11.4.3.3 Lost Profits — Market Share Method is a method used to calculate economic damages due to lost profits. It is used when the profits that would have been earned had the infringing activity not occurred cannot be directly determined. It is based on the assumption that the infringed would have earned a certain share of the total market for the relevant product or service. This method uses the market share of the infringed and the profits of the non-infringing competitors to estimate the lost profits. There are two types of 11.4.3.3 Lost Profits — Market Share Method: 1. The Market Expansion Method: This method assumes that the infringed would have been able to increase its market share had the infringing activity not occurred. 2. The Market Share Stabilization Method: This method assumes that the infringed’s market share would have remained constant had the infringing activity not occurred.

11.4.3.3 Lost Profits - Market Share Method

Description

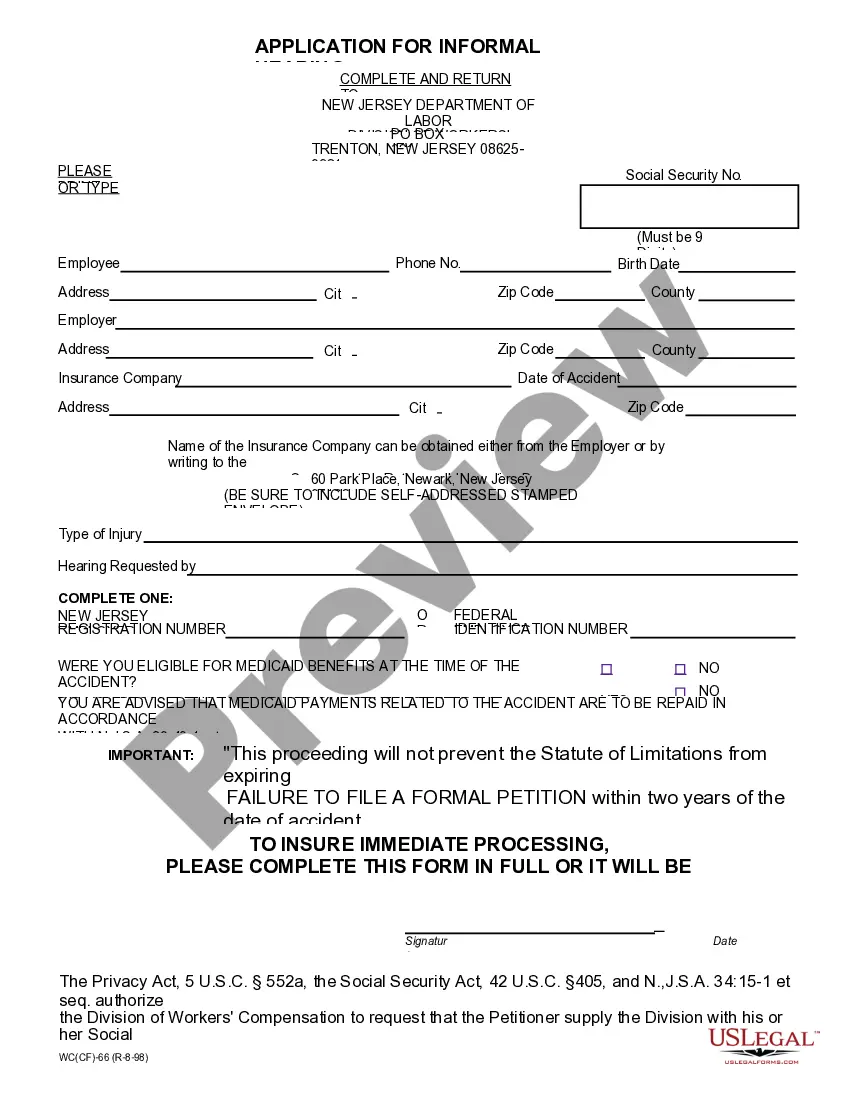

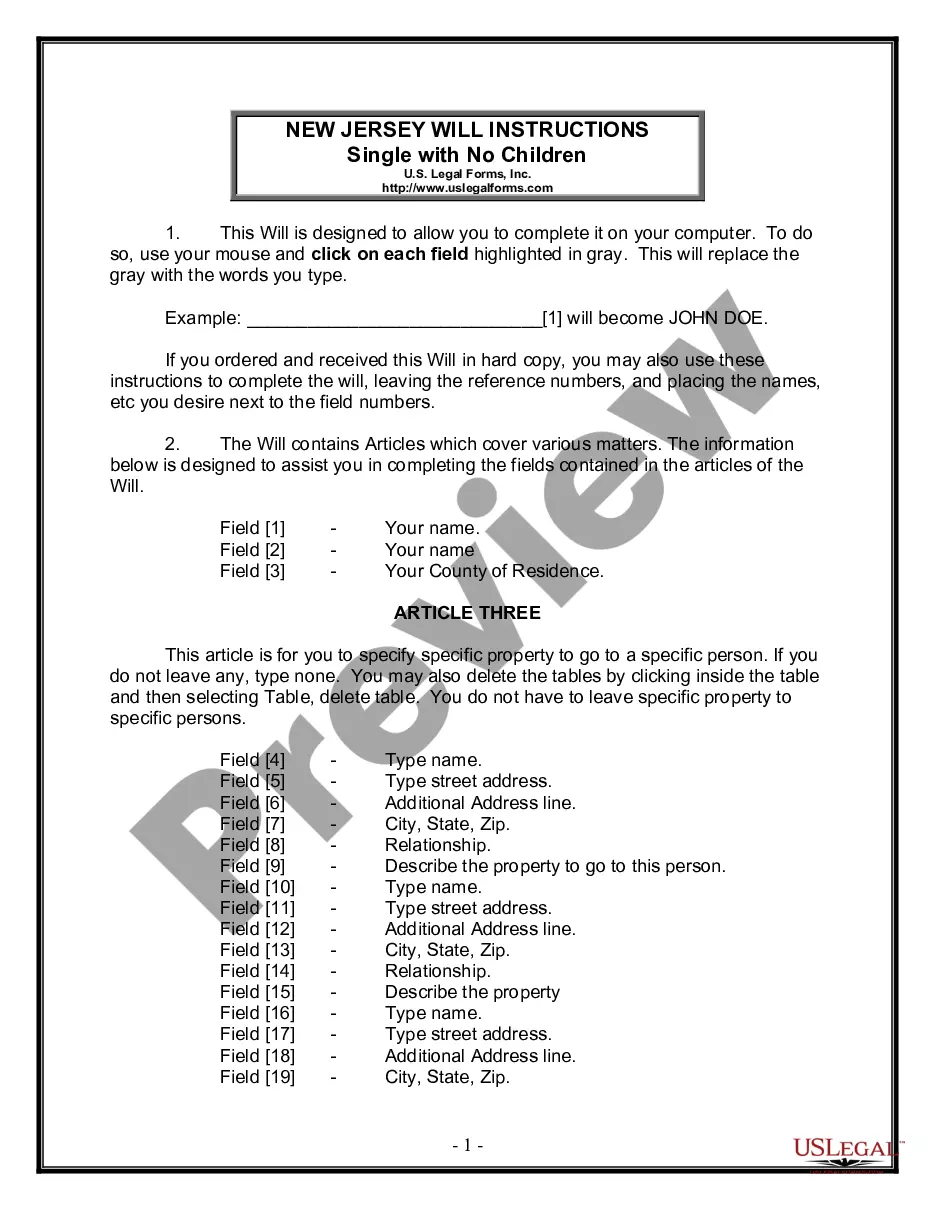

How to fill out 11.4.3.3 Lost Profits - Market Share Method?

US Legal Forms is the most straightforward and affordable way to find suitable formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and verified by attorneys. Here, you can find printable and fillable templates that comply with federal and local laws - just like your 11.4.3.3 Lost Profits - Market Share Method.

