Securities Exchange Act 15 USC Sec. 78j(b) — Rule 10b-5(a) is a federal regulation that prohibits fraudulent and deceptive activities related to the purchase or sale of securities. It is a part of the Securities Exchange Act of 1934, which is enforced by the U.S. Securities and Exchange Commission (SEC). Rule 10b-5(a) prohibits any person from making any untrue statement of material fact or omitting to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading. It also prohibits any person from engaging in any manipulative or deceptive device, scheme, or artifice to defraud in connection with the purchase or sale of any security. There are three types of Securities Exchange Act 15 USC Sec. 78j(b) — Rule 10b-5(a): 1. The Misleading or Omitting Material Fact Rule — which prohibits any person from making an untrue statement of material fact or omitting to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading. 2. The Manipulative or Deceptive Device Rule — which prohibits any person from engaging in any manipulative or deceptive device, scheme, or artifice to defraud in connection with the purchase or sale of any security. 3. The Insider Trading Rule — which prohibits any person from trading in a security while in possession of material non-public information.

Securities Exchange Act 15 USC Sec. 78j(b) - Rule 10b-5(a)

Description

How to fill out Securities Exchange Act 15 USC Sec. 78j(b) - Rule 10b-5(a)?

If you’re searching for a way to properly complete the Securities Exchange Act 15 USC Sec. 78j(b) - Rule 10b-5(a) without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business situation. Every piece of paperwork you find on our web service is designed in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward instructions on how to obtain the ready-to-use Securities Exchange Act 15 USC Sec. 78j(b) - Rule 10b-5(a):

