Loan Officer Employment Agreement

Description Mortgage Loan Officer Employment Agreement

How to fill out Mortgage Agreement Form Statement?

- Log in to your US Legal Forms account if you're an existing user. Ensure your subscription is active; if it's expired, renew it immediately.

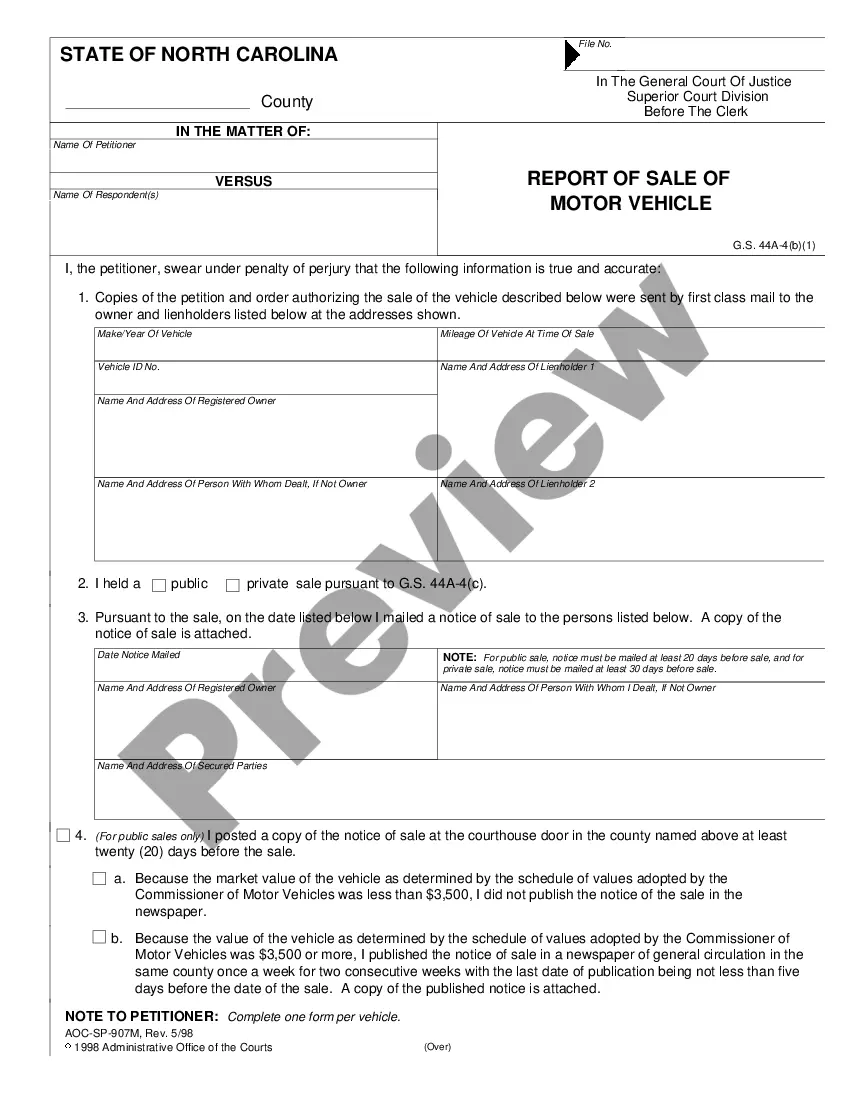

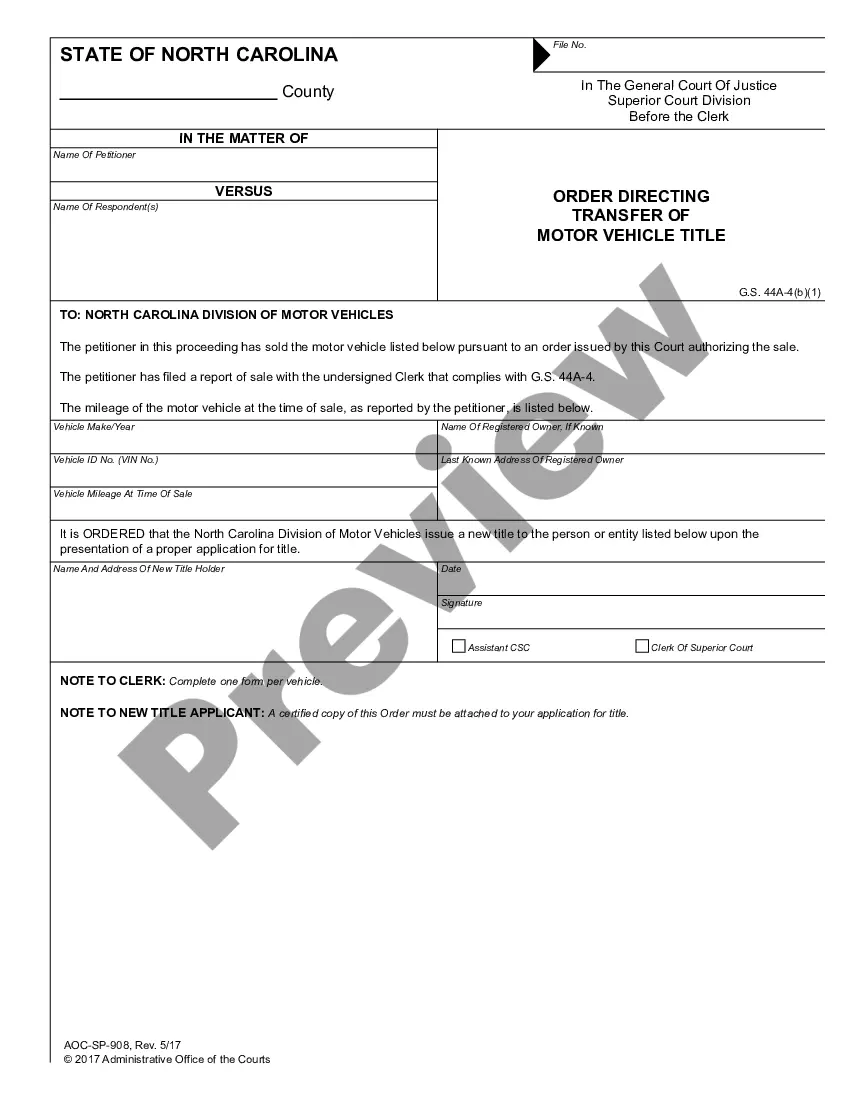

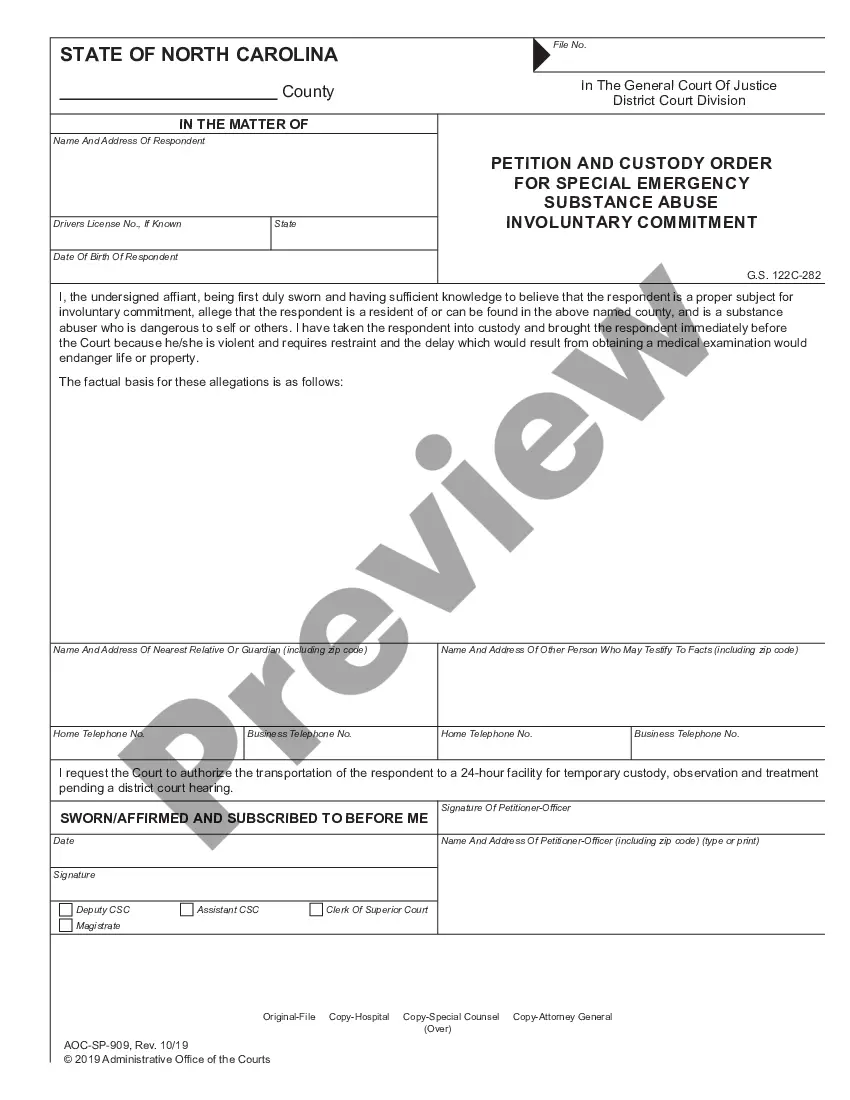

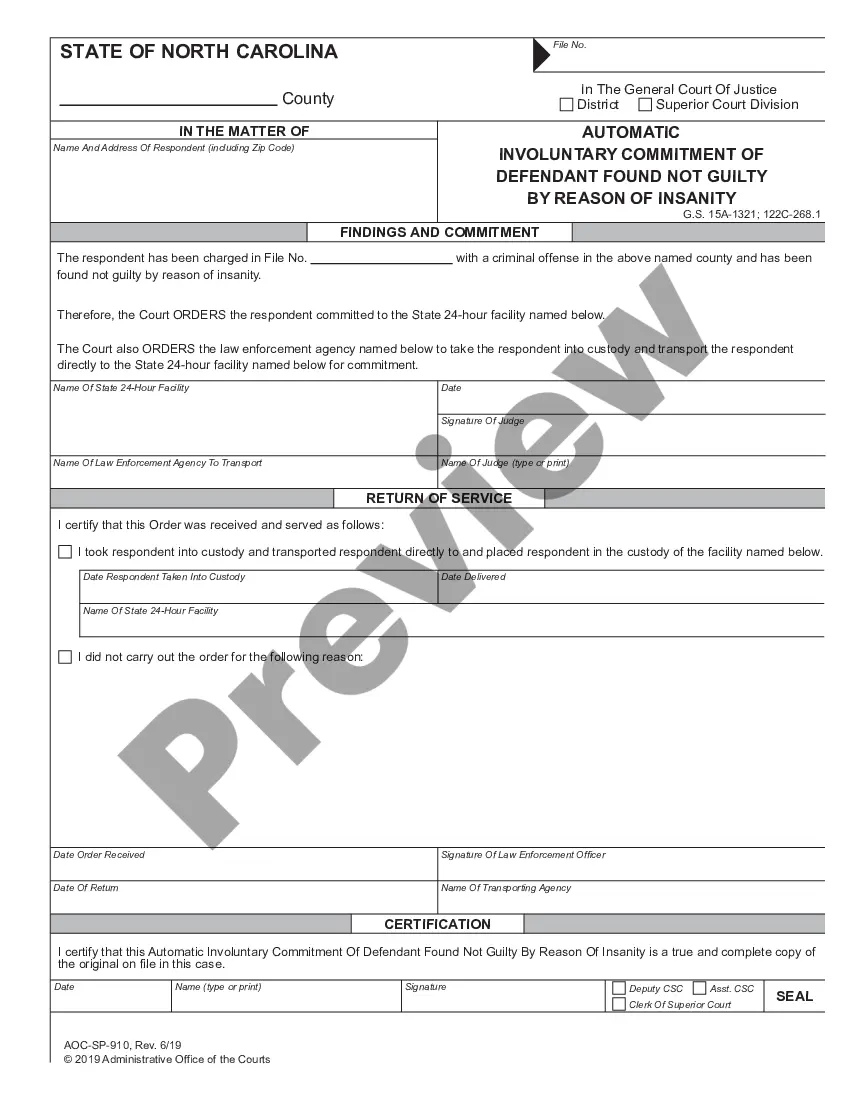

- For first-time users, begin by reviewing the documents in Preview mode. Confirm that the form meets your needs and aligns with local jurisdiction requirements.

- If you need an alternative template, utilize the Search tab at the top of the page to find the appropriate document for your situation.

- Select the correct form and click on the Buy Now button to choose your subscription plan, creating an account if you haven’t done so yet.

- Complete your purchase by entering your payment details, using either a credit card or PayPal for convenience.

- Download the form directly to your device for immediate access. You can also find it later in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the entire process of obtaining a Mortgage Loan