Payroll Specialist Agreement - Self-Employed Independent Contractor

Description Payroll Contractor Complete

How to fill out Payroll Contractor Sample?

Among lots of paid and free samples that you can get on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they are skilled enough to take care of what you require these people to. Keep relaxed and use US Legal Forms! Find Payroll Specialist Agreement - Self-Employed Independent Contractor templates created by professional legal representatives and avoid the expensive and time-consuming procedure of looking for an lawyer and then paying them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re seeking. You'll also be able to access all your previously saved examples in the My Forms menu.

If you’re making use of our platform the very first time, follow the guidelines below to get your Payroll Specialist Agreement - Self-Employed Independent Contractor with ease:

- Make certain that the file you see applies where you live.

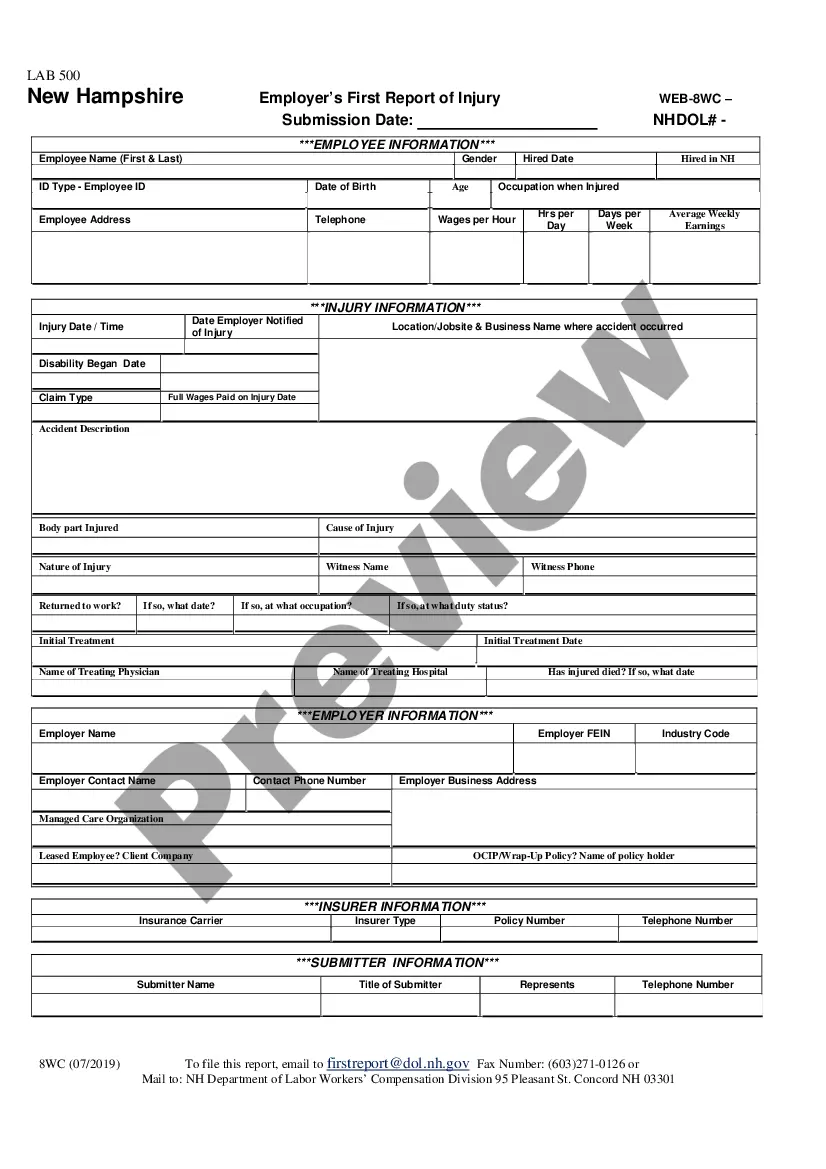

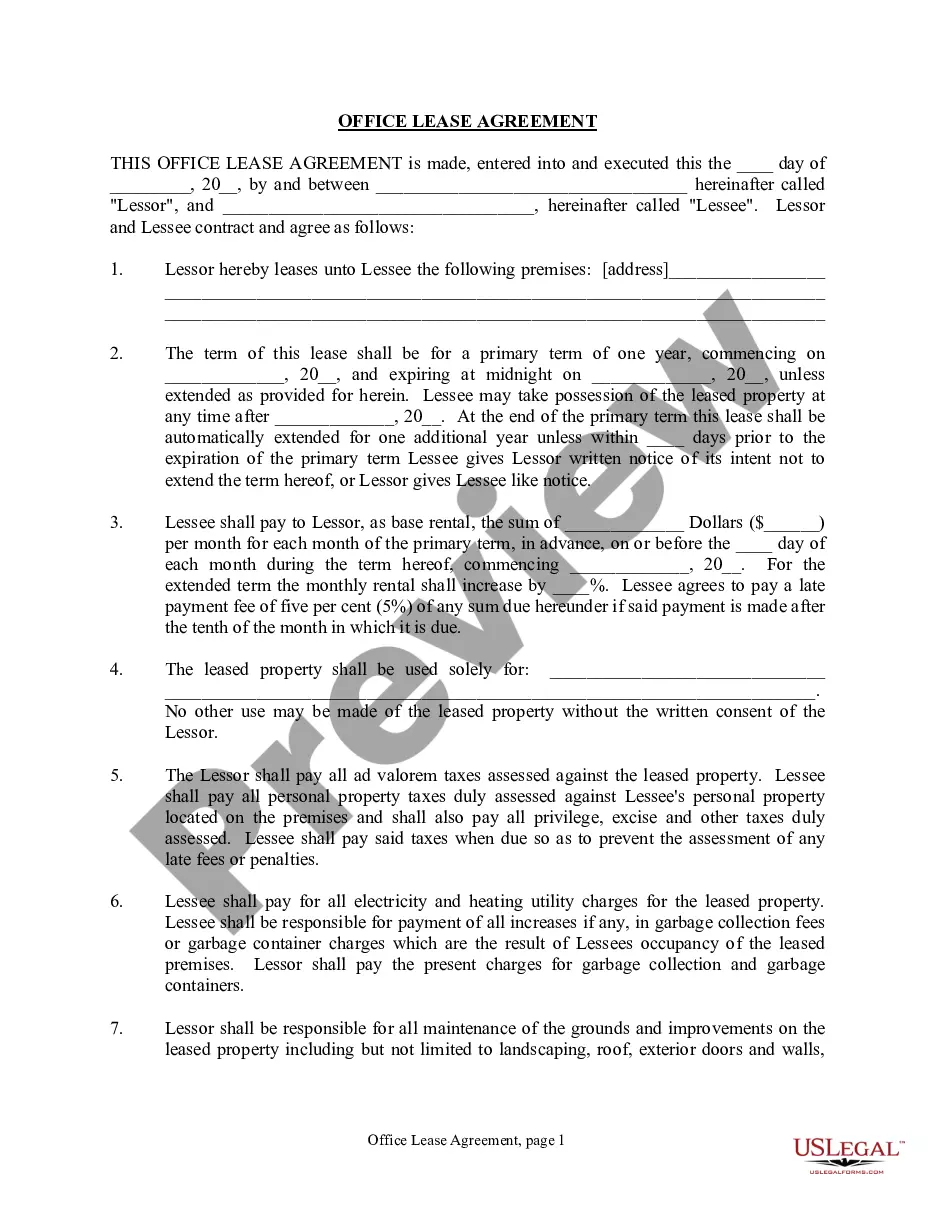

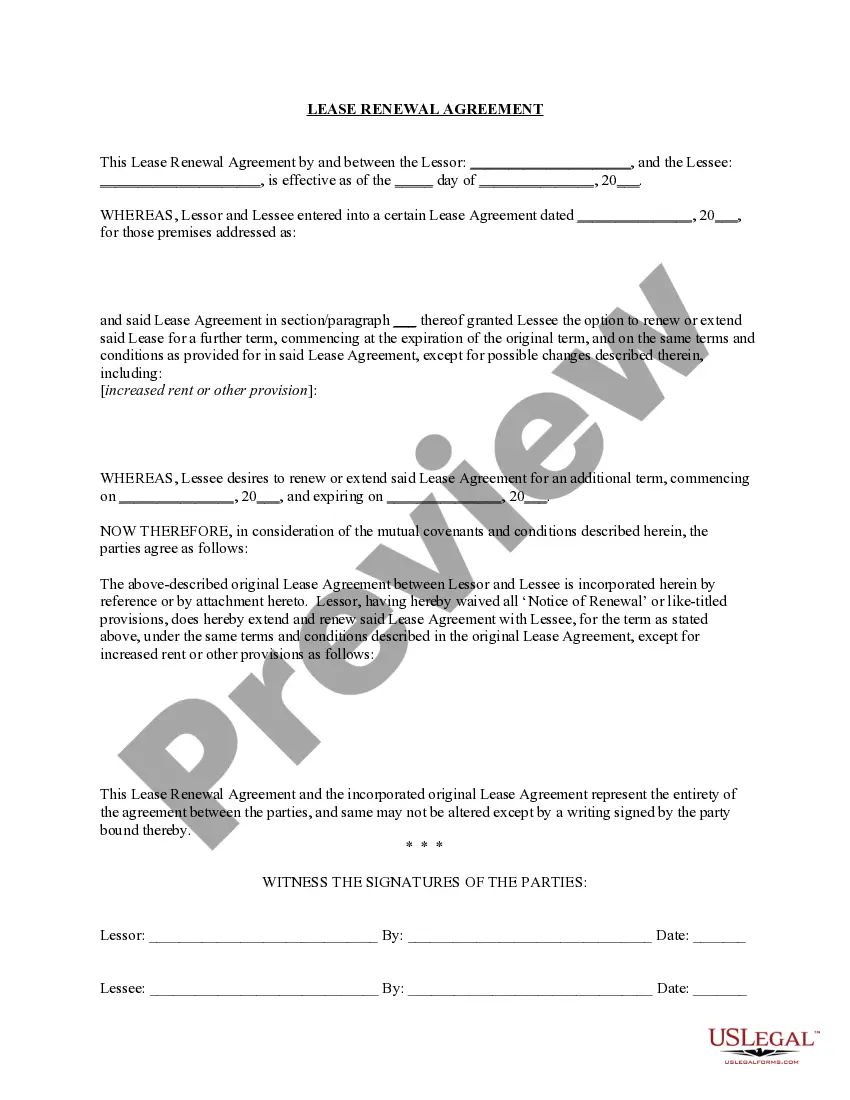

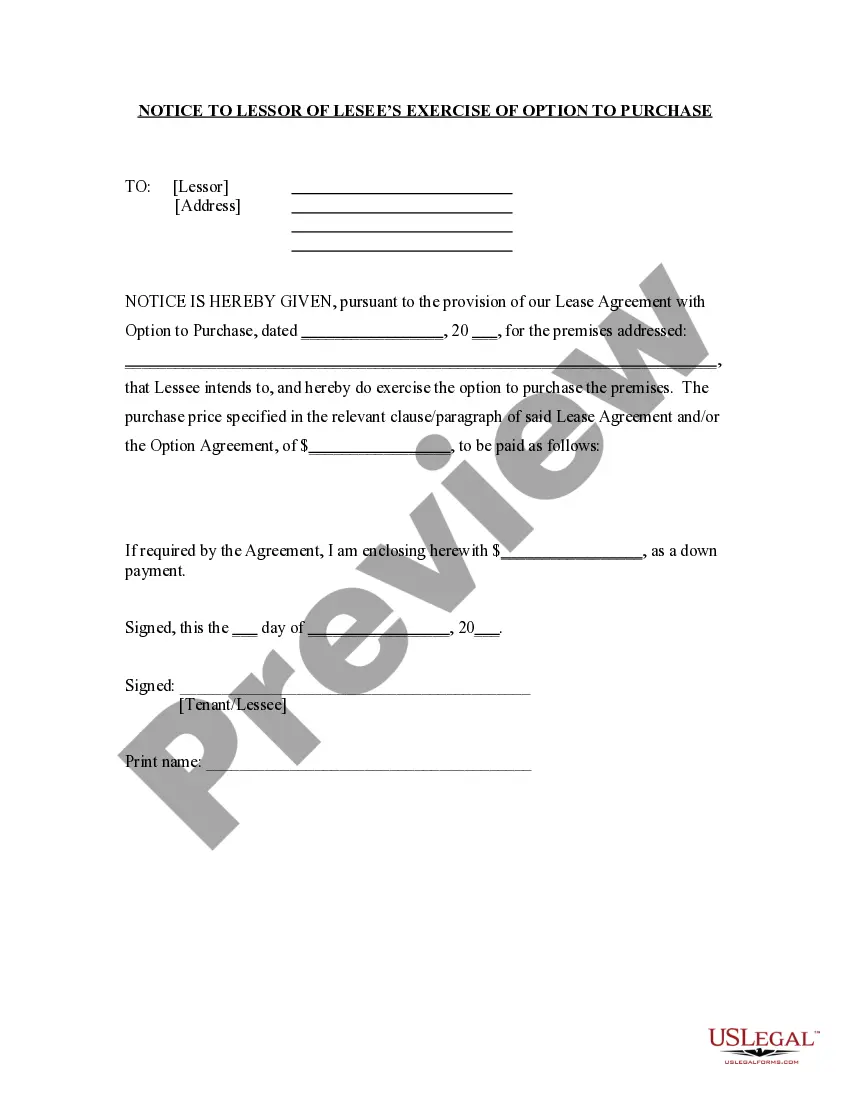

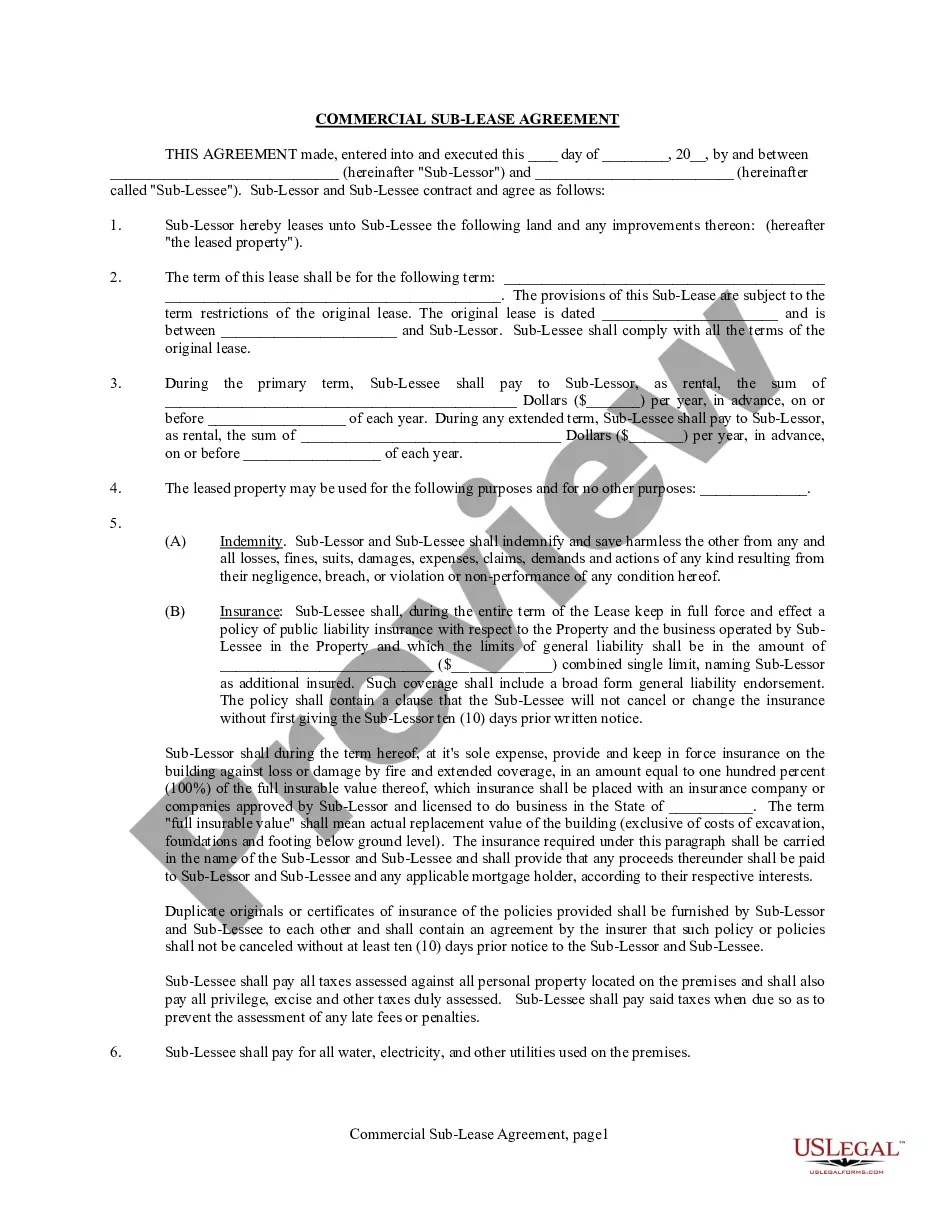

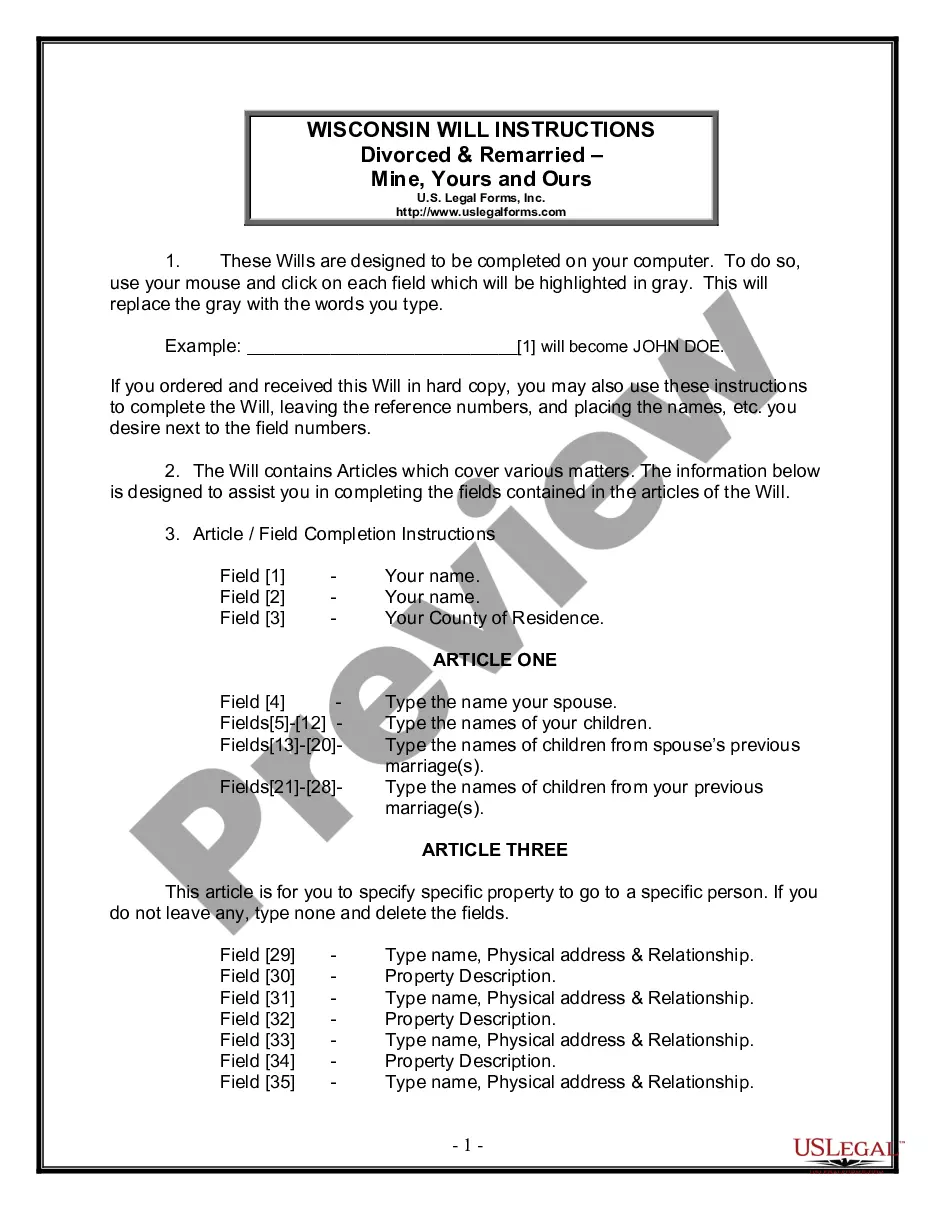

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or find another sample utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you’ve