Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

Among numerous free and paid templates that you can find on the internet, you can't be certain about their accuracy and reliability. For example, who created them or if they are qualified enough to take care of what you require these people to. Keep relaxed and make use of US Legal Forms! Get Electrologist Agreement - Self-Employed Independent Contractor samples created by skilled attorneys and avoid the costly and time-consuming procedure of looking for an lawyer and after that having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re searching for. You'll also be able to access all of your previously acquired templates in the My Forms menu.

If you’re using our service the first time, follow the instructions below to get your Electrologist Agreement - Self-Employed Independent Contractor easily:

- Make certain that the document you see is valid in your state.

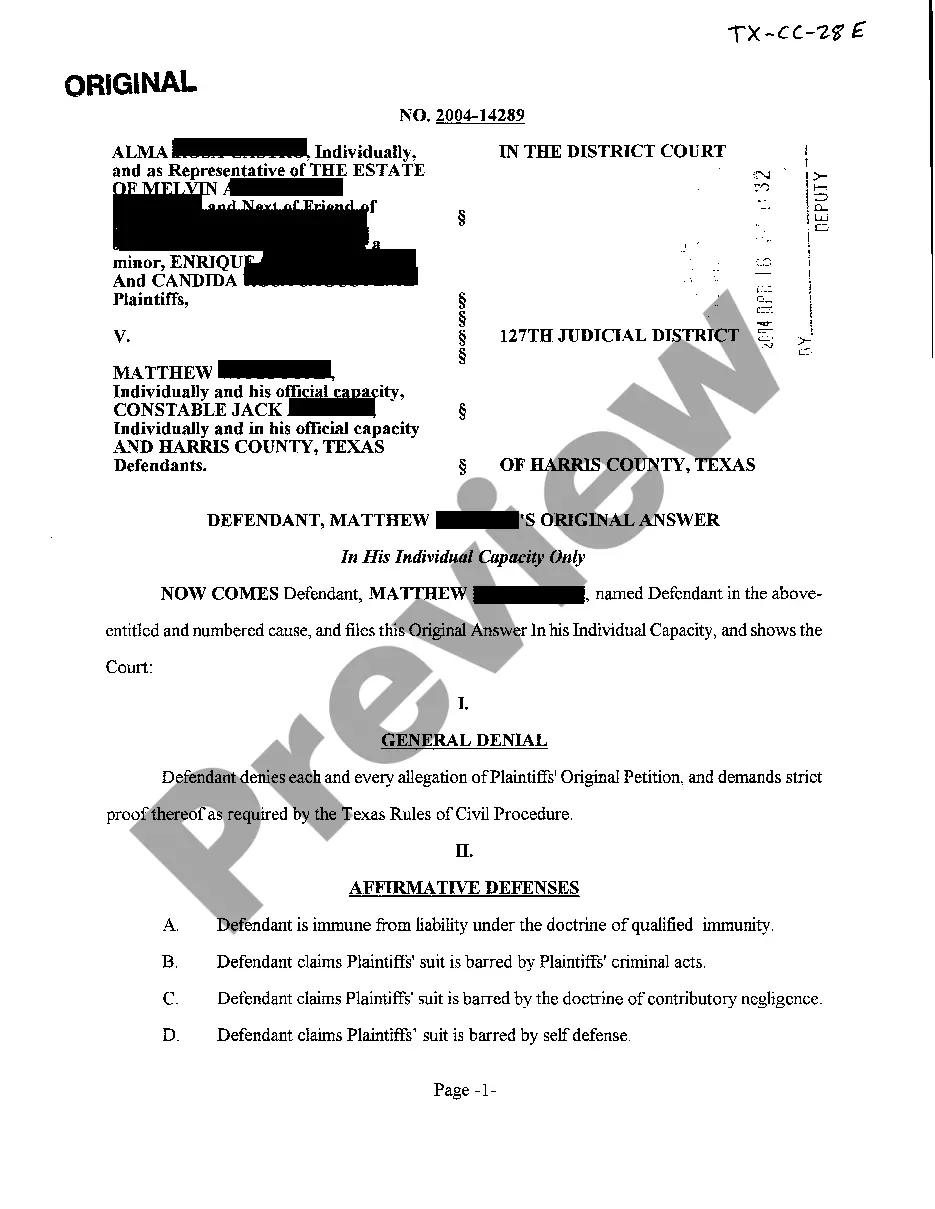

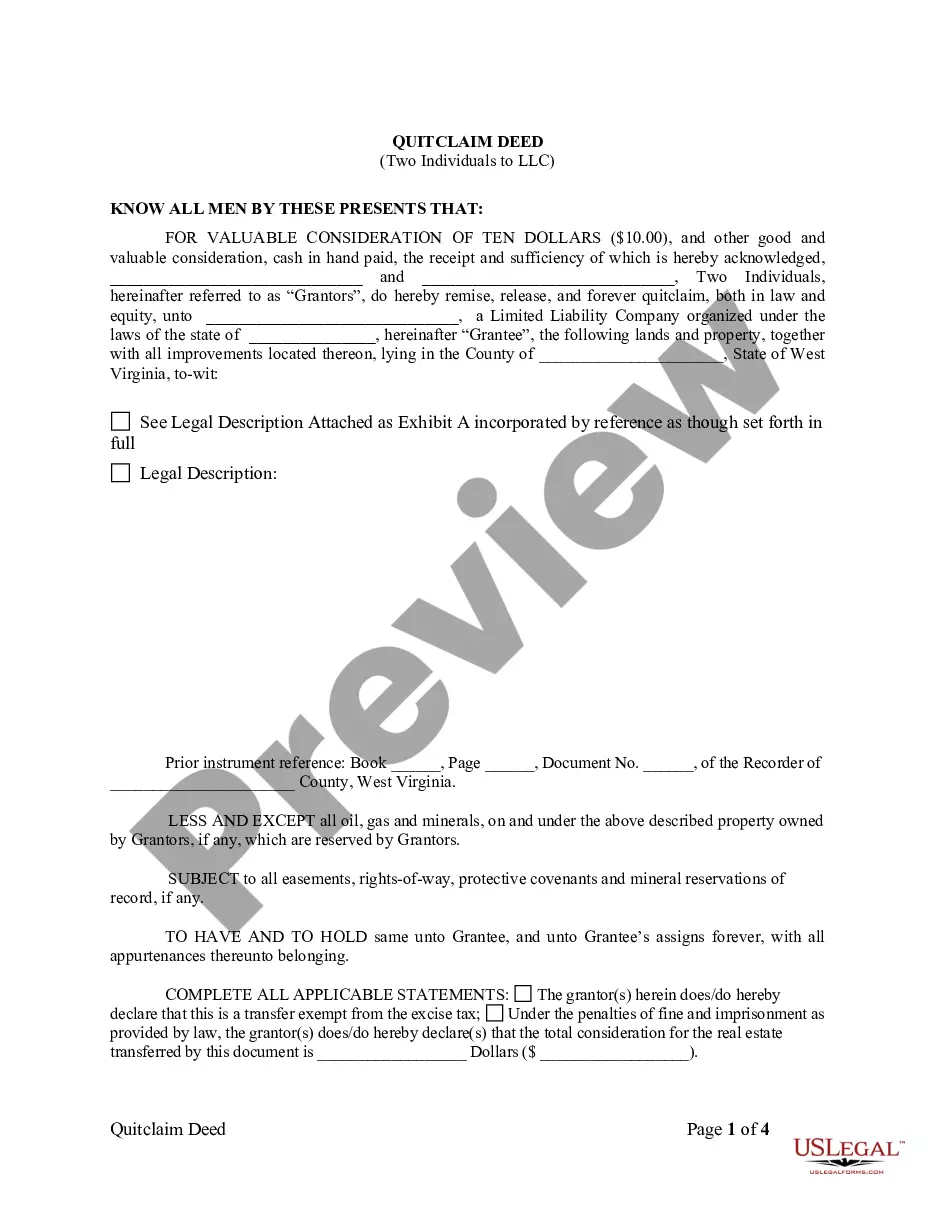

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another template utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you have signed up and paid for your subscription, you can use your Electrologist Agreement - Self-Employed Independent Contractor as often as you need or for as long as it remains active in your state. Change it in your preferred offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

For independent contractors, the California employment law and the Fair Labor Standards Act does not apply to them, meaning they do not get overtime pay. Employees, on the other hand, are protected by these laws that require minimum wages and overtime pay.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including: A description of the services provided. Terms and length of the project or service.

An independent contractor agreement is a document that an employer uses to hire a freelancer for a specific job. By extension, it distinguishes the independent contractor from an employee of the business for legal and tax purposes.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

You must file an annual income tax return (Form 1040). This requirement applies if you earned $400 or more through self-employment. You must pay estimated taxes on a quarterly basis. Specifically, you are responsible for paying:

If you run a small business that hires 1099 contractors, also known as independent contractors, it is vital that you have them sign an independent contractor contract. This is because there is a significant gray area between who is classified as an independent contractor and who is classified as an employee.