Self-Employed Groundskeeper Services Contract

Description Self Employed Contract Sample

How to fill out Self-Employed Groundskeeper Services Contract?

Among countless paid and free templates which you find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re competent enough to take care of what you require them to. Always keep calm and utilize US Legal Forms! Find Self-Employed Groundskeeper Services Contract templates made by professional attorneys and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and then having to pay them to draft a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access all of your earlier downloaded templates in the My Forms menu.

If you’re utilizing our platform the very first time, follow the guidelines listed below to get your Self-Employed Groundskeeper Services Contract quickly:

- Make certain that the file you see is valid in your state.

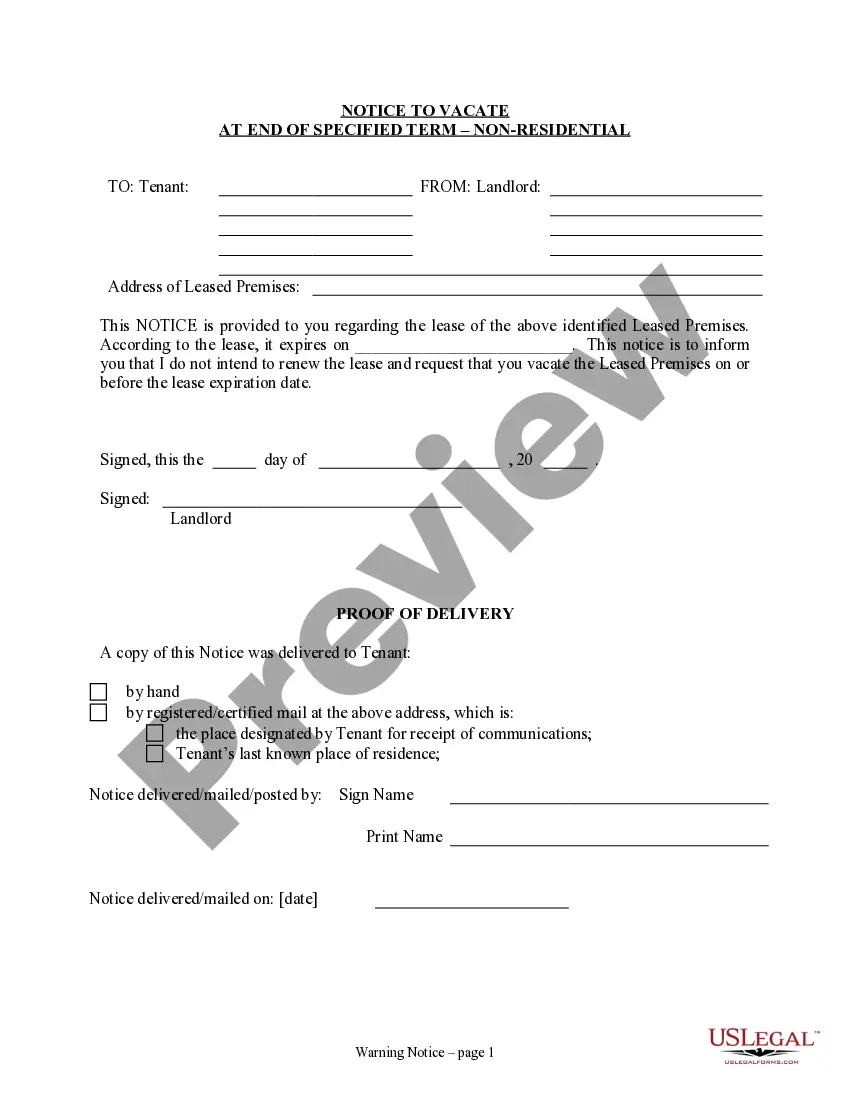

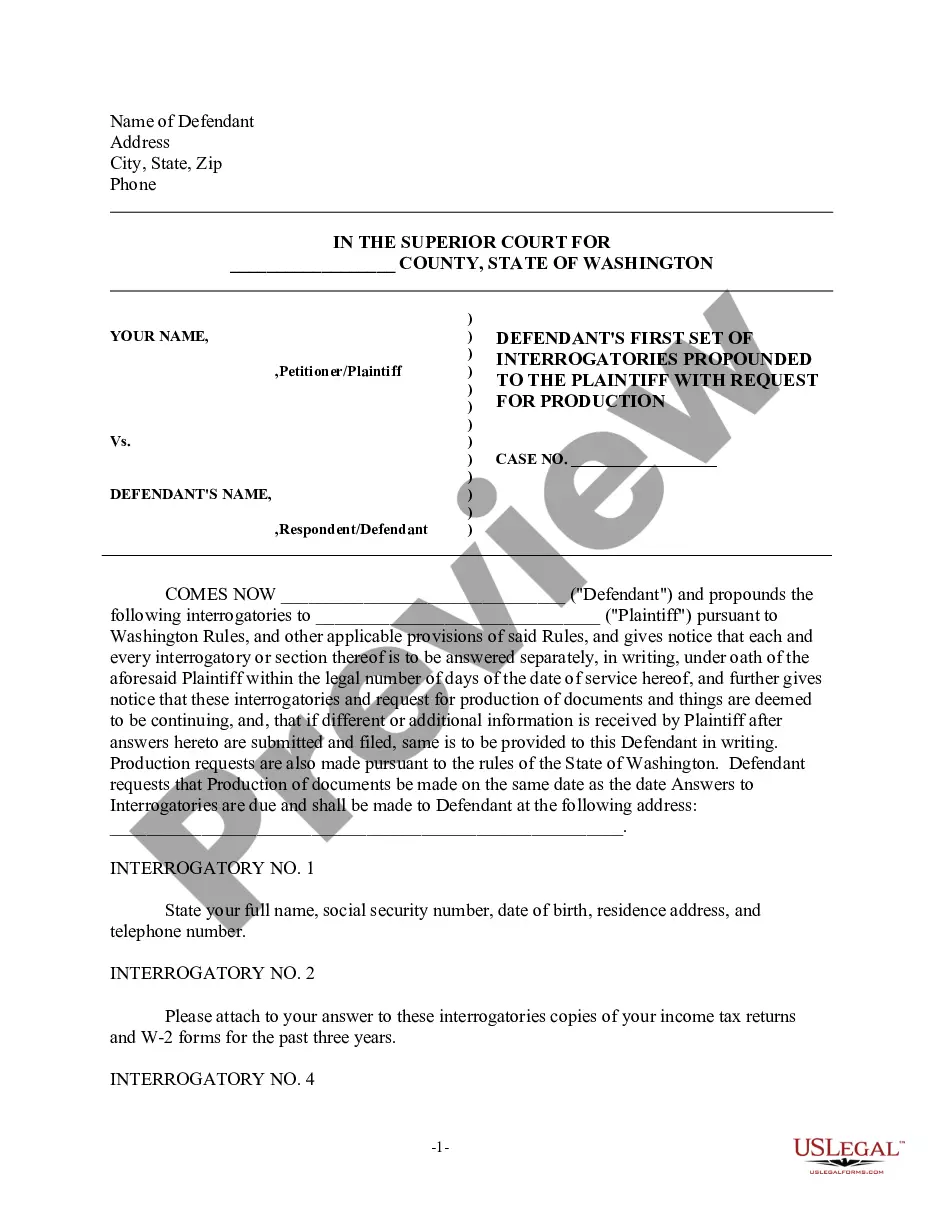

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another sample using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you’ve signed up and purchased your subscription, you can use your Self-Employed Groundskeeper Services Contract as often as you need or for as long as it stays active in your state. Edit it with your preferred offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Self Employed Services Contract Form popularity

FAQ

Locate all of your annual tax returns. Tax returns are your first go-to when it comes to income proof. Bank statements indicate personal cash flow. Make use of online accounting services that track payments and expenditures. Maintain profit and loss statements.

