Disability Services Contract - Self-Employed

Description Disability Self Employed Buy

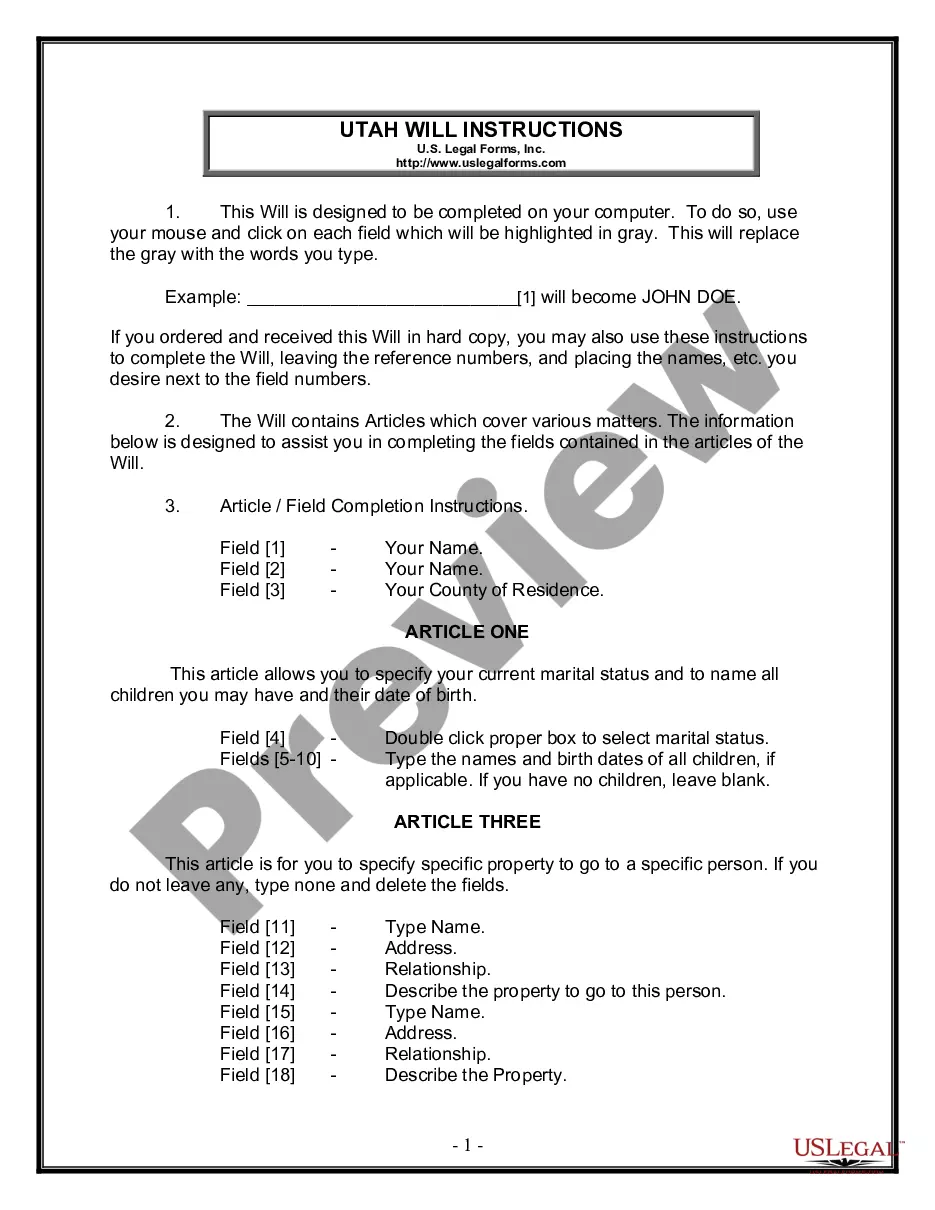

How to fill out Disability Services Contract - Self-Employed?

Among numerous free and paid templates that you’re able to find online, you can't be certain about their accuracy. For example, who made them or if they’re skilled enough to take care of what you require them to. Keep calm and use US Legal Forms! Locate Disability Services Contract - Self-Employed samples created by skilled attorneys and prevent the expensive and time-consuming process of looking for an lawyer or attorney and then having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access all of your previously saved examples in the My Forms menu.

If you’re using our service the very first time, follow the tips listed below to get your Disability Services Contract - Self-Employed fast:

- Make sure that the document you discover applies where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

Once you’ve signed up and purchased your subscription, you can use your Disability Services Contract - Self-Employed as many times as you need or for as long as it continues to be valid in your state. Edit it with your favored online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC).They are considered employees and are subject to the mandatory provisions of the California Unemployment Insurance Code.

If you are self-employed, you will need to consider whether you need short term coverage, long term coverage, or both. Short term disability insurance is typically for temporary, less serious injuries that limit the ability to work, but that people generally recover from.

For adults, medical conditions that automatically qualify you for social security disability compensation include:Mental disorders, such as depression, anxiety, schizophrenia, autism, or intellectual disability. Immune system disorders, such as HIV/AIDS, lupus, rheumatoid arthritis, and kidney disease.

For Small Business Owners, Self-Employed and Independent Contractors. Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC). It is not required that all active general partners be included in the application.

Self-employed individuals are only covered by the SDI program if they have enrolled in Disability Insurance Elective Coverage with EDD and paid the premiums. Usually you become eligible for benefits after six months of elective coverage.

Regardless of how Social Security taxes are paid, self-employed people are just as eligible for Social Security disability insurance (SSDI) benefits as if they were employed by another person or company.

Housing Benefit. Working Tax Credit. Income-based Jobseeker's Allowance. Income related Employment and Support Allowance.

SSI itself is not taxed, but if you earn additional income like self-employment, dividends, or interest, you will need to file a tax return. SSDI benefits are also not subject to federal tax.

When determining countable income, Social Security looks at your gross income before any deductions. However, if you are an independent contractor or self- employed, your income may not be the amount of any check you receive but a lower amount.