Fuel Delivery And Storage Services - Self-Employed

Description

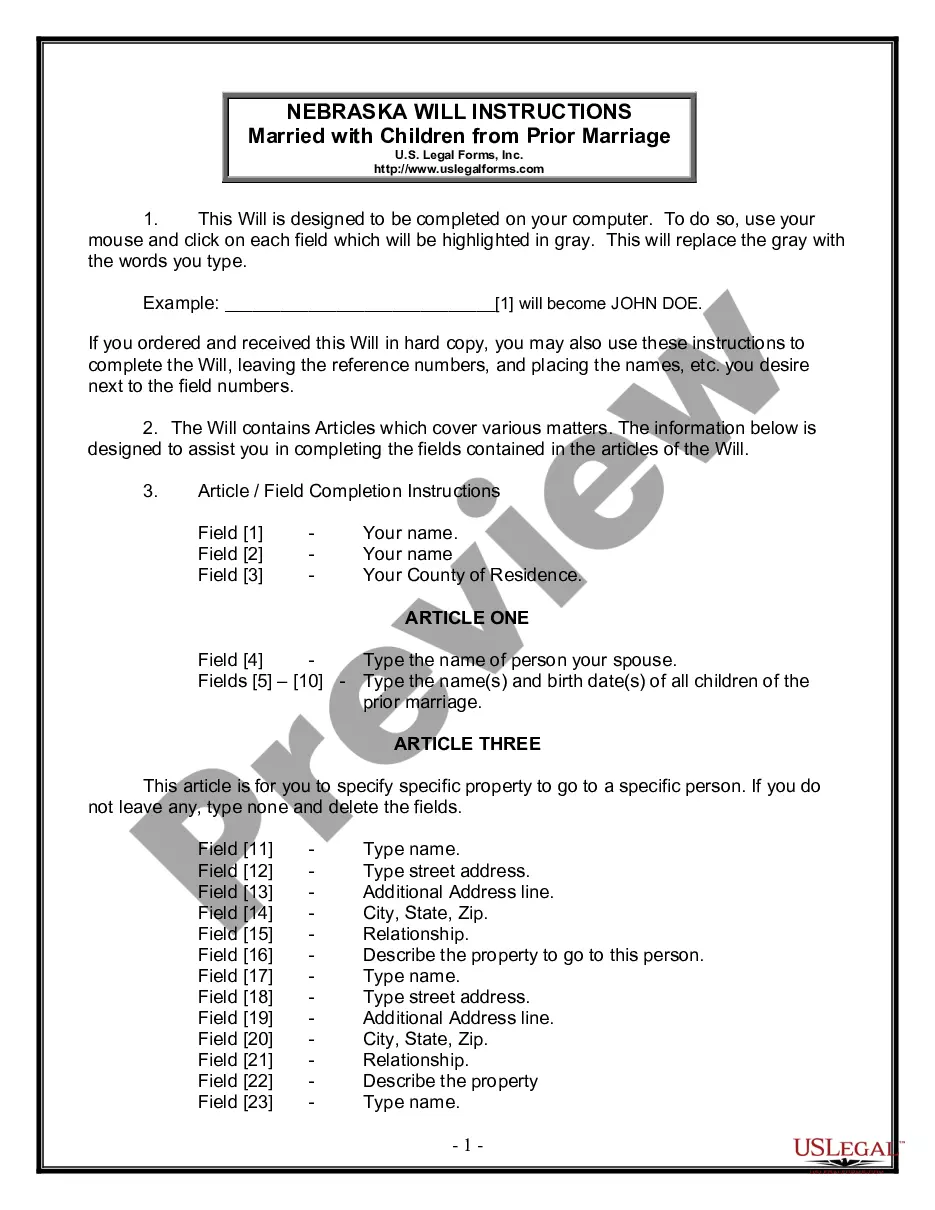

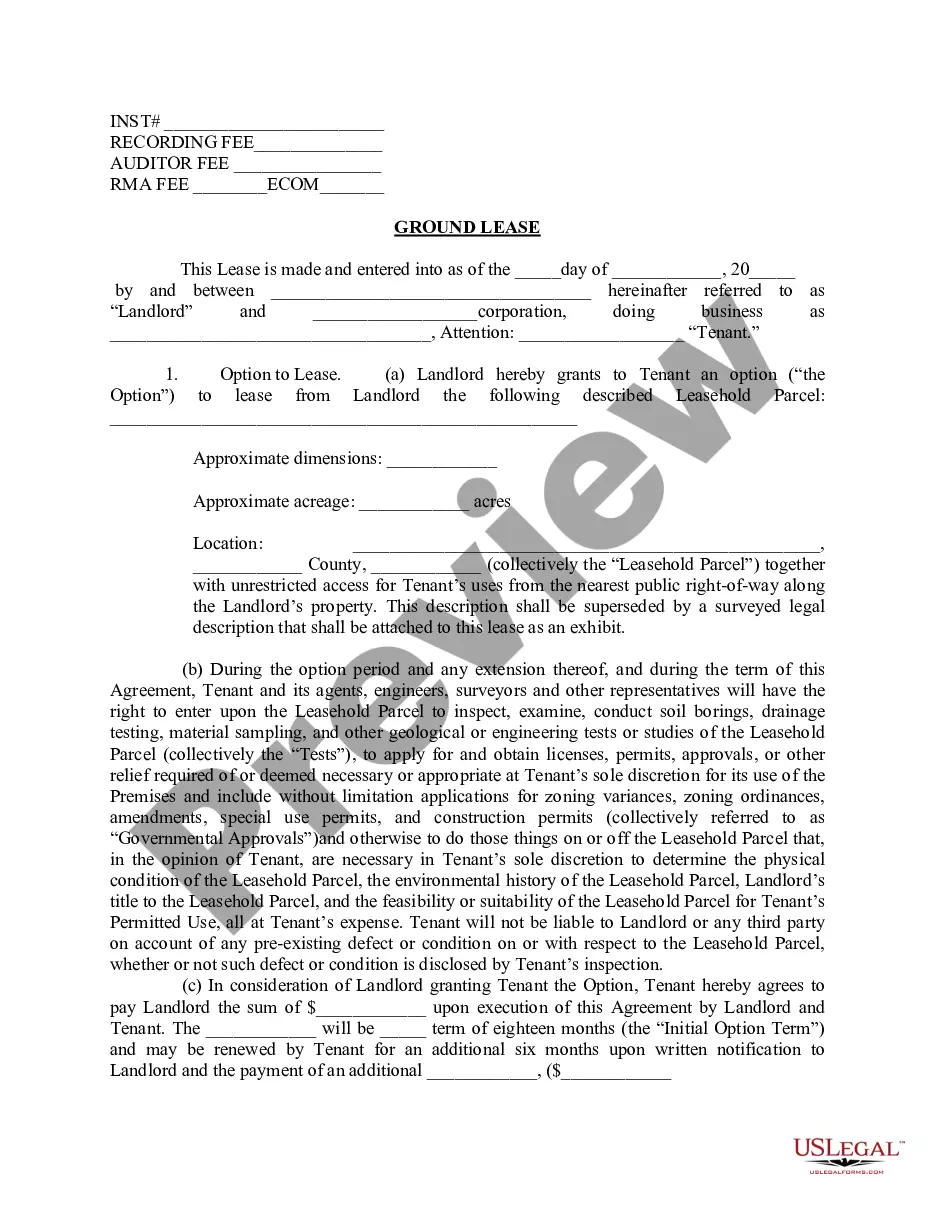

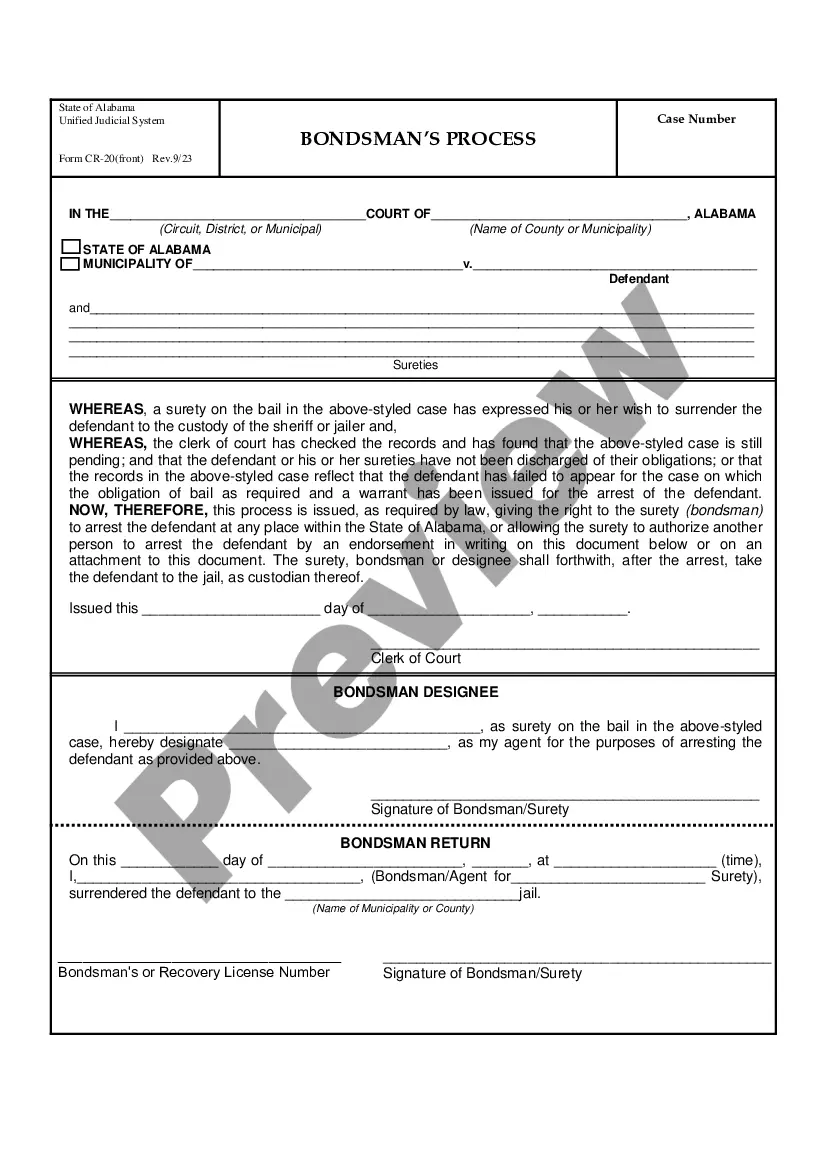

How to fill out Fuel Delivery And Storage Services - Self-Employed?

Among numerous free and paid templates that you can find on the net, you can't be certain about their reliability. For example, who created them or if they are competent enough to deal with the thing you need them to. Always keep calm and make use of US Legal Forms! Discover Fuel Delivery And Storage Services - Self-Employed samples developed by skilled attorneys and avoid the expensive and time-consuming process of looking for an attorney and then paying them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are seeking. You'll also be able to access all your previously acquired documents in the My Forms menu.

If you’re using our website the very first time, follow the instructions below to get your Fuel Delivery And Storage Services - Self-Employed fast:

