Self-Employed Special Events Driver Services Contract

Description

How to fill out Self-Employed Special Events Driver Services Contract?

Among hundreds of paid and free templates that you’re able to get on the net, you can't be certain about their accuracy. For example, who created them or if they’re skilled enough to take care of what you require those to. Always keep calm and utilize US Legal Forms! Find Self-Employed Special Events Driver Services Contract samples developed by skilled legal representatives and get away from the costly and time-consuming process of looking for an attorney and after that paying them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access all your previously saved examples in the My Forms menu.

If you’re utilizing our platform the first time, follow the instructions listed below to get your Self-Employed Special Events Driver Services Contract fast:

- Make certain that the document you see applies where you live.

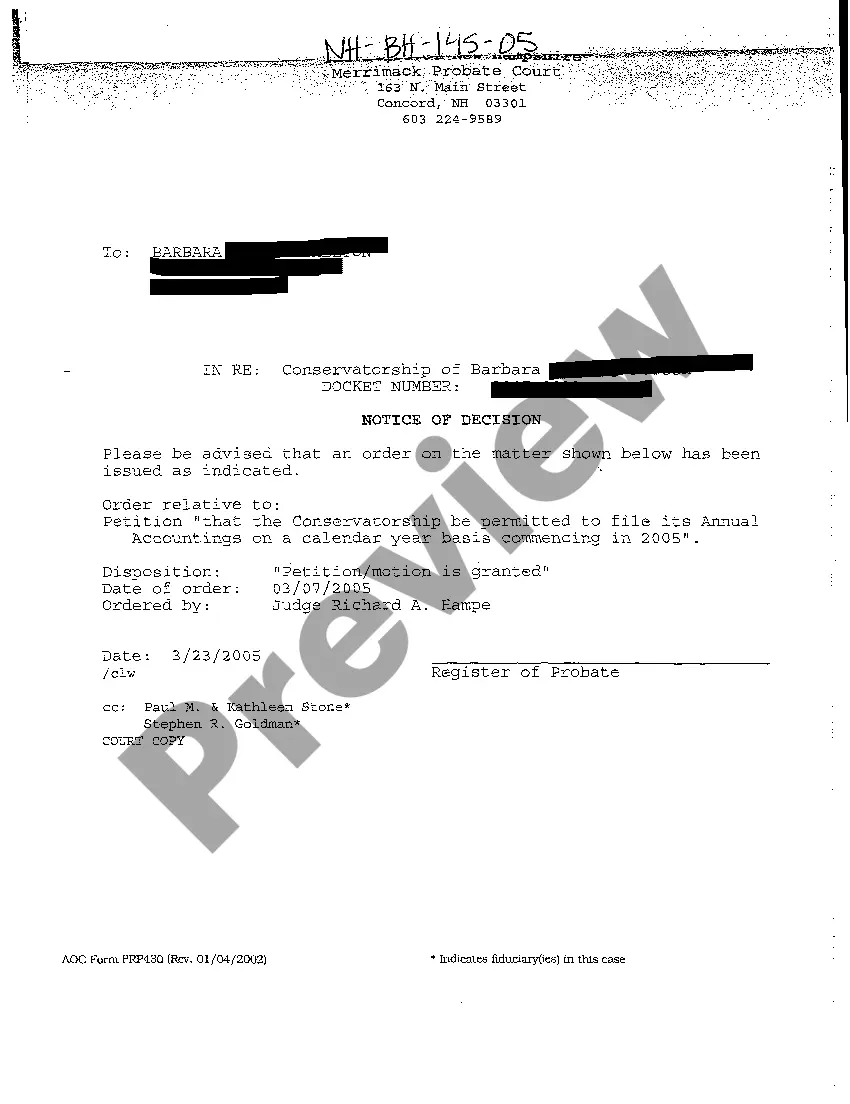

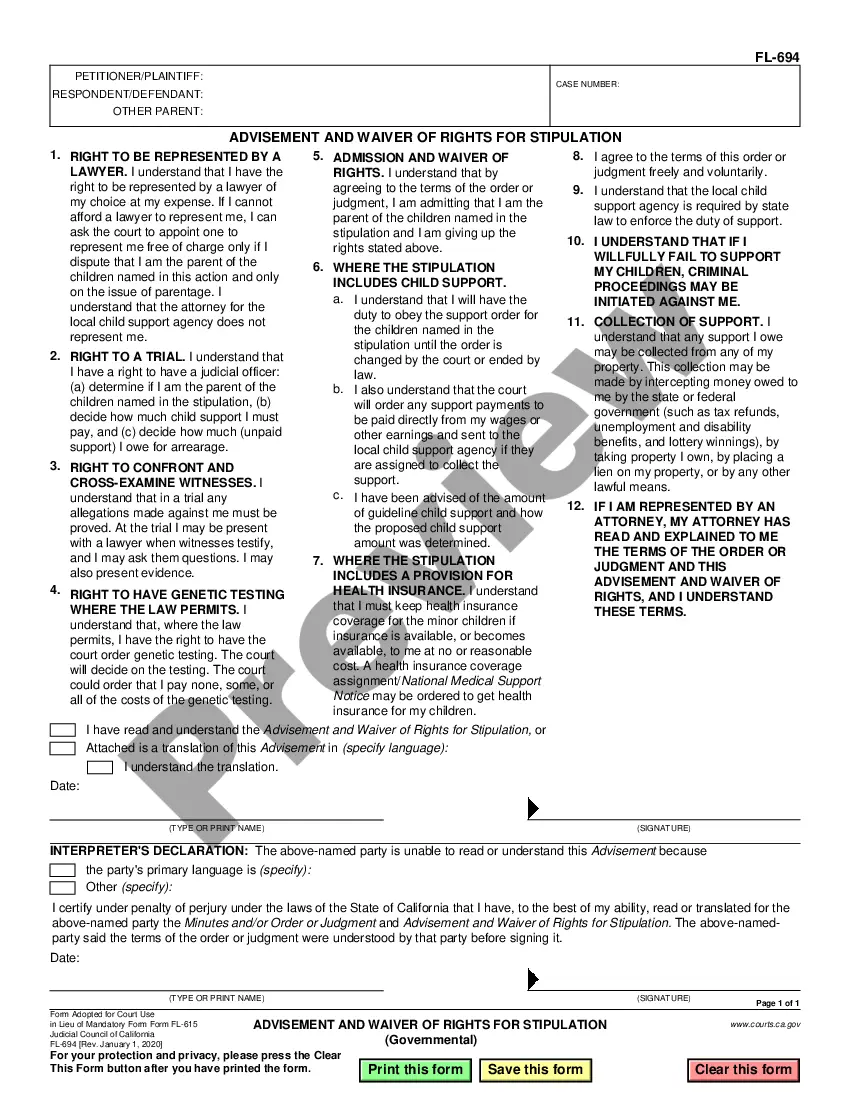

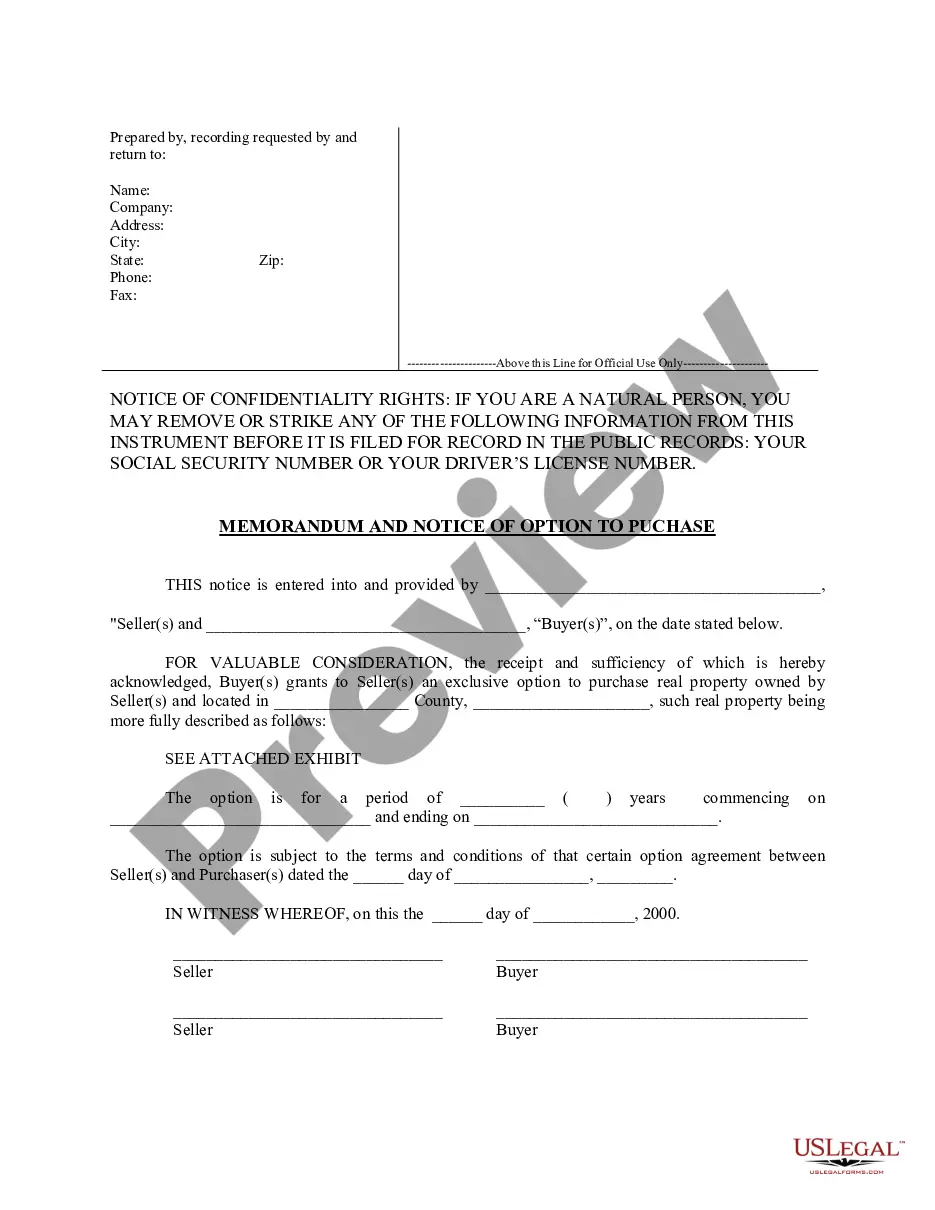

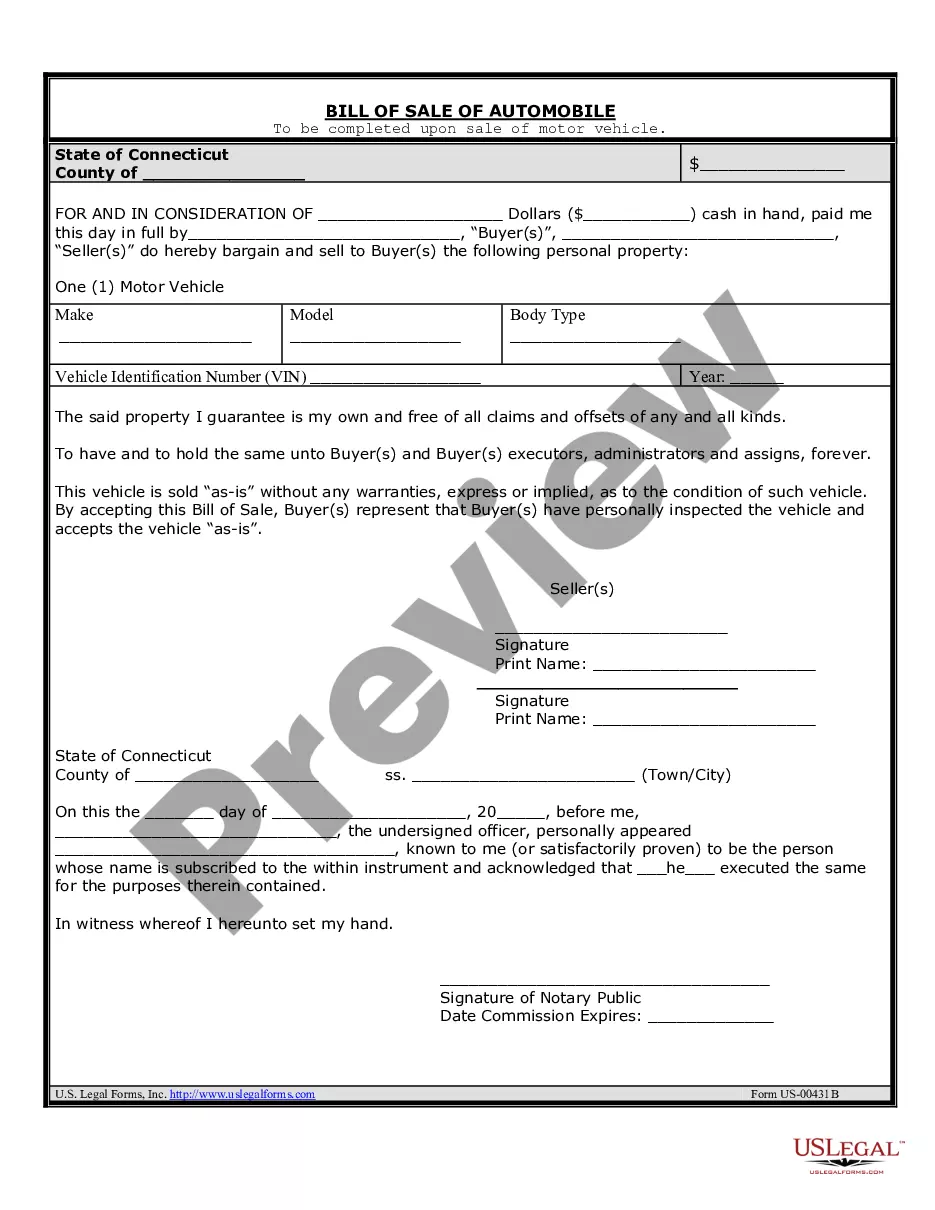

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template utilizing the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you’ve signed up and bought your subscription, you can utilize your Self-Employed Special Events Driver Services Contract as often as you need or for as long as it stays active in your state. Change it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

An independent delivery driver contract is between a company seeking to hire an individual to deliver goods to customers. The most common types are short to medium distance drivers for delivering goods for companies such as Amazon or for food-related businesses.

Since delivery drivers, for the most part, have to operate within the limits of company policies, time constraints, and usually only work for one company they should not be classified as independent contractors.

Independent contractors pay their own Social Security and Medicare taxes and do not receive employee benefits.Truck drivers are often owner-operators of their own freelance business and are therefore considered independent contractors.

A 1099 employee is one person or an entire company that you hire to do a specific job for you.In trucking, your 1099 employee would be an owner-operator or an independent contractor. A 1099 employee is not a company driver, so that means you don't provide benefits for them (say, such as health insurance).

Truck drivers' employment status is classified based on a variety of factors. Generally speaking, companies can only classify truck drivers as independent contractors if the truckers have control over how and when they perform their duties.

Independent contractor truck drivers are freelance owner-operators of their own commercial truck. In this role, you can choose which assignments to accept, set your own hours, and negotiate payment and contract conditions.

As a contract driver, your primary responsibilities are to drive a vehicle to transport materials or items on a contract basis. Your duties vary depending on the details of each contract.

A delivery contract, or delivery order contract, is an agreement that provides for delivery orders of property. It usually doesn't specify an exact quantity, outside of a minimum or maximum amount. These types of agreements can be used for varying purposes.