Auctioneer Services Contract - Self-Employed Independent Contractor

Description

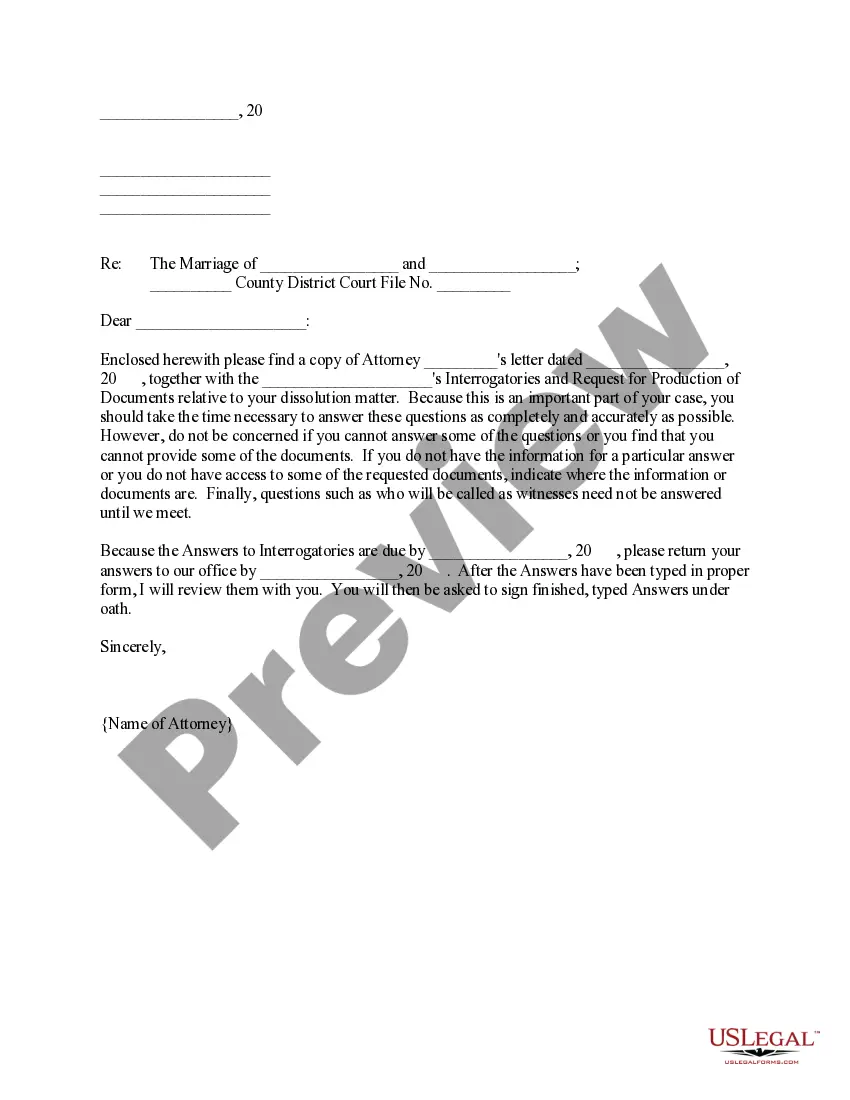

How to fill out Auctioneer Services Contract - Self-Employed Independent Contractor?

Among hundreds of paid and free examples that you can find on the web, you can't be certain about their reliability. For example, who made them or if they’re qualified enough to deal with the thing you need those to. Always keep relaxed and make use of US Legal Forms! Find Auctioneer Services Contract - Self-Employed Independent Contractor samples created by skilled attorneys and avoid the high-priced and time-consuming procedure of looking for an attorney and then paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all of your earlier saved templates in the My Forms menu.

If you’re making use of our service for the first time, follow the guidelines listed below to get your Auctioneer Services Contract - Self-Employed Independent Contractor quickly:

- Make certain that the file you see is valid in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another template using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you’ve signed up and purchased your subscription, you can use your Auctioneer Services Contract - Self-Employed Independent Contractor as often as you need or for as long as it continues to be active where you live. Change it in your favored online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

According to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor so long as the individual is performing completely different duties that would qualify them as an independent contractor.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed.You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done).

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else. An independent contractor is someone who provides a service on a contractual basis.

Yes, if you have 1099 income you are considered to be self-employed, and you will need to pay self-employment taxes (Social Security and Medicare taxes) on this income.

Termination of the Contract Because this is a contract with an independent contractor, not an employee, the contract should state that either party can terminate the agreement with or without notice, depending on the circumstances.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

1099 employees are self-employed independent contractors. They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return.The employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's work.

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.