Specialty Services Contact - Self-Employed

Description

How to fill out Specialty Services Contact - Self-Employed?

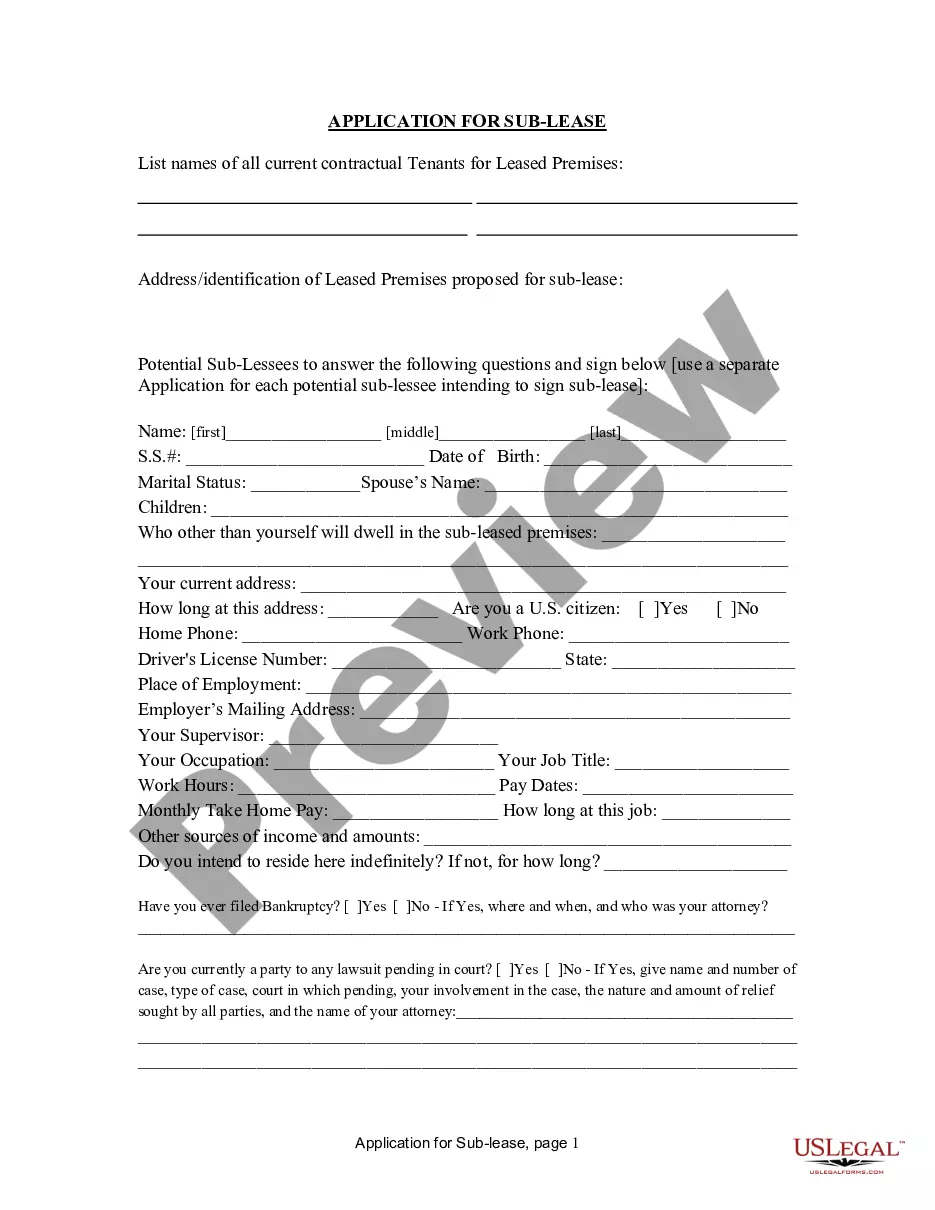

Among countless free and paid examples that you find on the net, you can't be certain about their reliability. For example, who created them or if they’re competent enough to take care of what you require these people to. Always keep relaxed and make use of US Legal Forms! Get Specialty Services Contact - Self-Employed templates made by skilled lawyers and get away from the expensive and time-consuming procedure of looking for an attorney and after that paying them to write a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access all your earlier saved examples in the My Forms menu.

If you’re making use of our service the first time, follow the tips below to get your Specialty Services Contact - Self-Employed quickly:

- Ensure that the document you discover applies in the state where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you’ve signed up and bought your subscription, you may use your Specialty Services Contact - Self-Employed as often as you need or for as long as it continues to be valid in your state. Revise it in your favored online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

A freelancer is a self-employed person who: Pays their own income tax, known as self-employment tax. Doesn't usually have employees, but may outsource work for specific projects. Has full control over where they work (e.g., they'll often work remotely) and the work hours.

Special rules apply to workers who perform in-home services for elderly or disabled individuals (caregivers).In such cases, the caregiver must still report the compensation as income of his or her Form 1040 or 1040-SR, and may be required to pay self-employment tax depending on the facts and circumstances.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

To be self-employed is essentially what it says you are employed by yourself. A freelancer is self-employed, for instance.As a self-employed person, you might run a business with employees or use freelancers. Self-employed people are also not necessarily working with clients in the same way freelancers do.

The Internal Revenue Service considers freelancers to be self-employed, so if you earn income as a freelancer you must file your taxes as a business owner. While you can take additional deductions if you are self-employed, you'll also face additional taxes in the form of the self-employment tax.

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

Locate all of your annual tax returns. Tax returns are your first go-to when it comes to income proof. Bank statements indicate personal cash flow. Make use of online accounting services that track payments and expenditures. Maintain profit and loss statements.

A self-employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

As a freelancer, you're going to have to register as self-employed and more specifically as a sole trader. Despite how it sounds, it doesn't actually apply to people who just work alone. So you can take on staff if you want. It just means that you're solely responsible for the business.