Property Manager Agreement - Self-Employed Independent Contractor

Description Onsite Property Manager Agreement

How to fill out Property Manager Form Contract?

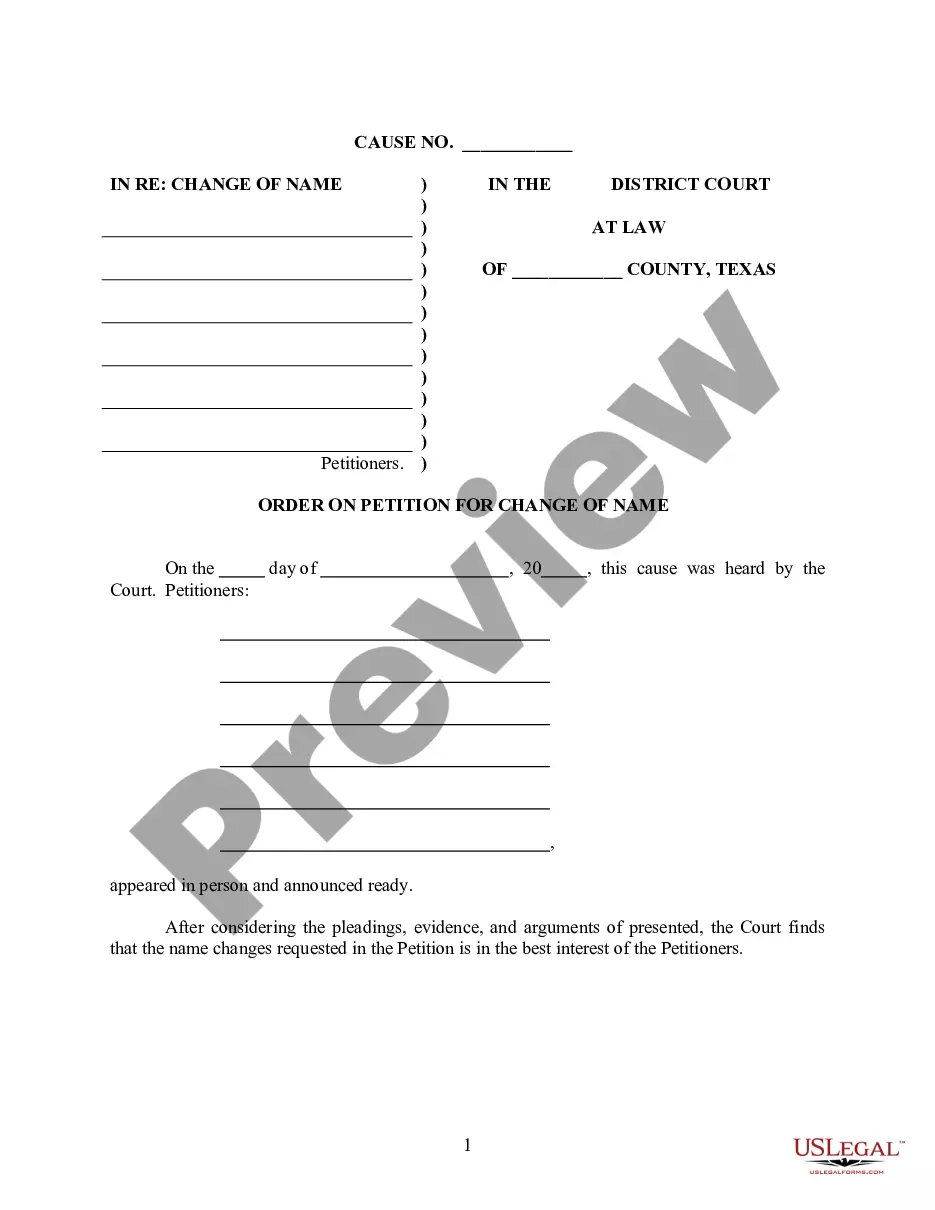

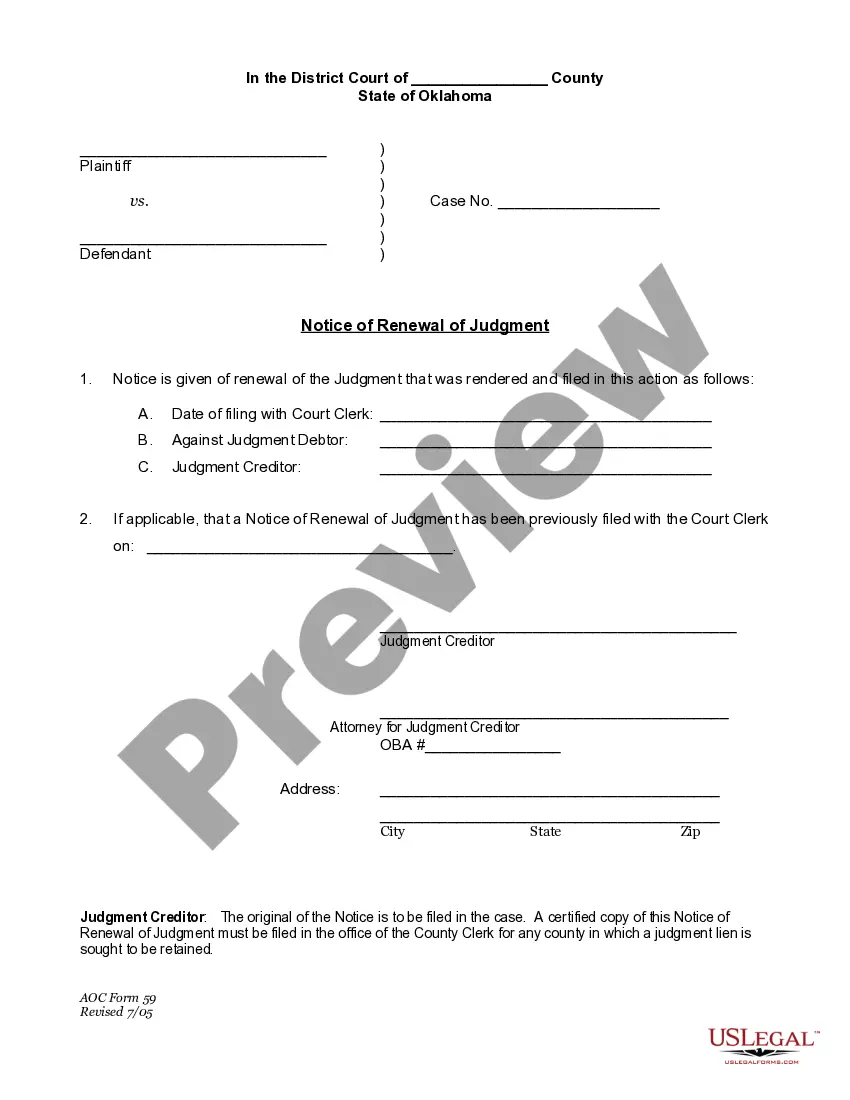

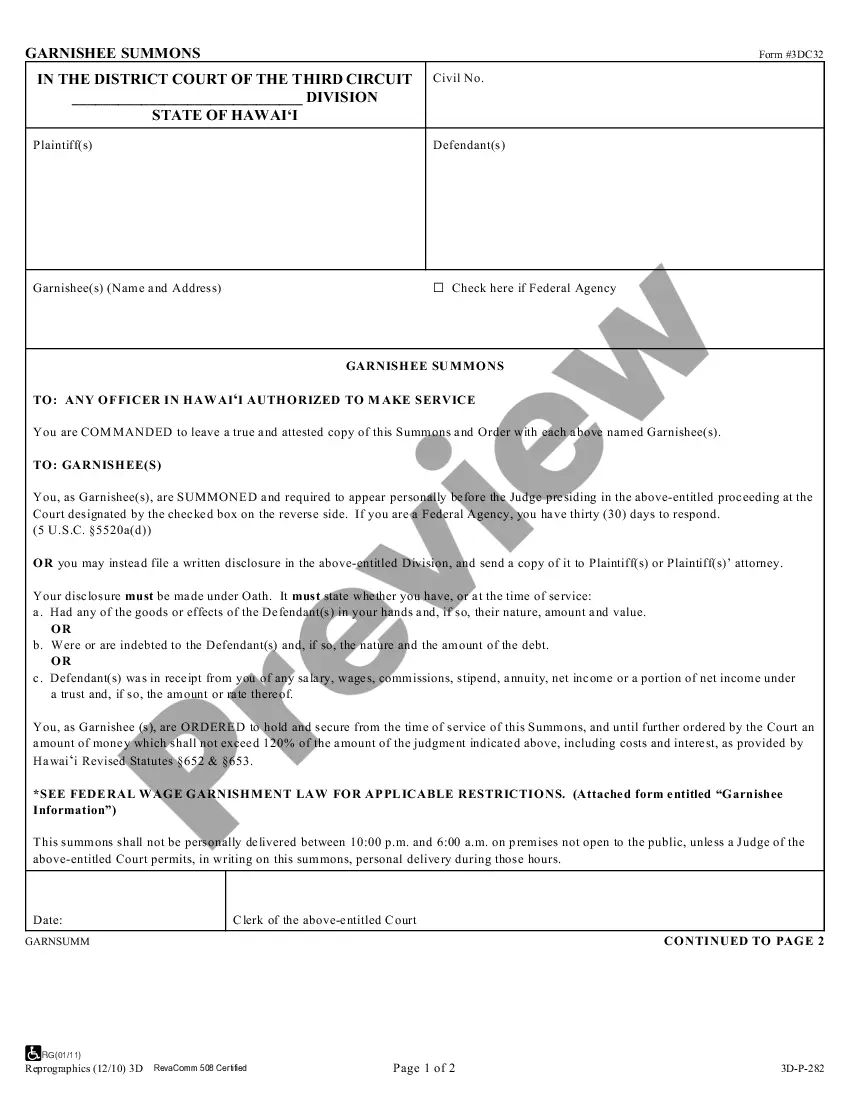

Use US Legal Forms to obtain a printable Property Manager Agreement - Self-Employed Independent Contractor. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the internet and offers affordable and accurate samples for customers and lawyers, and SMBs. The templates are categorized into state-based categories and a few of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to easily find and download Property Manager Agreement - Self-Employed Independent Contractor:

- Check out to make sure you get the proper form in relation to the state it is needed in.

