4.2 Liability of Corporations-Scope of Authority Not in Issue is a legal concept related to the liability of a corporation’s agents and officers for actions taken in the scope of their authority. It recognizes that certain decisions and activities are within the scope of authority granted to them by the corporation and, consequently, those individuals should not be held personally liable for such activities. This principle applies even if the action taken does not result in a successful outcome. There are two types of 4.2 Liability of Corporations-Scope of Authority Not in Issue: 1. Absolute Liability: Absolute liability means that the corporation is responsible for all actions and decisions taken by its agents and officers acting within the scope of their authority, regardless of the outcome of such actions. 2. Qualified Liability: Qualified liability means that the corporation is only responsible for losses caused by its agents and officers acting within the scope of their authority, but not for losses caused by actions outside their authority.

4.2 Liability of Corporations-Scope of Authority Not in Issue

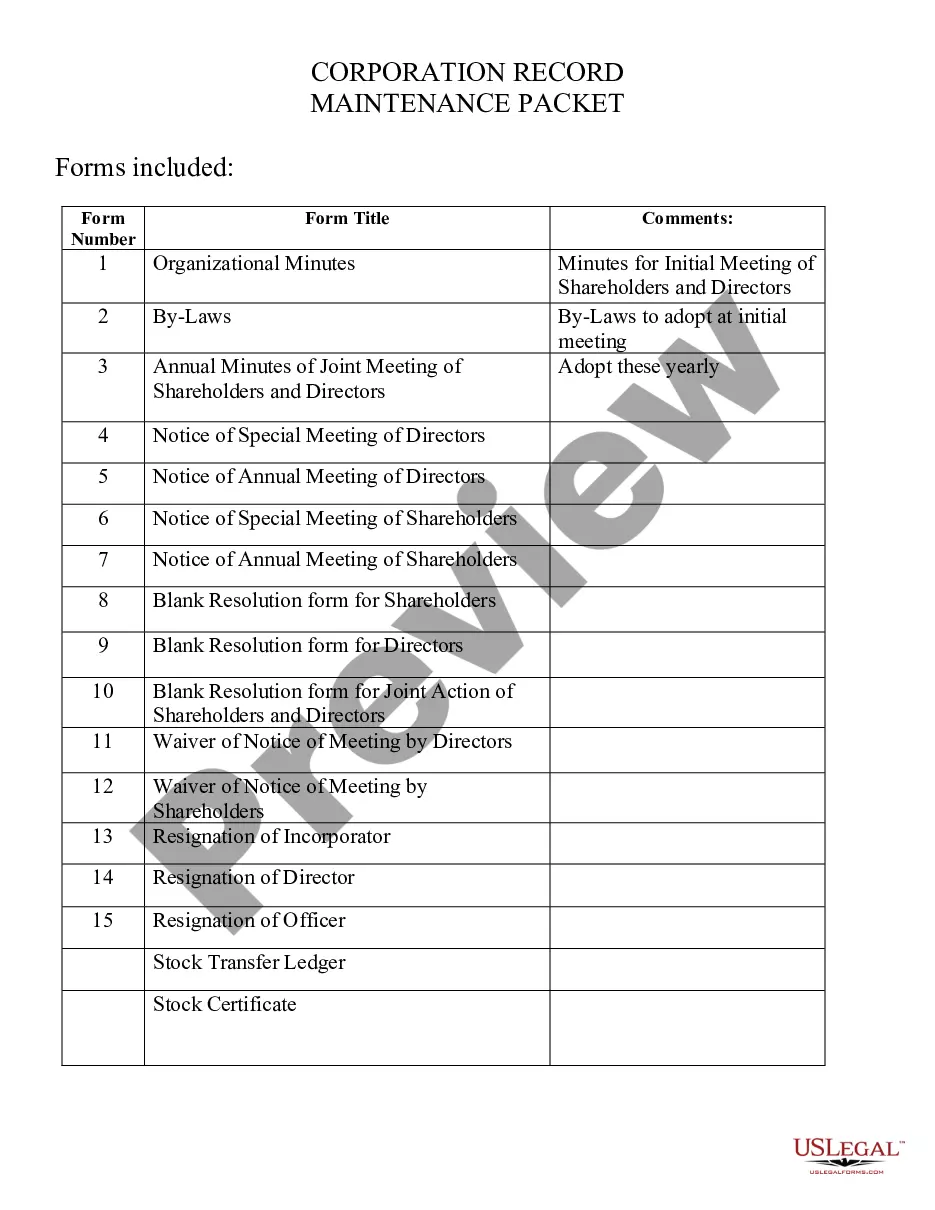

Description

How to fill out 4.2 Liability Of Corporations-Scope Of Authority Not In Issue?

How much time and resources do you usually spend on composing official documentation? There’s a better opportunity to get such forms than hiring legal experts or wasting hours searching the web for a suitable template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, like the 4.2 Liability of Corporations-Scope of Authority Not in Issue.

To get and prepare an appropriate 4.2 Liability of Corporations-Scope of Authority Not in Issue template, follow these simple instructions:

- Look through the form content to ensure it meets your state laws. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t meet your requirements, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the 4.2 Liability of Corporations-Scope of Authority Not in Issue. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally secure for that.

- Download your 4.2 Liability of Corporations-Scope of Authority Not in Issue on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web services. Join us now!

