Dancer Agreement - Self-Employed Independent Contractor

Definition and meaning

The Dancer Agreement - Self-Employed Independent Contractor is a formal contract between a dancer, referred to as the "Dancer," and an employer, referred to as the "Employer." This agreement outlines the terms under which the dancer will provide their services. It is a crucial document that protects both parties by clarifying expectations, payment terms, and responsibilities.

Who should use this form

This agreement is ideal for independent dancers who are hired for performances, events, or projects by various employers. It serves to formalize the working arrangement, ensuring that both the dancer and the employer are on the same page regarding service expectations and compensation. Individuals and companies seeking to hire dancers should also use this form to create a clear contractual relationship.

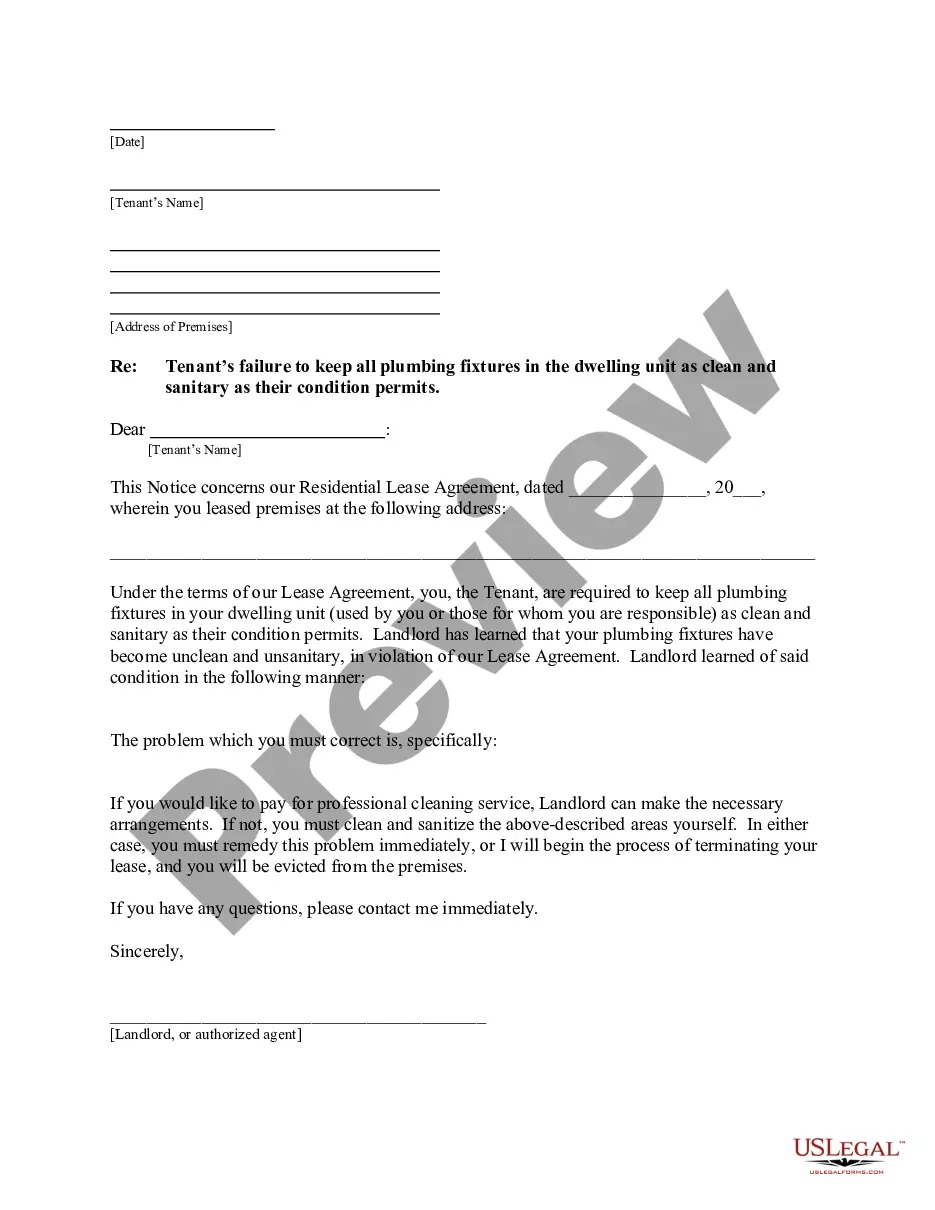

Key components of the form

The Dancer Agreement includes several essential elements:

- Scope of Services: A detailed description of the services the dancer will perform.

- Term of Employment: The duration for which the dancer is contracted.

- Liquidated Damages: Specifies the penalties if the dancer fails to fulfill their obligations.

- Payment Terms: Outlines how and when the dancer will be compensated.

- Tax Responsibilities: Clarifies that the dancer is responsible for their own taxes and necessary employment-related expenses.

- Governing Laws: Indicates which state's laws will govern the agreement.