1Get it in writing.2Keep it simple.3Deal with the right person.4Identify each party correctly.5Spell out all of the details.6Specify payment obligations.7Agree on circumstances that terminate the contract.8Agree on a way to resolve disputes.Ten Tips for Making Solid Business Agreements and Contracts Nolo\nwww.nolo.com > make-business-contract-agreement-30313

Self-employed persons, including direct sellers, report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Use Schedule SE (Form 1040), Self-Employment Tax if the net earnings from self-employment are $400 or more.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructions PDF.

According to the Turf survey, landscape business owners made $53,323 on average in 2014. They expect an increase this year to $59,265 on average. This is based on an average revenue of $542,653. Landscapers said corporate officer/owner/partner salaries make up approximately 10 percent of total sales.

Landscaping contracts should include a detailed description of the project and what exactly you will be doing. Put in writing the basic services that will be performed and also additional ones, those that will be provided for an added cost if desired.

The average salary for a landscape contractor in the United States is somewhere between $29,696 and $111,546. See how much this can vary?!

As an independent contractor, report your income on Schedule C of Form 1040, Profit or Loss from Business. You must pay self-employment taxes on net earnings exceeding $400. For those taxes, you must submit Schedule SE, Form 1040, the self-employment tax.

Occupational Operating Expenses. The cost of advertising yourself, your services, or your products would fall into this category. Supplies and Materials. Almost any items you need to conduct business can be written off. Home Office. Snacks and Coffee. Business Entertainment. Travel. Child Care. Cleaning Services.