Form popularity

FAQ

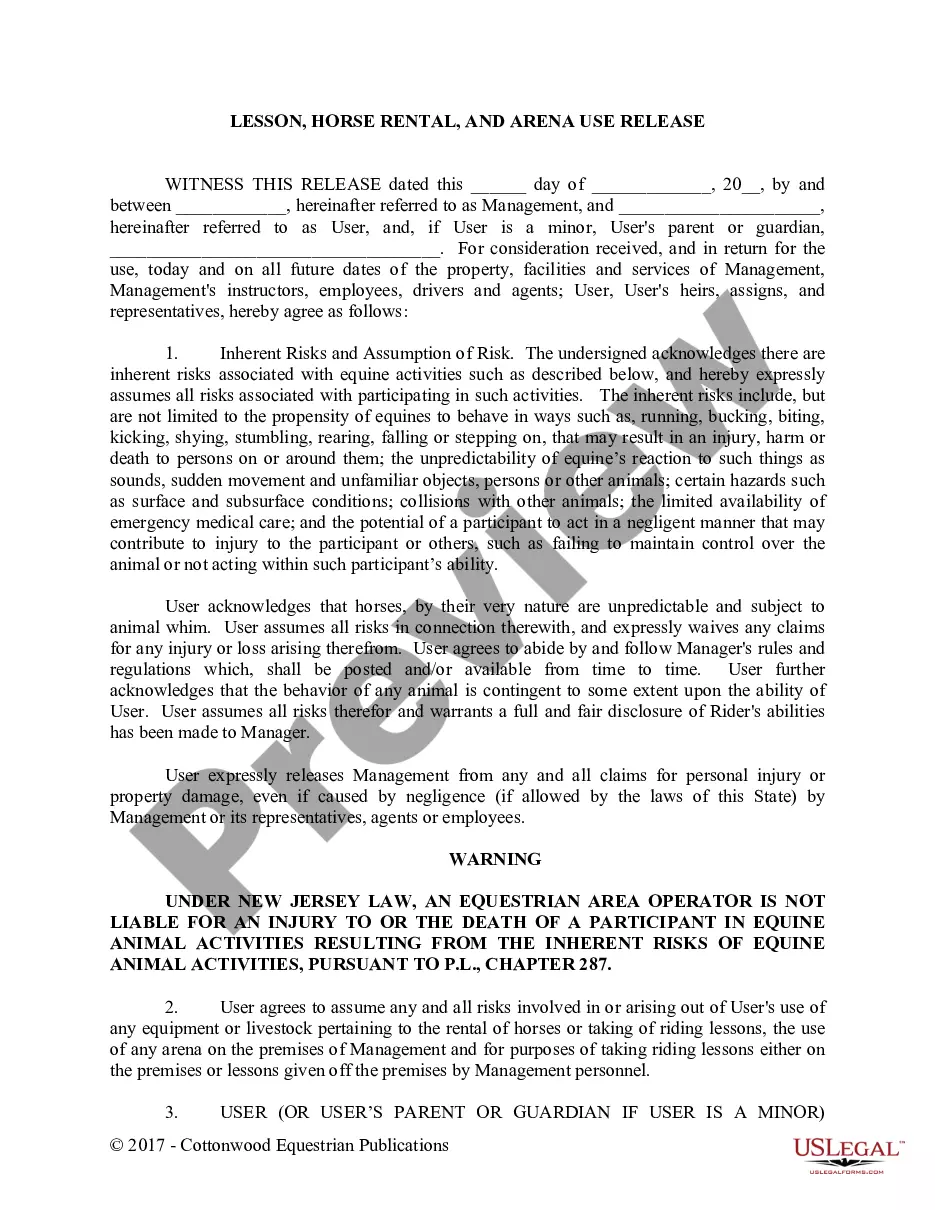

Corporations have always been liable for the contracts and obligations that directors, officers, and employees enter into on their behalf. Absent a severe abuse of this power to contract by an individual employee or director, any contract in which the company receives a benefit will attach to the company.

Typically, a corporate officer isn't held personally liable, as long as his or her actions fall within the scope of their position and the parameters of the law. An officer of a corporation may serve on the board of directors or fulfill a managerial role.

The concept of entity liability allows a corporation to be held liable for the criminal misdeeds of its agents if: The agent is acting within the actual or apparent scope of their employment or authority, and. If the agents intend, at least in part, to some way benefit the corporation through their actions.

From corporate non-compliance to personal acts of negligence, CEOs can face personal liability in a number of different circumstances. In federal enforcement matters, CEOs can also face the risk of criminal prosecution if accused of intentionally facilitating or participating in fraudulent or other illegal conduct.

One of the fundamental principles of corporate law is that the owners, directors and officers of a corporate entity generally are not personally responsible for the entity's debts. Without this insulation from personal liability, individuals would be deterred from taking on risk.

A corporation can be held liable for the criminal acts of its employees as long as the employees are acting within the scope of their authority and their conduct benefits the corporation.

Officers and directors may also be liable to the corporation or its shareholders. Because they can be incredibly influential in the direction and operation of a company, officers and directors must be held accountable to the corporation for their actions.

Thus, the liabilities of a corporation are also separate and distinctly its own and as a general rule, shareholders, directors and officers are not personally liable for the debts of a corporation. In some limited instances, an individual member of a corporation may be held liable for the liabilities of a corporation.