Self-Employed Surveyor Services Contract

Description Self Employed Contract Agreement

How to fill out Self-Employed Surveyor Services Contract?

Among lots of free and paid examples that you can get on the net, you can't be sure about their accuracy. For example, who made them or if they’re competent enough to deal with what you need these to. Keep relaxed and utilize US Legal Forms! Find Self-Employed Surveyor Services Contract templates made by skilled lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer and then paying them to draft a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all your previously acquired documents in the My Forms menu.

If you are utilizing our website the very first time, follow the tips listed below to get your Self-Employed Surveyor Services Contract with ease:

- Ensure that the file you see applies in your state.

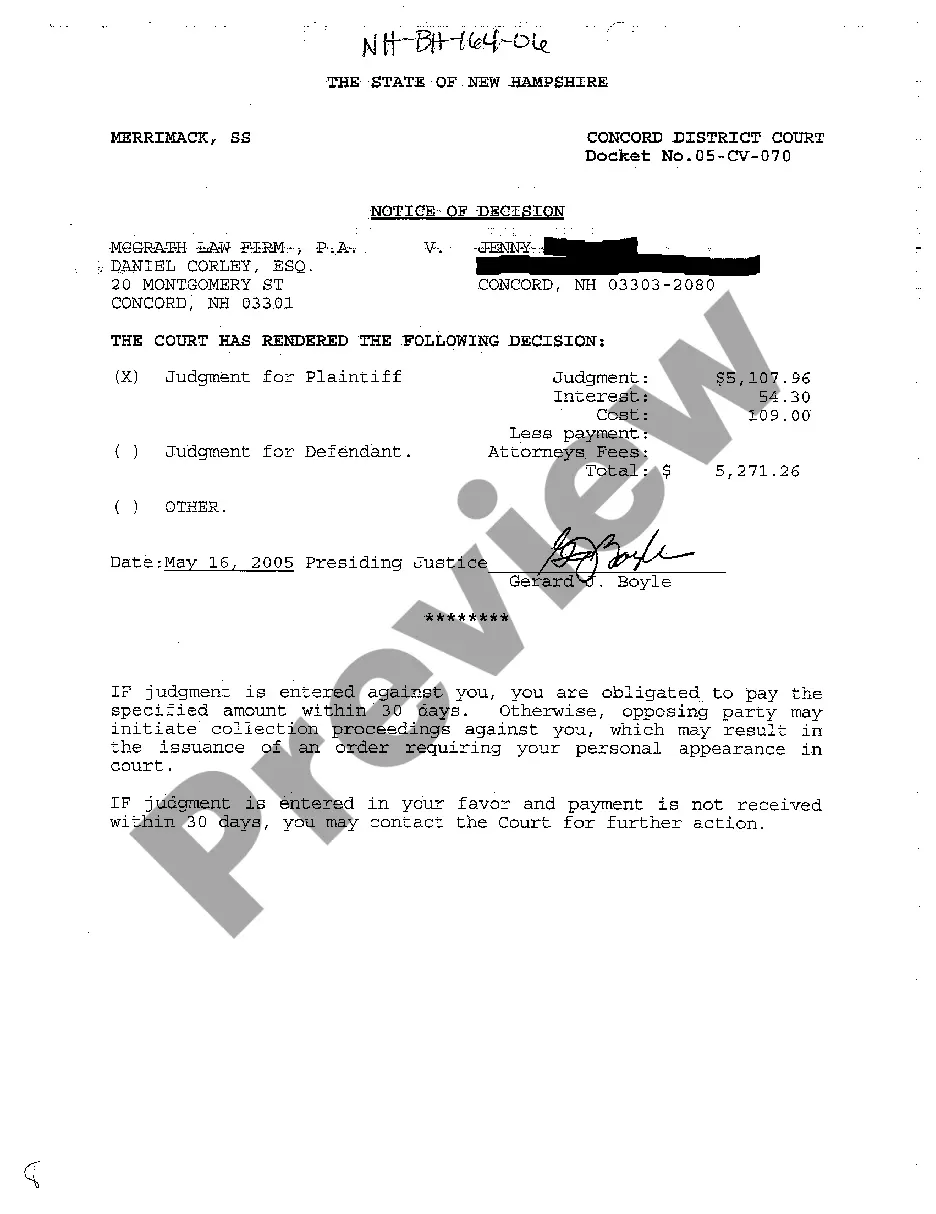

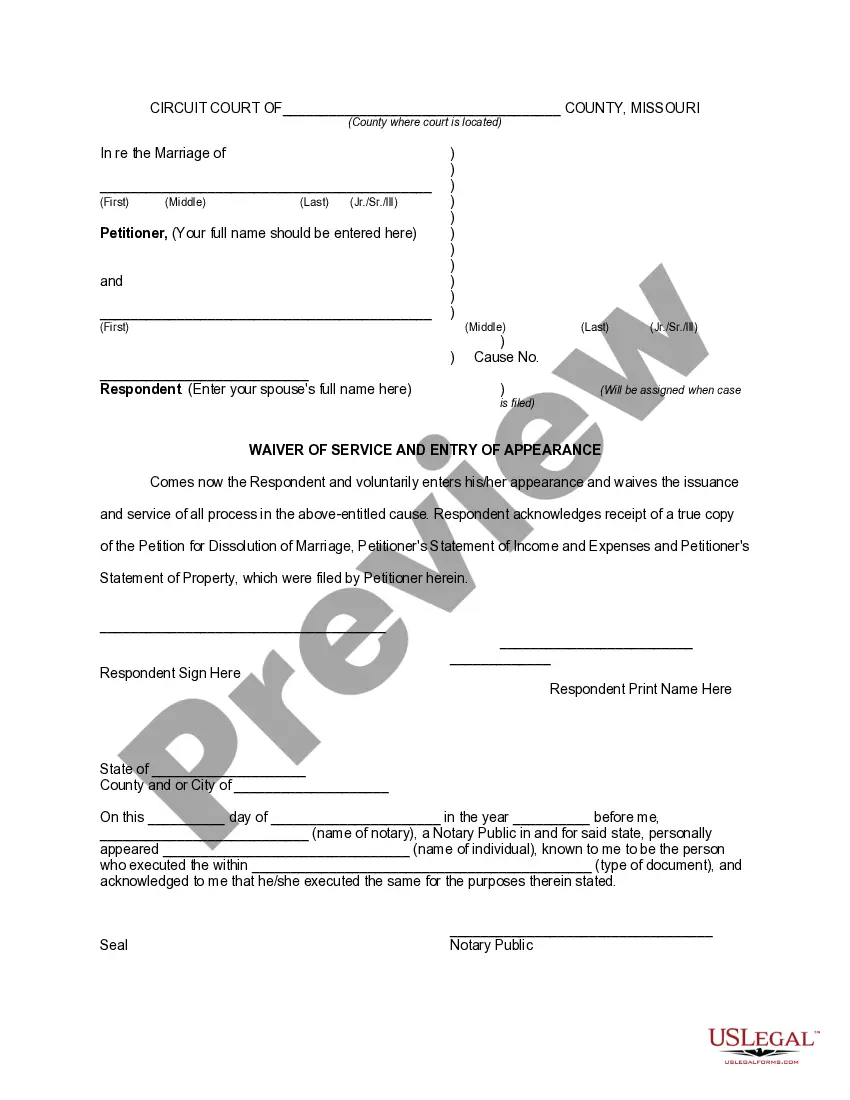

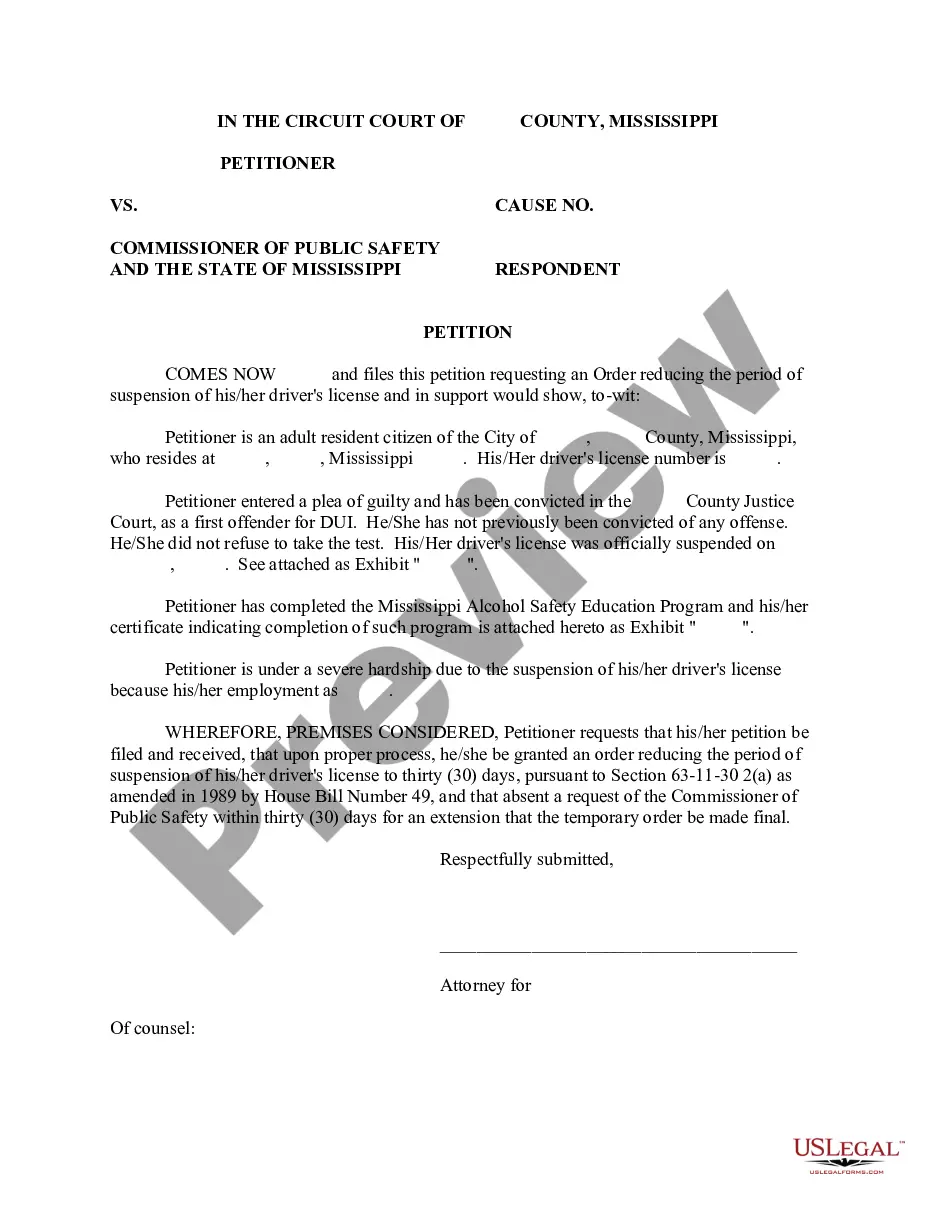

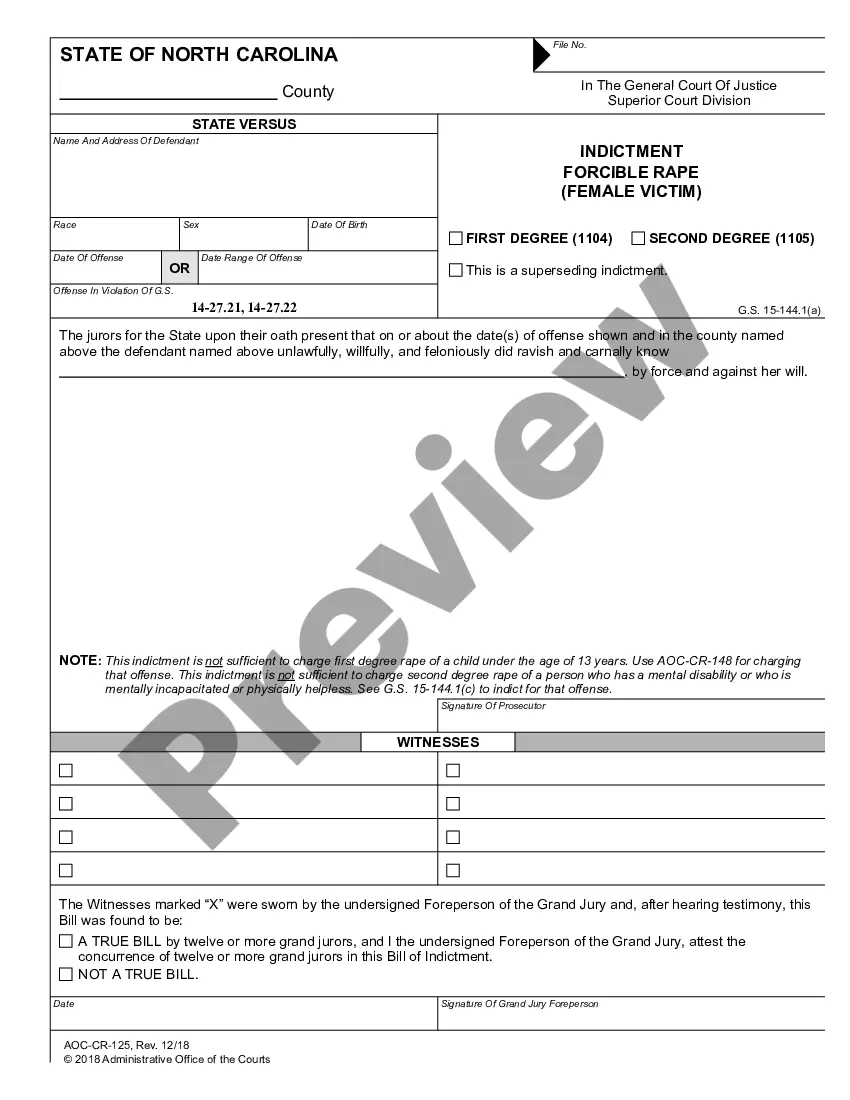

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or find another sample using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

As soon as you have signed up and bought your subscription, you can utilize your Self-Employed Surveyor Services Contract as often as you need or for as long as it stays valid where you live. Change it in your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Payer's (that's you!) name, address, and phone number. Your TIN (Taxpayer Identification Number) Recipient's TIN. Recipient's name and address. Your account number, if applicable. Amount you paid the recipient in the tax year.

