Tax evasion, as defined in 26 U.S.C. Sec. 7201 of the Internal Revenue Code, is the intentional attempt to evade or defeat any tax imposed by the federal government or the payment thereof. It is a felony punishable by a fine of up to $100,000 and/or imprisonment of up to five years. Types of tax evasion include failing to file a federal income tax return, filing a fraudulent return, failing to pay taxes due, understating income, overstating deductions, claiming nonexistent or inflated exemptions or credits, or hiding or transferring assets to avoid taxation. Other forms of tax evasion may include filing false documents with the IRS, using false Social Security numbers, or declaring false information on a tax return.

TAX EVASION / 26 U.S.C. Sec. 7201

Description

How to fill out TAX EVASION / 26 U.S.C. Sec. 7201?

If you’re searching for a way to properly prepare the TAX EVASION / 26 U.S.C. Sec. 7201 without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business situation. Every piece of paperwork you find on our online service is drafted in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these straightforward guidelines on how to obtain the ready-to-use TAX EVASION / 26 U.S.C. Sec. 7201:

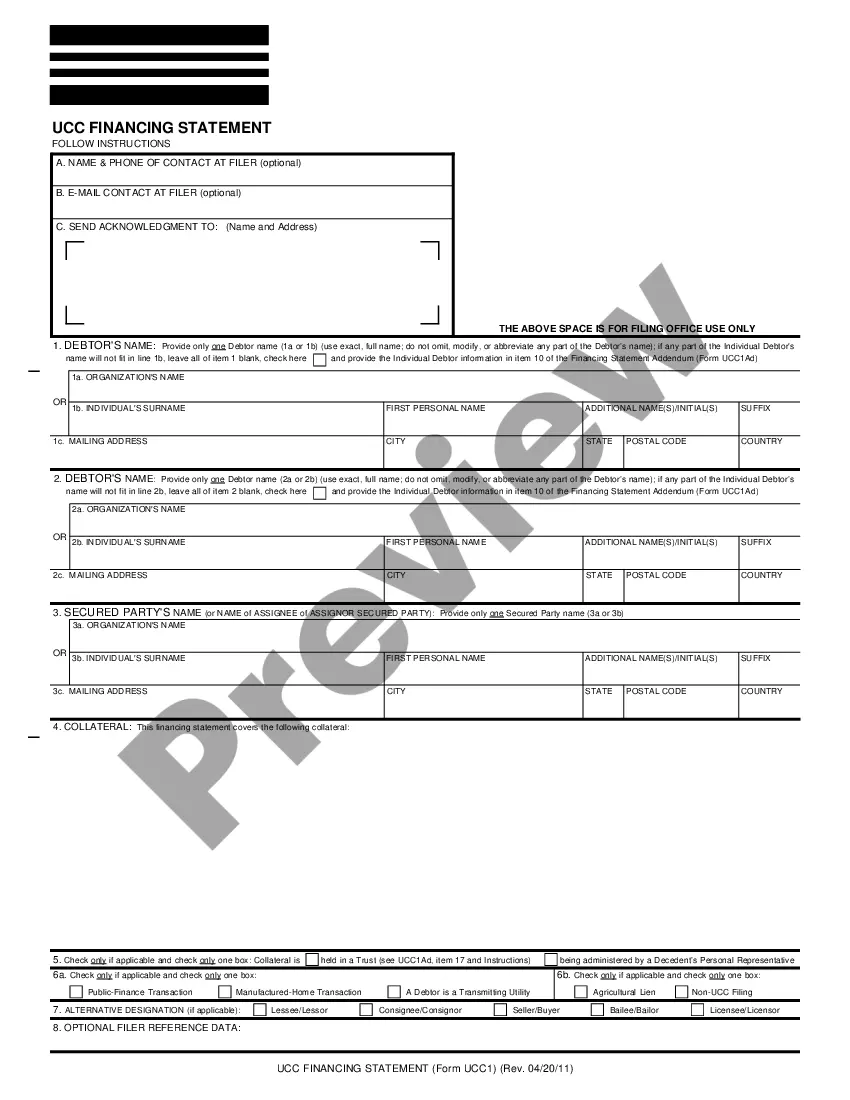

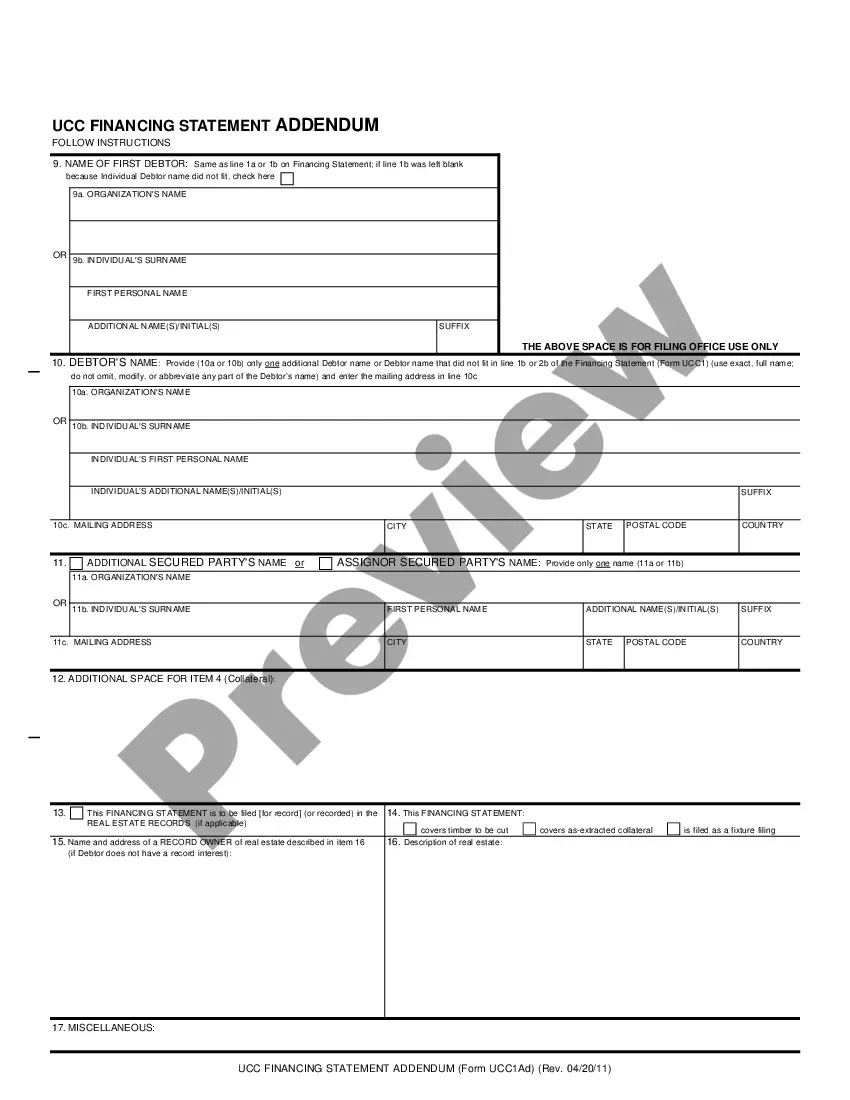

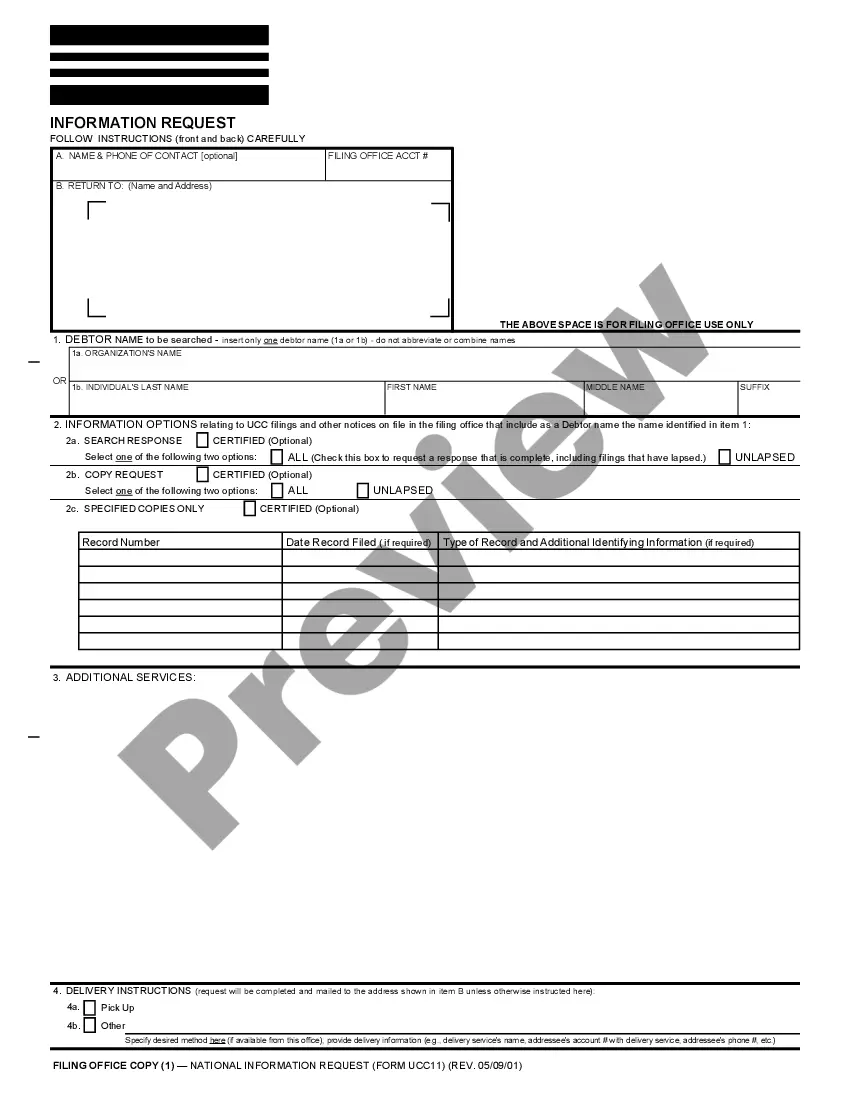

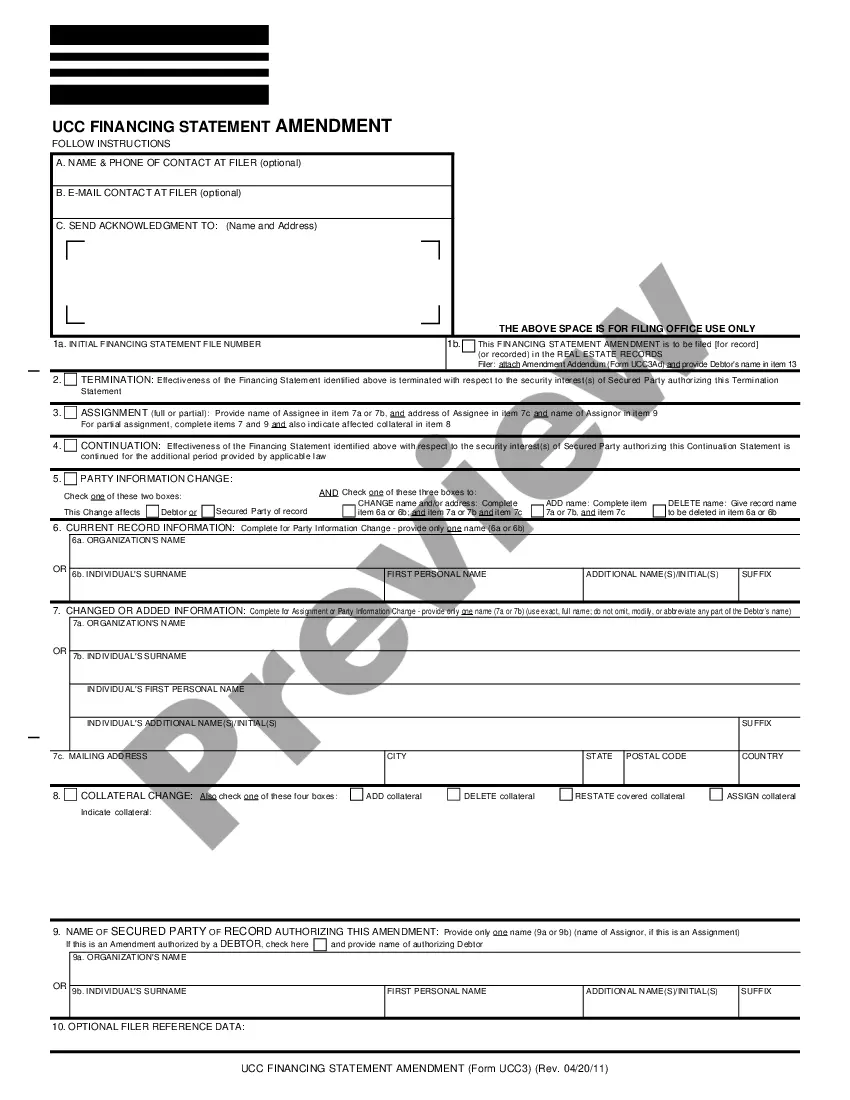

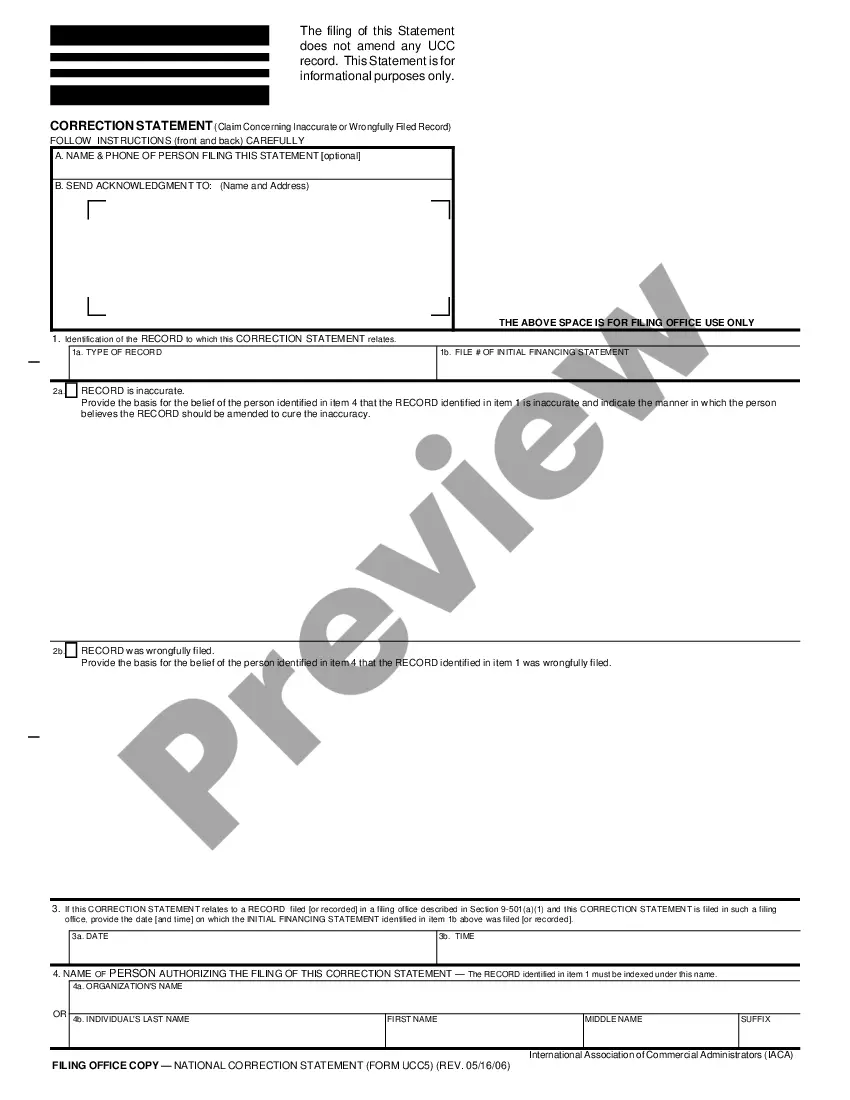

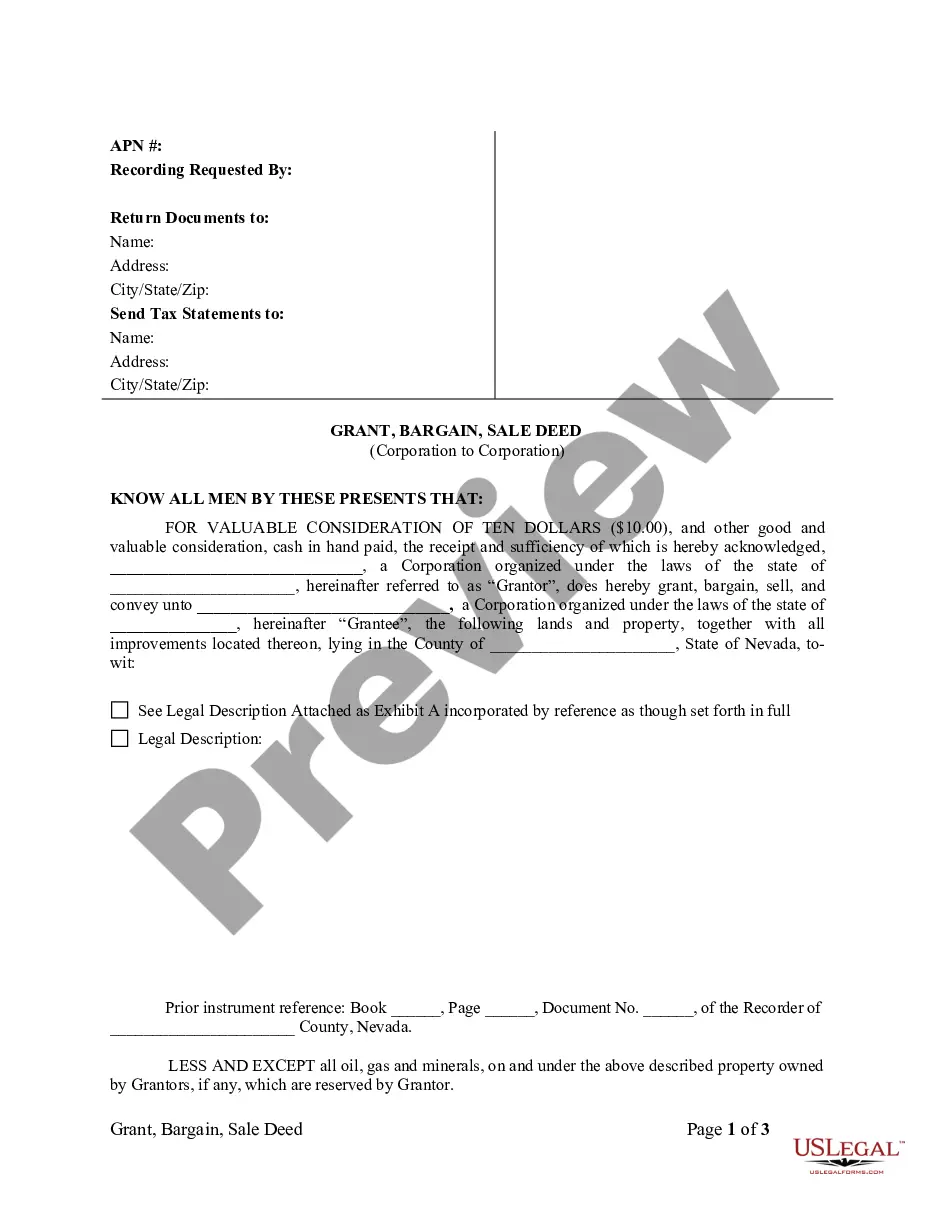

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and select your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your TAX EVASION / 26 U.S.C. Sec. 7201 and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years. The IRS tries to audit tax returns as soon as possible after they are filed.

For fraud and tax evasion, the tax law dictates that if you're convicted, you may be fined up to $100,000 and sent to jail for up to five years.

The average jail time for tax evasion is 3-5 years. Evading tax is a serious crime, which can result in substantial monetary penalties, jail, or prison. The U.S. government aggressively enforces tax evasion and related matters, such as fraud.

The federal tax statute of limitations describes the time the IRS has to file charges against you if you are suspected of tax fraud. In most cases, the IRS can audit your tax returns up to three years after you file them, which means the tax return statute of limitations is three years.

Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall, in addition to other penalties provided by law, be guilty of a felony and, upon conviction thereof, shall be fined not more than $100,000 ($500,000 in the case of a corporation), or imprisoned

Section 7201 creates two offenses: (a) the willful attempt to evade or defeat the assessment of a tax, and (b) the willful attempt to evade or defeat the payment of a tax. Sansone v. United States, 380 U.S. 343, 354 (1965).

The lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.