Freelance Writer Agreement - Self-Employed Independent Contractor

Description Lance Agreement Document

How to fill out Self Employed Independent Contractor?

Among numerous paid and free examples which you find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re skilled enough to deal with the thing you need those to. Always keep calm and utilize US Legal Forms! Find Freelance Writer Agreement - Self-Employed Independent Contractor samples developed by professional legal representatives and prevent the expensive and time-consuming process of looking for an lawyer and then paying them to write a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access all of your earlier downloaded files in the My Forms menu.

If you’re using our website the very first time, follow the guidelines listed below to get your Freelance Writer Agreement - Self-Employed Independent Contractor quick:

- Ensure that the file you see is valid in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you’ve signed up and bought your subscription, you can use your Freelance Writer Agreement - Self-Employed Independent Contractor as often as you need or for as long as it continues to be valid where you live. Change it in your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Lance Agreement Paper Form popularity

Lance Agreement Other Form Names

Lance Agreement Sample FAQ

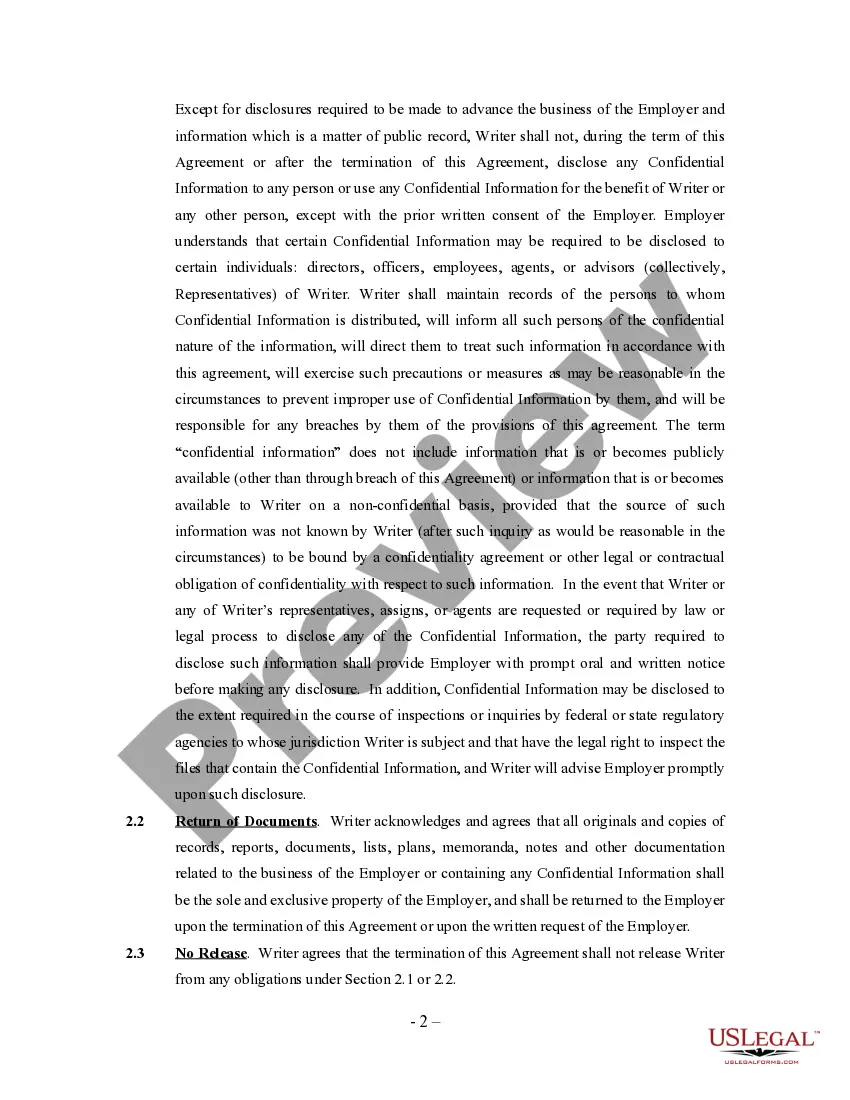

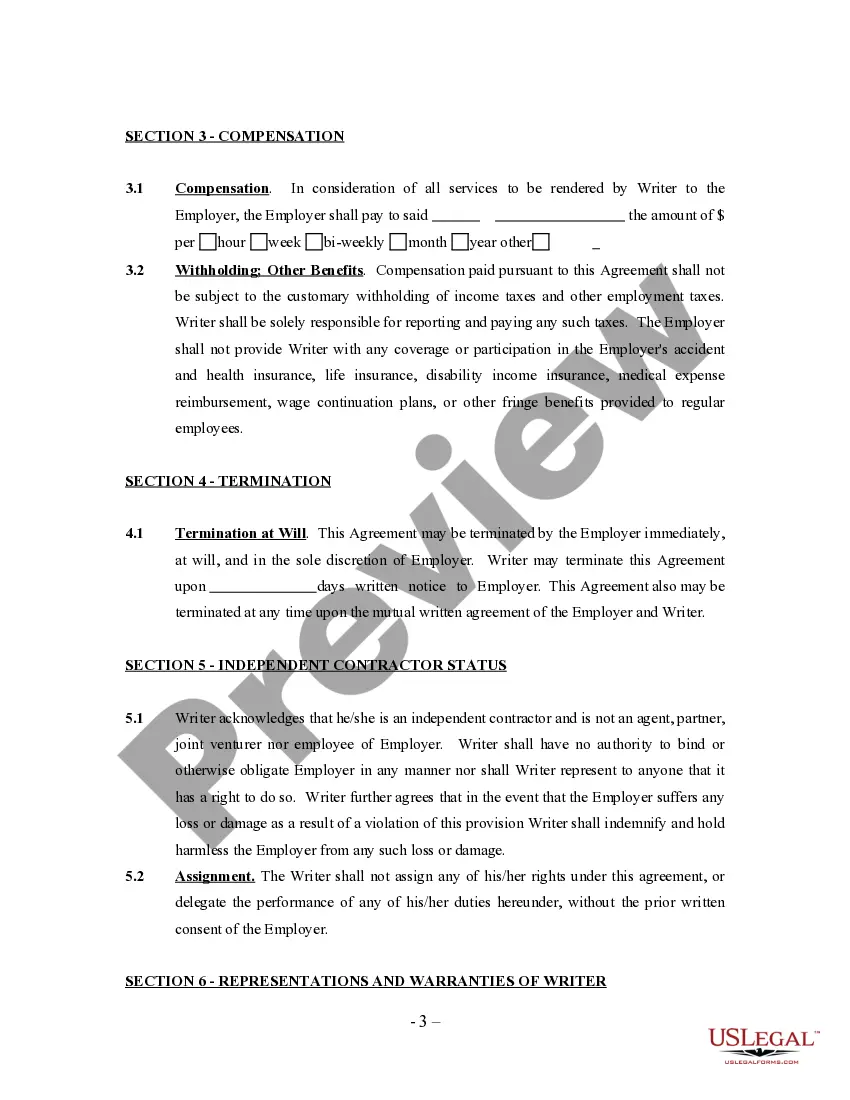

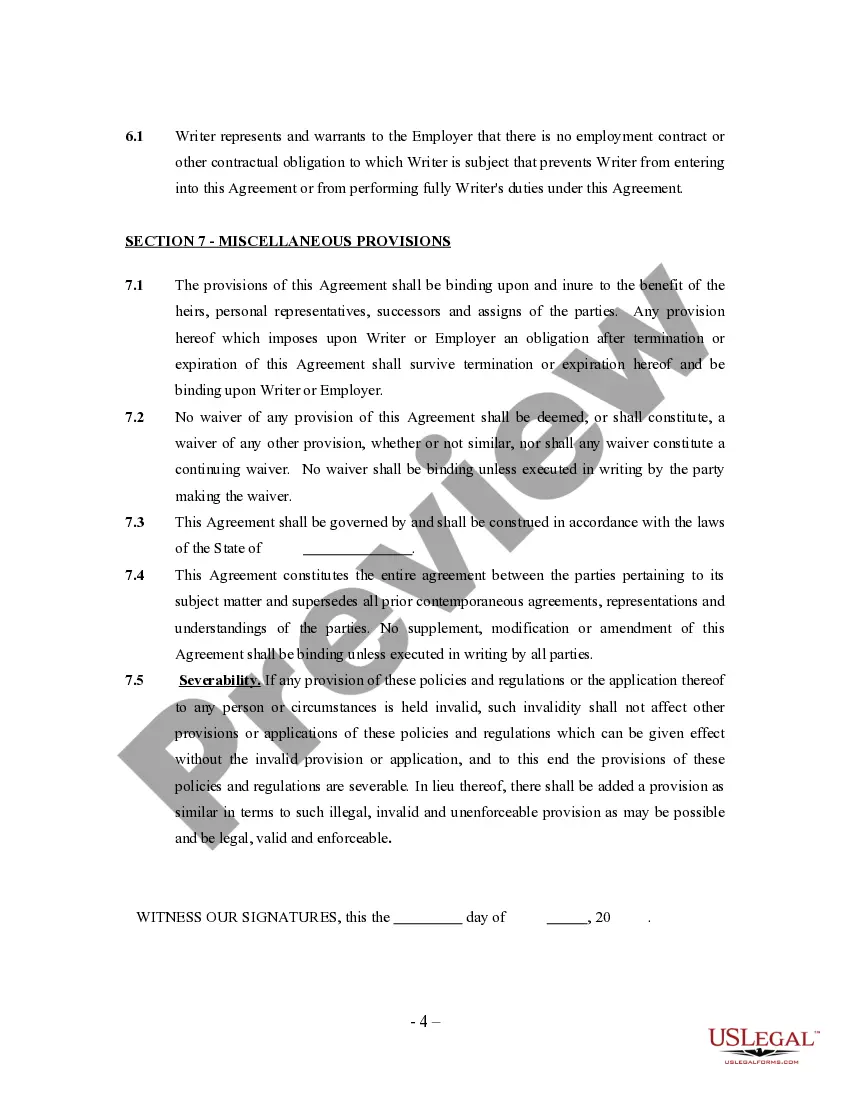

An Independent Contractor Agreement should contain all of these basic terms: Description of the services to be provided.Explanation of what the hiring party will provide or not provide, such as equipment, for the independent contractor to use. Ownership of work product if that is relevant to the work being performed.

California Governor Newsom has signed Assembly Bill 2257,exempting freelance writers, musicians, artists and others from the stringent rules established by the 'ABC' test for independent contractors, which makes them more likely to be reclassified as employees.

If you are an independent contractor, you are self-employed.However, your earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding.

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

The Internal Revenue Service considers freelancers to be self-employed, so if you earn income as a freelancer you must file your taxes as a business owner. While you can take additional deductions if you are self-employed, you'll also face additional taxes in the form of the self-employment tax.

Freelancer vs ContractorFreelancers are self-employed individuals who are not affiliated to any company or an agency.A contractor on the other hand, is an external employee who may or may not be self-employed. In the traditional sense of the word, a contractor is actually employed by a vendor or an agency.

Freelance workers generally work on a project with expected outcomes for an agreed fee.Furthermore, they might work through a third party or agency but can also work on their own. If an independent contractor works on their own, they are responsible for taxes and insurance.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.