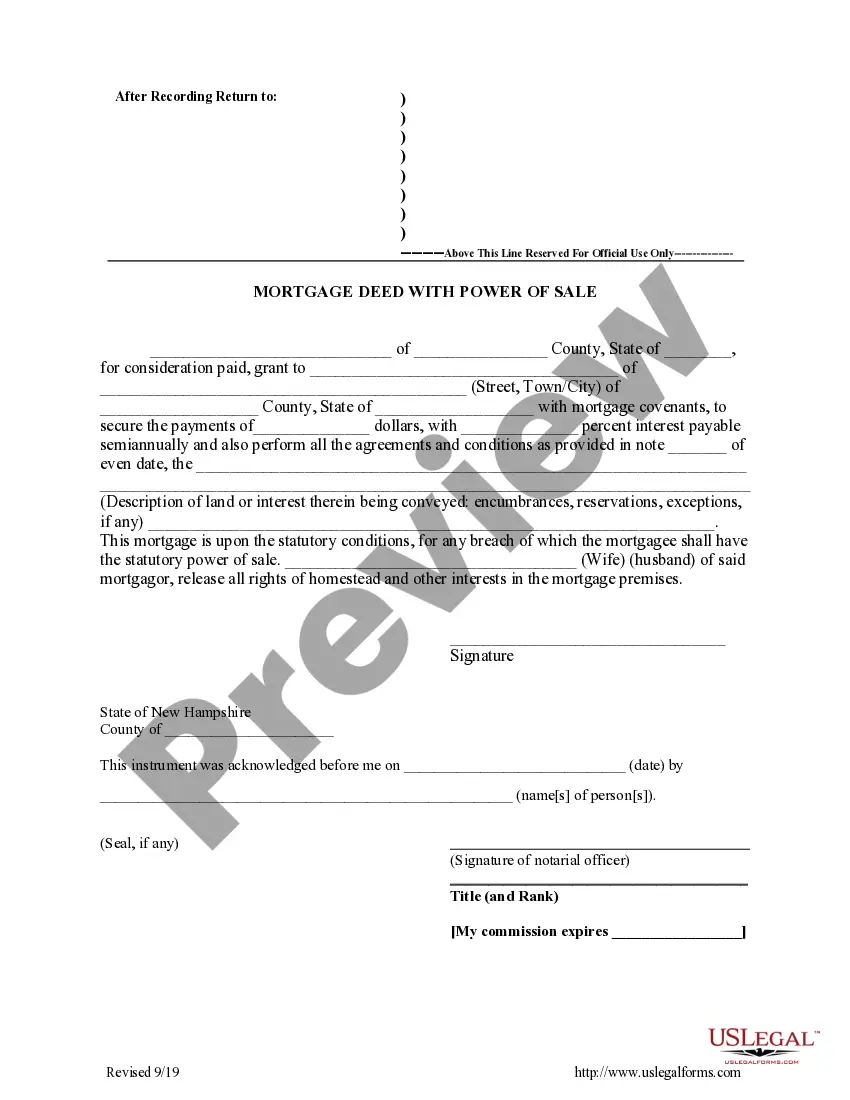

- Review the document by reading the description and by using the Preview feature.

- Press Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Make use of the Search field if you need to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Property Manager Agreement - Self-Employed Independent Contractor. More than three million users already have utilized our service successfully. Choose your subscription plan and have high-quality forms within a few clicks.

Manager Agreement Property Form popularity

Agreement Property Manager Other Form Names

Agreement Independent Contractor Form Blank FAQ

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Property managers are required to issue a 1099-MISC tax form for any service provider or owner who receives more than $600 related to their rental business.For owners: a property manager must fill out the 1099 to report rent paid over to the property owner in excess of $600 during the tax year.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

About half of property managers are self-employed.Some apartment managers are required to live in the apartment complexes where they work, so that they are available to handle emergencies, even when they are off duty. Most property managers work full time.

While property managers are exempt from receiving 1099s for rental income received (even from a tenant renting a commercial space), the PM company itself is required to send a 1099-MISC for all rental income received on behalf of property owners.

Allowing independent contractors or consultants to manage company employees is not a recommended practice.Both the Internal Revenue Service (IRS) and the U.S. Department of Labor (DOL) may refer to these criteria when evaluating whether a worker has been properly classified as an independent contractor.

A management company is an independent contractor, not your employee. The people who work for the company are its employees or independent contractorsyou are not responsible for their payroll taxes.