signed up and bought your subscription, you can use your Payroll Specialist Agreement - Self-Employed Independent Contractor as often as you need or for as long as it continues to be active in your state. Change it in your favorite editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Payroll Contractor File Form popularity

Payroll Contractor Order Other Form Names

Payroll Independent Contractor Sample FAQ

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

An independent contractor is not an employee; therefore, he's not paid through the payroll. As a small-business owner with both employees and independent contractors, it is important that you know the differences between the two.

If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check,

Do employers need to complete employment verification checks for independent contractors? No.However, it is important to note that businesses and individuals may not hire independent contractors if they are aware that the independent contractor is not authorized to work in the United States.

Payments that businesses make to independent contractors and self-employed workers are not payroll expenses that qualify for Paycheck Protection Program (PPP) loans. However, independent contractors and sole proprietors themselves are small businesses who can qualify for the loans.

Finally, the new stimulus bill provides independent contractors with paid sick and paid family leave benefits through March 14, 2021.Under CARES Act II, unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA.

Independent Contractors Included in Payroll Employers are generally required to withhold PAYE and contribute SDL for all employees earning remuneration. The income of these independent contractors is, therefore, subject to PAYE (and SDL, if applicable) but not UIF and will be reported on their IRP5s under code 3616.

As of 2019, the self-employment tax rate is 15.3%. You can calculate your self-employment tax using Schedule SE on Form 1040. An additional 0.9% Medicare surtax applies to high-income earners.