Minister Agreement - Self-Employed Independent Contractor

Description

How to fill out Minister Agreement - Self-Employed Independent Contractor?

Among hundreds of free and paid samples which you get on the net, you can't be certain about their accuracy. For example, who created them or if they are qualified enough to take care of what you require them to. Always keep calm and make use of US Legal Forms! Locate Minister Agreement - Self-Employed Independent Contractor samples made by professional lawyers and prevent the high-priced and time-consuming procedure of looking for an lawyer and then paying them to write a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you are looking for. You'll also be able to access your earlier acquired files in the My Forms menu.

If you are making use of our platform the very first time, follow the tips listed below to get your Minister Agreement - Self-Employed Independent Contractor quickly:

- Ensure that the document you discover applies in your state.

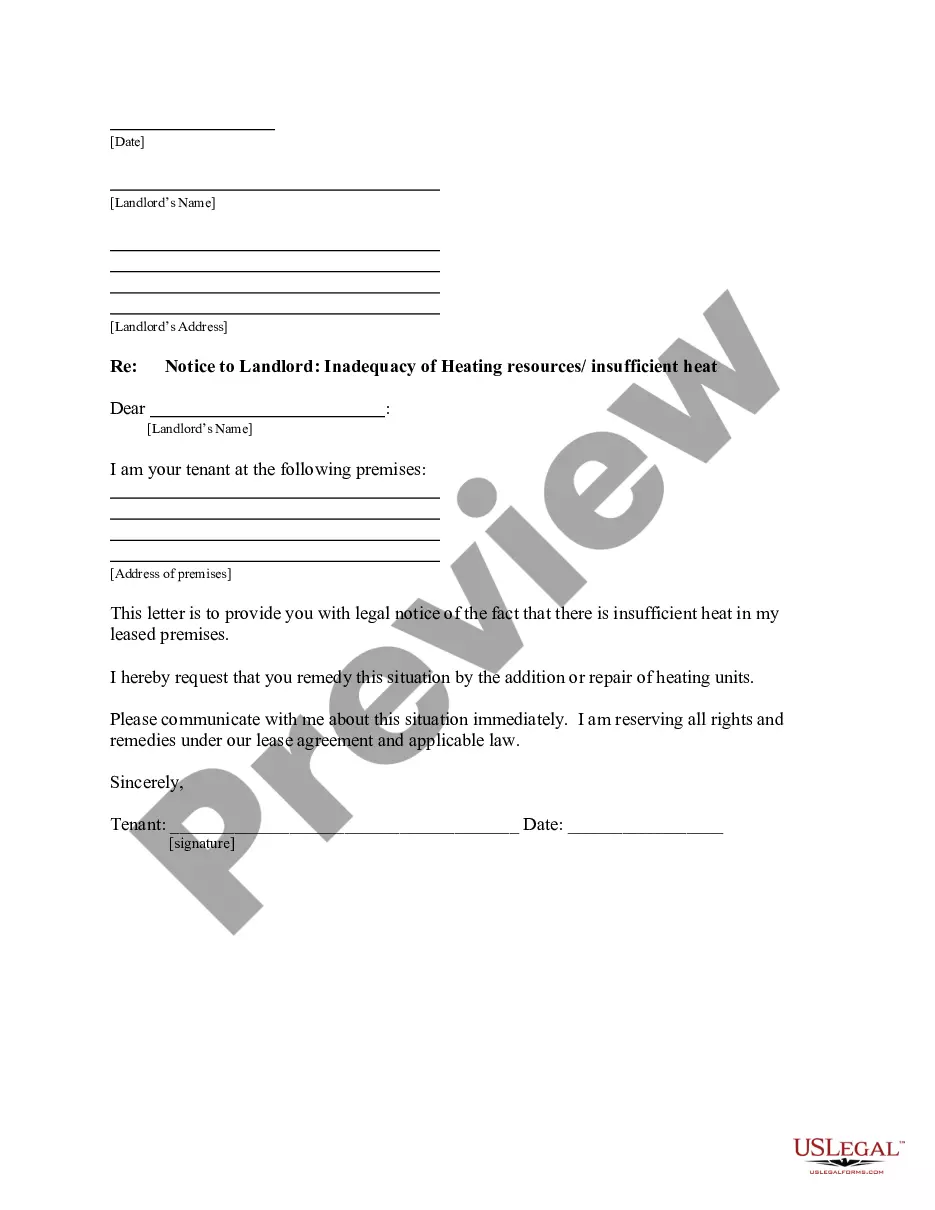

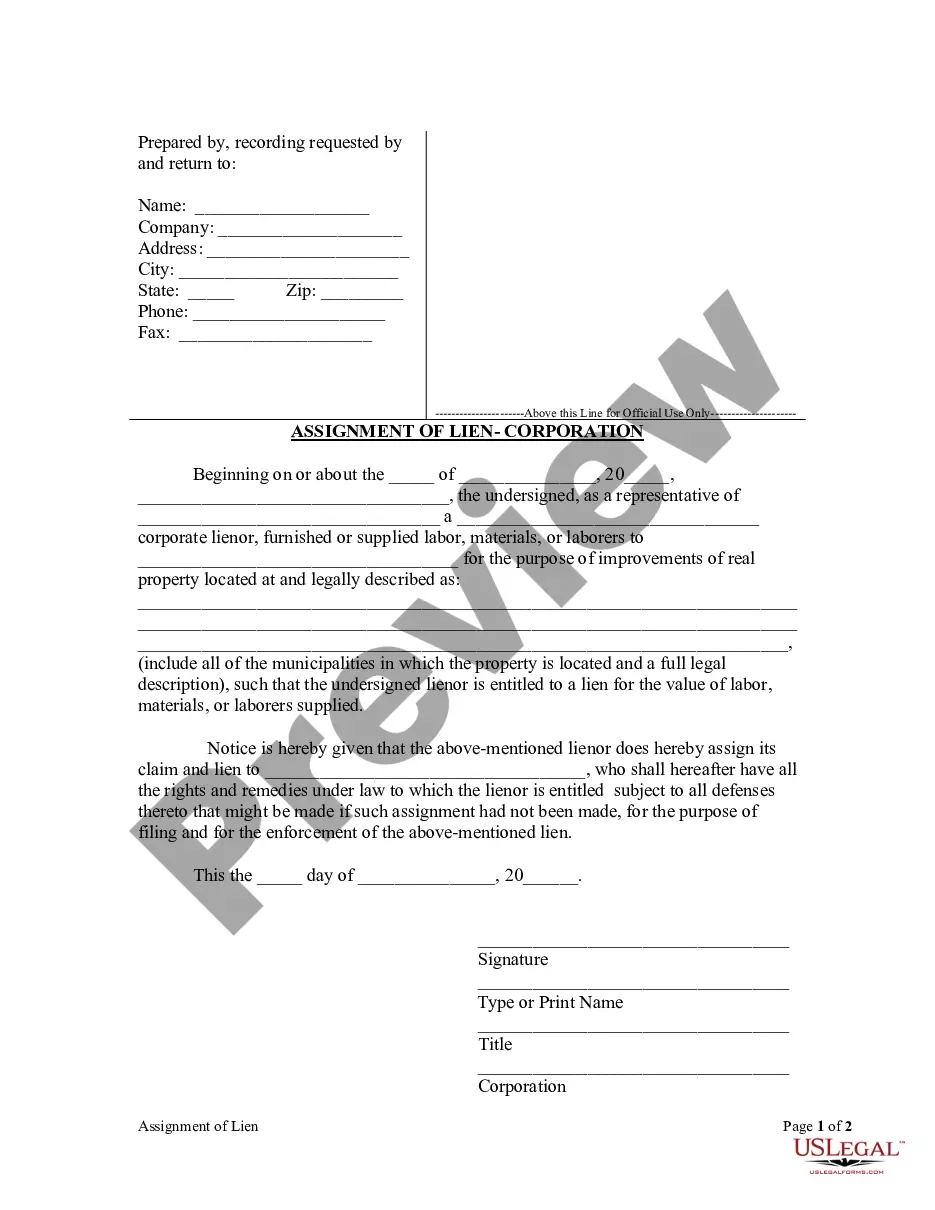

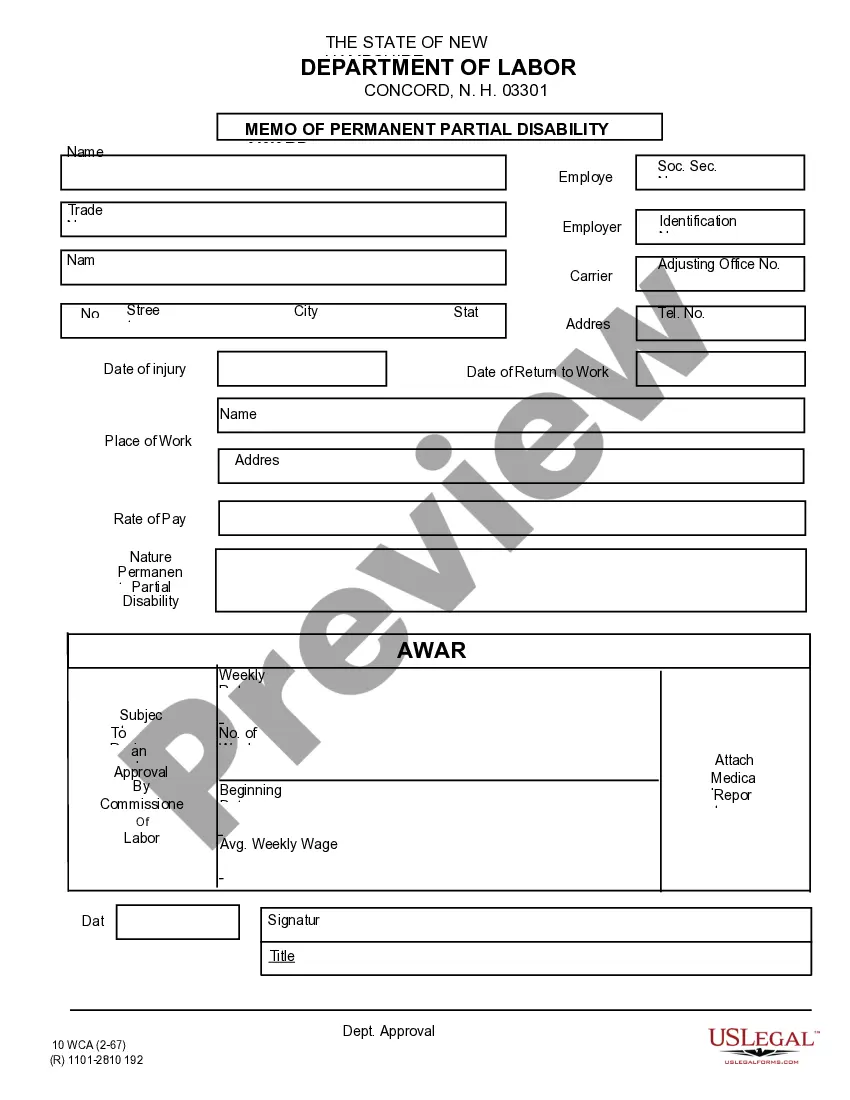

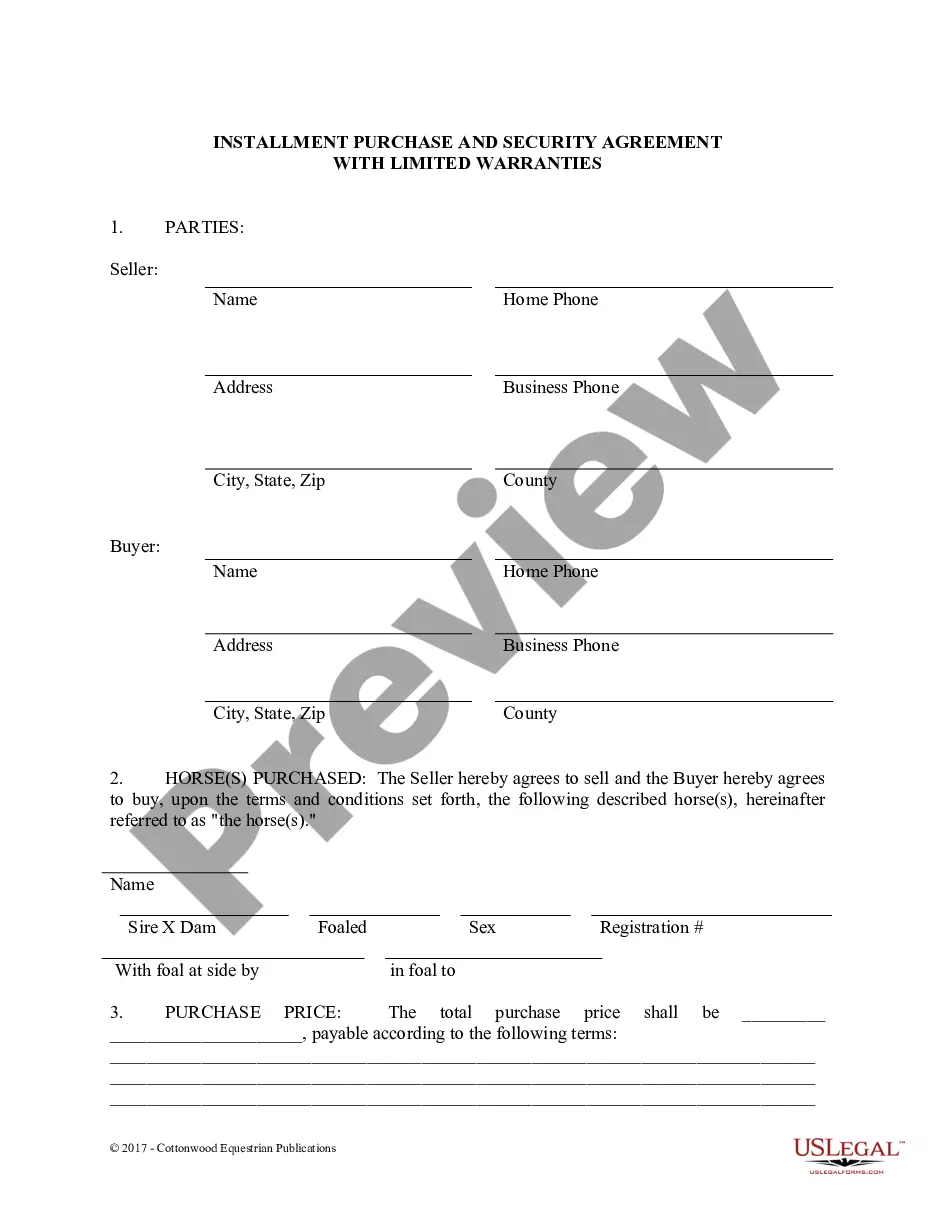

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another example utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you’ve signed up and purchased your subscription, you may use your Minister Agreement - Self-Employed Independent Contractor as many times as you need or for as long as it stays valid where you live. Change it with your favored offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

According to IRS guidelines, a pastor is considered self-employed if a church does not have control over the pastor's employment status or activities. When a pastor is given a housing allowance or provided a parsonage, the IRS does not require this compensation to be reported as taxable income.

