Mismatched Social Security Number and Name Form

Description

How to fill out Mismatched Social Security Number And Name Form?

Among hundreds of paid and free examples that you can find on the web, you can't be sure about their reliability. For example, who made them or if they are qualified enough to deal with what you need them to. Always keep relaxed and use US Legal Forms! Find Mismatched Social Security Number and Name Form templates developed by professional legal representatives and prevent the high-priced and time-consuming process of looking for an attorney and then paying them to draft a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are trying to find. You'll also be able to access your earlier saved documents in the My Forms menu.

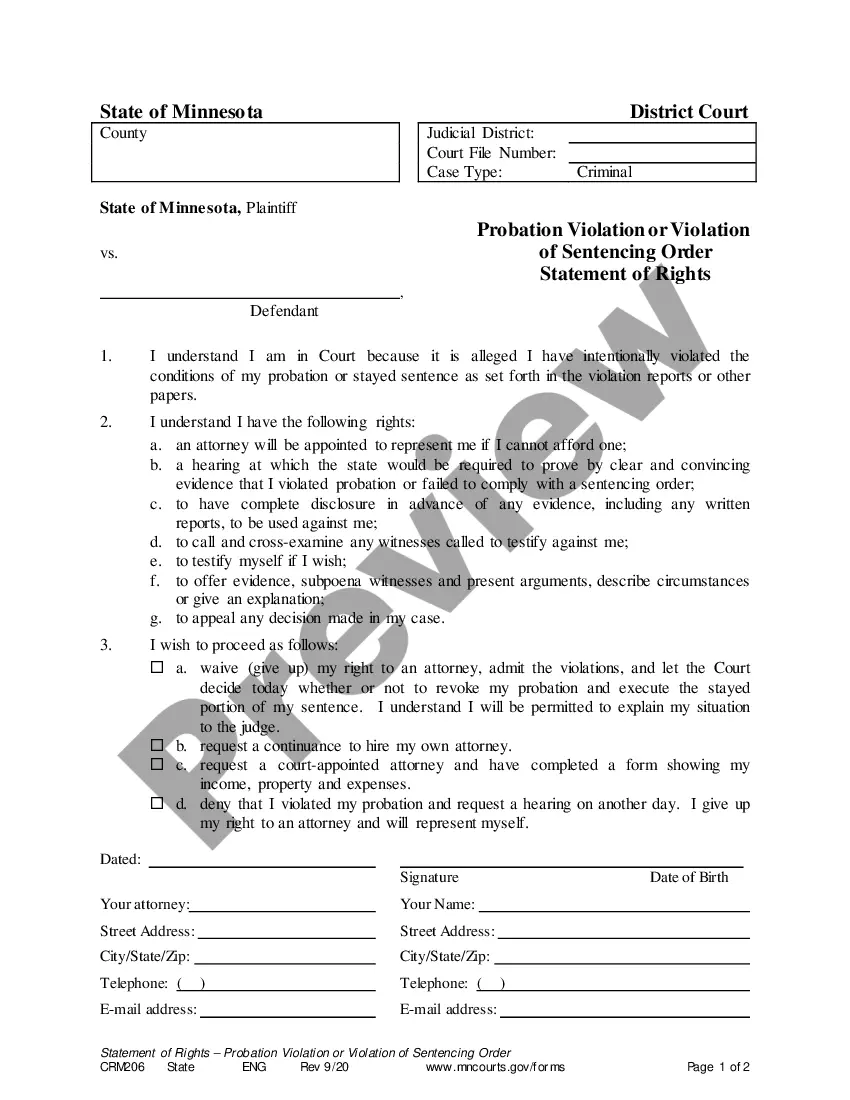

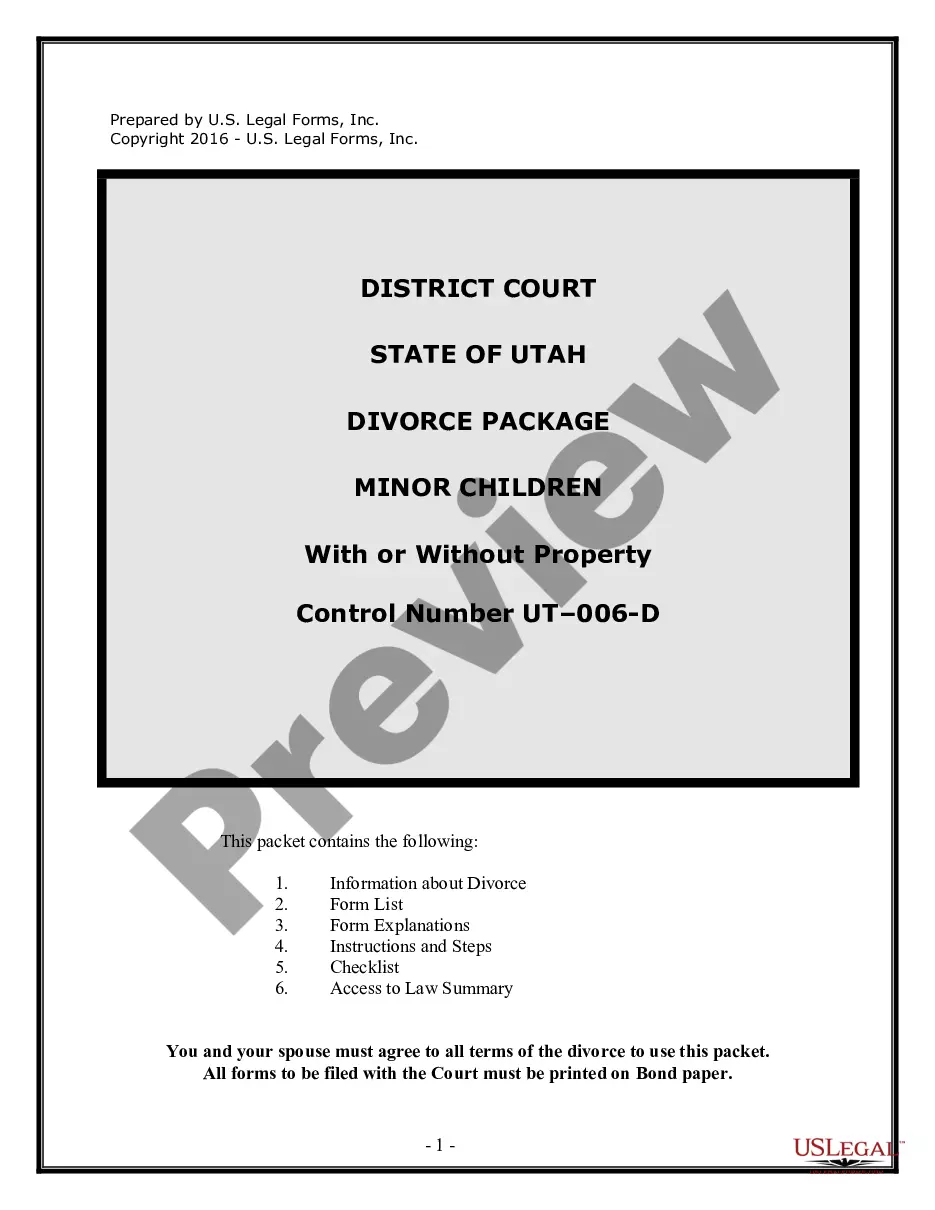

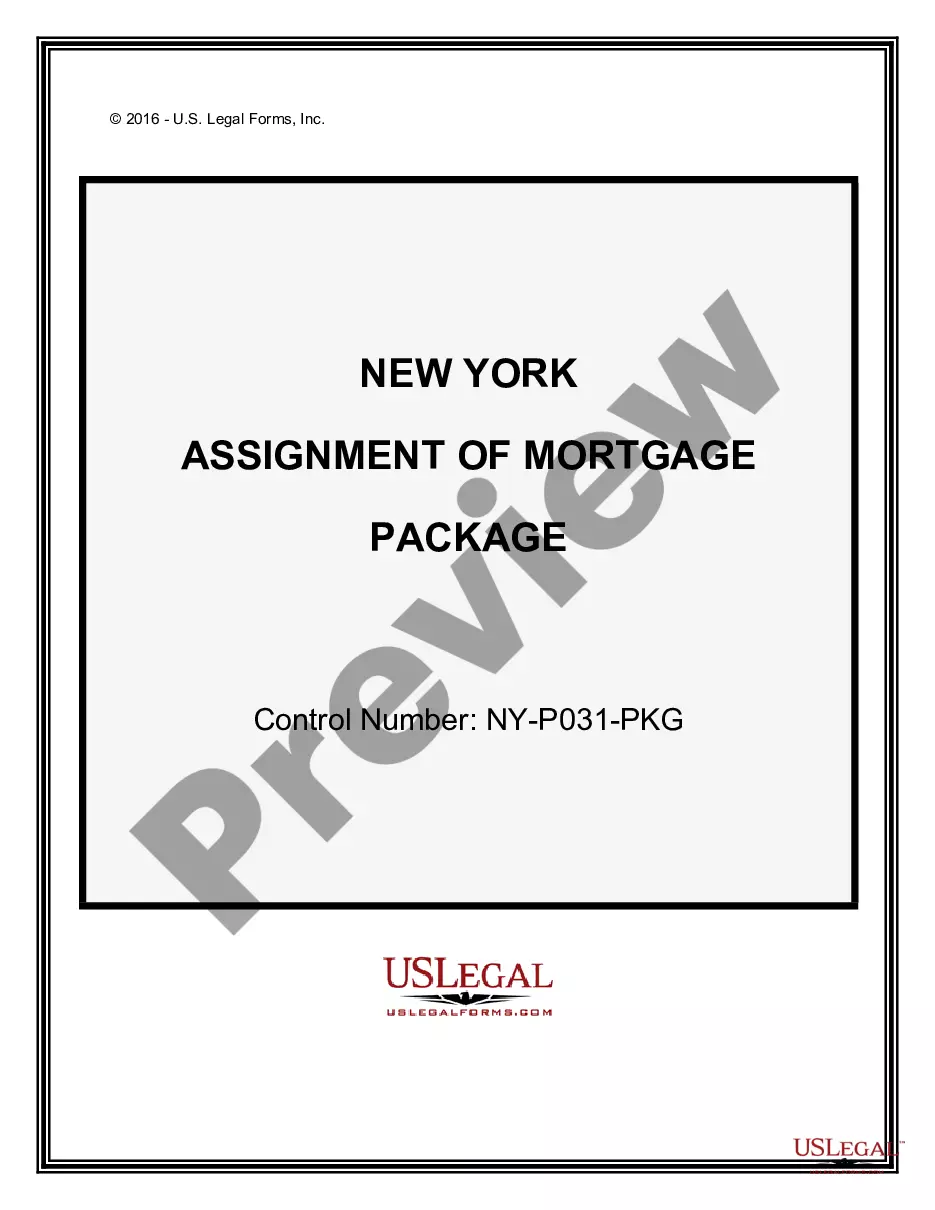

