Securities Exchange Act — 15 USC Sec. 78j(b— - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 — Fraudulent Practice or Course of Dealing is a federal law that prohibits fraud in the purchase or sale of any security. It is designed to protect investors from deceptive or manipulative practices in the stock market. The Rule 10b-5(c) of the Securities Exchange Act of 1934 states that it is unlawful for any person to directly or indirectly use any manipulative or deceptive device or contrivance in connection with the purchase or sale of any security. The rule covers a wide range of fraudulent activities, including the making of false statements, insider trading, market manipulation, and other deceptive practices. Under the Rule 10b-5(c), fraudulent practices can include activities such as making false or misleading statements, omitting material facts, or engaging in a course of dealing that would mislead or deceive investors. There are three types of fraudulent practices or courses of dealing: 1) traditional frauds, 2) manipulative activities, and 3) insider trading. Traditional frauds are deceptive practices such as making false or misleading statements to investors or omitting material facts. Manipulative activities involve manipulating the market or stock price to gain an advantage. These activities include market timing, scalping, wash trading, and front running. Insider trading is the illegal practice of trading on the basis of material nonpublic information. This includes trading on the basis of insider knowledge or tips received from someone with knowledge of the company’s operations. The Securities Exchange Act — 15 USC Sec. 78j(b— - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 — Fraudulent Practice or Course of Dealing is enforced by the U.S. Securities and Exchange Commission (SEC). The SEC can bring civil or criminal action against anyone who violates the rule.

Securities Exchange Act - 15 USC Sec. 78j(b) - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 - Fraudulent Practice or Course of Dealing

Description

How to fill out Securities Exchange Act - 15 USC Sec. 78j(b) - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 - Fraudulent Practice Or Course Of Dealing?

