Fireplace Contractor Agreement - Self-Employed

Description

How to fill out Fireplace Contractor Agreement - Self-Employed?

Among lots of free and paid samples that you’re able to get on the net, you can't be certain about their reliability. For example, who made them or if they are qualified enough to deal with what you require them to. Keep relaxed and utilize US Legal Forms! Locate Fireplace Contractor Agreement - Self-Employed samples developed by professional lawyers and get away from the costly and time-consuming procedure of looking for an lawyer and then paying them to write a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are trying to find. You'll also be able to access all of your previously acquired documents in the My Forms menu.

If you are making use of our service the very first time, follow the instructions listed below to get your Fireplace Contractor Agreement - Self-Employed with ease:

- Make certain that the document you see applies in your state.

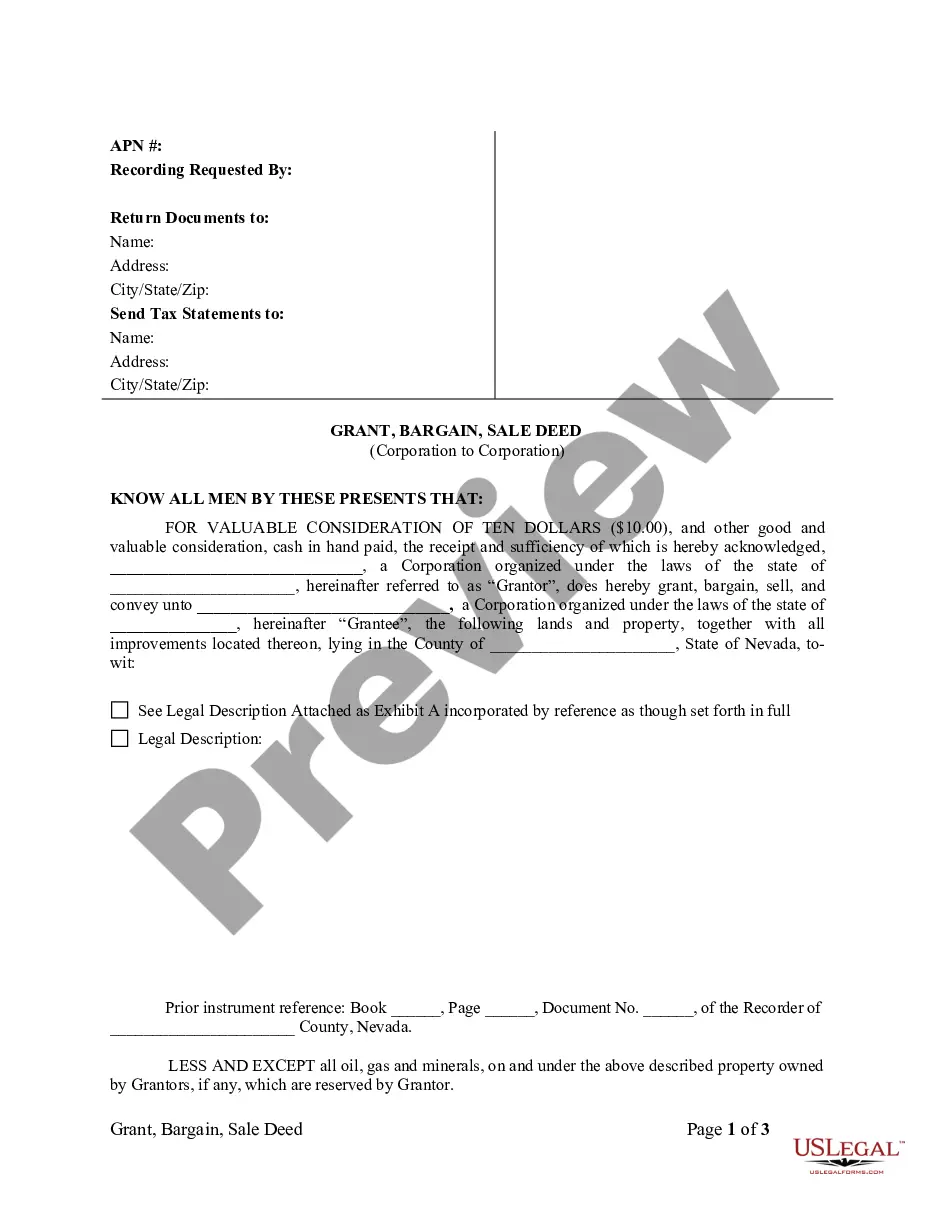

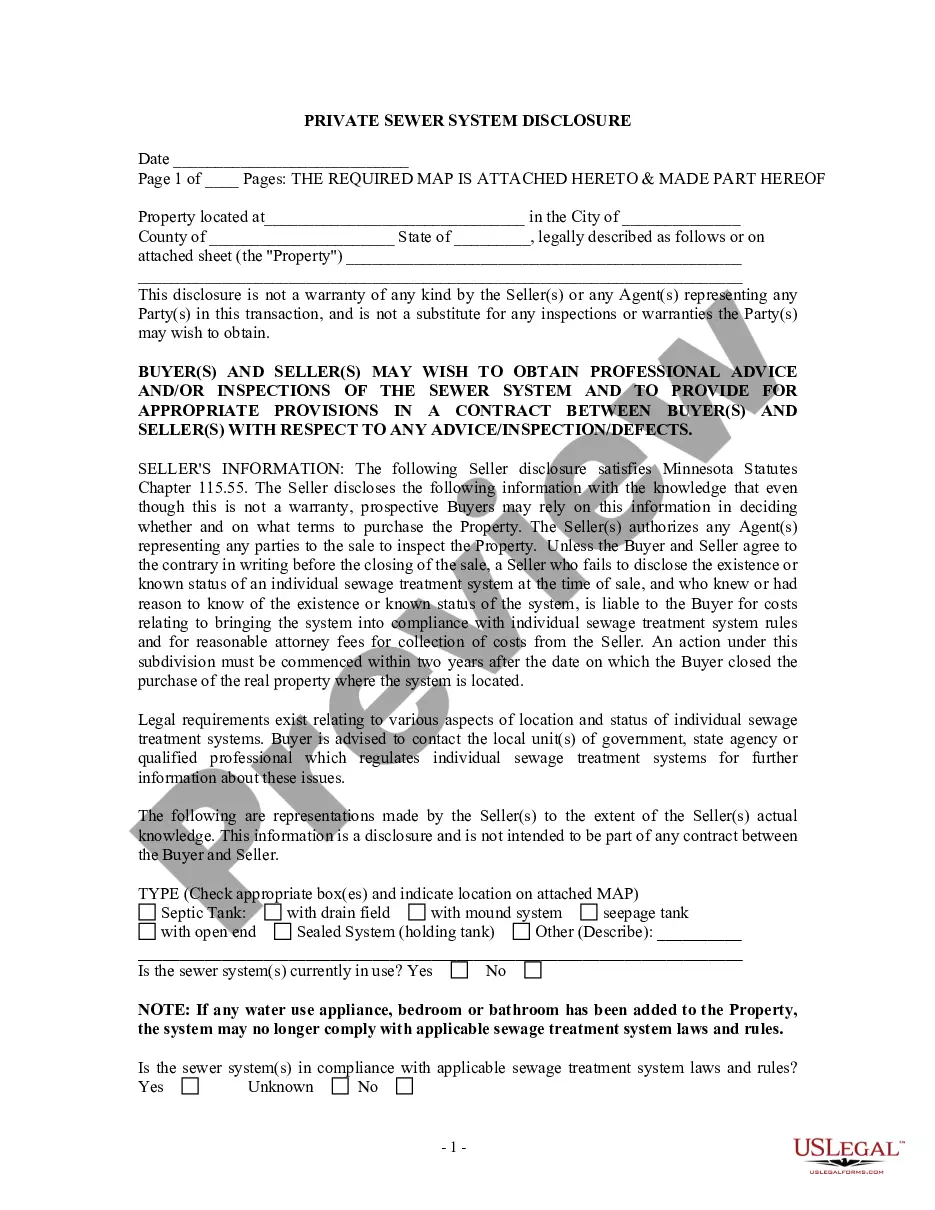