Regardless of whether you're a minister performing ministerial services as an employee or a self-employed person, all of your earnings, including wages, offerings, and fees you receive for performing marriages, baptisms, funerals, etc., are subject to income tax.

A minister can apply to be exempt from paying the self-employment tax. This exemption will only apply to their wages from the church, not other services performed. They must fill out Form 4361 and attach a statement stating they have taken a vow of poverty or oppose public insurance.

Clergy are still considered self-employed and file Schedule SE on their 1040 and pay both the Employee and Employer portion of Social Security and Medicare tax (a total of up to 15.3%) on earned income.

Compensation paid to a minister or clergy member typically is reported to them on Form W-2 (if the minister is an employee of the church), or Form 1099-MISC (if the minister performed services such as weddings and baptisms). Most ministers are treated as dual-status taxpayers.

Since they are considered self-employed, ministers are exempt from federal income tax withholding. However, ministers can request that their employers withhold taxes. This approach may be easier than making quarterly estimated payments.

Regardless of whether you're a minister performing ministerial services as an employee or a self-employed person, all of your earnings, including wages, offerings, and fees you receive for performing marriages, baptisms, funerals, etc., are subject to income tax.

Pastors Are Always Self-Employed For Social Security Taxes When it comes to Social Security and Medicare taxes, also known as payroll taxes, you are always considered self-employed. Pastors are always self-employed for Social Security taxes and pay under the SECA system.You're always considered self-employed.