Court Reporter Employment Agreement - Self-Employed Independent Contractor

Description

How to fill out Court Reporter Employment Agreement - Self-Employed Independent Contractor?

Among numerous paid and free templates which you find on the web, you can't be certain about their reliability. For example, who made them or if they’re qualified enough to take care of what you need them to. Always keep calm and make use of US Legal Forms! Locate Court Reporter Employment Agreement - Self-Employed Independent Contractor samples created by skilled legal representatives and prevent the costly and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access your earlier saved samples in the My Forms menu.

If you’re using our website the first time, follow the instructions below to get your Court Reporter Employment Agreement - Self-Employed Independent Contractor quick:

- Make certain that the file you find applies in the state where you live.

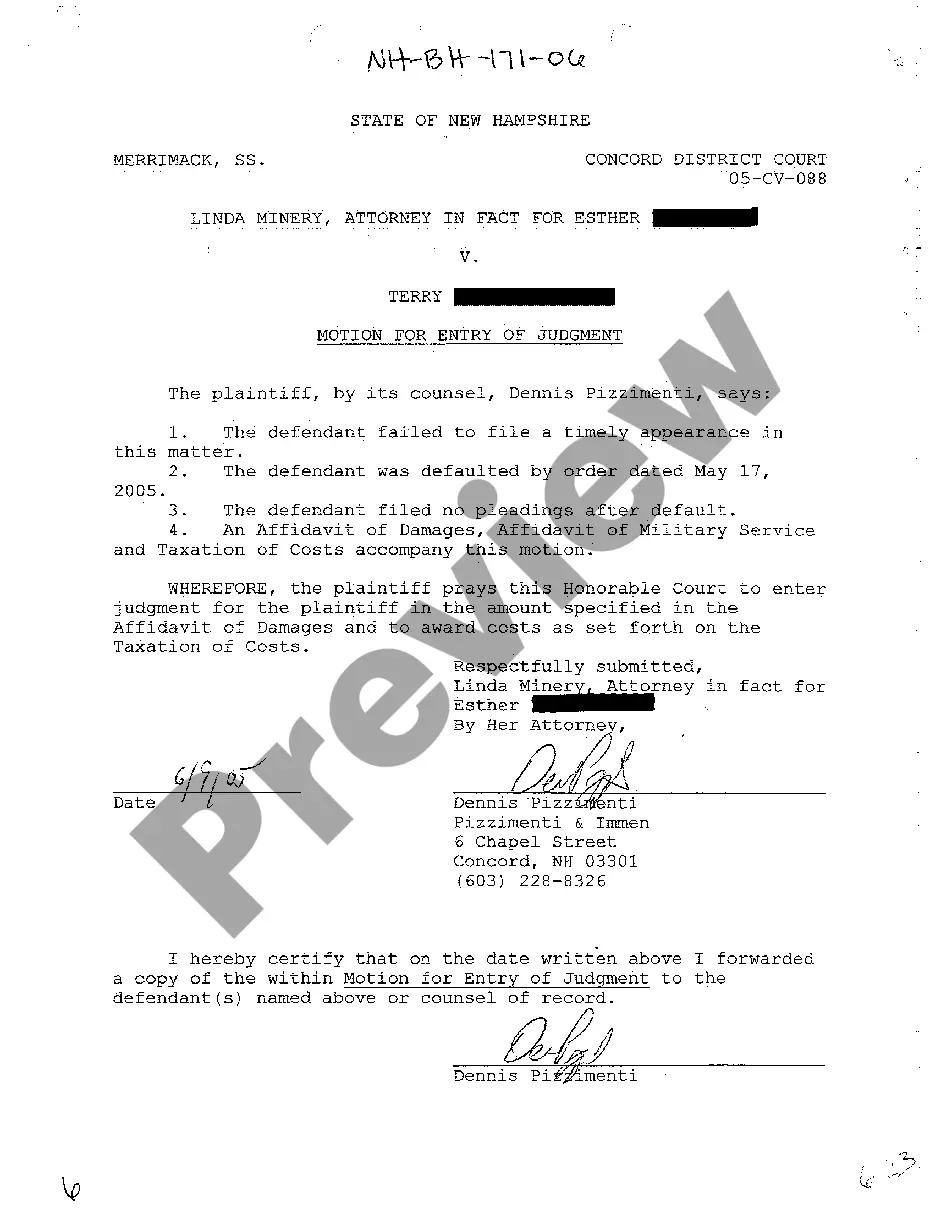

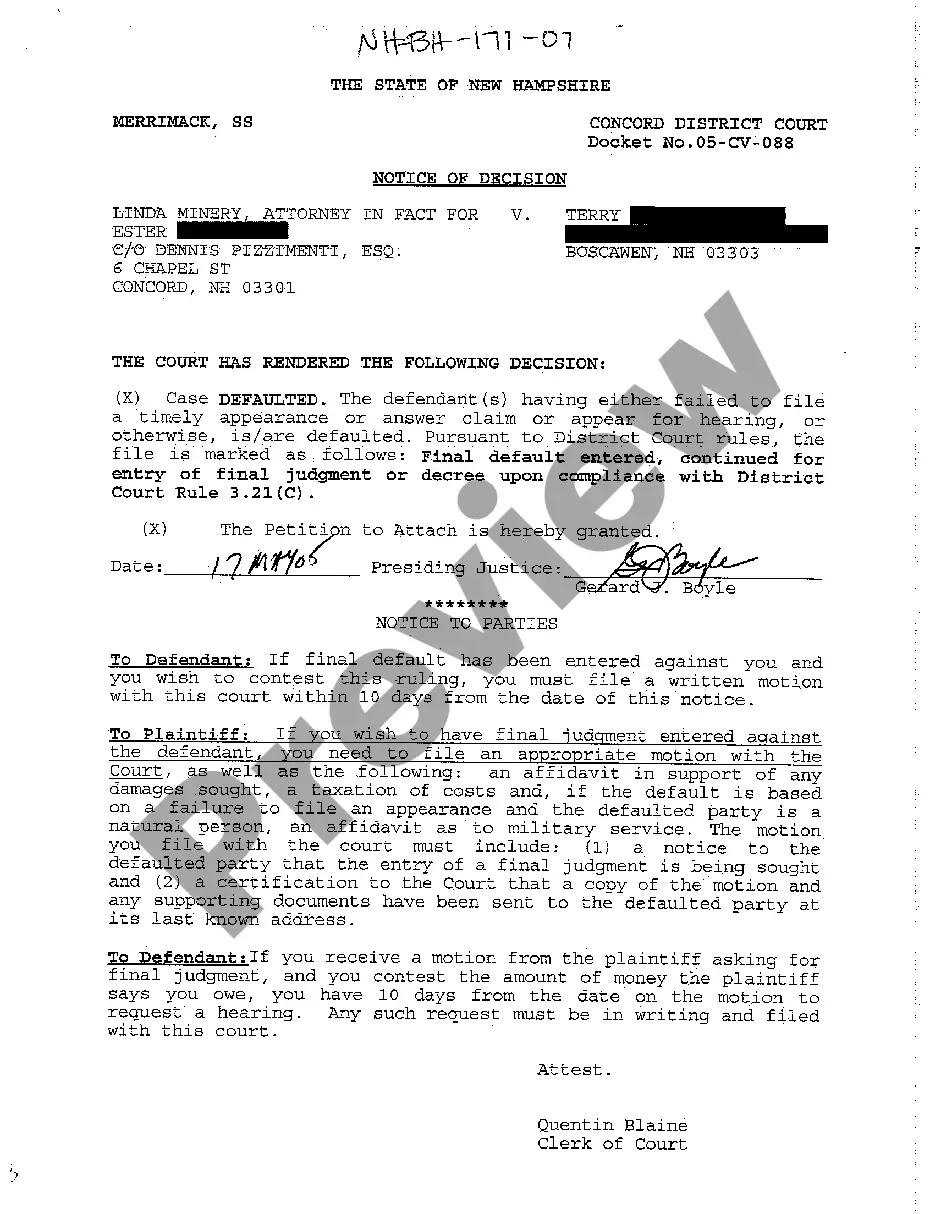

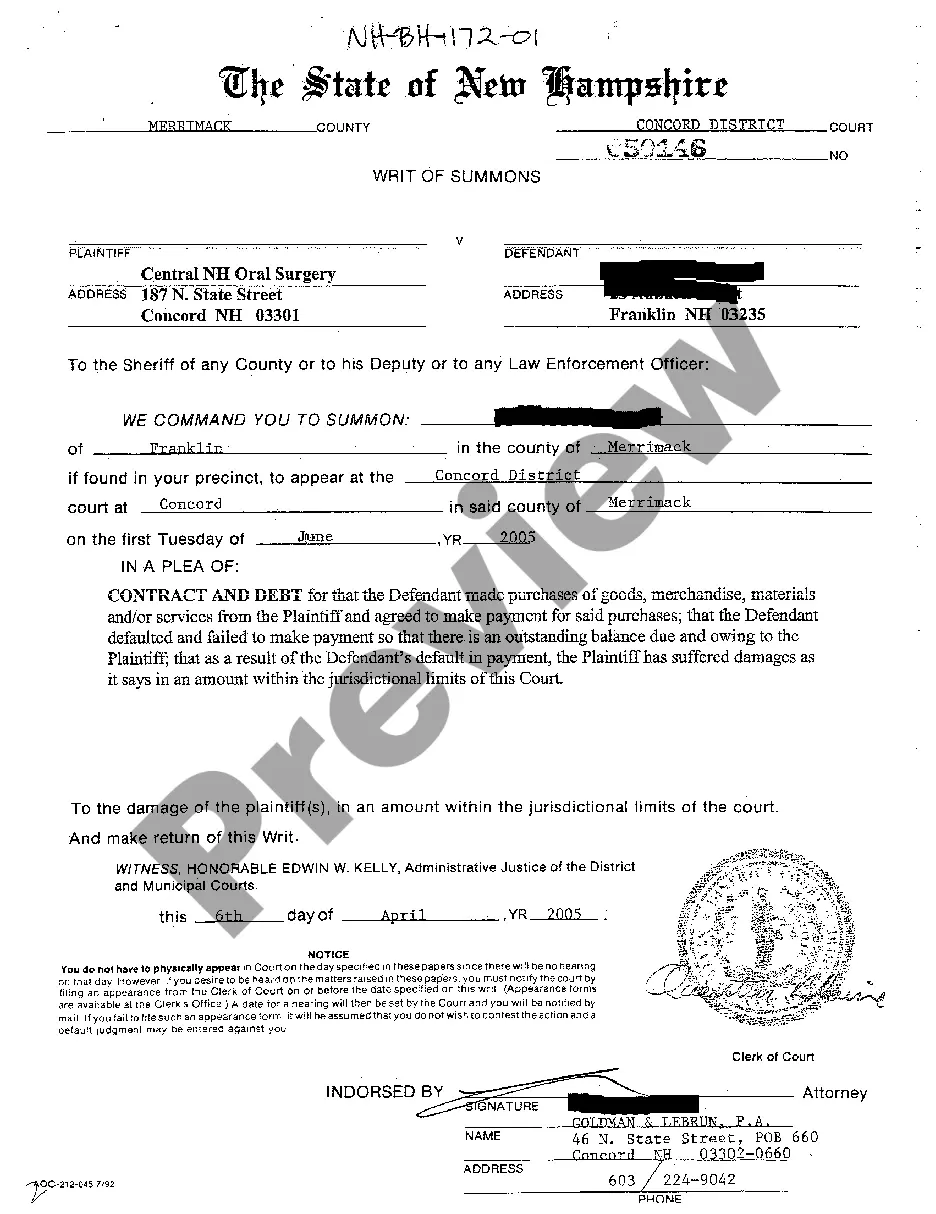

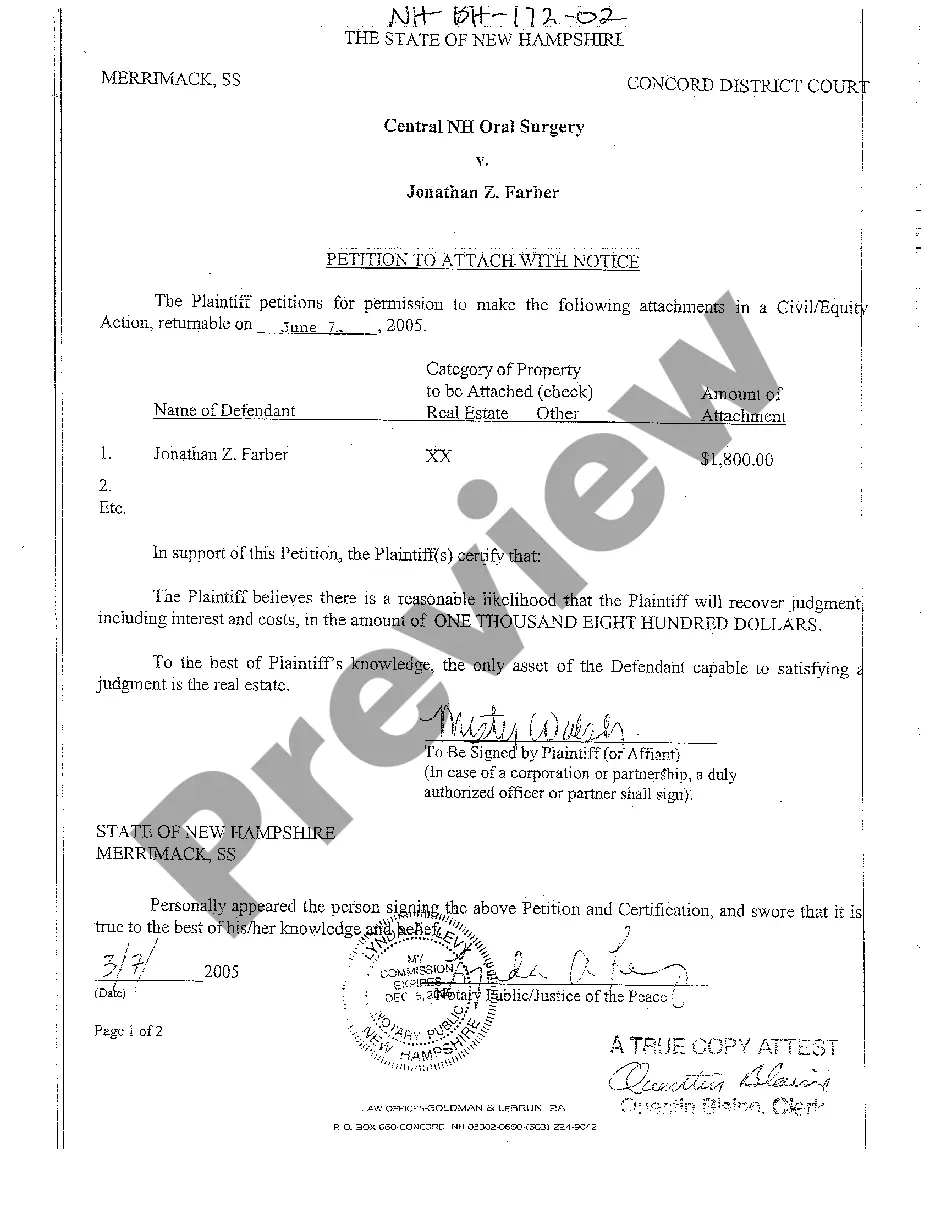