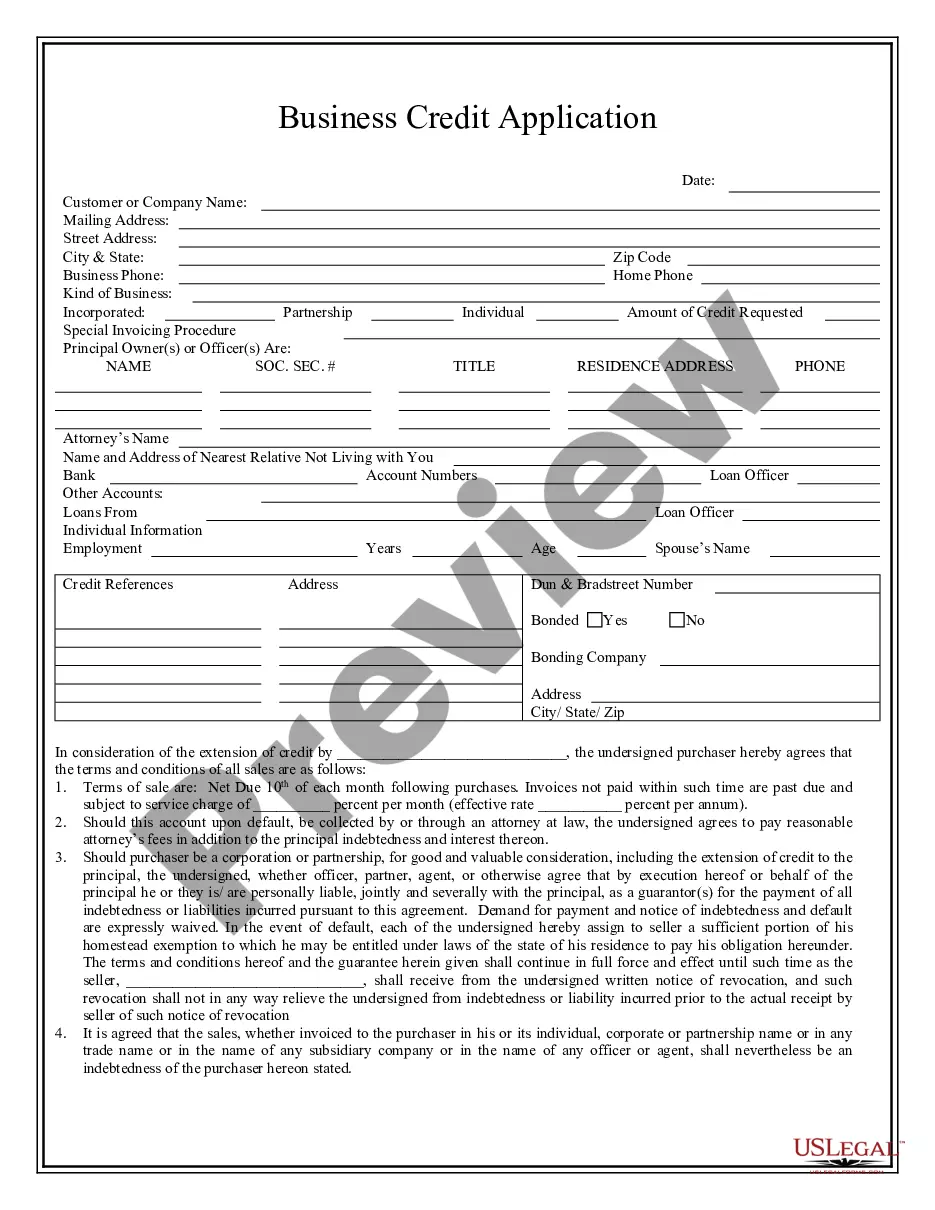

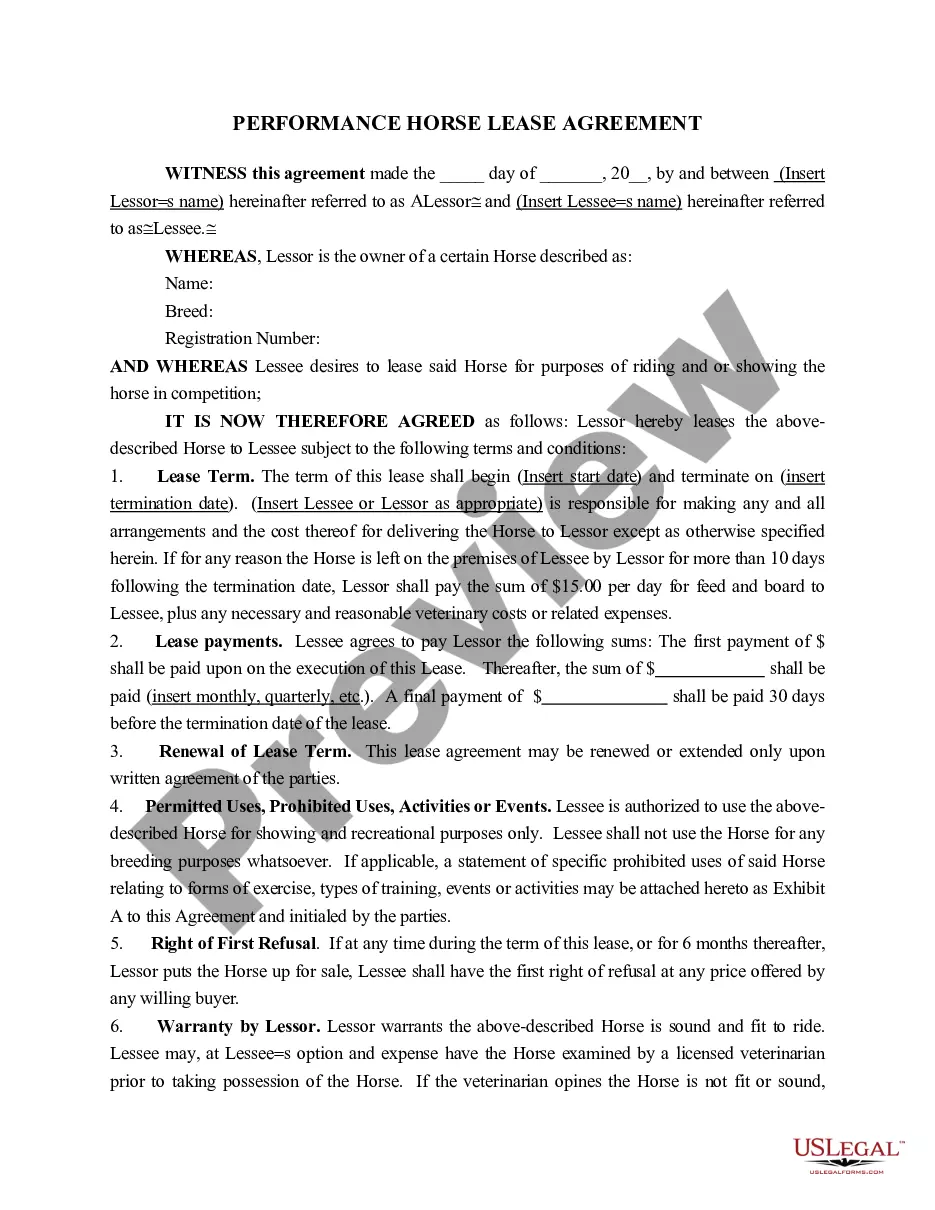

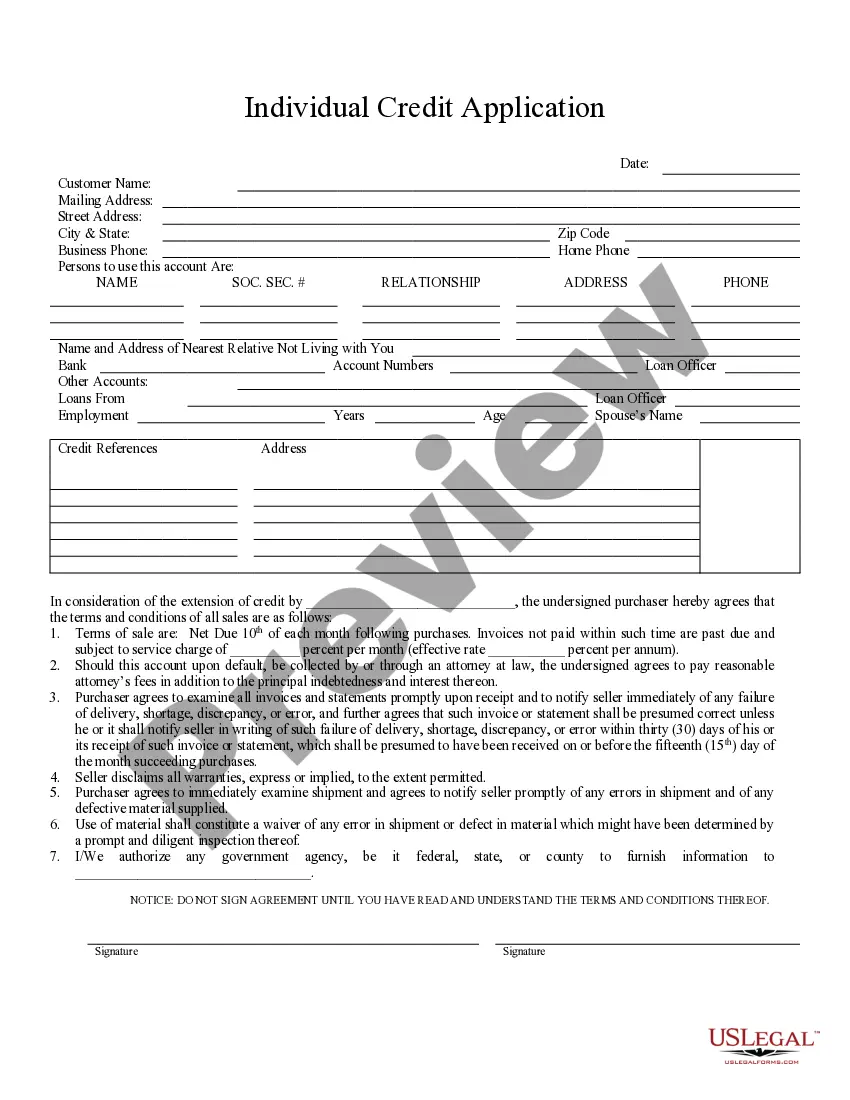

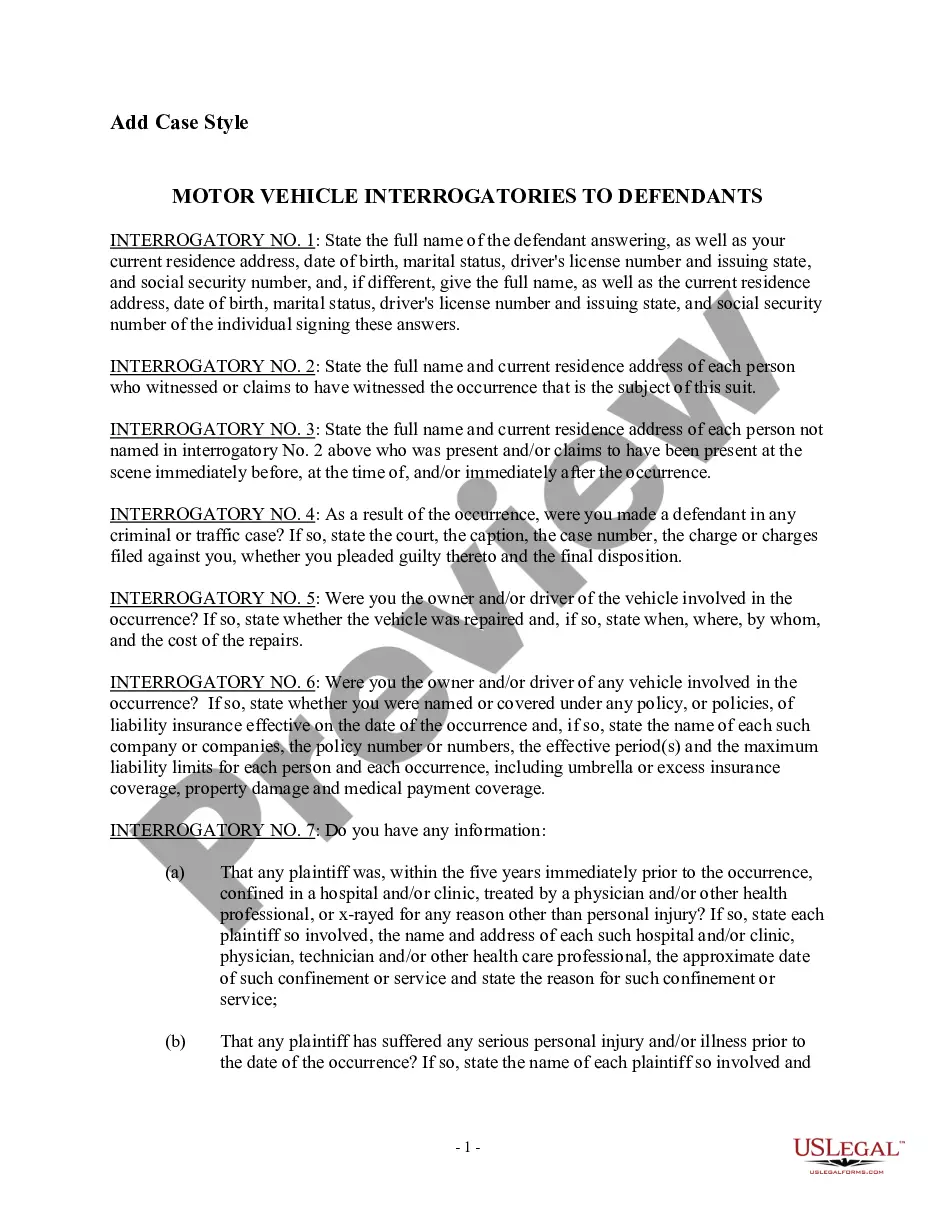

Dealing with legal documentation requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Securities Exchange Act - 15 USC Sec. 78j(b) - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 - Fraudulent Practice or Course of Dealing template from our service, you can be certain it complies with federal and state laws.

Dealing with our service is easy and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Securities Exchange Act - 15 USC Sec. 78j(b) - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 - Fraudulent Practice or Course of Dealing within minutes:

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Securities Exchange Act - 15 USC Sec. 78j(b) - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 - Fraudulent Practice or Course of Dealing in the format you need. If it’s your first time with our service, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Securities