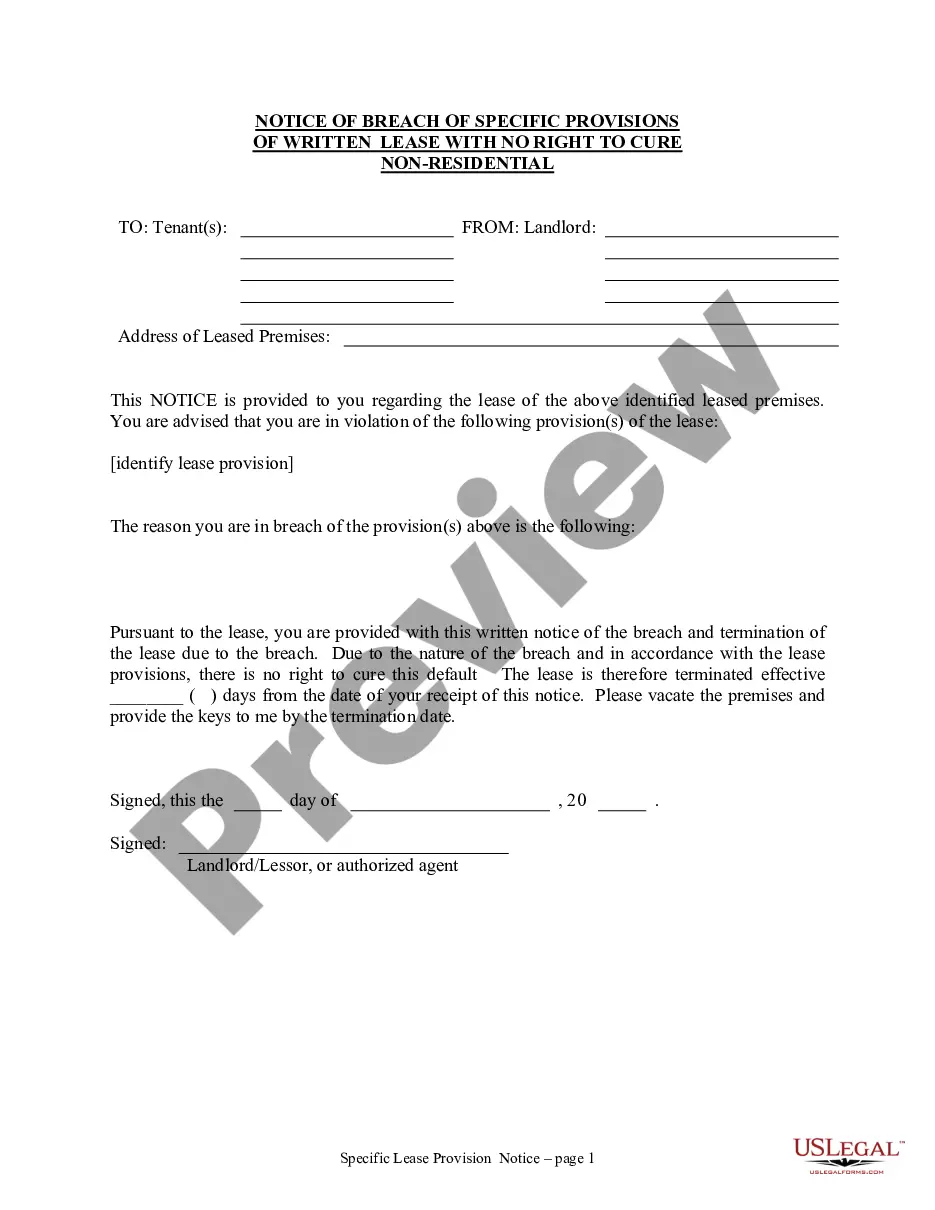

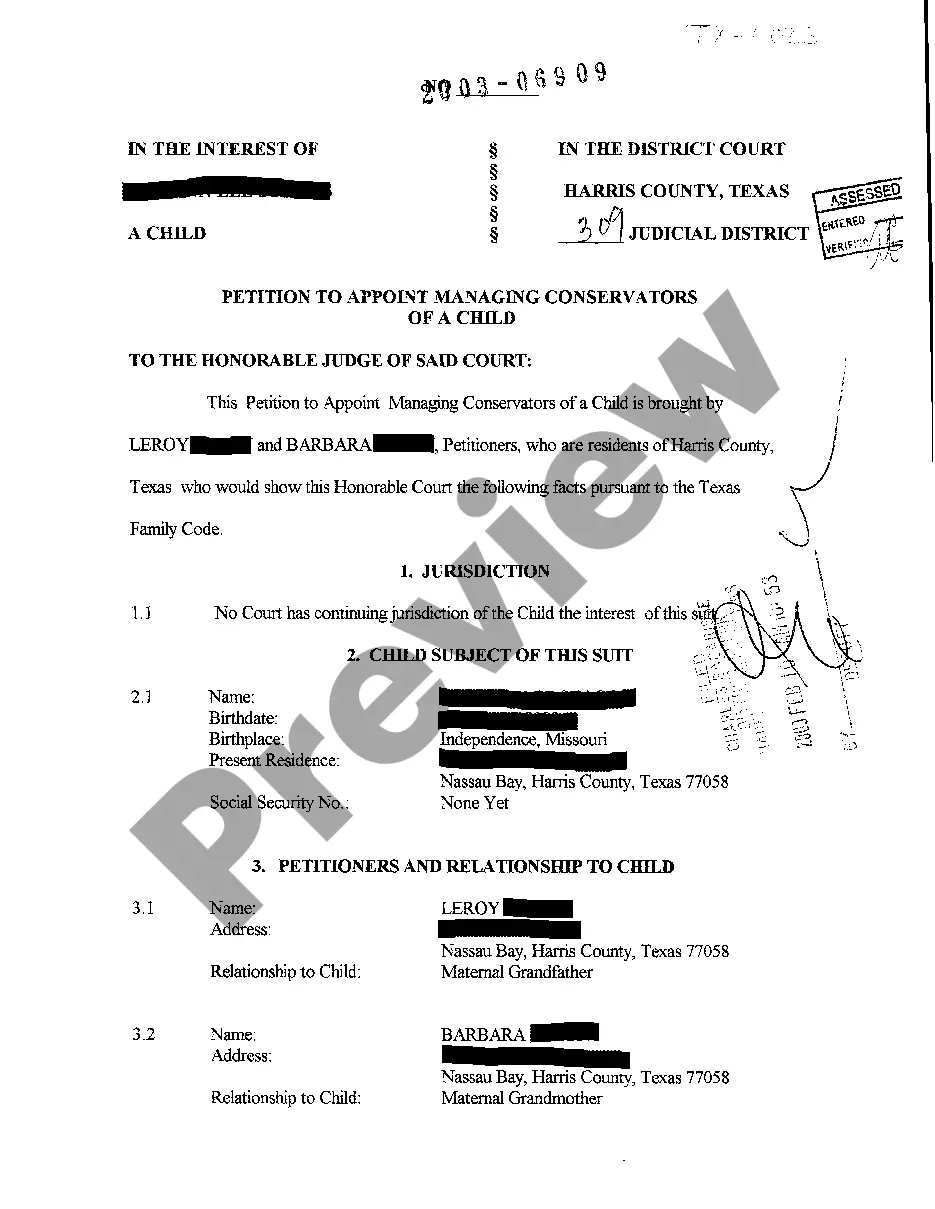

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Securities Exchange Act 15 USC Sec. 78j(b) - Rule 10b-5(a) and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

SEC Rule 10b-5, states that it is illegal for any person to defraud or deceive someone, including through the misrepresentation of material information, with respect to the sale or purchase of a security.

The term ?municipal securities investment portfolio? means all municipal securities held for investment and not for sale as part of a regular business by a municipal securities dealer or by a person, directly or indirectly, controlling, controlled by, or under common control with a municipal securities dealer.

Any party directly connected to the sale of securities is potentially liable; though there may be limits on the liability of certain professionals, such as auditors, bankers, accountants, etc. Rule 10(b)(5) allows for a cause of action by the SEC as well as private actions.

Section 10(b) of the Exchange Act and Rule 10b-5 prohibit material misrepresentations and misleading omissions in connection with the purchase or sale of securities. To prove a violation of Section 10(b) of the Exchange Act and Rule 10b-5 thereunder, the Commission must prove that the defendants acted with scienter.

Standing. While not explicit in the language, courts have interpreted Rule 10b-5 to create a private civil cause of action and additionally allow the SEC to bring criminal enforcement actions. In order to bring a private right of action under Rule 10b-5, the plaintiff must have standing. In Blue Chip Stamps v.

Elements of the offense. To establish a claim under Rule 10b-5, plaintiffs (including the SEC) must show (i) Manipulation or Deception (through misrepresentation and/or omission); (ii) Materiality; (iii) "In Connection With" the purchase or sale of securities, and (iv) Scienter.

(b) To use or employ, in connection with the purchase or sale of any security registered on a national securities exchange or any security not so registered, any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in

Generally, anyone who has material, non-public information must either disclose that information prior to trading the securities or abstain from trading in the effected or related security. Normally, insiders include officers, directors, and professionals in fiduciary relationships with the firm.