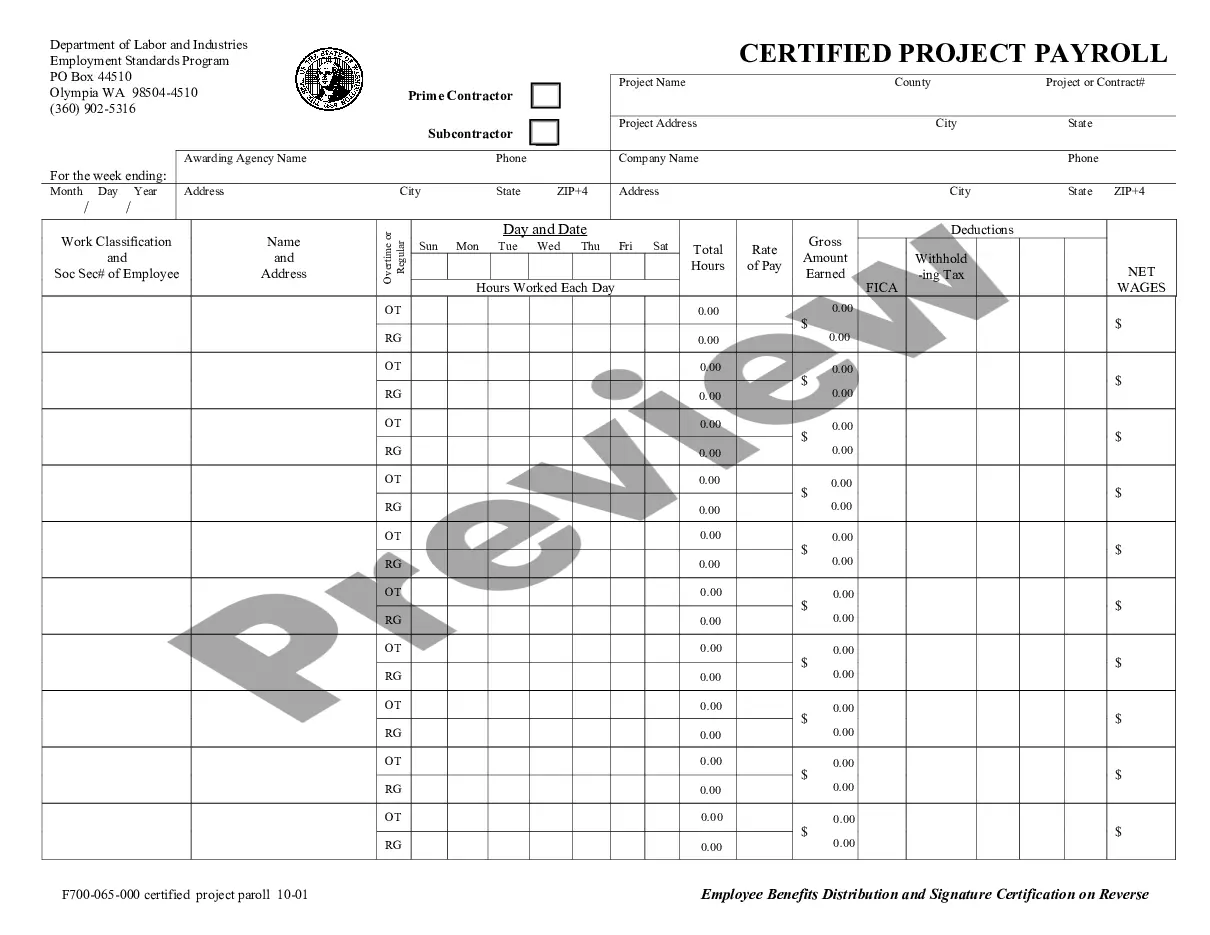

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another template using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

When you’ve signed up and paid for your subscription, you may use your Fireplace Contractor Agreement - Self-Employed as many times as you need or for as long as it stays active where you live. Change it in your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Usually, independent contractors cannot be fired at-will like employees can because they have contracts that outline termination.

People who work for themselves or who own their own company are sometimes alternately referred to as self-employed or independent contractors, though there is a difference between the two. In general, all independent contractors are self-employed, but not all self-employed people are independent contractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else. An independent contractor is someone who provides a service on a contractual basis.

As an independent contractor, you have the right to market your services to other businesses and can work with more than one client at a time. Even if you have a long-term contract with a particular client, you can choose to work on additional projects as well.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

As an independent contractor, you can sue for wrongful termination, and particularly the employer misclassifies you as an independent contractor, yet you are an employee. The California law considers any person rendering services to another person to be an employee.

An independent contractor cannot be fired so long as he or she produces a result that meets the specifications of the contract. Training. An employee may be trained to perform services in a particular manner. However, independent contractors ordinarily use their own methods and receive no training from the employer.

Protect your social security number. Have a clearly defined scope of work and contract in place with clients. Get general/professional liability insurance. Consider incorporating or creating a limited liability company (LLC).