A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

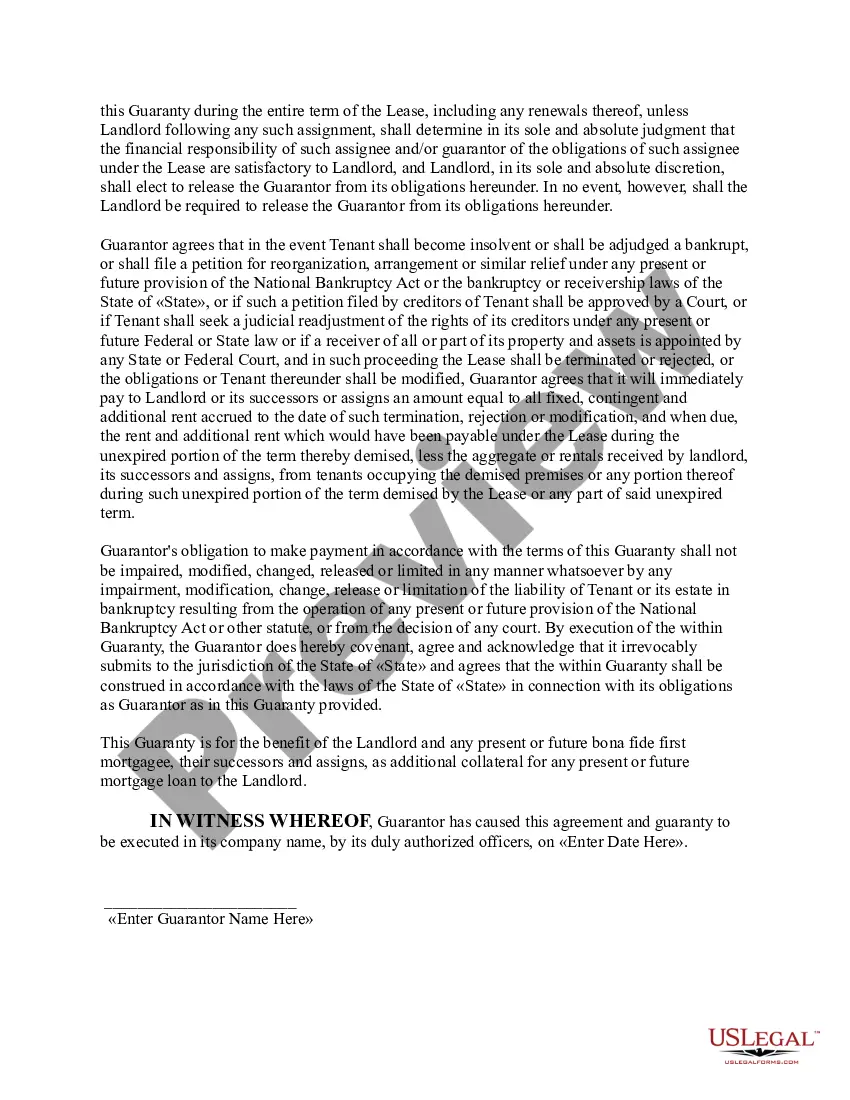

A Guaranty Attachment to Lease is a document in which a third party (known as the guarantor) agrees to be liable for the obligations of a tenant under a lease agreement, should the tenant default on its obligations. This document is often used when the tenant is a corporation or other entity, or when the tenant does not have sufficient credit or assets to cover its obligations. There are two types of Guaranty Attachments to Lease: Absolute Guaranty and Limited Guaranty. An Absolute Guaranty is a guarantee that covers all the tenant’s obligations under the lease, including rent, taxes, insurance, and maintenance. A Limited Guaranty only covers the tenant’s obligations related to a specific issue, such as rent or taxes. The Guarantor is typically asked to provide evidence of their ability to pay any obligations they are liable for, such as a financial statement or other proof of creditworthiness.