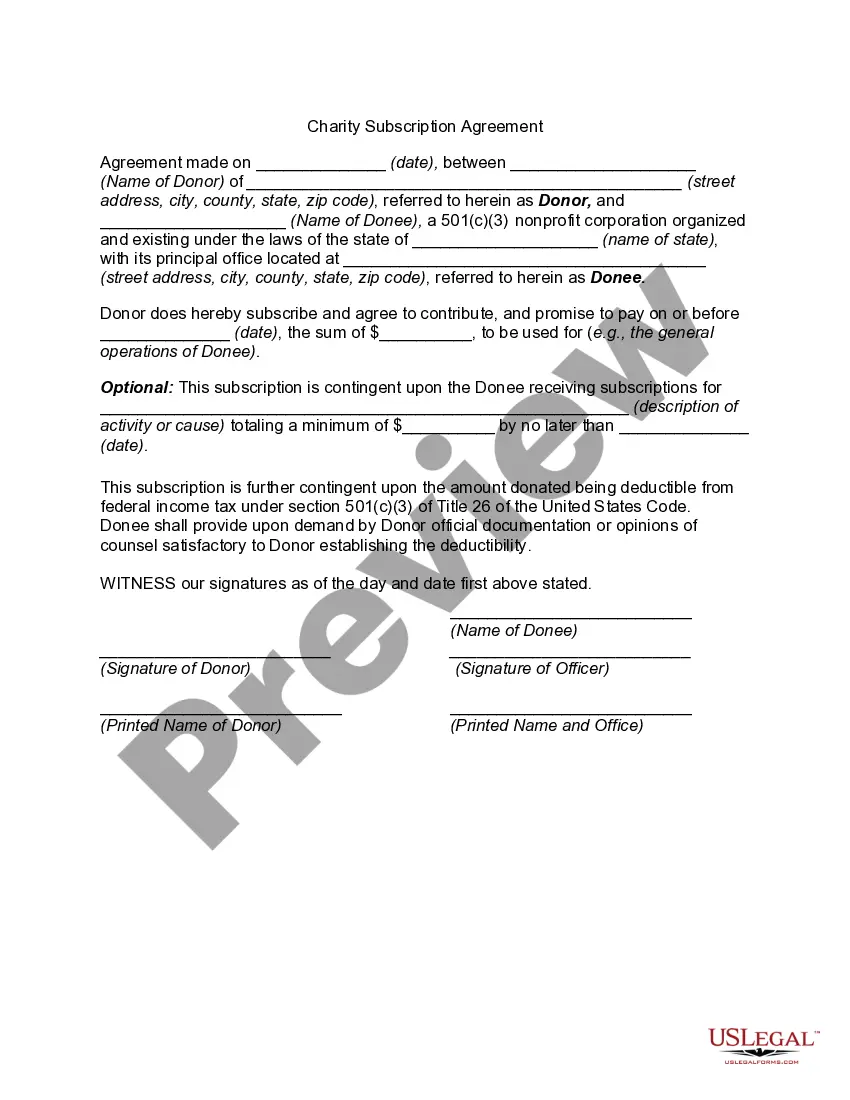

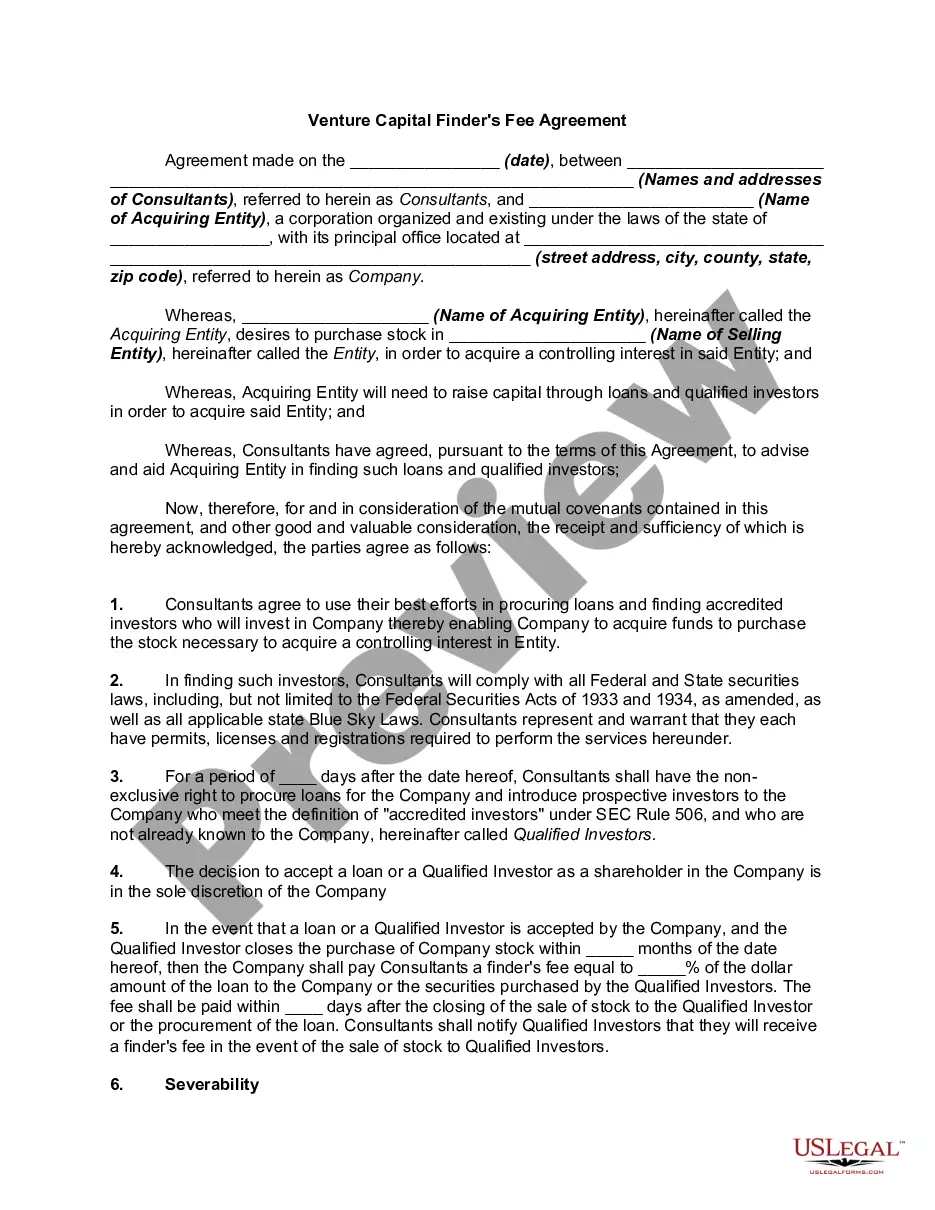

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another example utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

When you’ve signed up and paid for your subscription, you can utilize your Court Reporter Employment Agreement - Self-Employed Independent Contractor as often as you need or for as long as it continues to be valid where you live. Change it with your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Many court reporters are independent contractors who work out of their home either independently or through a court reporting agency. Wireless and Internet technologies have made it easy to do these jobs remotely, even if they must "attend" the event they are documenting.

Types of Court ReportersCourt reporters that work for judges and the courts are generally referred to as official court reporters.Traditionally, the official reporter was a government employee, employed by the court system within which they worked.

Transcript income can be dubbed as 'outside income' by court administration; and because of their classification as independent contractors, court reporters are exempt from policies that prevent employees from doing work for 'outside income' during office hours.

Freelance court reporters can be considered independent contractors, which means you are technically self-employed, or employees, depending how the court reporting firm is structured.These agencies work with freelancers to cover depositions, examinations under oath, hearings and board meetings.

A freelance court reporter is an independent contractor, or one who works for one or more court reporting agencies. Their work primarily consists of recording testimony taken in the discovery phase of a case (depositions), as well as meetings, arbitrations, and hearings.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Transcript income can be dubbed as 'outside income' by court administration; and because of their classification as independent contractors, court reporters are exempt from policies that prevent employees from doing work for 'outside income' during office hours.