Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description Hardship Letter For Immigration For Spouse Sample

How to fill out Sample Hardship Letter For Mortgage Assistance?

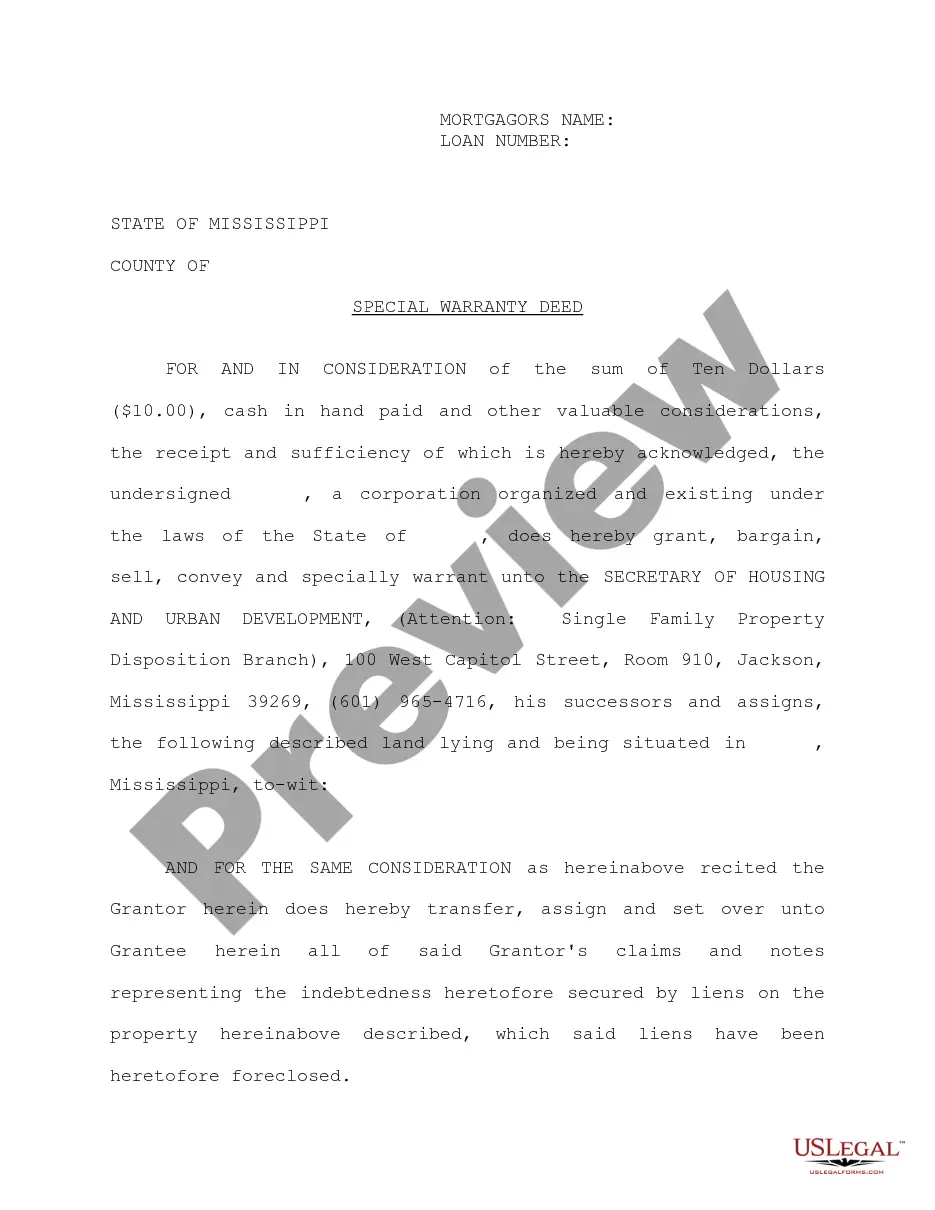

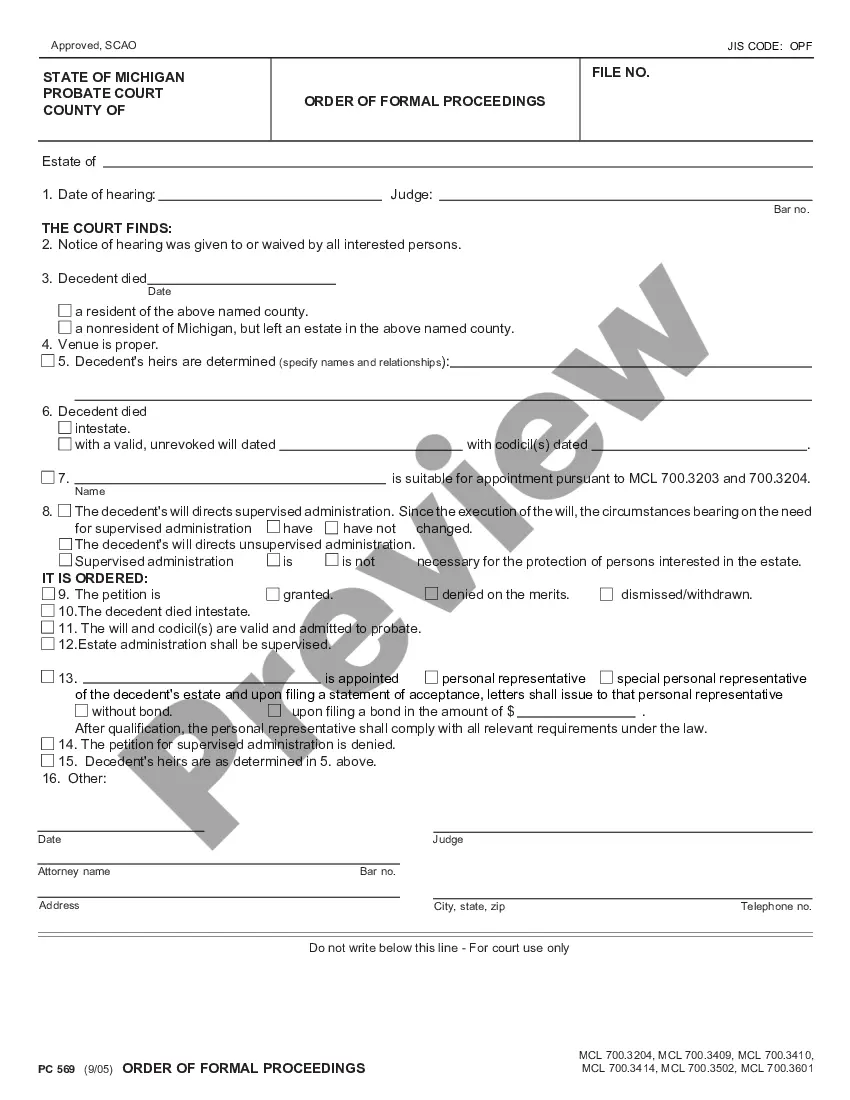

When it comes to drafting a legal form, it is easier to leave it to the specialists. However, that doesn't mean you yourself can’t find a template to use. That doesn't mean you yourself can’t get a sample to utilize, however. Download Hardship Letter to Mortgagor or Lender to Prevent Foreclosure straight from the US Legal Forms web site. It provides numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you’re signed up with an account, log in, search for a specific document template, and save it to My Forms or download it to your device.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Hardship Letter to Mortgagor or Lender to Prevent Foreclosure quickly:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Choose the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Hardship Letter to Mortgagor or Lender to Prevent Foreclosure is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Examples Of Hardship Letters Form popularity

How To Write A Financial Hardship Letter Other Form Names

Mortgage Hardship Letter Sample Pdf FAQ

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

Keep the letter concise. Typically, lenders spend less than five minutes reading a hardship letter so it's in your interest to restrict the letter to a single page. Explain your situation. Keep your request specific. Restate your request.

Proof of income (pay stubs, offer letter, etc.) proof of other income (e.g., alimony, child support, disability benefits) an expense sheet laying out all your expenses. tax returns (two years worth of returns) profit and loss statement. current bank statements.

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

Make the letter concise. Do not write pages explaining your hardship. State your response to the hardship. You need to describe the steps you have taken in response to the difficulty. Clearly state what you want. You can include enclosures. The conclusion.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

Financial hardship typically refers to a situation in which a person cannot keep up with debt payments and bills or if the amount you need to pay each month is more than the amount you earn, due to a circumstance beyond your control.