Self-Employed Utility Services Contract

Description

How to fill out Self-Employed Utility Services Contract?

Among numerous paid and free samples that you find on the internet, you can't be certain about their accuracy. For example, who made them or if they’re competent enough to take care of what you require these to. Always keep relaxed and make use of US Legal Forms! Locate Self-Employed Utility Services Contract samples created by professional legal representatives and prevent the expensive and time-consuming process of looking for an lawyer or attorney and then having to pay them to write a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all your earlier downloaded documents in the My Forms menu.

If you’re using our platform the first time, follow the instructions listed below to get your Self-Employed Utility Services Contract with ease:

- Make certain that the file you see is valid in your state.

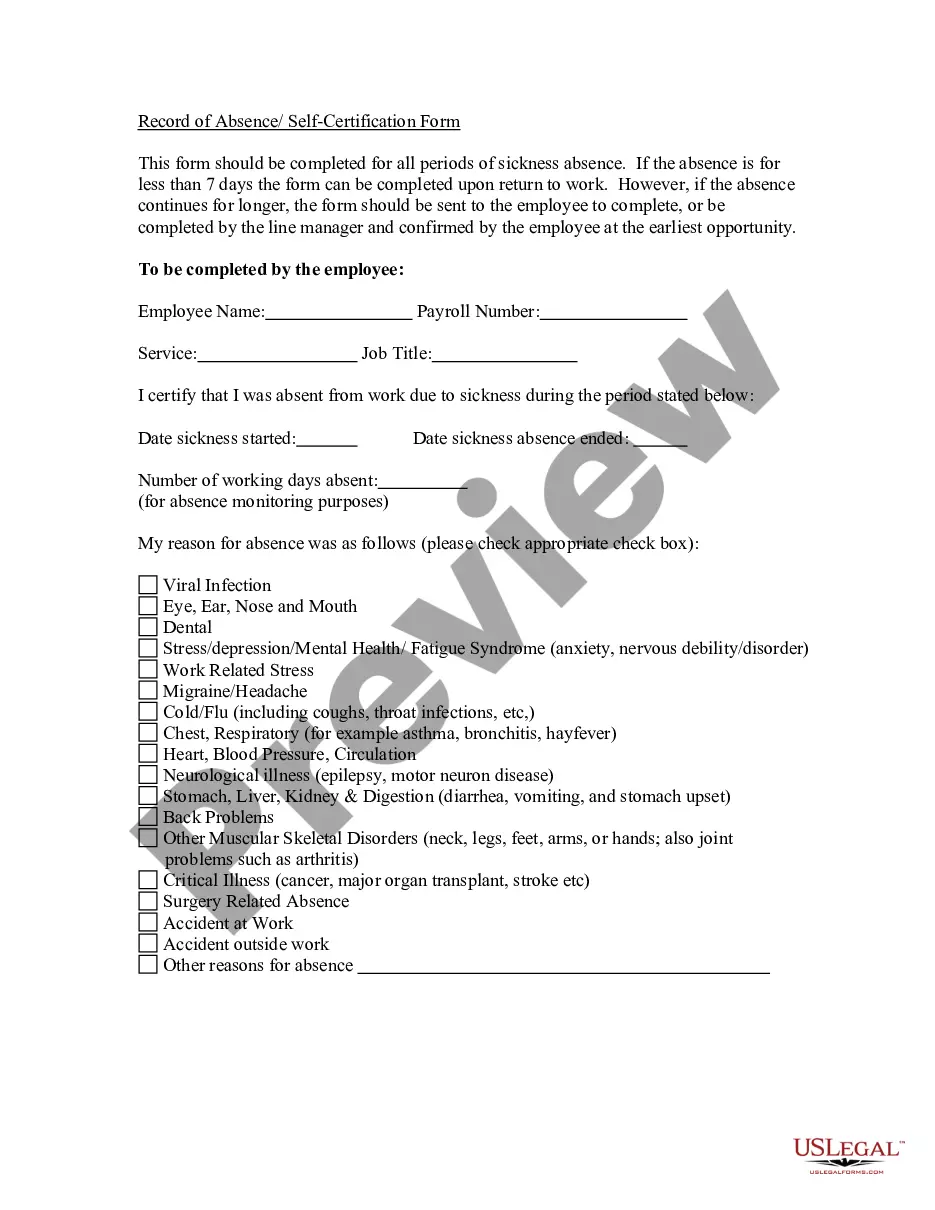

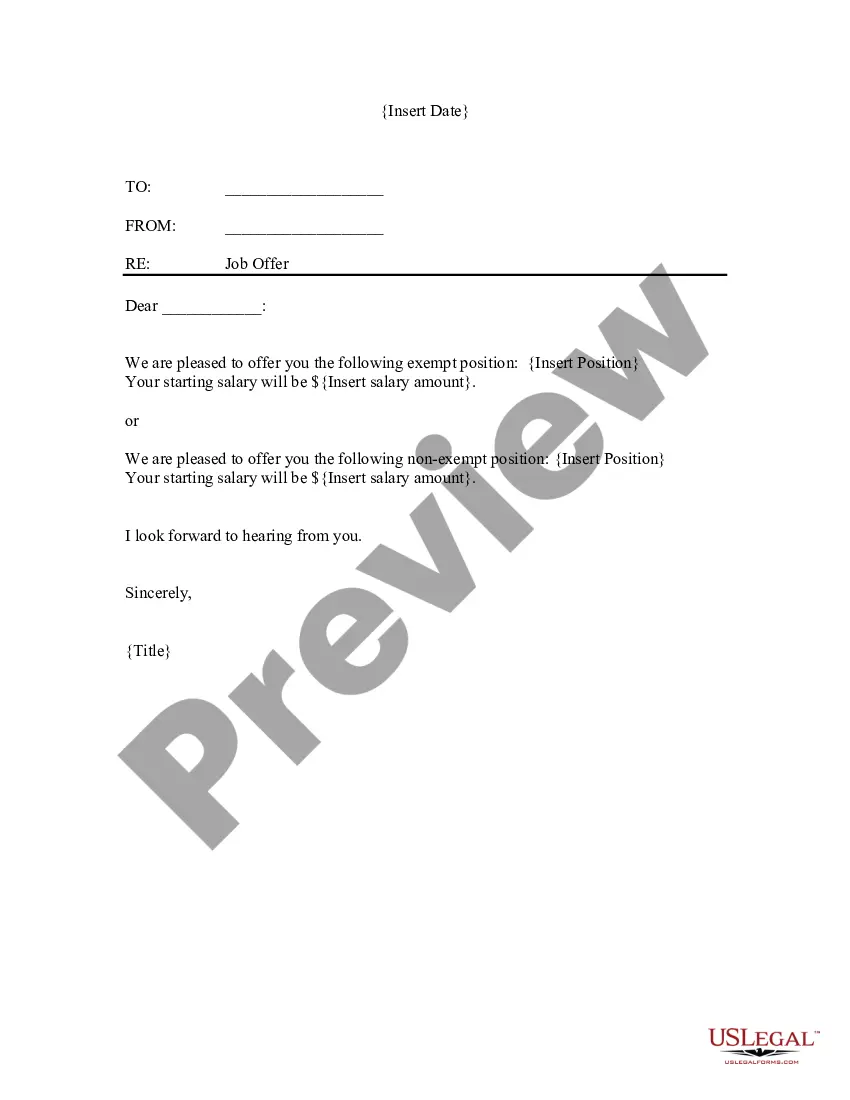

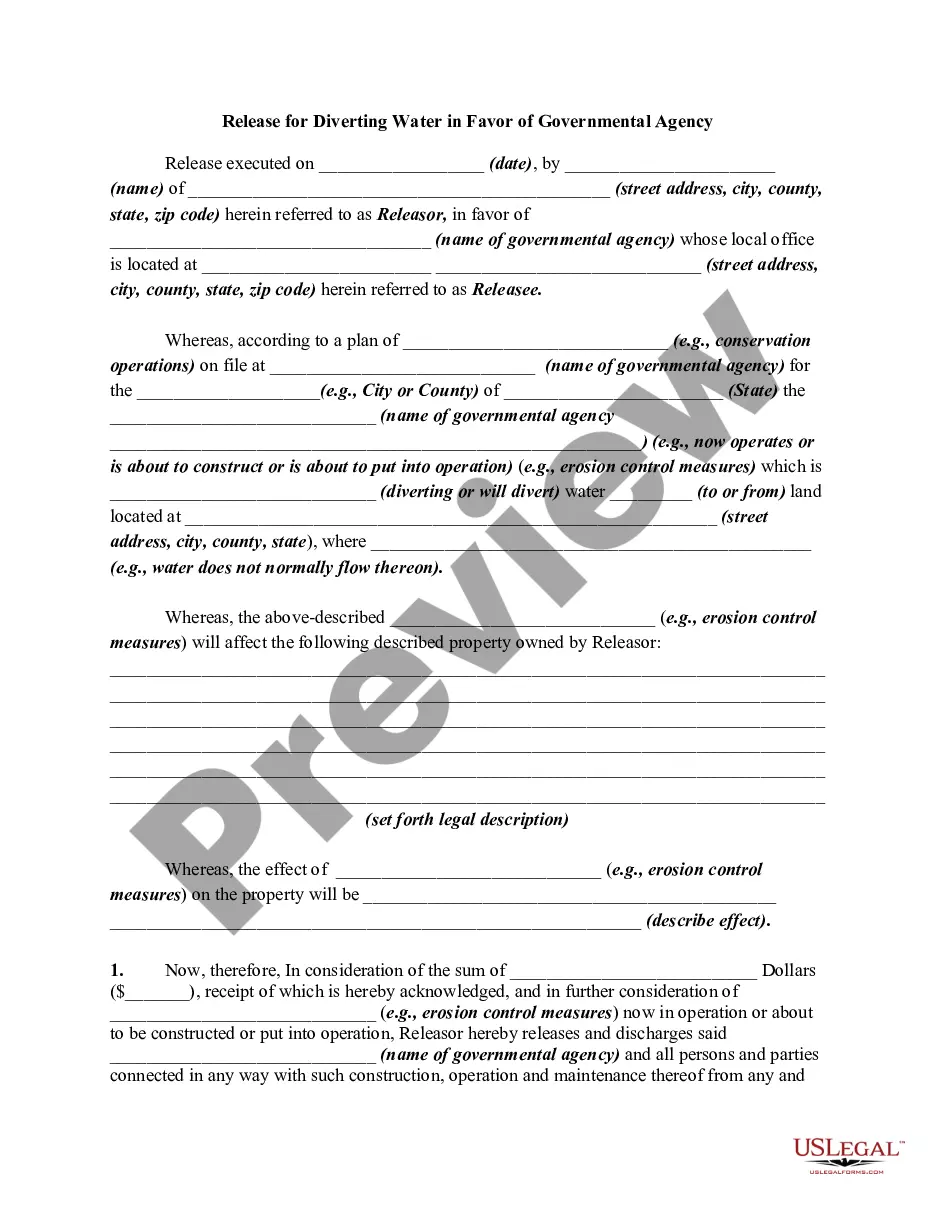

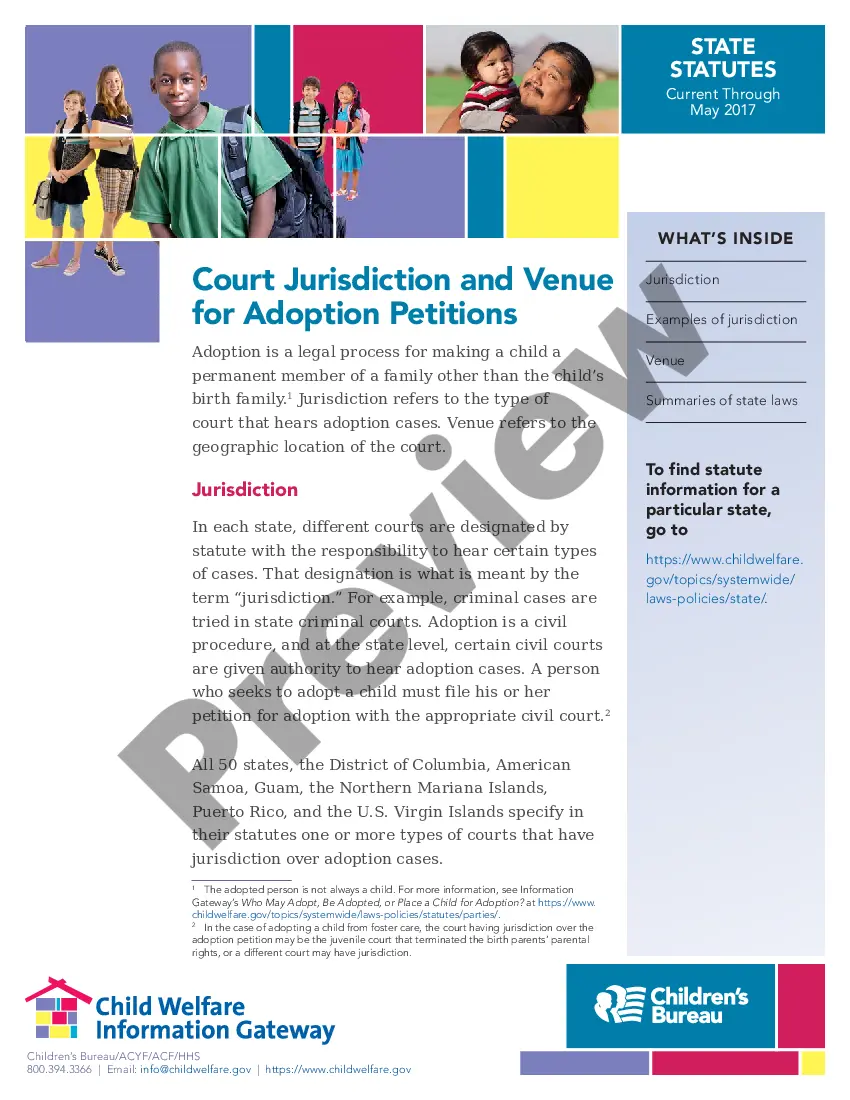

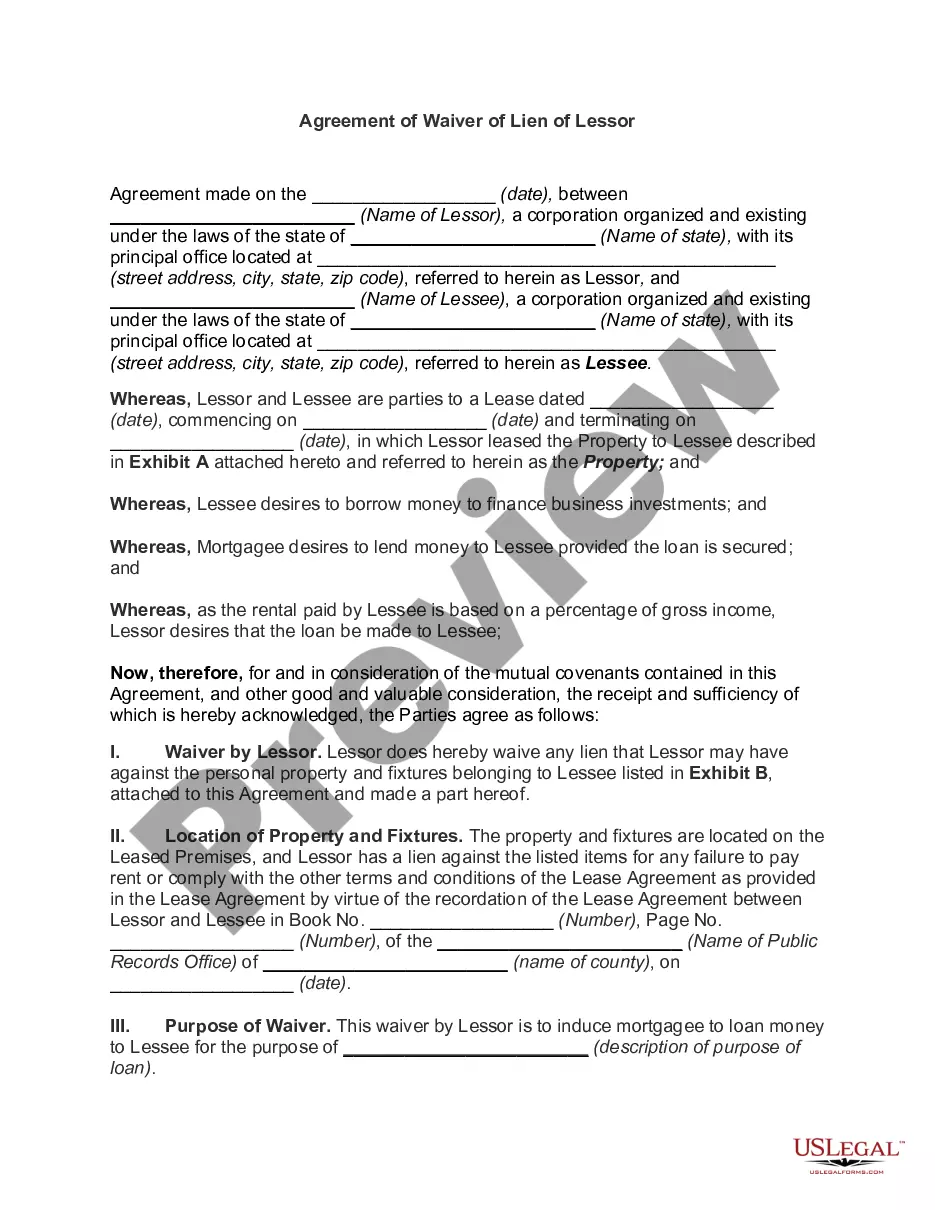

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

As soon as you have signed up and paid for your subscription, you can use your Self-Employed Utility Services Contract as many times as you need or for as long as it continues to be active in your state. Change it in your favored offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Yes, if you have 