Clerical Staff Agreement - Self-Employed Independent Contractor

Description

How to fill out Clerical Staff Agreement - Self-Employed Independent Contractor?

Among hundreds of paid and free samples that you’re able to get on the internet, you can't be sure about their accuracy and reliability. For example, who created them or if they’re skilled enough to take care of what you need those to. Always keep relaxed and use US Legal Forms! Find Clerical Staff Agreement - Self-Employed Independent Contractor templates developed by professional lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer and then paying them to draft a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access all your previously downloaded documents in the My Forms menu.

If you’re utilizing our service the first time, follow the instructions listed below to get your Clerical Staff Agreement - Self-Employed Independent Contractor quickly:

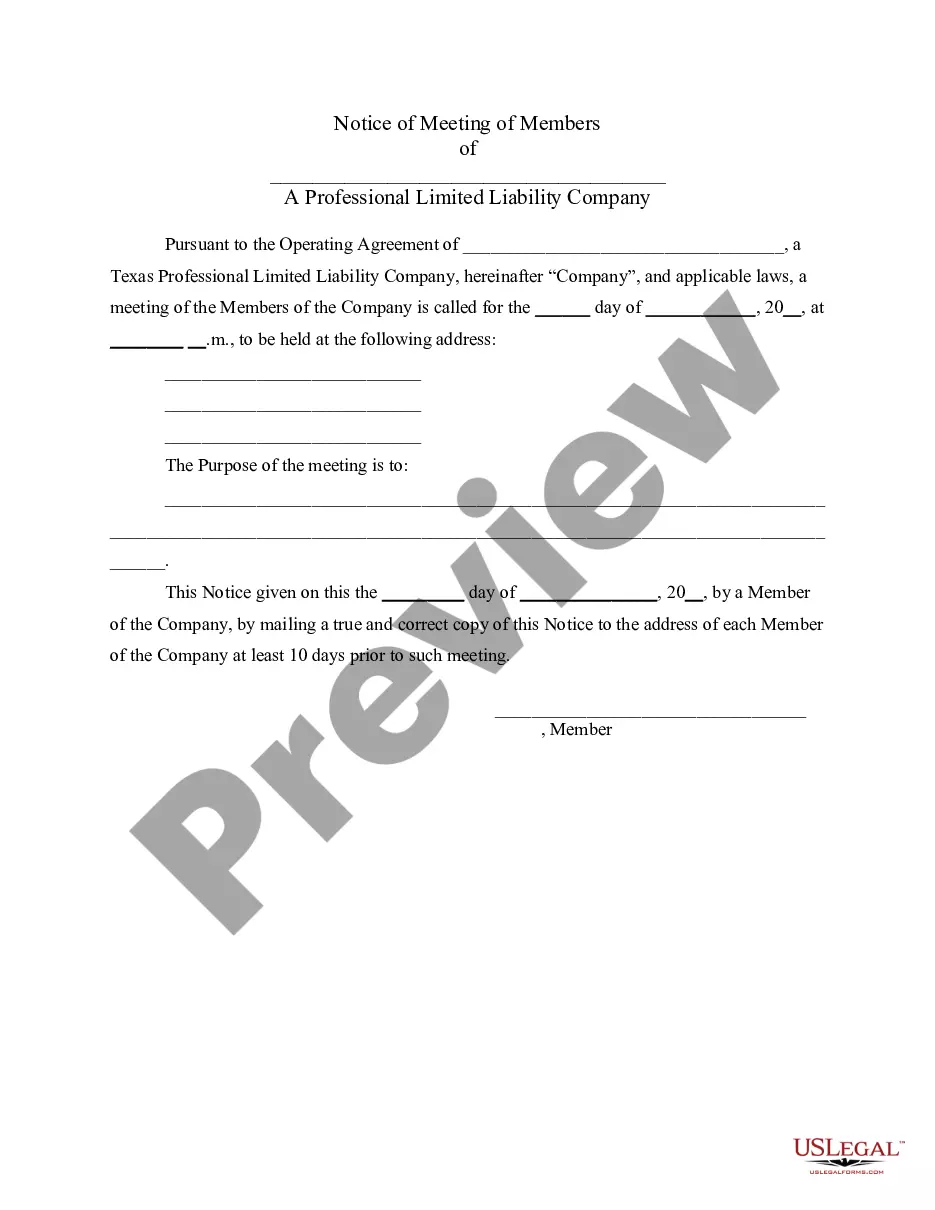

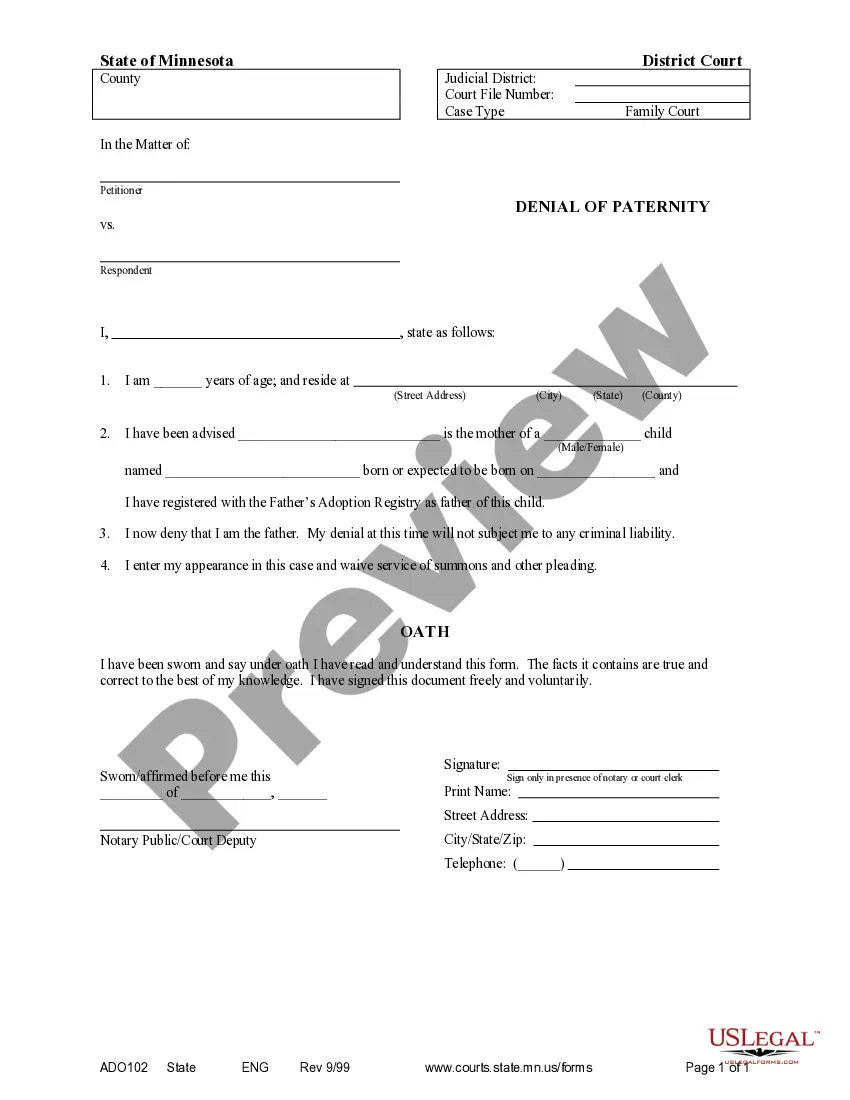

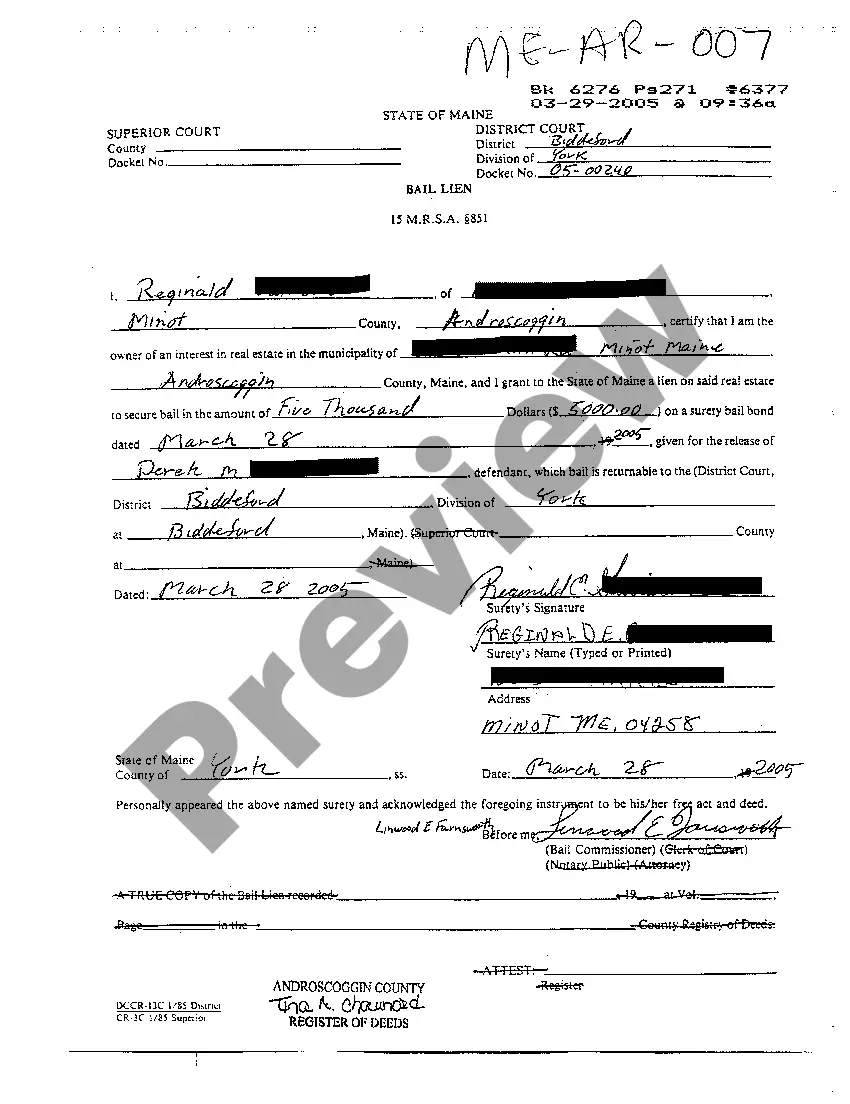

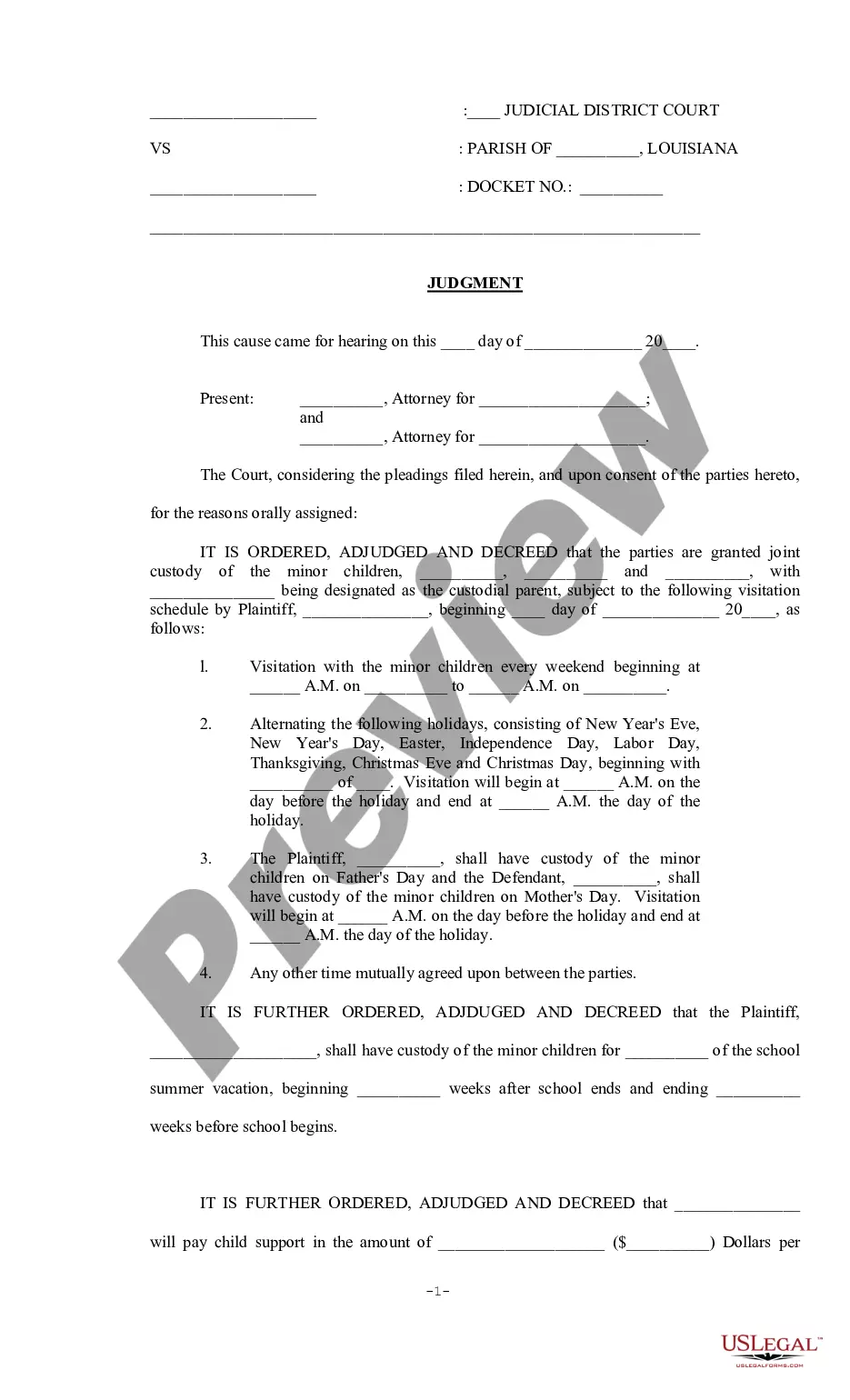

- Make sure that the file you discover applies in the state where you live.

