Counselor Agreement - Self-Employed Independent Contractor

Description

Key Concepts & Definitions

Counselor Agreement Self Employed Independent: A formal document between a counselor as an independent contractor and a client or agency. This agreement outlines terms related to services, confidentiality, payment, and termination. Key terms include legal forms, contractor agreement, and independent contractor.

Step-by-Step Guide to Creating a Counselor Agreement for Self-Employed Independent

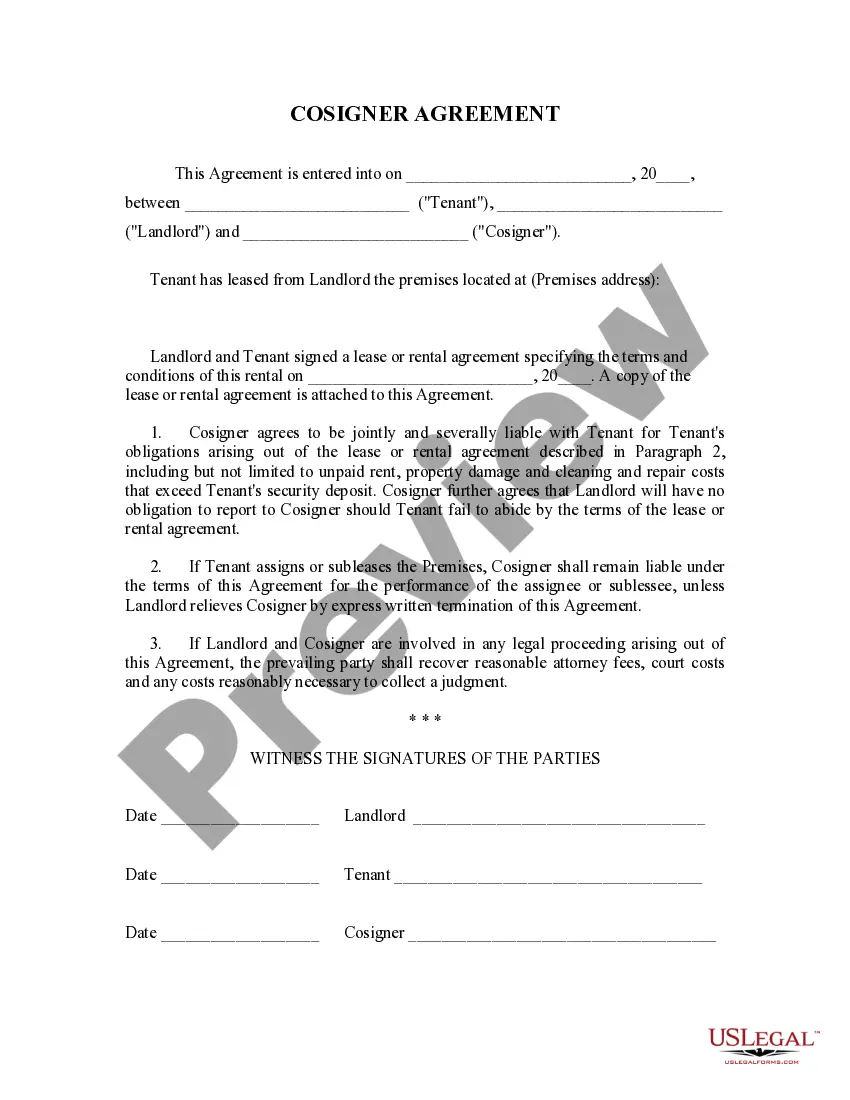

- Identify the Parties: Clearly state the names of the independent counselor and the client or agency involved.

- Define the Services: Specify the scope of counseling services that will be provided. This may include therapy expectations and mental health practices.

