Self-Employed Lecturer - Speaker - Services Contract

Description

How to fill out Self-Employed Lecturer - Speaker - Services Contract?

Among numerous paid and free templates which you find on the net, you can't be certain about their accuracy and reliability. For example, who made them or if they are competent enough to take care of what you need those to. Keep calm and use US Legal Forms! Get Self-Employed Lecturer - Speaker - Services Contract templates made by skilled lawyers and get away from the expensive and time-consuming process of looking for an lawyer or attorney and after that paying them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access all your earlier acquired examples in the My Forms menu.

If you’re making use of our website the very first time, follow the instructions below to get your Self-Employed Lecturer - Speaker - Services Contract quickly:

- Make certain that the document you discover applies in the state where you live.

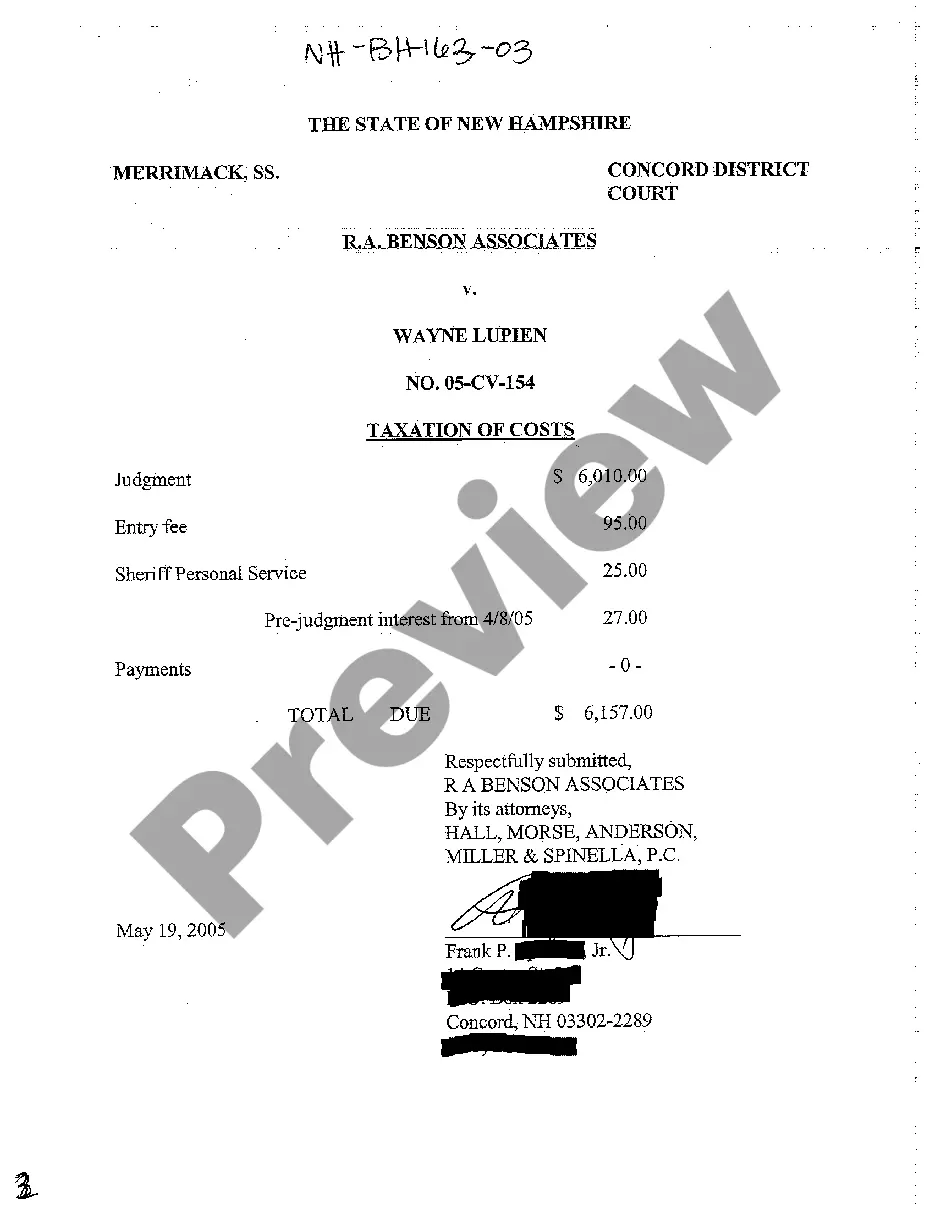

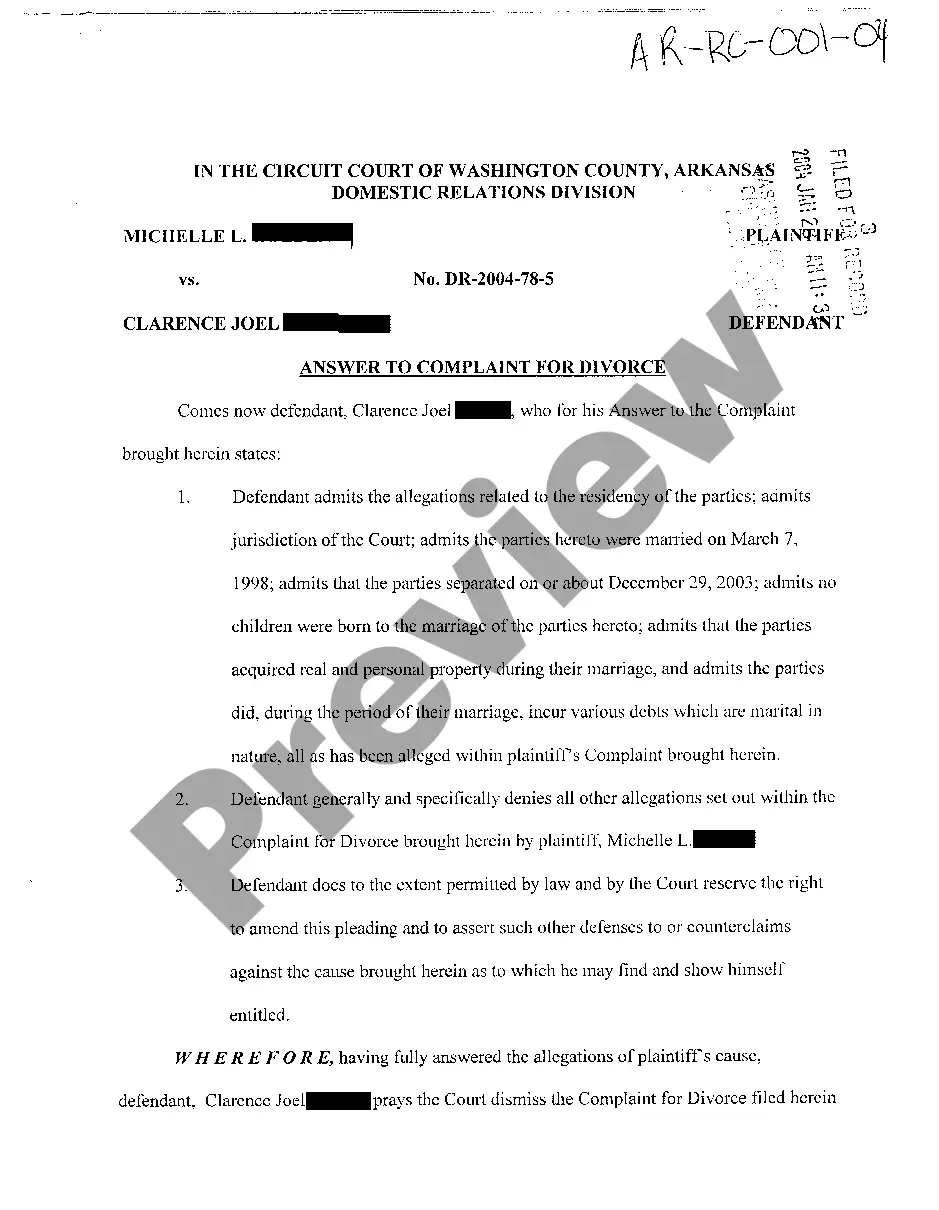

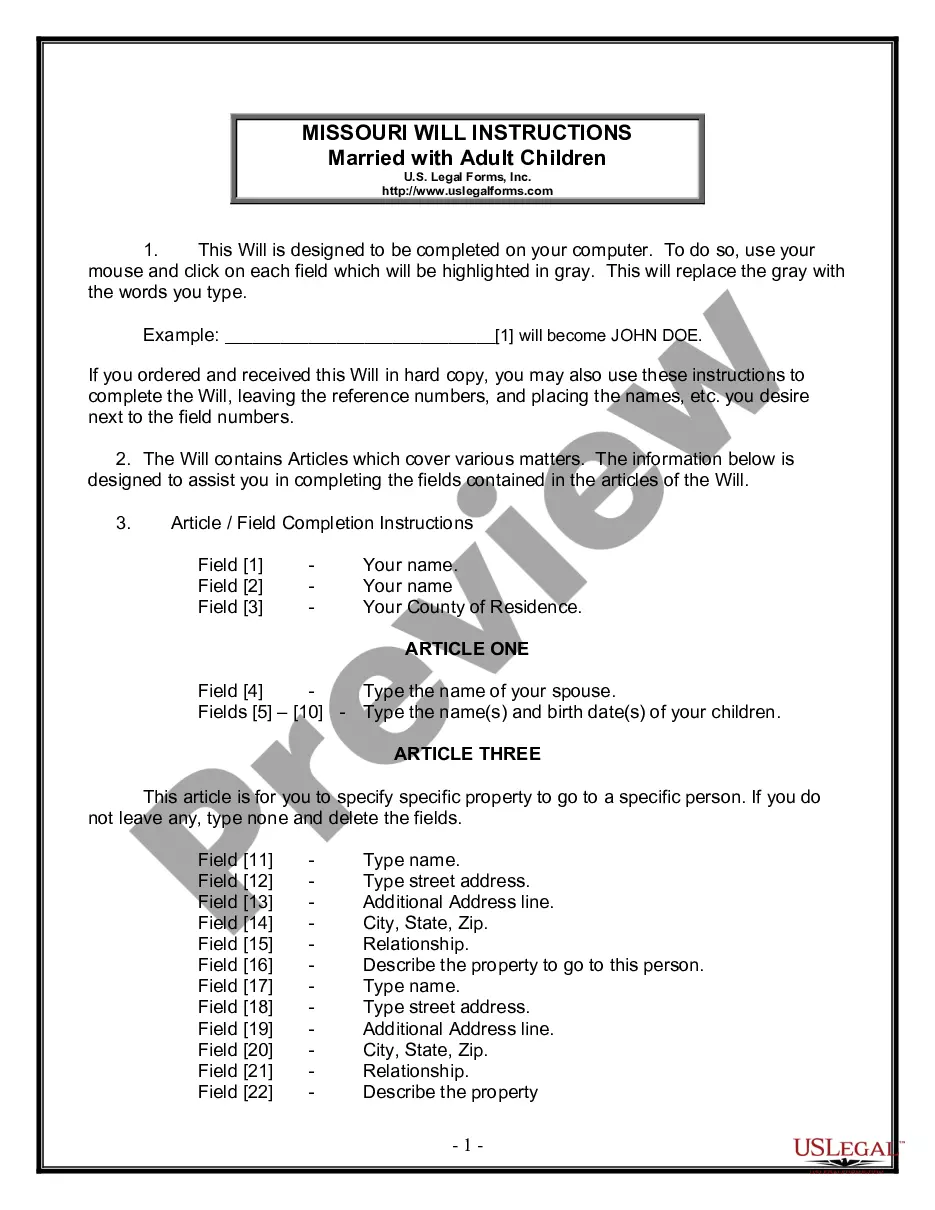

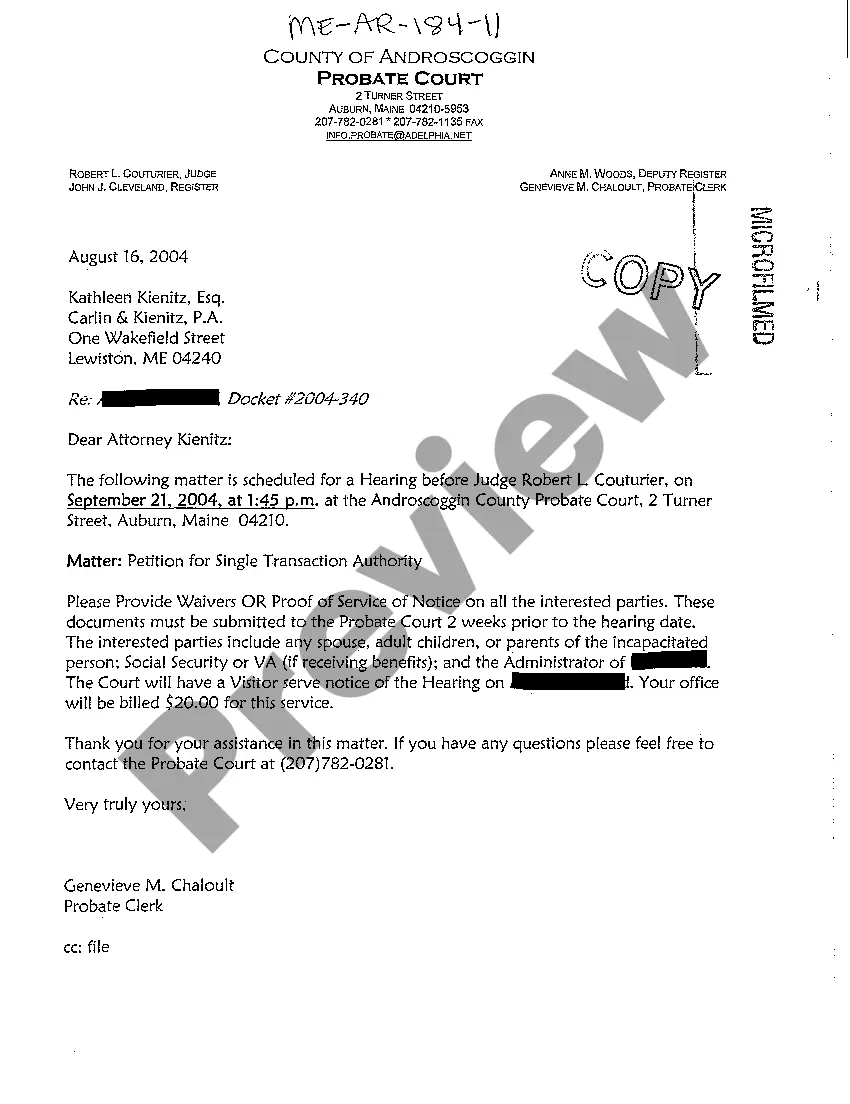

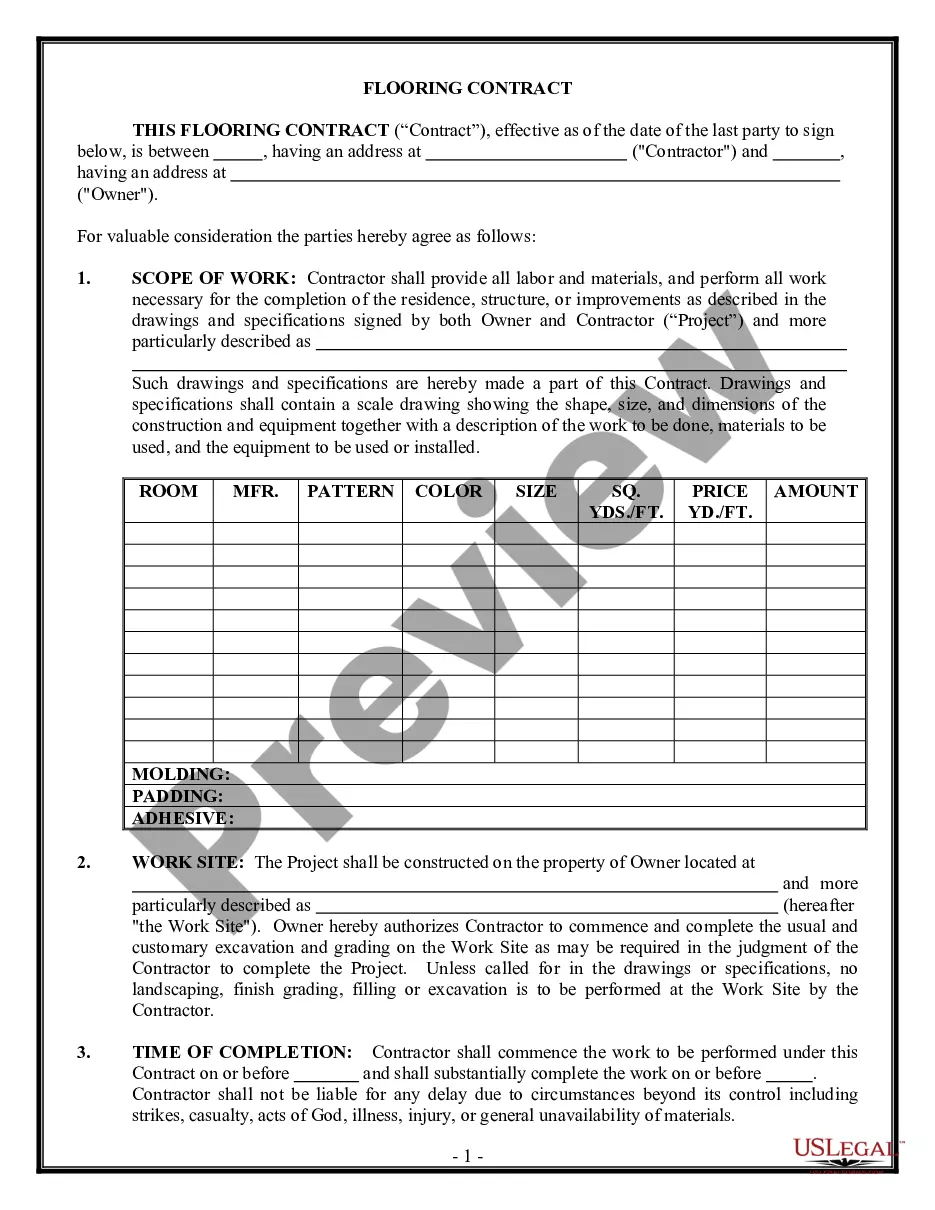

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another template using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you have signed up and bought your subscription, you can utilize your Self-Employed Lecturer - Speaker - Services Contract as many times as you need or for as long as it stays valid where you live. Change it with