- Make sure that the document you discover applies where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or find another example utilizing the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you have signed up and purchased your subscription, you can use your Fuel Delivery And Storage Services - Self-Employed as many times as you need or for as long as it remains valid in your state. Revise it with your favored offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

The $550 fee covers trucks weighing more than 55,000 pounds and is due by Aug. 1 for the July 1-June 30 period. You also face fuel and mileage taxes under the International Fuel Tax Agreement (IFTA).Everything they do on the road is deductible.

Yes, you can deduct the mileage. As an independent contractor (received a 1099-MISC) you are considered self employed by the IRS. Because you received a 1099-MISC, you are considered a "business" owner.You can deduct the miles driven for business.

Yes, you can deduct the cost of gasoline on your taxes. Use the actual expense method to claim the cost of gasoline, taxes, oil and other car-related expenses on your taxes.

You report the self-employed mileage deduction in the Expenses section of Schedule C.

The answer is yes. It is treated as earned compensation and then the expense of fuel is the total amount. That's how I handle it. The surcharge is income and then the fuel is deducted as an expense.

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be written off." Just make sure to keep a detailed log and all receipts, he advises, or keep track of your yearly mileage and then deduct the

Mileage for self-employed workers isn't subject to any threshold requirements either. In other words, all miles are deductible regardless of how much a person drives for work.Self-employed workers can claim their mileage deduction on their Schedule C tax form, rather than a Schedule A form for itemized deductions.

As a self-employed taxpayer, you can deduct expenses for mileage accrued while doing business. If you use a car solely for business, you can deduct all the expenses related to operating the car. However, if you use the car for both personal and business travel, you can only deduct the cost of the business use.

You can deduct more in 2019, the IRS says. The Internal Revenue Service is giving some taxpayers who use their cars for business a much-appreciated bonus: a boost of three-and-a-half cents per mile, bringing the mileage deduction to 58 cents per mile in 2019.The typical driver logs about 14,000 miles per year.