Catering Services Contract - Self-Employed Independent Contractor

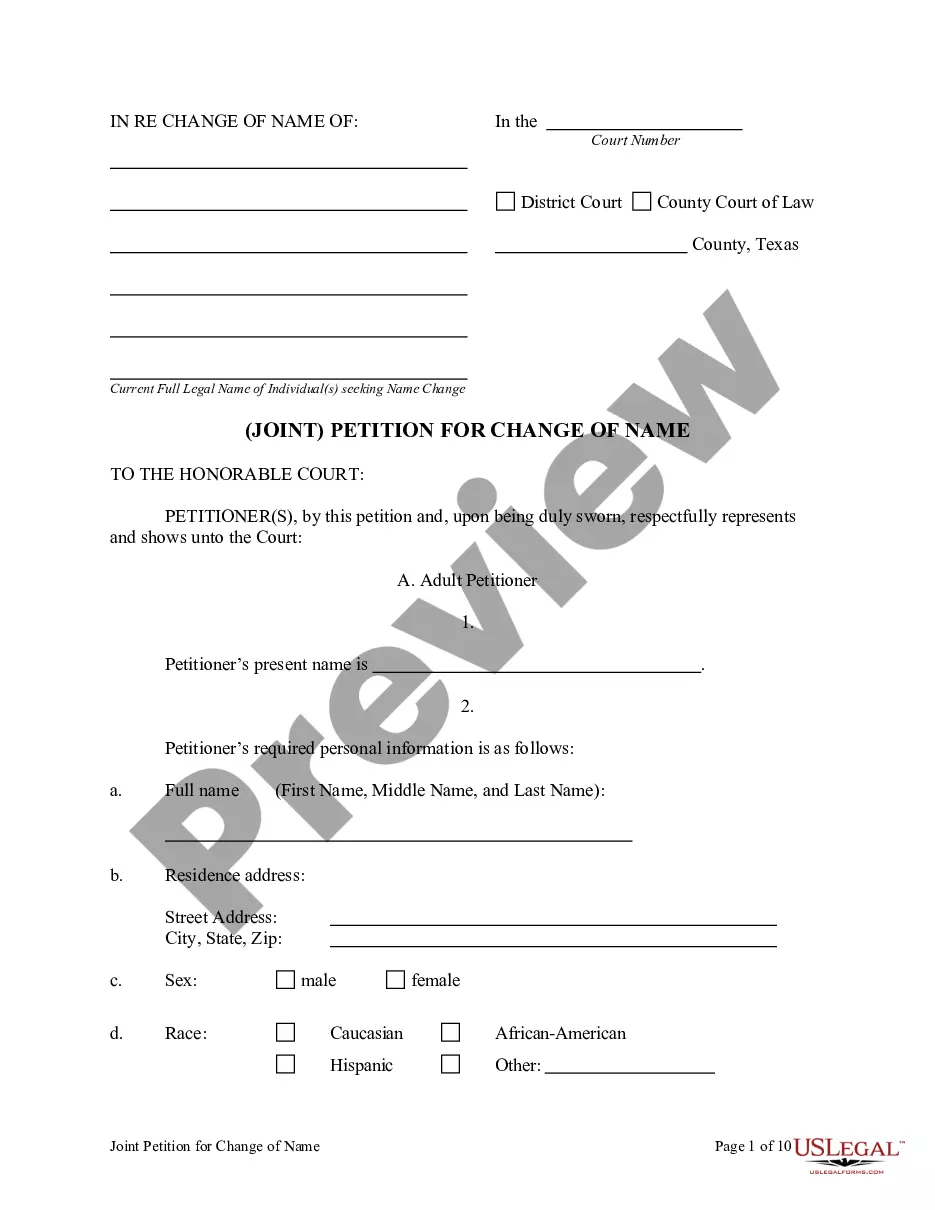

Description Catering Contract Sample

How to fill out Catering Services Contract?

Among numerous free and paid templates that you’re able to find on the web, you can't be certain about their accuracy and reliability. For example, who made them or if they’re competent enough to take care of what you require these people to. Always keep relaxed and make use of US Legal Forms! Locate Catering Services Contract - Self-Employed Independent Contractor samples created by skilled lawyers and get away from the costly and time-consuming procedure of looking for an attorney and then paying them to draft a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all of your earlier downloaded templates in the My Forms menu.

If you’re making use of our service for the first time, follow the guidelines listed below to get your Catering Services Contract - Self-Employed Independent Contractor quick:

- Ensure that the file you discover is valid in the state where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another sample utilizing the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you have signed up and purchased your subscription, you can utilize your Catering Services Contract - Self-Employed Independent Contractor as often as you need or for as long as it continues to be active in your state. Edit it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Catering Contract Form Sample Form popularity

Catering Services Contract Agreement Other Form Names

Catering Contract Form FAQ

The major difference between those workers and Independent Contractors is that the contractors are actually W-2 employees, but they are employed by a staffing agency or a back-office service provider such as FoxHire instead of by the company they are performing work for.

The full legal name of the catering company and the client. The dates the contract will be valid. A description of the service to be provided. The menu. Payment information (per person and or total) A list of additional services that may be provided. Cancellation fees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work, not what will be done and how it will be done. Small businesses should consider all evidence of the degree of control and independence in the employer/worker relationship.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

An Independent Contractor Agreement should contain all of these basic terms: Description of the services to be provided.Explanation of what the hiring party will provide or not provide, such as equipment, for the independent contractor to use. Ownership of work product if that is relevant to the work being performed.

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

A chef is integral to the business of preparing food and would not be considered an independent contractor. A specialist chef, who prepares food for a one-time event for the restaurant, could be considered an independent contractor.

Length of Contract. Each client contractor agreement should outline the length of the working relationship. Project Description. Payment Terms. Nondisclosure Terms. Rights and Responsibilities. Termination Clause. Disclaimers.