1099 income you are considered to be self-employed, and you will need to pay self-employment taxes (Social Security and Medicare taxes) on this income.

You are eligible to apply for a PPP loan as an independent contractor or self-employed individual who has been or will be harmed by the pandemic if all of the following are true:You filed or will file a Form 1040 Schedule C for 2019 showing self-employment income.

Must be in operation before February 15, 2020. Must have income from self-employment, sole proprietorship, or as an independent contractor. Must live in the United States. Must file a Form 1040, Schedule C for 2019. Must have net profit for 2019.

The Paycheck Protection Program (PPP) allows lenders to offer low-interest loans that may be 100% forgiven in certain circumstances. Independent contractors and self-employed individuals that have been adversely impacted by the COVID-19 pandemic have been eligible to apply for these loans since April 10, 2020.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else. An independent contractor is someone who provides a service on a contractual basis.

The PPP limits compensation to an annualized salary of $100,000. For sole proprietors or independent contractors with no employees, the maximum possible PPP loan is therefore $20,833, and the entire amount is automatically eligible for forgiveness as owner compensation share.

In order to apply for a PPP loan as a self-employed individual or independent contractor, you have to meet the following criteria:Must have income from self-employment, sole proprietorship, or as an independent contractor. Must live in the United States. Must file a Form 1040, Schedule C for 2019.

Independent contractors can submit a PPP loan application through their bank or a lending marketplace.PPP applications opened for 1099 employees on April 10, 2020. 1099 employees are now eligible to apply for their own PPP loans through their banks or a loan marketplace.

You are eligible to apply for a PPP loan as an independent contractor or self-employed individual who has been or will be harmed by the pandemic if all of the following are true:You filed or will file a Form 1040 Schedule C for 2019 showing self-employment income.