modification to protect the lender's interest at the lowest cost.

You may be able to reapply or modify your application if your reported and actual income don't match up, but many mortgage servicers will simply deny your application. Calculate a new monthly budget and cut unnecessary expenses to the bone.

An income and expenses financial worksheet. tax returns (often, two years' worth) recent pay stubs or a profit and loss statement. proof of any other income (including alimony, child support, Social Security, disability, etc.) recent bank statements, and.

How long will it take? The loan modification process typically takes 30 to 90 days, depending mostly on your lender and your ability to efficiently work through the process with your attorney or other loan modification representative.