Nonemployee compensation is fees, commissions, or any other compensation paid by a business to an individual who is not an employee. Nonemployee compensation is reported on Form 1099-MISC.

As an independent contractor, report your income on Schedule C of Form 1040, Profit or Loss from Business. You must pay self-employment taxes on net earnings exceeding $400. For those taxes, you must submit Schedule SE, Form 1040, the self-employment tax.

In the past, compensation of $600 or more paid to non-employees for services in the course of a trade or business was reported on the Form 1099-MISC. But, compensation of $600 or more paid to non-employees in 2020 and subsequent years is now required to be reported on the Form 1099-NEC.

From within your TaxAct® return (Online or Desktop), click on the Federal tab. Click Form 1099-MISC to expand the category and then click 7-Nonemployee compensation. On the screen titled Federal Q&A - Form 1099-MISC, Box 7, choose which schedule you will use and click Continue.

The short answer is yes, you can fill out a 1099 by hand, but there's a little more to it than that. Handwriting your tax forms comes with a long list of rules from the IRS since handwritten forms need to be scanned by their machines.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

Enter your information in the 'payer' section. Fill in your tax ID number. As a business owner, enter the contractor's tax ID number which is found on their form W-9. Fill out the account number you have assigned to the independent contractor. Enter the total amount you paid the independent contractor in box 7.

Gather the required information. Submit Copy A to the IRS. Submit copy B to the independent contractor. Submit form 1096. Check if you need to submit 1099 forms with your state.