Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

Among lots of free and paid templates that you find on the net, you can't be sure about their reliability. For example, who made them or if they are competent enough to deal with what you need these to. Keep calm and utilize US Legal Forms! Get Personal Shopper Services Contract - Self-Employed Independent Contractor samples made by professional legal representatives and get away from the high-priced and time-consuming process of looking for an lawyer and after that having to pay them to write a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all of your earlier downloaded templates in the My Forms menu.

If you’re using our service the very first time, follow the guidelines below to get your Personal Shopper Services Contract - Self-Employed Independent Contractor quick:

- Ensure that the document you find applies where you live.

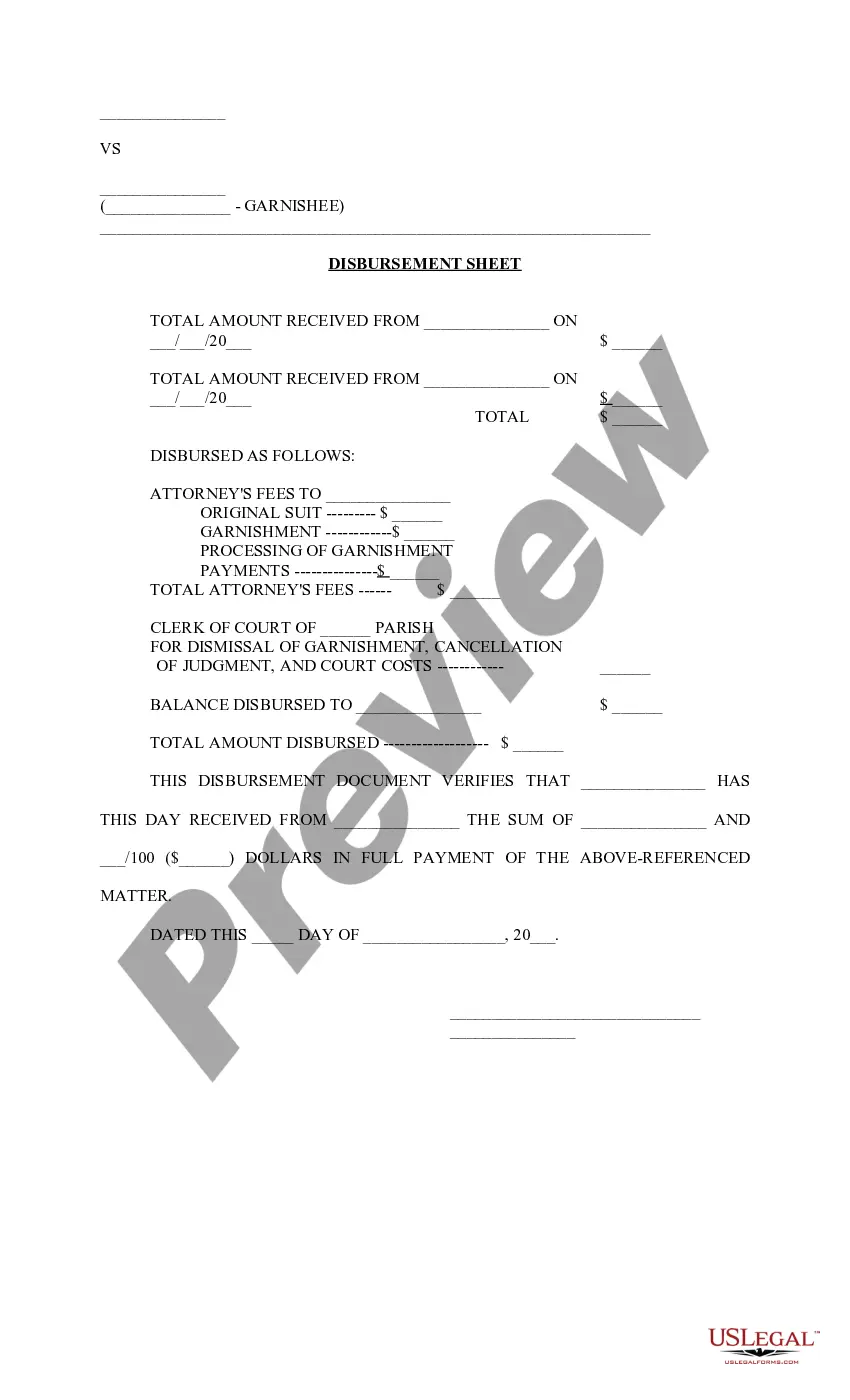

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or find another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

When you’ve signed up and purchased your subscription, you can utilize your Personal Shopper Services Contract - Self-Employed Independent Contractor as often as you need or for as long as it remains valid in your state. Change it in your favorite editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Writing Your Construction Contract. Write the title and a little preamble. Your title should describe the purpose of the contract. The preamble should simply state basics like: the date the agreement was entered into, the parties' names, the project, the work site location, and work commencement and end dates.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

IRS Form W-9 is most commonly used by individuals when they are working as a freelancer or independent contractor. If you ever find yourself filling out a Form W-9, it generally means that a business or person who is paying you money needs your Social Security number so it can notify the IRS of the amount.

Timeframe or key milestones of the project; hours of work; deliverables of the project; and. way the business will pay the contractor for their services.