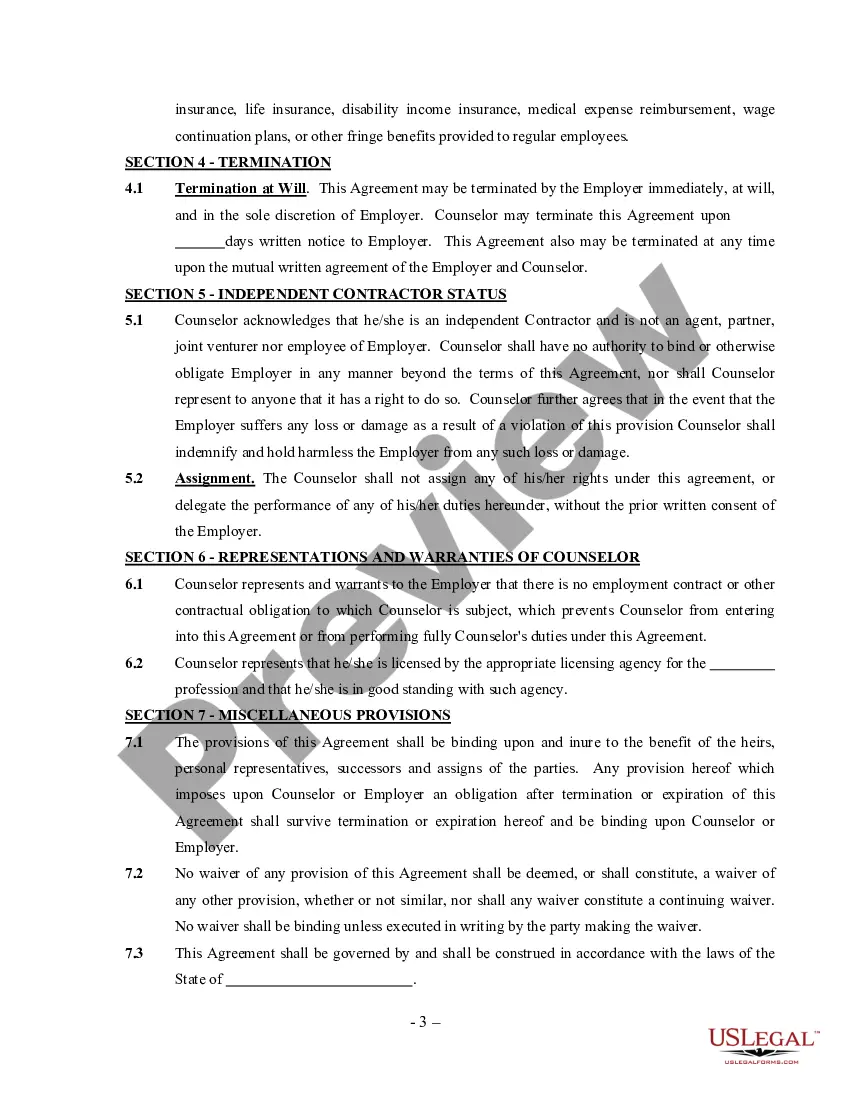

- Outline the Compensation: Detail the payment terms, including rates, invoicing schedule, and payment methods.

