Self-Employed Supplier Services Contract

Description Supplier Services Contract

How to fill out Self Employed Contract Template?

Among lots of free and paid examples that you can get on the net, you can't be sure about their accuracy. For example, who made them or if they’re competent enough to deal with what you need these to. Keep relaxed and utilize US Legal Forms! Find Self-Employed Supplier Services Contract templates made by skilled lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer and then paying them to draft a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all your previously acquired documents in the My Forms menu.

If you are utilizing our website the very first time, follow the tips listed below to get your Self-Employed Supplier Services Contract with ease:

- Ensure that the file you see applies in your state.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or find another sample using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

As soon as you have signed up and bought your subscription, you can utilize your Self-Employed Supplier Services Contract as often as you need or for as long as it stays valid where you live. Change it in your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Supplier Contract Download Form popularity

Supplier Agreement Other Form Names

Supplier Agreement Contract FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

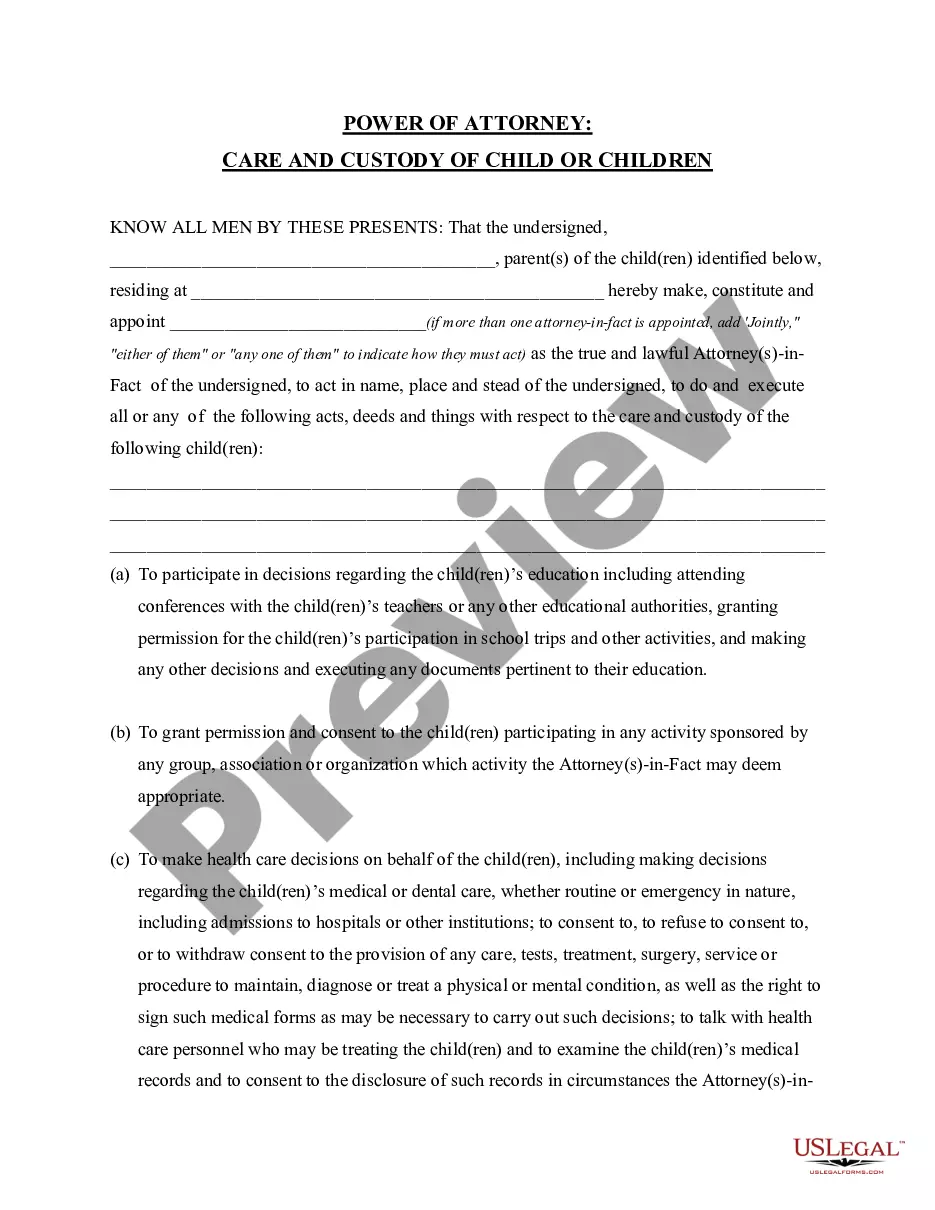

Identify the customer and service provider. Describe the services being provided. Outline a payment schedule. Establish terms about confidentiality, non-solicitation, and non-competition. Address ownership of materials. Personalize your Service Agreement.

An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including: A description of the services provided. Terms and length of the project or service. Payment details (including deposits, retainers, and other billing details)

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Length of Contract. Each client contractor agreement should outline the length of the working relationship. Project Description. Payment Terms. Nondisclosure Terms. Rights and Responsibilities. Termination Clause. Disclaimers.