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

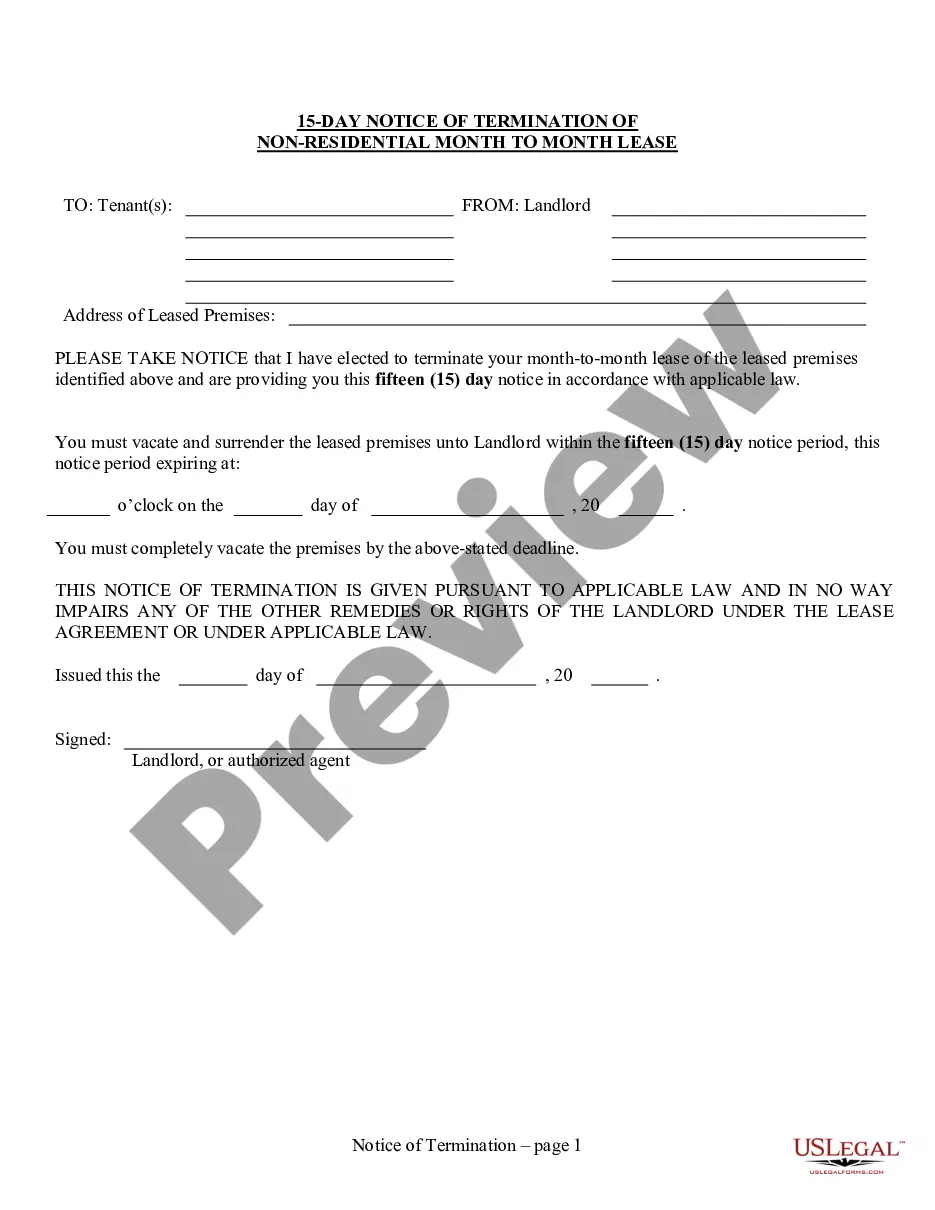

And here’s how you can get a professionally drafted 11.4.3.3 Lost Profits - Market Share Method if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one meeting your demands, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you like most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your 11.4.3.3 Lost Profits - Market Share Method and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reliable assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

BASICS: ?To collect lost profits from lost sales, a 'patentee must show 'a reasonable probability that 'but for' the infringing activity, the patentee would have made the infringer's sales. ' This is done by determining what profits the patentee would have made absent the infringing product.

The burden of proof is on the defendant to prove that consent has been given and that such consent covers the infringement in issue. Typical facts relied upon by claimants A given product falls within one or more of the product claims of the patent.

In order to recover lost profits in a commercial damage case, three standards must be met. First, plaintiff must show proximate cause; second, the foreseeability; and third, reasonable certainty.

Typically, a plaintiff will establish three principles in order to be awarded damages related to a lost profits claim: proximate cause, foreseeability, and reasonable certainty.

Based on this decision, patent holders may still receive damages for lost profits, along with a reasonable royalty, even if a market contains acceptable non-infringing substitutes.

This market share approach allows a patentee to recover lost profits, despite the presence of acceptable, noninfringing substitutes, because it nevertheless can prove with reasonable probability sales it would have made but for the infringement.

For lost profits, the ?more money? is the infringer's detrimental impact on the patentee's own revenues and costs. For a reasonable royalty, the ?more money? is the amount the infringer should have paid to take a license before practicing the invention.