8.32 Transmitting or Presenting False Writing To Defraud United States (18 U.S.C. Sec. 495) is a federal crime that involves someone transmitting or presenting a false writing or document, such as a check, to defraud the United States. It is a type of fraud that is punishable under the law and carries fines, restitution, or imprisonment. There are several types of 8.32 Transmitting or Presenting False Writing To Defraud United States (18 U.S.C. Sec. 495). These include: • Fraudulent Checks: Writing or presenting a check that is known to be false or contains false information. • Counterfeit Money: Creating or passing counterfeit currency or coins with the intent to defraud the United States. • False Documents: Creating or presenting documents that contain false information with the intent to defraud the United States. • False Claims: Making false claims to the government in order to receive benefits or money. • Tax Fraud: Making false statements or omissions on a tax return in order to reduce the amount of taxes owed.

8.32 Transmitting or Presenting False Writing To Defraud United States (18 U.S.C. Sec. 495)

Description

How to fill out 8.32 Transmitting Or Presenting False Writing To Defraud United States (18 U.S.C. Sec. 495)?

US Legal Forms is the most easy and profitable way to find suitable formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your 8.32 Transmitting or Presenting False Writing To Defraud United States (18 U.S.C. Sec. 495).

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted 8.32 Transmitting or Presenting False Writing To Defraud United States (18 U.S.C. Sec. 495) if you are using US Legal Forms for the first time:

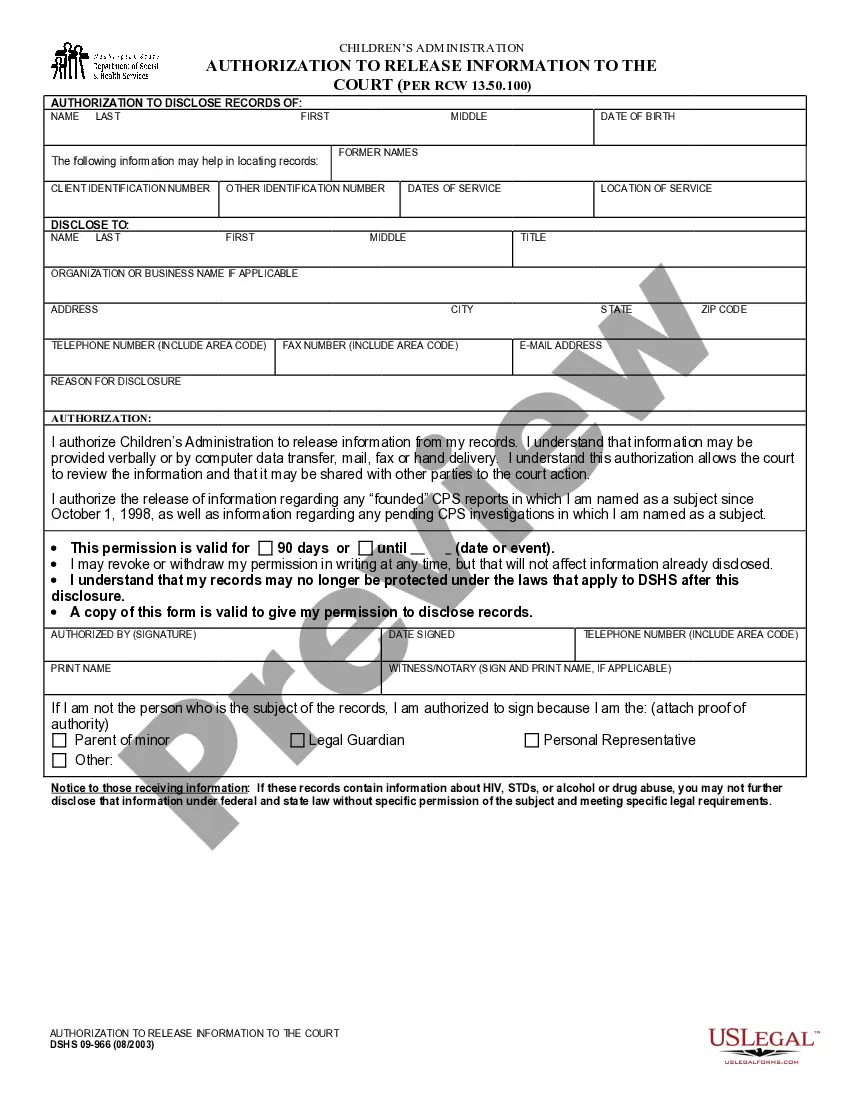

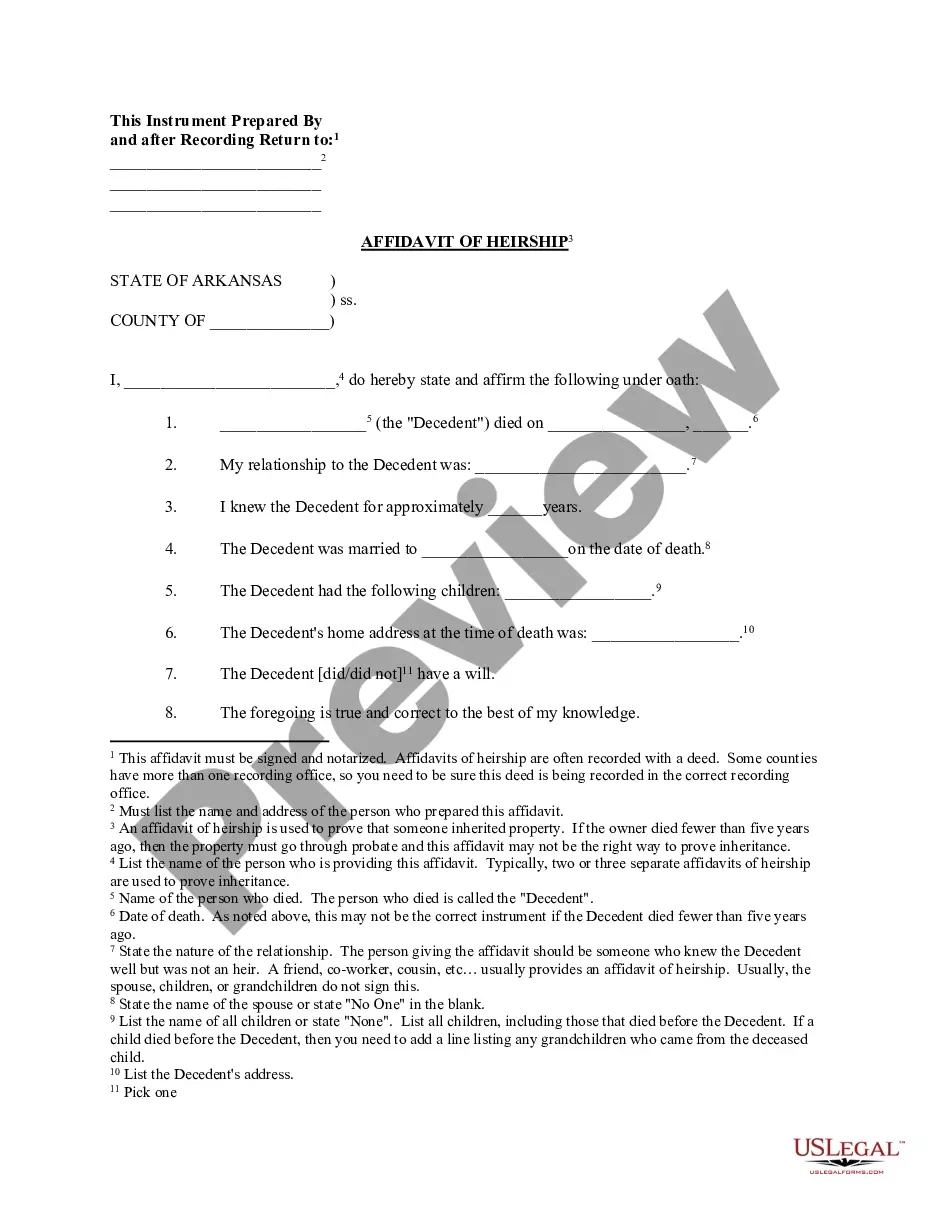

- Read the form description or preview the document to make sure you’ve found the one corresponding to your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your 8.32 Transmitting or Presenting False Writing To Defraud United States (18 U.S.C. Sec. 495) and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your reliable assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

Thompson, 63 M.J. 228 (the defense of duress applies when the accused has a (1) reasonable apprehension that (2) the accused or another innocent person would (3) immediately suffer death or serious bodily injury if the accused did not commit the act; a reasonable apprehension does not exist if the accused has any

To show constructive possession, the government must prove a connection between the defendant and the firearm or ammunition sufficient "to support the inference that the defendant exercised dominion and control over" it. United States v. Carrasco, 257 F. 3d 1045, 1049 (9th Cir.

§ 495 set forth three separate offenses: forgery, uttering a forged instrument, and presentation of a false writing to an officer of the United States in support of a claim against the government. The second and third paragraphs specifically contain "intent to defraud the United States" as an element of those offenses.

3d 682, 683 (9th Cir. 1993). "In order to be entitled to an instruction on duress or necessity as a defense to the crime charged, an escapee must first offer evidence justifying his continued absence from custody as well as his initial departure." United States v. Bailey, 444 U.S. 394, 408 (1980).

The Elements of Duress A reasonable fear of imminent death or serious bodily harm. Through the words or actions of another person. With no reasonable opportunity to escape the threat. Through no fault of the defendant.

Requirements of Duress The party is in immediate threat of serious bodily harm or death. The threat made to the victim must be constant.The party believes that the perpetrator of the act will carry out the threat.There is no opportunity to escape safely, except by committing the unlawful act.

There are three elements of the duress defense: (1) an immediate threat of death or serious bodily injury, (2) a well-grounded fear that the threat will be carried out, and (3) no reasonable opportunity to escape the threatened harm. United States v. Shapiro, 669 F. 2d 593, 596 (9th Cir.