Exchange Act - 15 USC Sec. 78j(b) - Rule 10b-5(c) - 17 C.F.R. Sec. 240.10b-5 - Fraudulent Practice or Course of Dealing you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

SEC Rule 10b-5, states that it is illegal for any person to defraud or deceive someone, including through the misrepresentation of material information, with respect to the sale or purchase of a security.

Rule 10b5 sets regulations against insider trading. The rule lays out the types of information considered Material Non Public Information (MPNI), and outlines ways that insiders can violate SEC insider trading regulations and expose themselves to penalties and fines.

What is liability under Section 10(b) and Rule 10(b)(5) of the 1934 Act? Section 10(b) prohibits fraud in connection with the purchase and sale of any security. This provision applies whether or not the security is registered under the 34 Act. The SEC adopted Rule 10(b)(5) to implement section 10(b).

?To succeed on a Rule 10b-5 fraud claim based on an untrue statement or omission of a material fact, a plaintiff must establish (1) a false statement or omission of material fact; (2) made with scienter; (3) upon which the plaintiff justifiably relied; (4) that proximately caused the plaintiff's injury.? Robbins v.

SEA Rule 10b-17 prescribes information that must be included in the notice, including, but not limited to: the title of the security; date of declaration; record date; payment or distribution date; for cash distributions, the amount to be paid per share; for distribution of securities, generally the amount of the

ECFR :: 17 CFR 240.10b-5 -- Employment of manipulative and deceptive devices.

Section 10(b) makes it unlawful to ?use or employ, in connection with the purchase or sale of any security? a ?manipulative or deceptive device or contrivance in contravention of such rules and regulations as the SEC may prescribe.? 15 U.S.C. § 78j(b).

240.10b-5 ? Employment of manipulative and deceptive devices. (c) To engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person, in connection with the purchase or sale of any security.