Physician's Assistant Agreement - Self-Employed Independent Contractor

Description Physician Assistant Contract

How to fill out Assistant Agreement Form?

Among lots of paid and free templates that you find on the internet, you can't be certain about their accuracy and reliability. For example, who made them or if they’re skilled enough to deal with the thing you need those to. Keep relaxed and make use of US Legal Forms! Get Physician's Assistant Agreement - Self-Employed Independent Contractor templates made by skilled lawyers and avoid the high-priced and time-consuming procedure of looking for an lawyer and then paying them to draft a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the form you’re looking for. You'll also be able to access all your earlier downloaded documents in the My Forms menu.

If you’re making use of our service the very first time, follow the guidelines listed below to get your Physician's Assistant Agreement - Self-Employed Independent Contractor with ease:

- Ensure that the file you see is valid where you live.

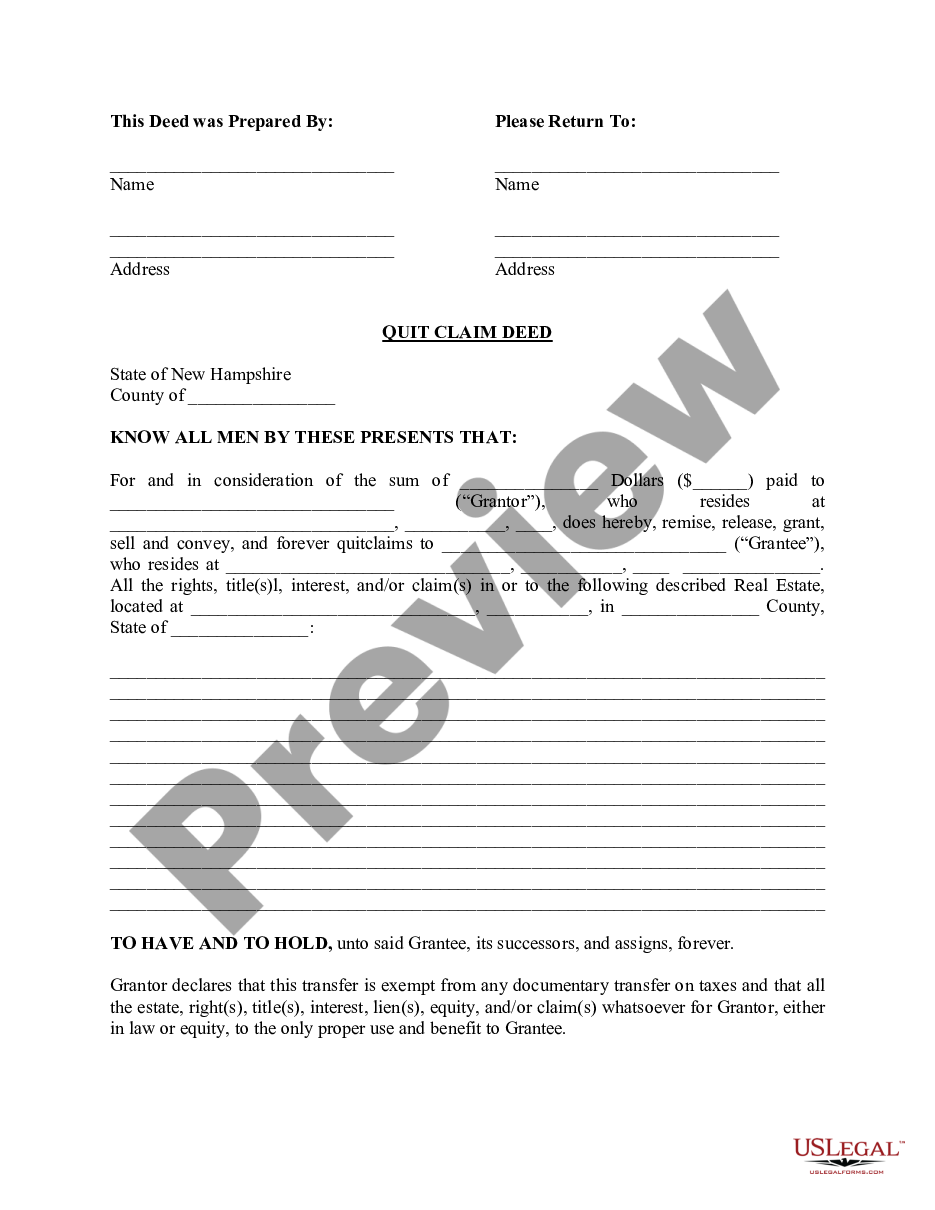

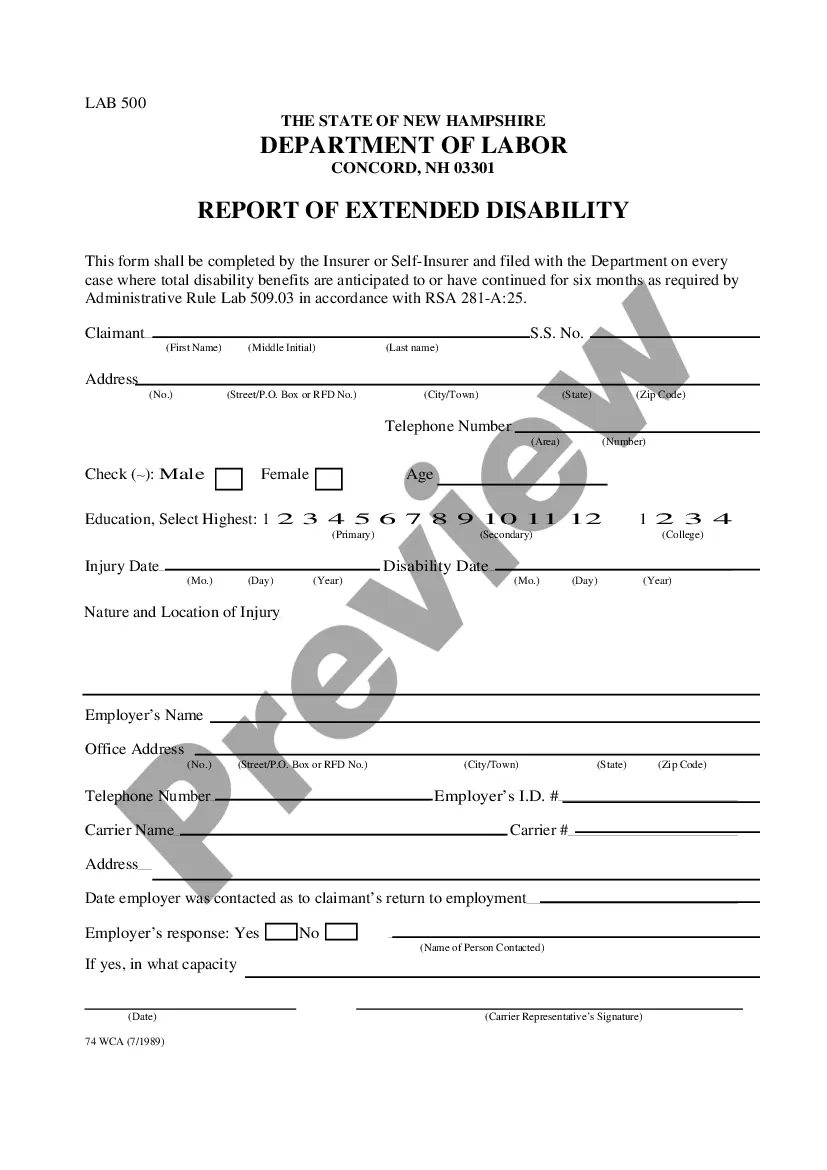

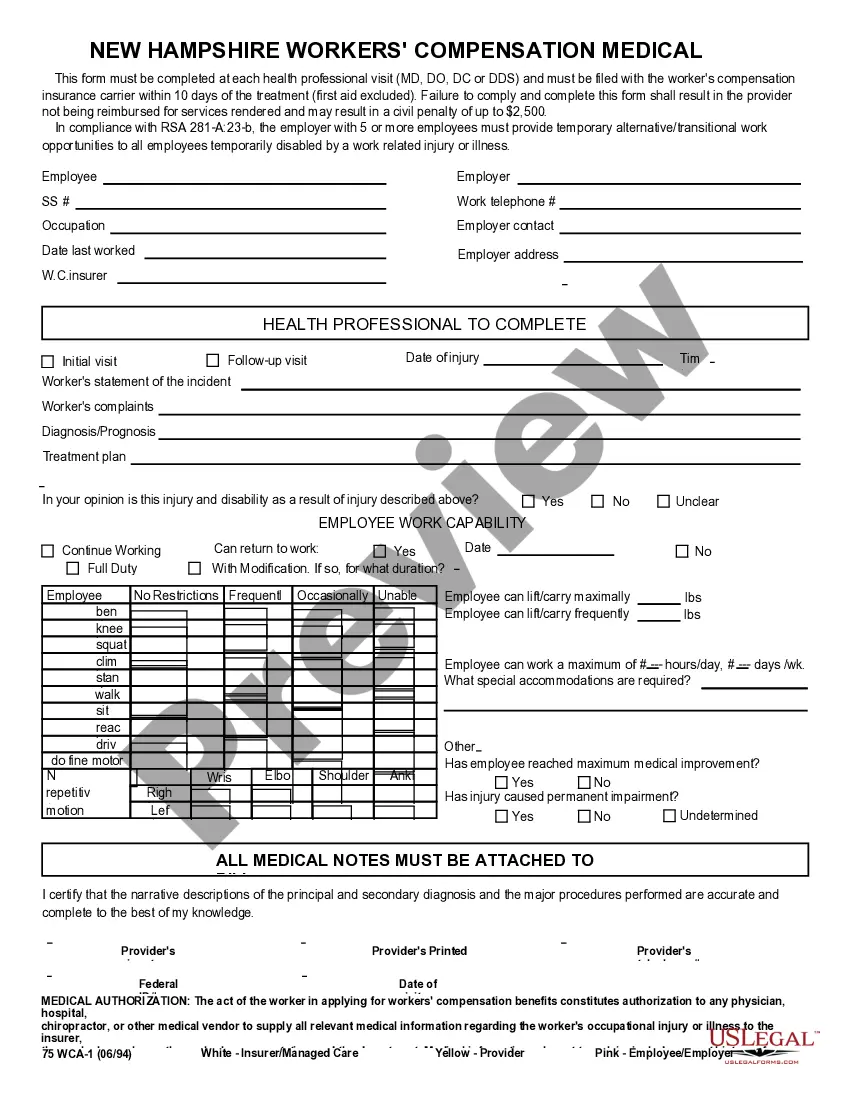

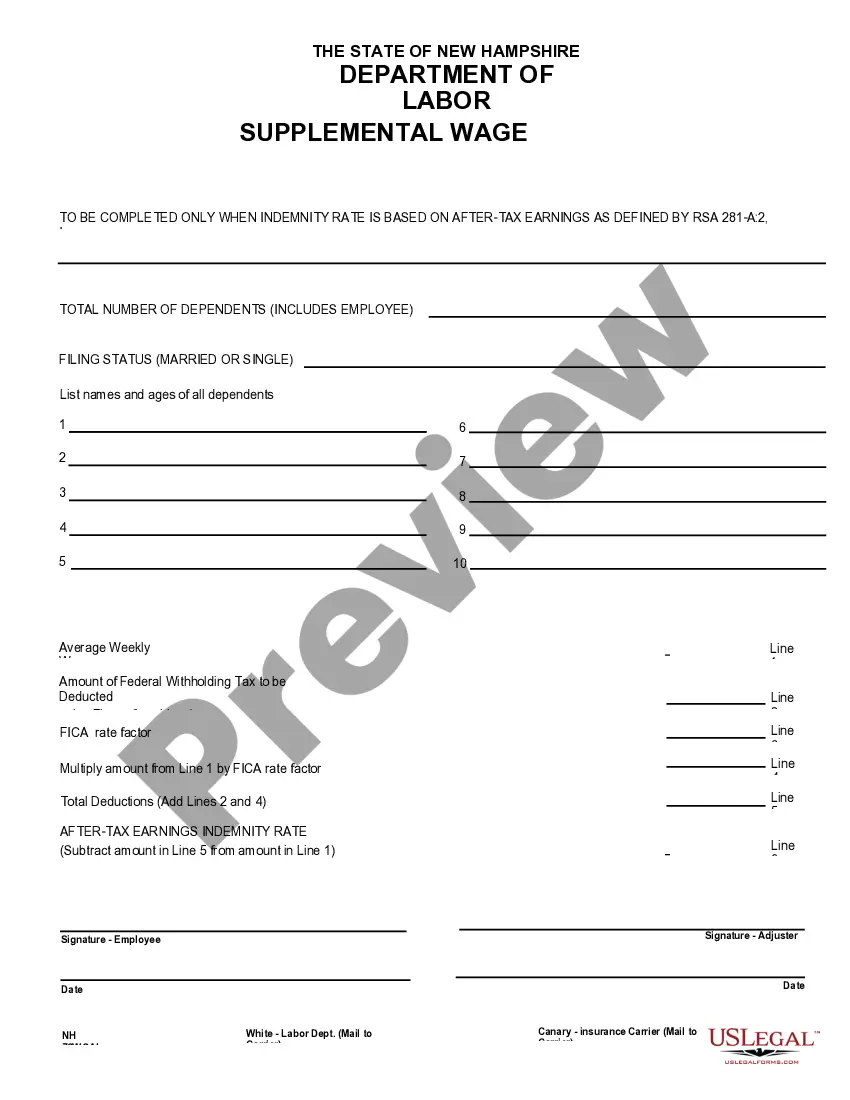

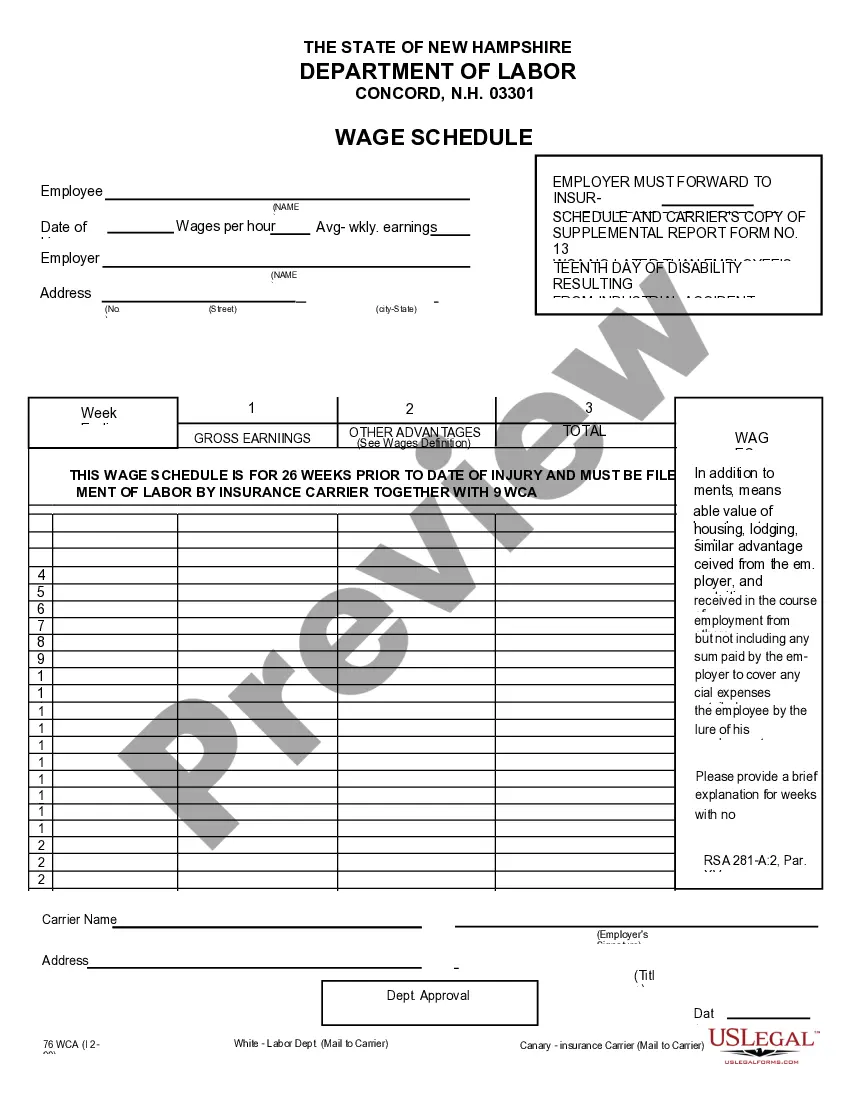

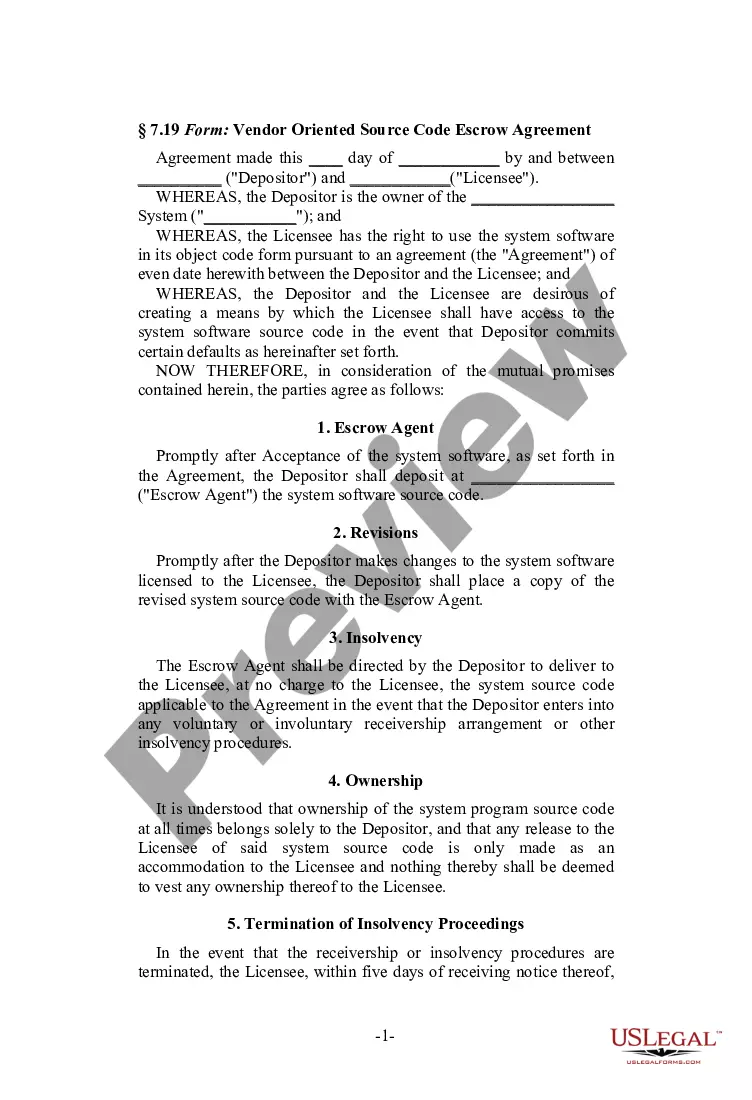

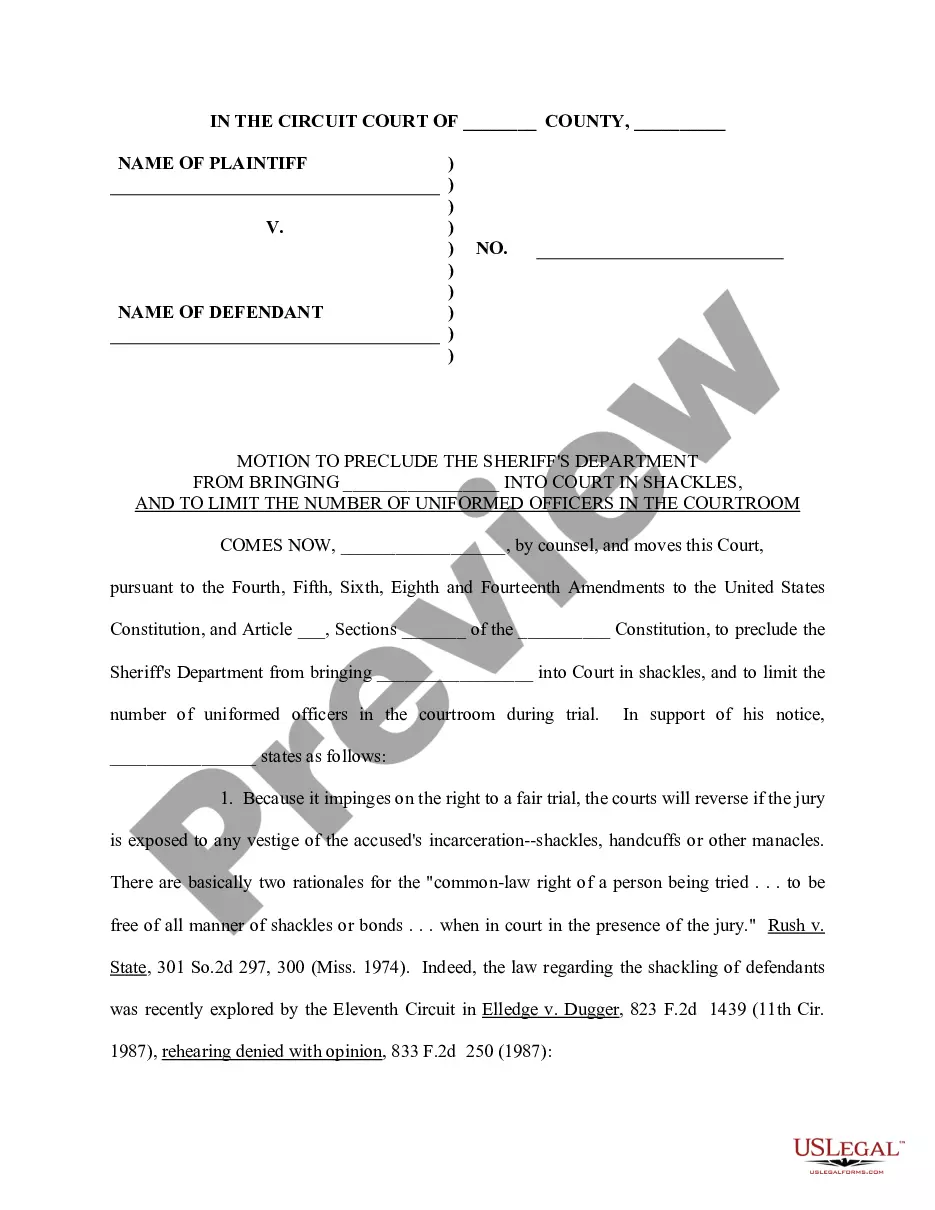

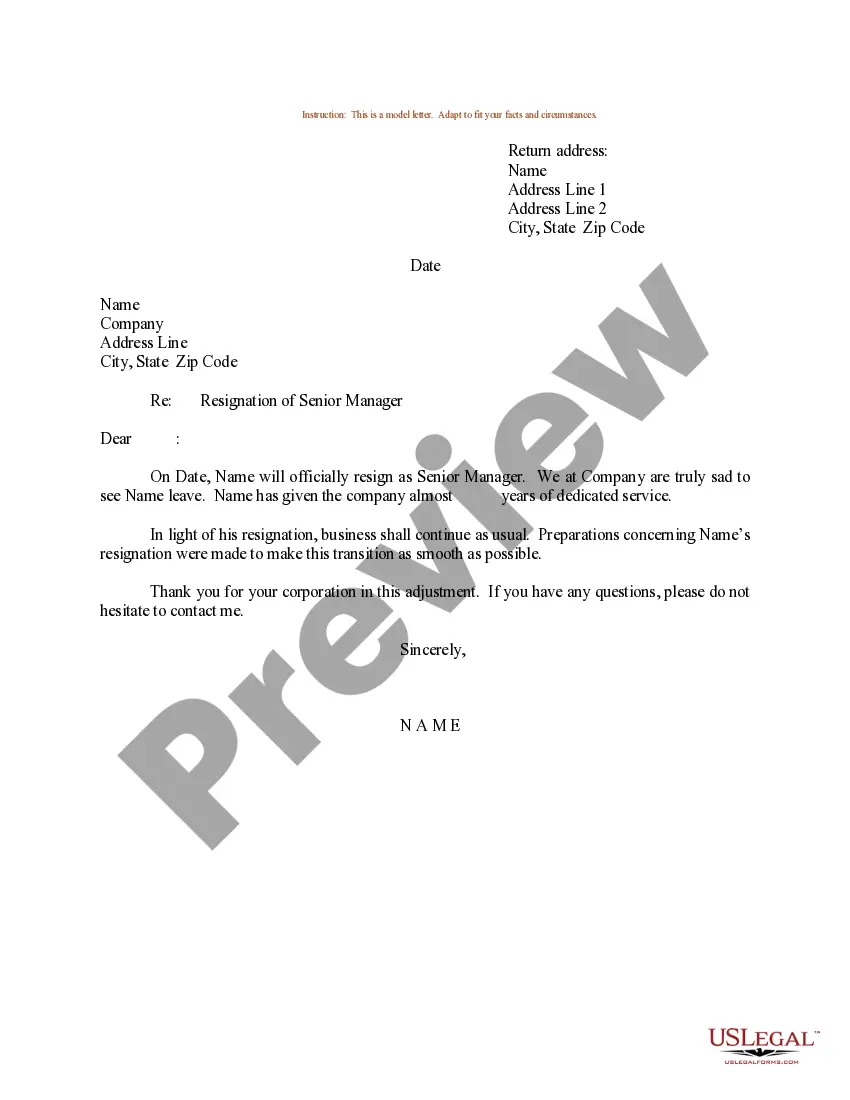

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another example using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and bought your subscription, you can utilize your Physician's Assistant Agreement - Self-Employed Independent Contractor as often as you need or for as long as it stays active where you live. Change it in your favored online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Agreement Independent Contractor Sample Form popularity

Independent Contract Agreement Template Other Form Names

Assistant Agree FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.

An independent contractor can be any type of business entity (sole proprietor, corporation, LLC, partnership), but most independent contractors are sole proprietors.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Finally, the new stimulus bill provides independent contractors with paid sick and paid family leave benefits through March 14, 2021.Under CARES Act II, unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.