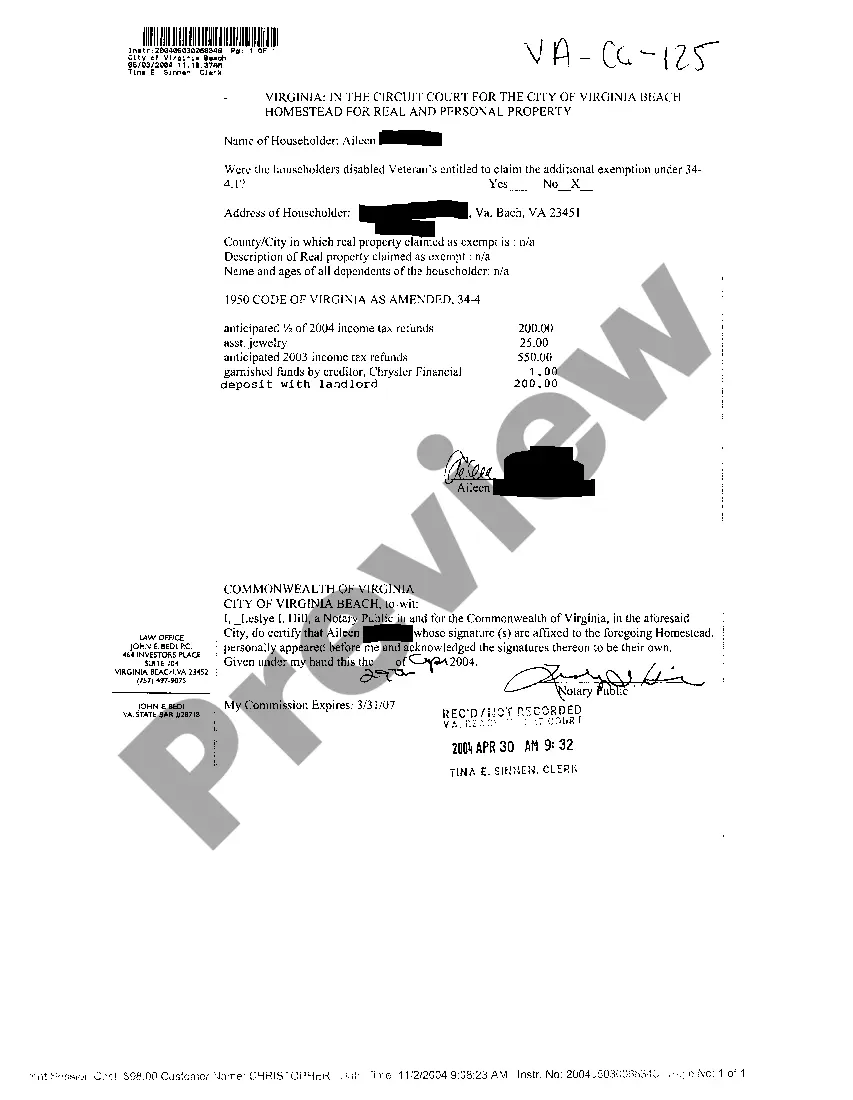

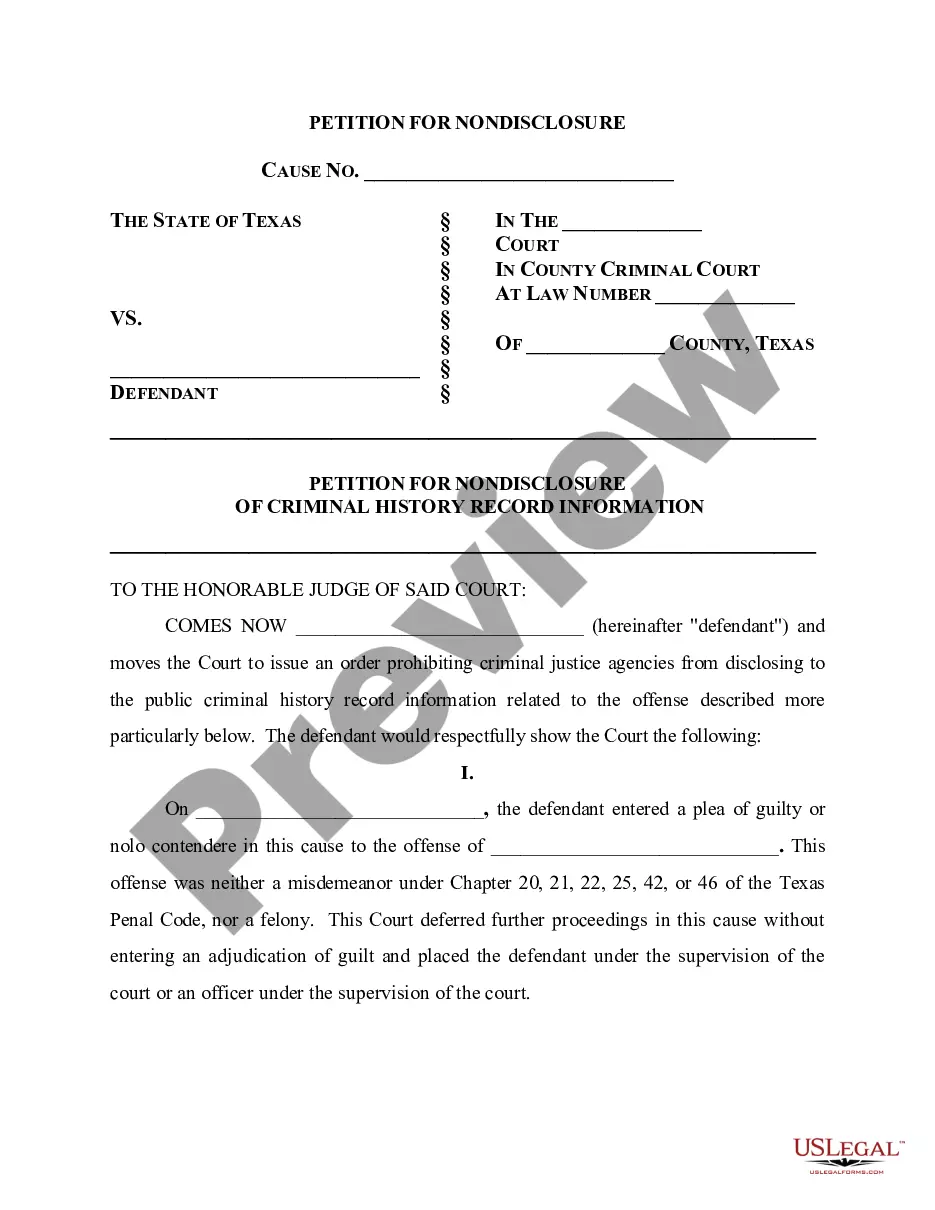

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another sample using the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you’ve signed up and bought your subscription, you may use your Clerical Staff Agreement - Self-Employed Independent Contractor as often as you need or for as long as it stays active where you live. Edit it in your favored online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.

If you're self-employed, you do not have a contract of employment with an employer.You don't have employment rights as such if you're self-employed as you are your own boss and can therefore decide how much to charge for your work and how much holiday to give yourself. You do have some legal protection.

The good news is that you can employ people and remain a sole trader. There's no need to set up a limited company if you don't want to. While sole traders operate the business on their own, that doesn't mean they have to work alone.

Finally, the new stimulus bill provides independent contractors with paid sick and paid family leave benefits through March 14, 2021.Under CARES Act II, unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA.

Do you know your ABCs? California's new independent contractor test makes it difficult to hire a former employee, even if they are retired, as an independent contractor.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Can independent contractors hire employees? Sure. As a self-employed person, you're technically your own business. Businesses are allowed to hire employees.