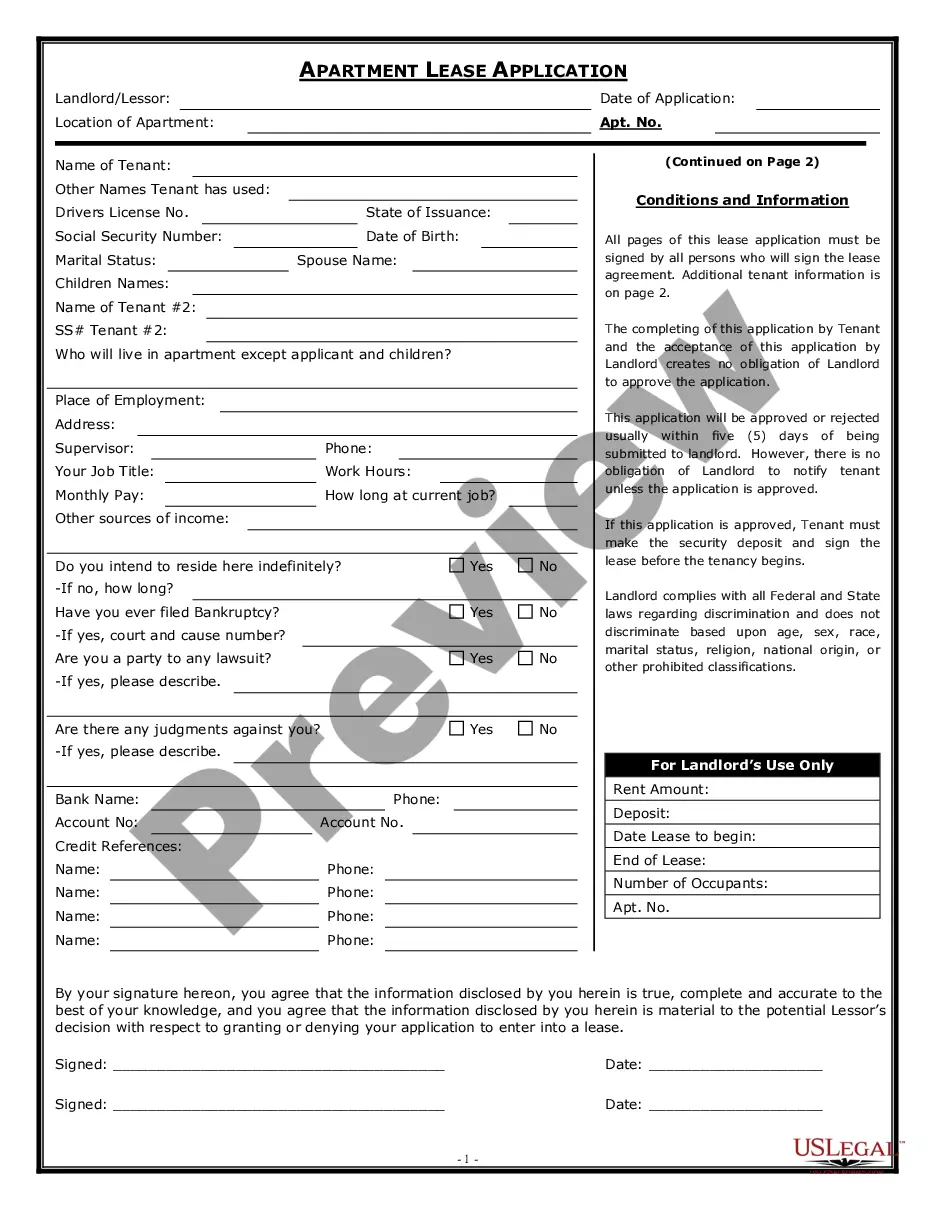

How to complete a form

To successfully complete the Dancer Agreement, follow these steps:

- Enter Names: Fill in the names of both the Employer and the Dancer at the top of the document.

- Detail Services: Clearly articulate the scope of services to be performed by the dancer.

- Specify Dates: Indicate the start and end dates of the engagement.

- Fill Payment Information: State the agreed payment amount and method.

- Review Tax Information: Ensure clarity on tax responsibilities and liabilities.

- Sign and Date: Both parties should sign and date the agreement to validate it.

Benefits of using this form online

Using the Dancer Agreement online offers several advantages:

- Convenience: Users can access and fill out the form from anywhere at any time.

- Time-Saving: Online forms often pre-fill certain details, reducing the time needed to complete them.

- Storage and Retrieval: Digital agreements are easier to store and retrieve compared to paper documents.

- Updates and Changes: Users can quickly revise contracts as necessary, keeping agreements current.

