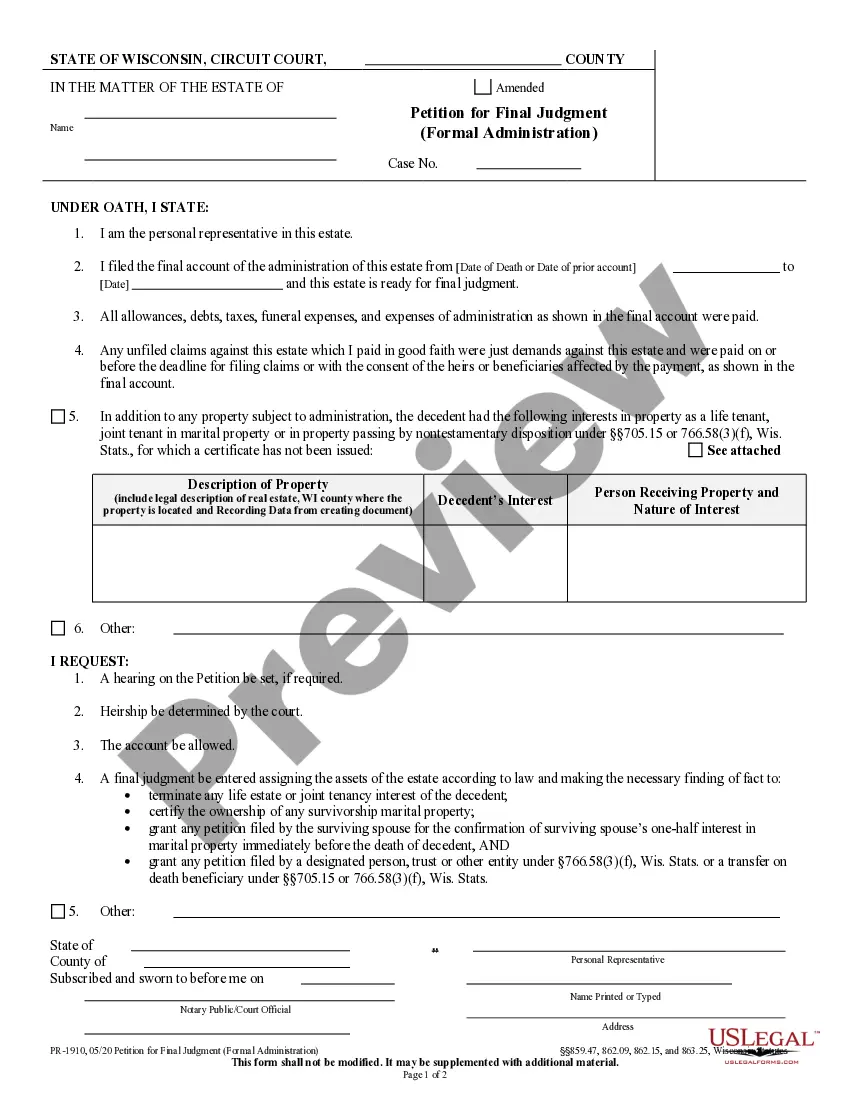

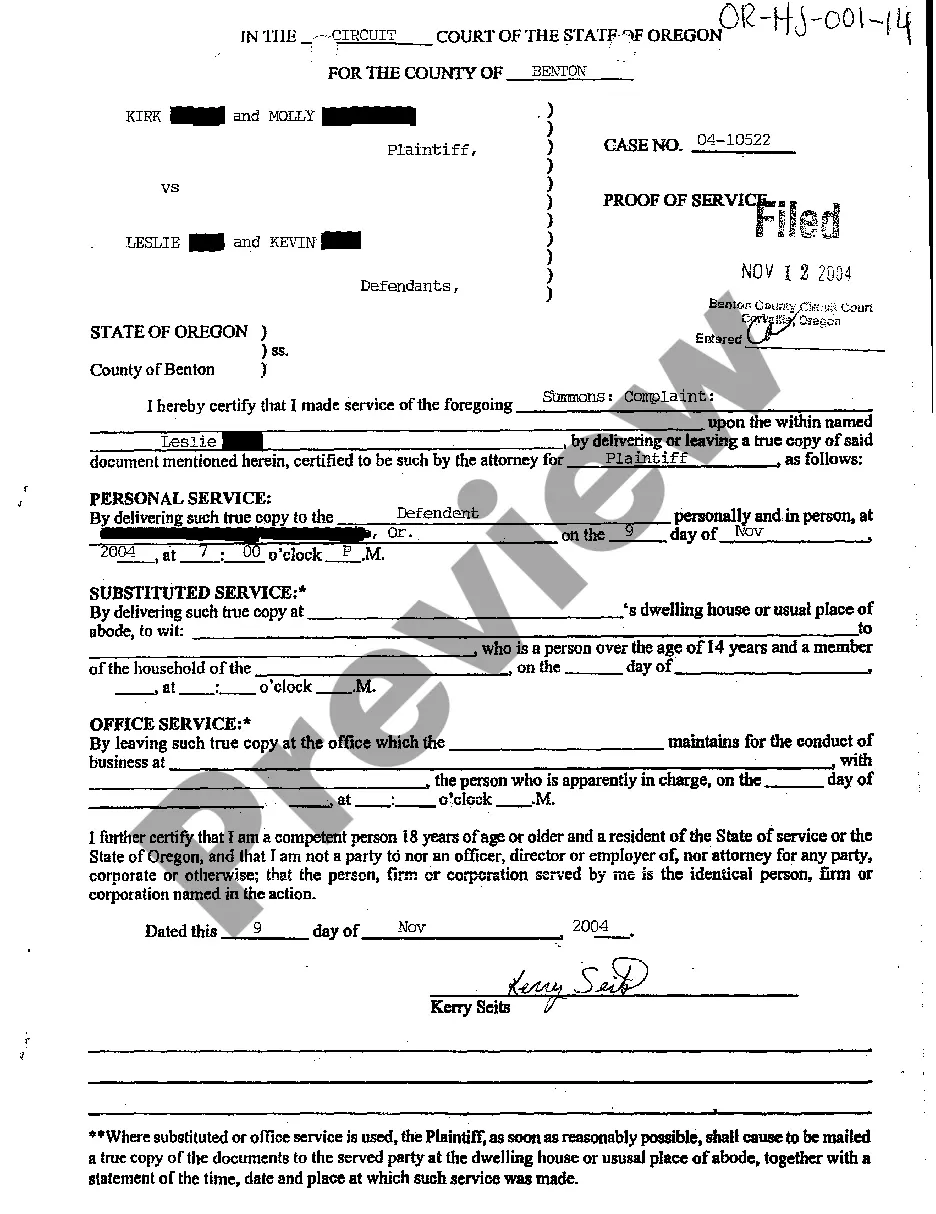

Presenting False Declaration or Certification is a serious offense under the law. It involves making a false representation about a material fact, either orally or in writing, in order to gain a benefit or advantage. This offense is most commonly seen in the context of tax returns, financial statements, loan applications, or other documents used for legal or commercial purposes. There are two primary types of Presenting False Declaration or Certification: 1. Making a False Representation: This involves providing false information on a document that is intended to be relied upon by another person or entity. This false information could be about the person or entity making the representation, or about a third party. 2. Signing a False Declaration or Certification: This involves signing a document that contains false information, even though the signer knows it is false. This is a criminal offense, as it is a form of perjury. In both cases, the person or entity making the false representation may be held liable for any damages that result from the false representation. The penalties for making a false representation or signing a false declaration or certification can include fines, imprisonment, and/or revocation of professional licenses.

Presenting False Declaration or Certification is a serious offense under the law. It involves making a false representation about a material fact, either orally or in writing, in order to gain a benefit or advantage. This offense is most commonly seen in the context of tax returns, financial statements, loan applications, or other documents used for legal or commercial purposes. There are two primary types of Presenting False Declaration or Certification: 1. Making a False Representation: This involves providing false information on a document that is intended to be relied upon by another person or entity. This false information could be about the person or entity making the representation, or about a third party. 2. Signing a False Declaration or Certification: This involves signing a document that contains false information, even though the signer knows it is false. This is a criminal offense, as it is a form of perjury. In both cases, the person or entity making the false representation may be held liable for any damages that result from the false representation. The penalties for making a false representation or signing a false declaration or certification can include fines, imprisonment, and/or revocation of professional licenses.