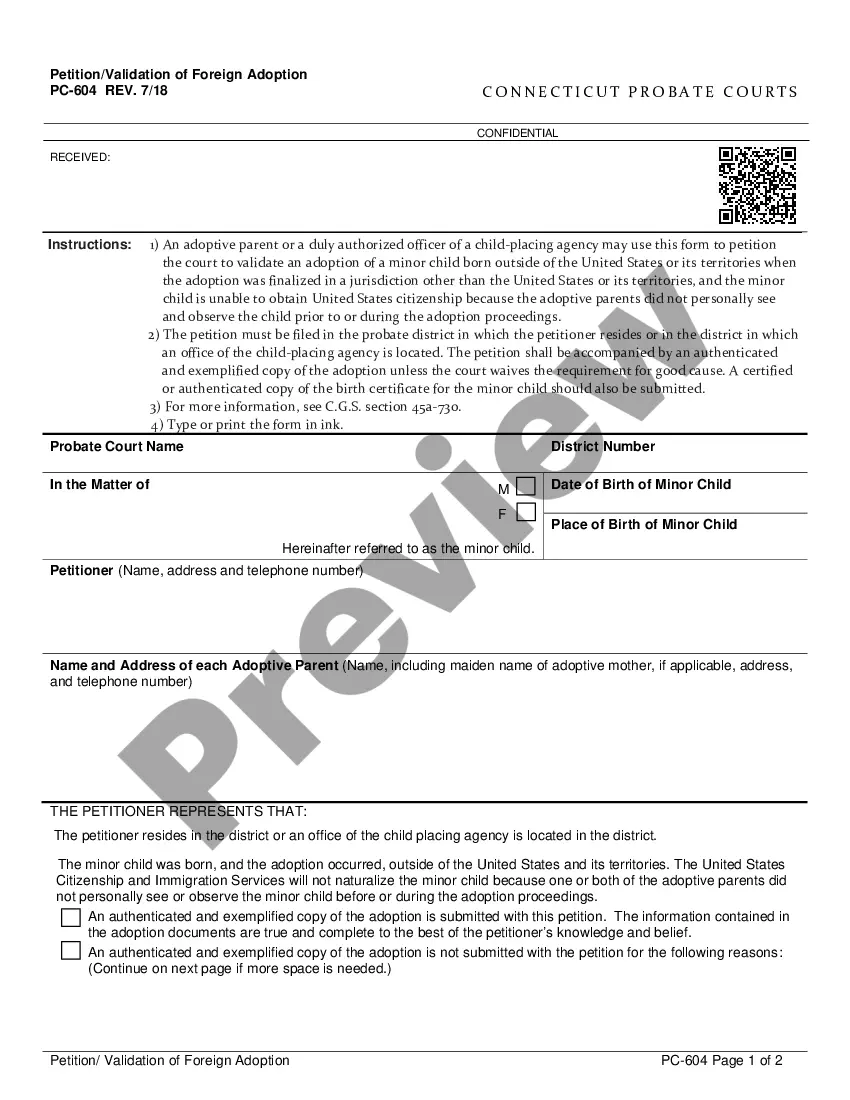

If you’re utilizing our website the very first time, follow the guidelines listed below to get your Mismatched Social Security Number and Name Form quick:

- Make certain that the document you find is valid in the state where you live.