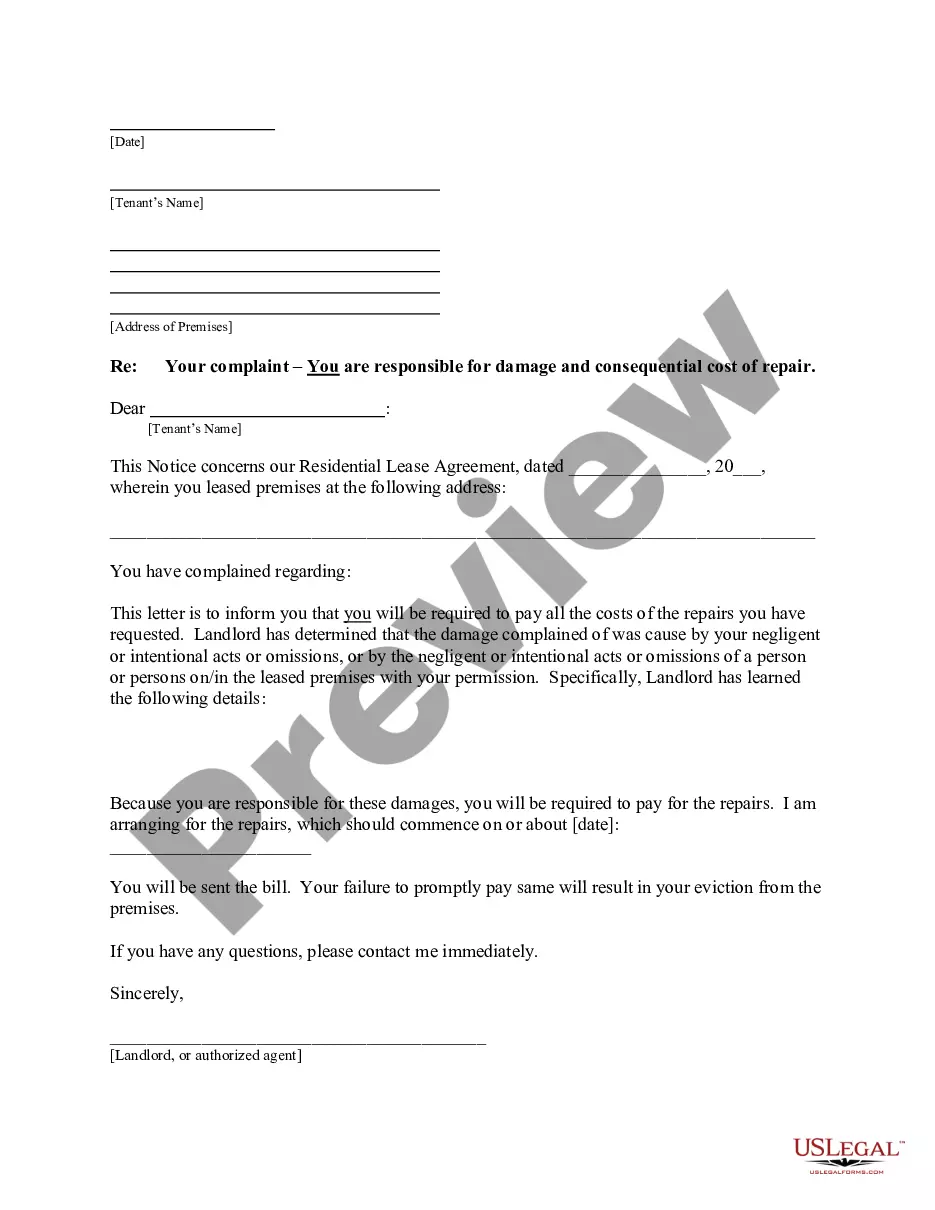

Common mistakes to avoid when using this form

When completing the Dancer Agreement, be mindful of these common errors:

- Incomplete Information: Ensure all required fields are filled out completely.

- Ambiguous Language: Avoid vague terms; be specific about services and payment.

- Not Signing: Ensure both parties sign the agreement; an unsigned contract may not be enforceable.

- Misunderstanding Tax Obligations: Clearly outline each party's tax responsibilities.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

The glib answer is yes. Webster's defines tutor as a person employed to instruct another, esp. privately. California wage order 15 says a tutor may be considered a household employee, along with other staff such as maids.

If you're self-employed or a freelancer, you likely get paid as an independent contractor rather than an employee. The IRS defines an independent contractor as someone who performs work for someone else, while controlling the way in which the work is done.

In most cases of studio owners I've encountered, your teachers are considered employees, not independent contractors. However, the business of dance studios is a very diverse group when it comes to schedules and employee structures.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

Teachers are independent contractors only if (a) you do not control or direct how they teach their classes, (b) if teaching yoga is outside of your yoga business, and (c) the teacher has an independent business that is the same as they work they do for you.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.

However, for the most part, under the Federal regulations (and most states including California), a crew member on a film or other similar type production should never be categorized as an independent contractor they are really employees and are subject to federal and state withholding (from their paychecks) as

For colleges and universities, the general rule is that instructors, adjunct faculty, and proctors are employees. Guest speakers and performers are independent contractors. Researchers and consultants must be determined on a case to case basis.