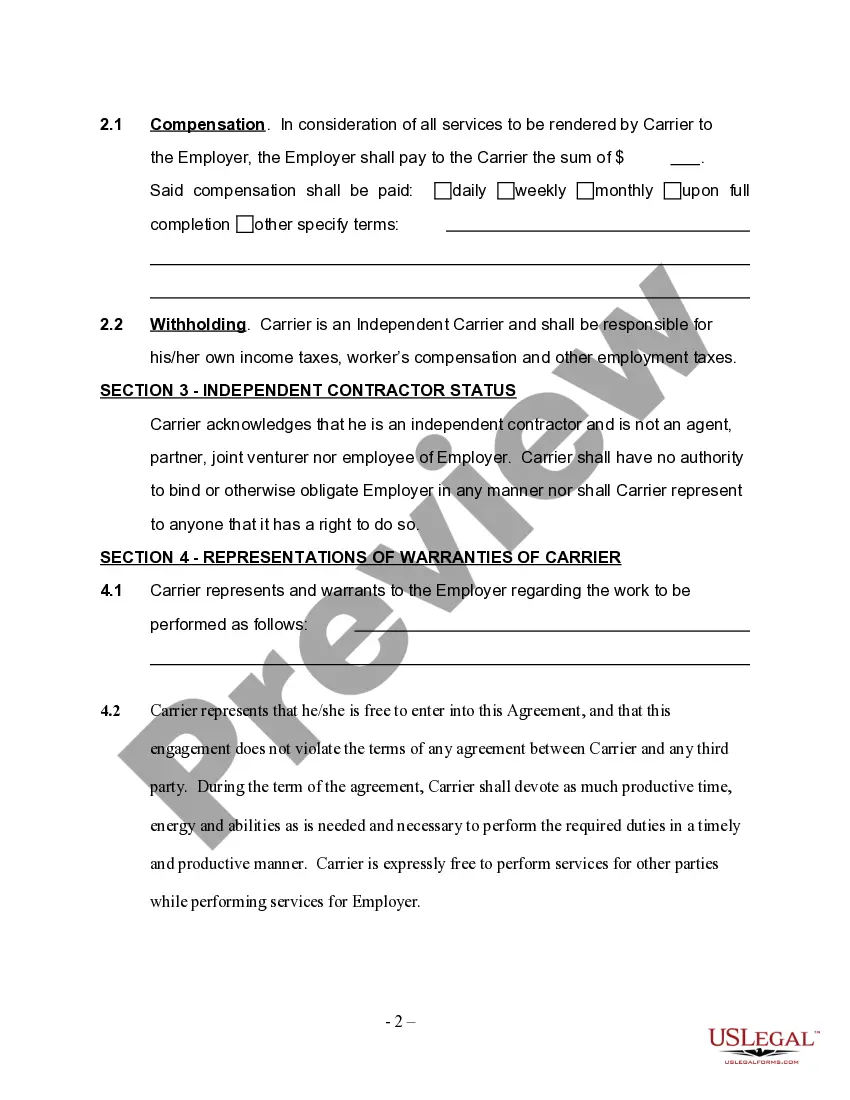

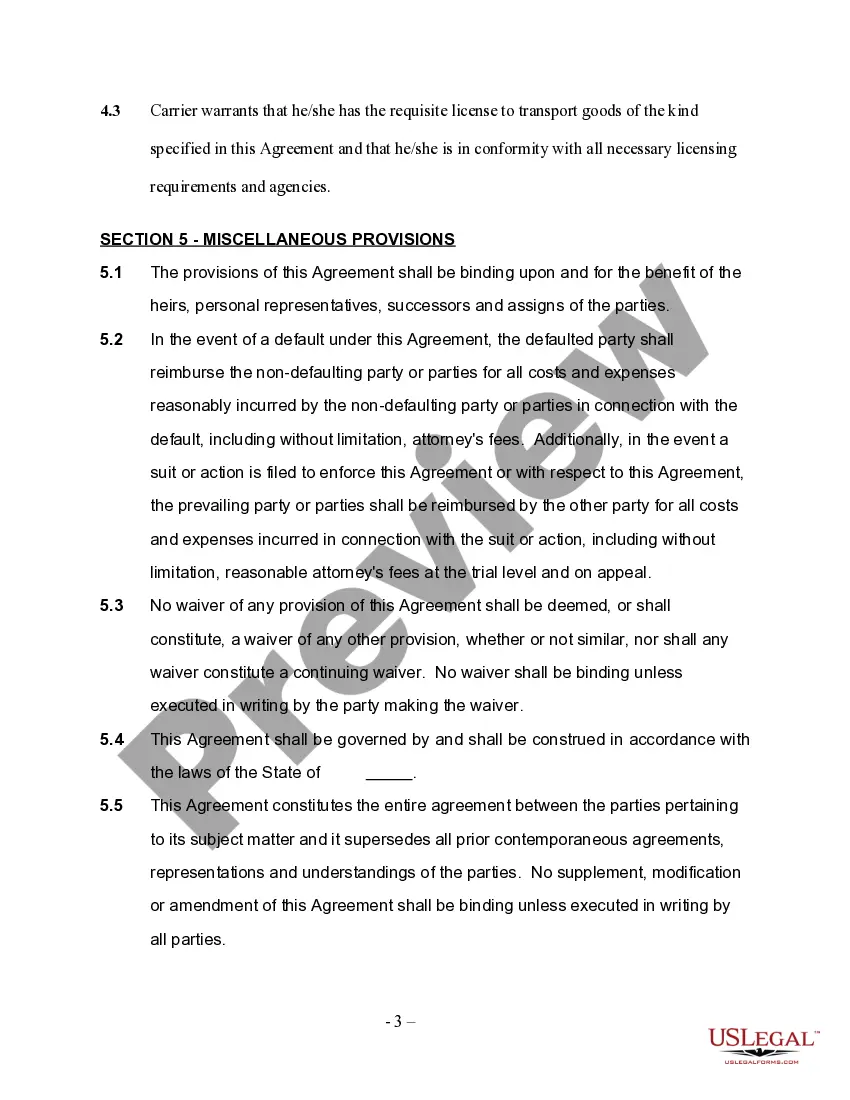

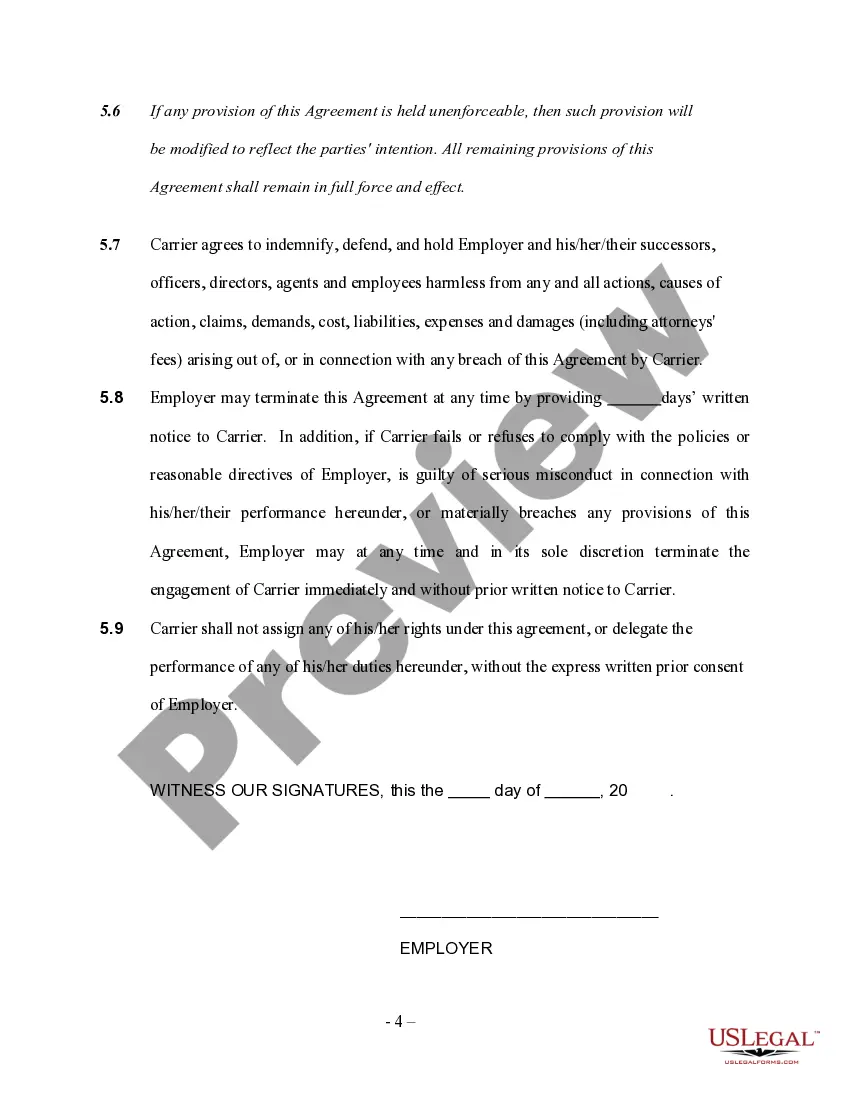

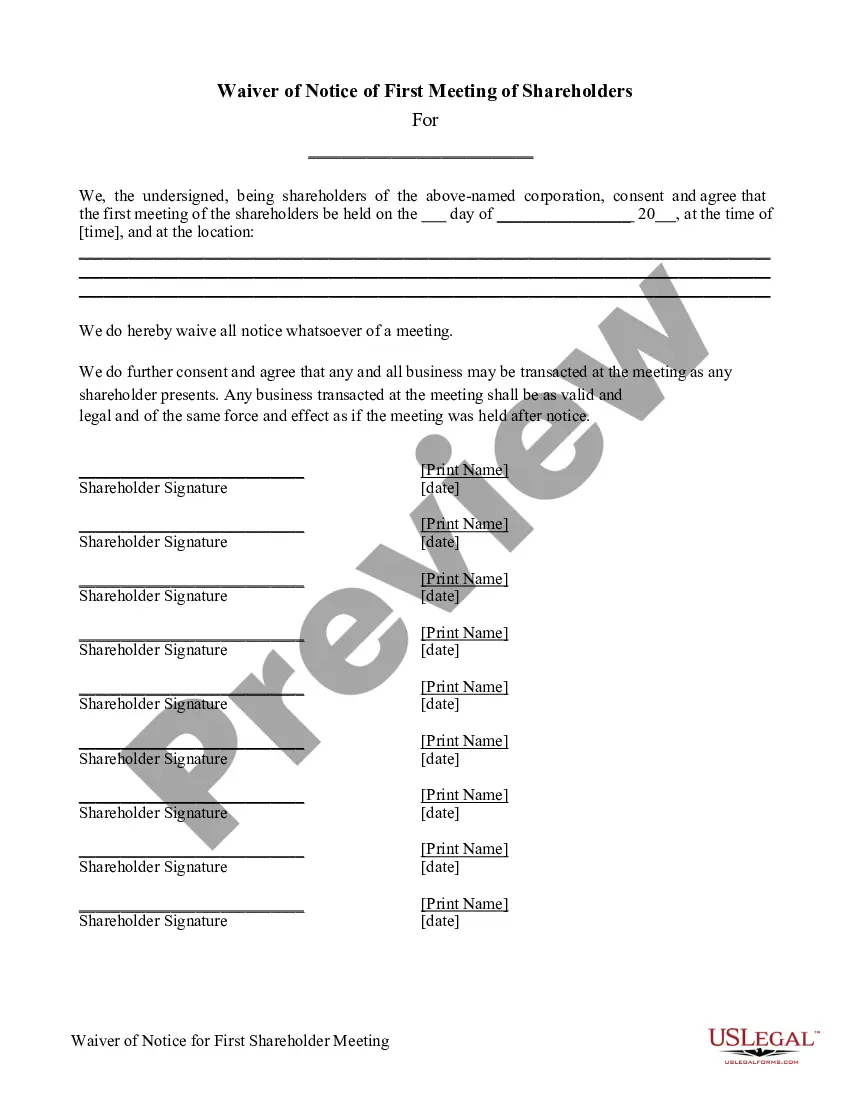

Carrier Services Contract - Self-Employed Independent Contractor

Description Services Contract Self Employed

How to fill out Last Mile Carrier Contracts?

Among hundreds of paid and free examples that you can find on the web, you can't be certain about their reliability. For example, who made them or if they’re qualified enough to deal with the thing you need those to. Always keep relaxed and make use of US Legal Forms! Find Carrier Services Contract - Self-Employed Independent Contractor samples created by skilled attorneys and avoid the high-priced and time-consuming procedure of looking for an attorney and then paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all of your earlier saved templates in the My Forms menu.

If you’re making use of our service for the first time, follow the guidelines listed below to get your Carrier Services Contract - Self-Employed Independent Contractor quickly:

- Make certain that the file you see is valid in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another template using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you’ve signed up and purchased your subscription, you can use your Carrier Services Contract - Self-Employed Independent Contractor as often as you need or for as long as it continues to be active where you live. Change it in your favored online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Contract Independent Contractor Agreement Form popularity

Self Employed Independent Contractor Other Form Names

Services Independent Contractor Template FAQ

Do employers need to complete employment verification checks for independent contractors? No.However, it is important to note that businesses and individuals may not hire independent contractors if they are aware that the independent contractor is not authorized to work in the United States.

Do not designate someone as a 1099 Employee if: Company provides training on a certain method of job performance. Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

Requirements for Becoming a Service Provider An ISP is an independent contractor who provides vocational rehabilitation services to assist individuals with disabilities to achieve their employment goals.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

If you received a 1099 form instead of a W-2 , then the payer of your income did not consider you an employee and did not withhold federal income tax or Social Security and Medicare tax. A 1099-MISC or NEC means that you are classified as an independent contractor and independent contractors are self-employed.

A self employed person will not usually have a contract of employment; they will usually be hired for a certain amount of time. The contract that exists between the self employed person and the person or company supplying the work will have a number of rules or conditions set down within it.

You are eligible to apply for a PPP loan as an independent contractor or self-employed individual who has been or will be harmed by the pandemic if all of the following are true:You filed or will file a Form 1040 Schedule C for 2019 showing self-employment income.

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else. An independent contractor is someone who provides a service on a contractual basis.