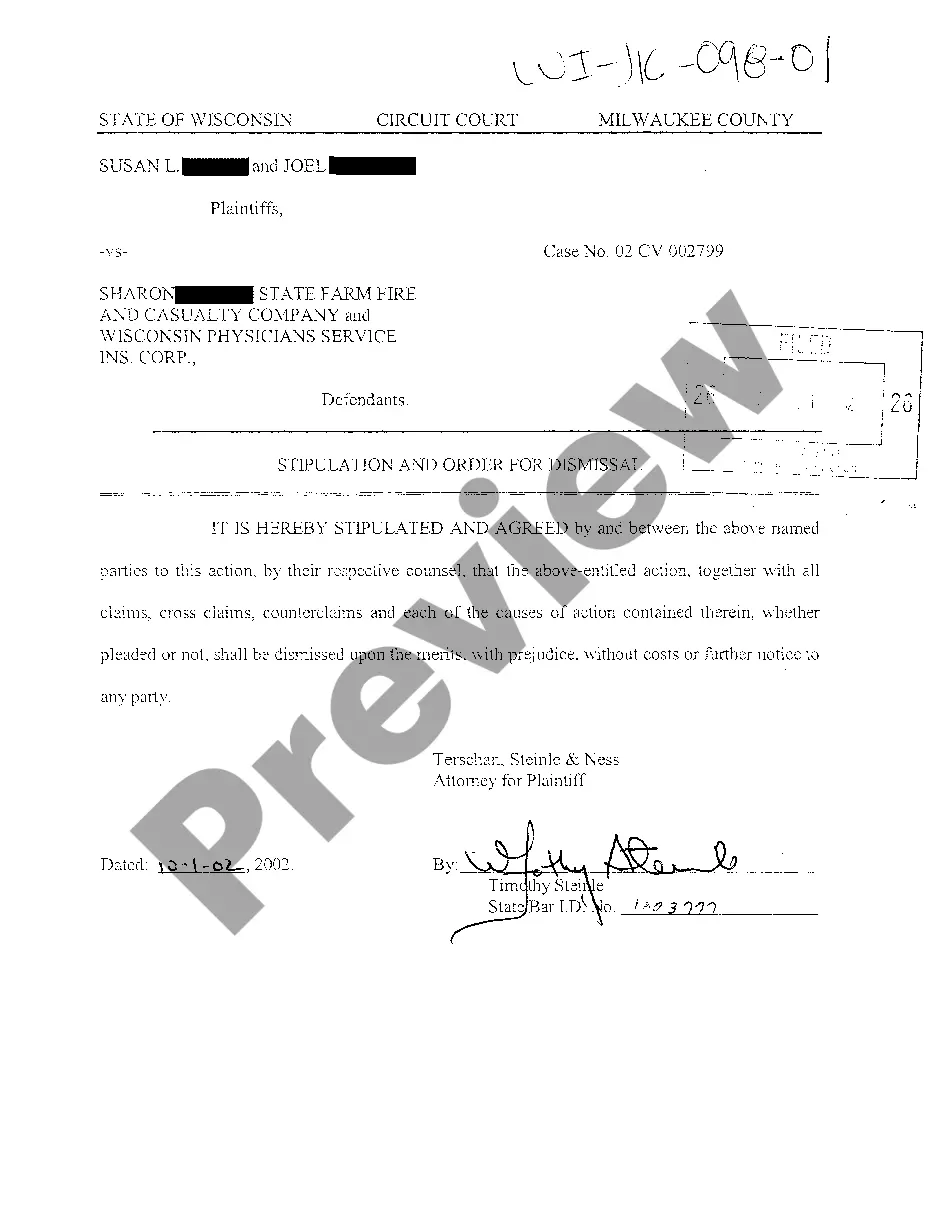

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another template utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you’ve signed up and purchased your subscription, you may use your Mismatched Social Security Number and Name Form as many times as you need or for as long as it remains valid where you live. Edit it with your preferred editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Individuals often ask, how long does it take to change your name on a Social Security card? The answer depends on the backlog at the SSA. Normally, it takes two to six weeks for the SSA to mail your new card, along with returning any supporting documentation. For this reason, don't wait to initiate the process.

If you change your mind about starting your benefits, you can cancel your application for up to 12 months after you became entitled to retirement benefits.This process is called a withdrawal. You can reapply later.

A dishonest person who has your Social Security number can use it to get other personal information about you. Identity thieves can use your number and your good credit to apply for more credit in your name.We don't give your number to anyone, except when authorized by law.

To seek correction of information related to individual records, benefits, or earnings, please call us at 1-800-772-1213 or contact us. The Social Security Administration has received no requests for correction to information under Section 515.

If you are unable to contact the employee, you are encouraged to document your efforts. If you have already sent a Form W-2 with an incorrect name and/or SSN, then submit a Form W-2c (Corrected Wage and Tax Statement) to correct the mismatch.

To seek correction of information related to individual records, benefits, or earnings, please call us at 1-800-772-1213 or contact us. The Social Security Administration has received no requests for correction to information under Section 515.

First, approach your employer (or your former employer) and ask them to both issue you a corrected W-2 (known as a W-2C), and to also send a corrected copy to the Social Security Administration.

Show the required documents. You will need proof of your identity. Fill out and print an Application for a Social Security Card; and. Mail your application and documents to your local Social Security office.