your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Perlman When dealing with independent contractors, companies shouldn't discipline them the same way they would an employee. Instead, the remedy for an independent contractor not complying with company expectations is to terminate or consider terminating the contract.

1099 employees are self-employed independent contractors. They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return.The employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's work.

As an independent contractor, you'll usually make more money than if you were an employee. Companies are willing to pay more for independent contractors because they don't have the enter into expensive, long-term commitments or pay health benefits, unemployment compensation, Social Security taxes, and Medicare taxes.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.An independent contractor is someone who provides a service on a contractual basis.

You define the work hours: Generally, independent contractors do the job as they see fit. They set their own hours and work how and when they want. And they should be paid by the project -- never on an hourly basis.After all, contractors are, by definition, independent professionals.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

By definition, independent contractors are able to dictate their schedules. This means that employers cannot tell an independent contractor when to work unless they want to give the worker the benefits of a true employee.

Do not designate someone as a 1099 Employee if: Company provides training on a certain method of job performance. Tools and materials are provided. Employees must follow set schedule. You provide benefits such as vacation, overtime pay, etc.

As your independent contractor person must abide by all safety regs for your project. If your company shirt is a safety feature, bullet proof, fireproof, the you can compel wearing. However, your independent contractors may want to wear their own company shirt.

Unless you fall into an exempted class, federal law demands that you be paid overtime of at least 1 and 1/2 times your regular hourly rate for any work performed in excess of 40 hours per week or 8 hours per day. Non-exempt employees cannot be forced to work beyond these hours without proper compensation.