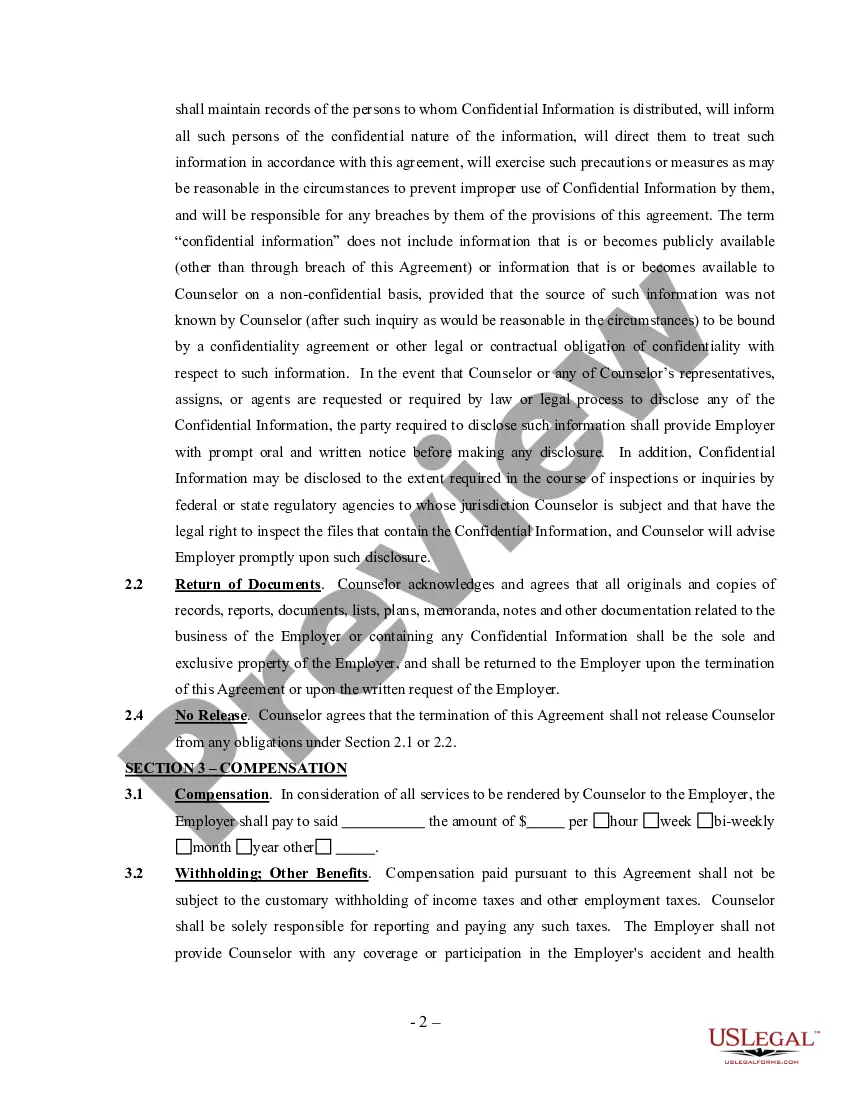

- Confidentiality and Privacy: Incorporate confidentiality clauses to protect both parties' information.

- Termination Clauses: Explain how the agreement can be terminated, noting any notice requirements or final settlements.

- Signatures: Ensure both parties sign the agreement to validate it.

Risk Analysis in Counselor Agreements

- Lack of Clarity: Ambiguous terms can lead to disputes or misunderstandings. Always use clear, precise language.

- Compliance Issues: Ensure that the agreement adheres to state and federal laws concerning mental health practices and independent contractors.

- Privacy Breaches: Improper handling of confidential information can result in legal penalties and damage to reputation.

Common Mistakes & How to Avoid Them

- Vague Descriptions: Specify all agreed services and terms to avoid ambiguity.

- Ignoring Legal Requirements: Consult with a legal expert to ensure the agreement meets all applicable laws.

- Neglecting Termination Provisions: Clearly articulate how either party can terminate the agreement, preparing for any situation.

FAQ

- What is an independent contractor? An independent contractor operates under their own business or under their name, providing services to clients under terms specified in a contract.

- Why is it important for a counselor to have a well-defined agreement? To ensure clarity of service, prevent legal issues, and define professional boundaries and expectations.

How to fill out Counselor Agreement - Self-Employed Independent Contractor?

Among countless paid and free examples which you find online, you can't be certain about their reliability. For example, who created them or if they are skilled enough to deal with what you need these to. Always keep calm and use US Legal Forms! Discover Counselor Agreement - Self-Employed Independent Contractor samples developed by professional legal representatives and prevent the expensive and time-consuming procedure of looking for an lawyer or attorney and then paying them to draft a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are seeking. You'll also be able to access all of your earlier acquired templates in the My Forms menu.

If you’re using our website the very first time, follow the guidelines listed below to get your Counselor Agreement - Self-Employed Independent Contractor quick:

- Make certain that the document you see applies where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another template using the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you have signed up and paid for your subscription, you can utilize your Counselor Agreement - Self-Employed Independent Contractor as often as you need or for as long as it stays valid where you live. Edit it in your preferred offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

OSHA literature doesn't typically use the term "independent contractor." It uses "self-employed." There's a pretty simple reason self-employed are exempted from OSHA. OSHA exists to protect workers from unsafe or "unhealthful" conditions that their employer might force them into using economic leverage.

An independent contractor (IC) is someone who is in an independent trade or profession offering services to the general public. An IC is considered to be able to control their own work, not the employer. 1fefffeff By contrast, an employee's work is controlled and directed by the employer.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

An Independent Contractor Agreement should contain all of these basic terms: Description of the services to be provided.Explanation of what the hiring party will provide or not provide, such as equipment, for the independent contractor to use. Ownership of work product if that is relevant to the work being performed.

An independent contractor can be any type of business entity (sole proprietor, corporation, LLC, partnership), but most independent contractors are sole proprietors.

Set up correctly, counselors are likely to qualify for independent contractor status. They often choose their own hours, work in multiple locations, and an argument can be made that the hiring party lacks control over how they perform their job, as it's primarily done in a private therapy office.

Finally, the new stimulus bill provides independent contractors with paid sick and paid family leave benefits through March 14, 2021.Under CARES Act II, unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax. If you are an independent contractor, you are self-employed. To find out what your tax obligations are, visit the Self-Employed Tax Center.