Officer Agreement for self-employed independent contractors. With a diverse collection of over 85,000 editable legal forms backed by expert assistance, your legal documentation needs can be efficiently met.

Start your hassle-free legal journey today by visiting US Legal Forms and accessing the templates you need!

Loan Officer Agreement Form popularity

Mortgage Broker Employment Contract Other Form Names

Loan Officer Contract FAQ

If you earn 1099 income as an independent contractor, freelance worker or a salesman, you can qualify for an FHA loan if you can document steady 1099 income for the past two years.

Federal law does not prohibit 1099 compensation to licensed loan originators.

If you earn 1099 income as an independent contractor, freelance worker or a salesman, you can qualify for an FHA loan if you can document steady 1099 income for the past two years.

Can the MLO use their federally registered MLO status to originate loans for their own non-federally regulated mortgage company? No! The SAFE Act exempts a federally registered MLO from state MLO licensing requirements only if the MLO is an employee of a federally regulated bank.

In California there is a new law defining independent contractors that applies to everyone in the state, including mortgage brokers (realtors have a special exemption).Alternatively, if the individual is self-employed, they must hold both MLO licensure and state mortgage lender/broker licensure.

Most lenders will typically ask to see evidence of at least two years of self-employed income but, in some cases, they may ask for three years. If you have this proof, then you're likely to have access to a similar selection of mortgages to anyone else in your situation.

Is it possible for a federally registered MLO to be employed by two different institutions at the same time? Yes, the system allows multiple employments to exist.

Self-employed mortgage borrowers can apply for all the same loans 'traditionally' employed borrowers can. There are no special requirements that make it harder for self-employed people to get a mortgage. You're held to the same standards for credit, debt, down payment, and income as other applicants.

There is no blanket rule saying loan officers are, or are not, independent contractors; every situation is case by case, according to Garofalo. The gist of classification: If you supervise workers, they could be employees.