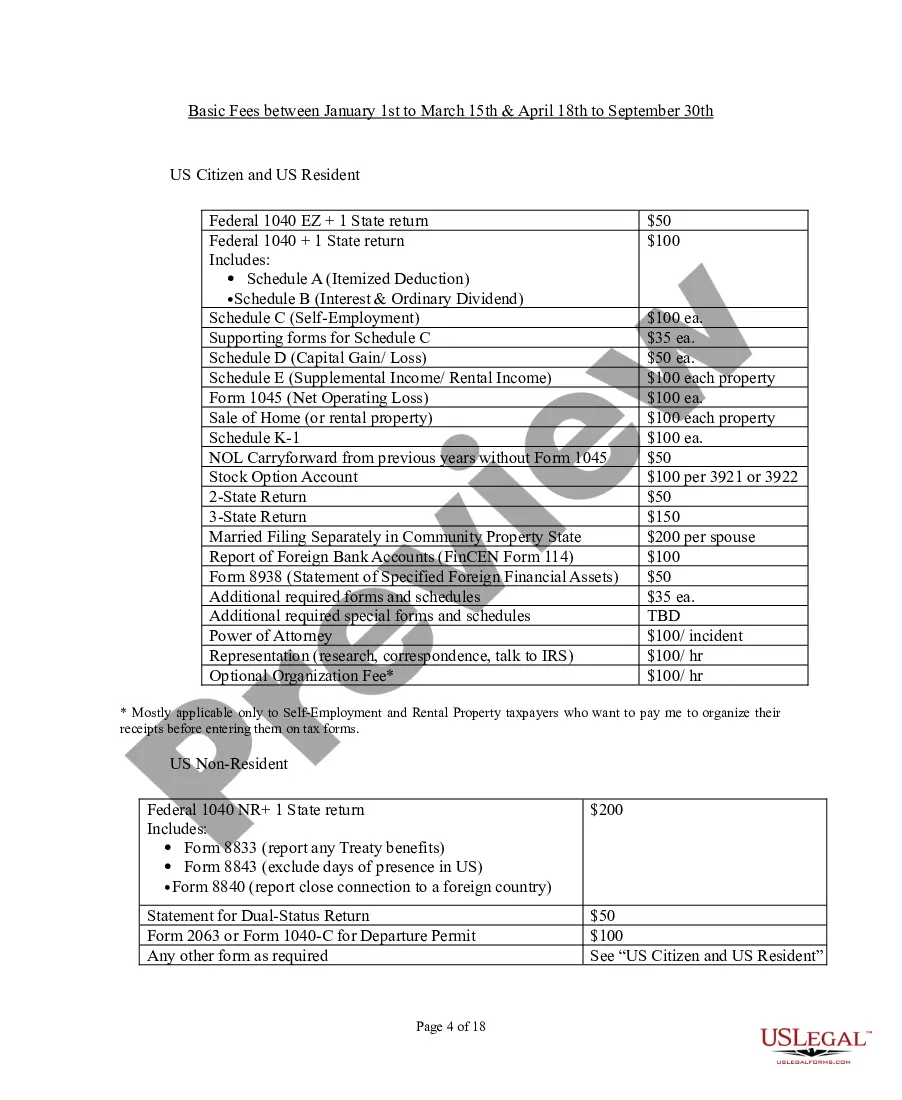

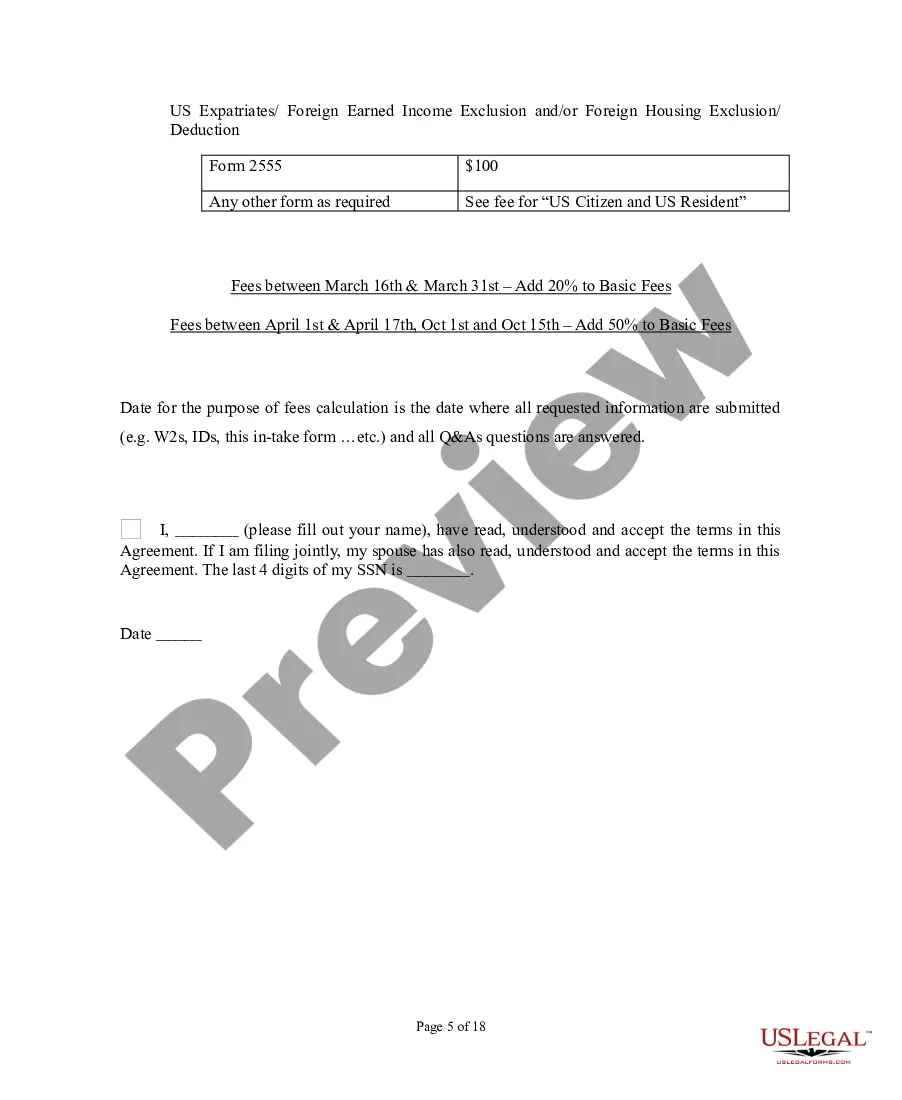

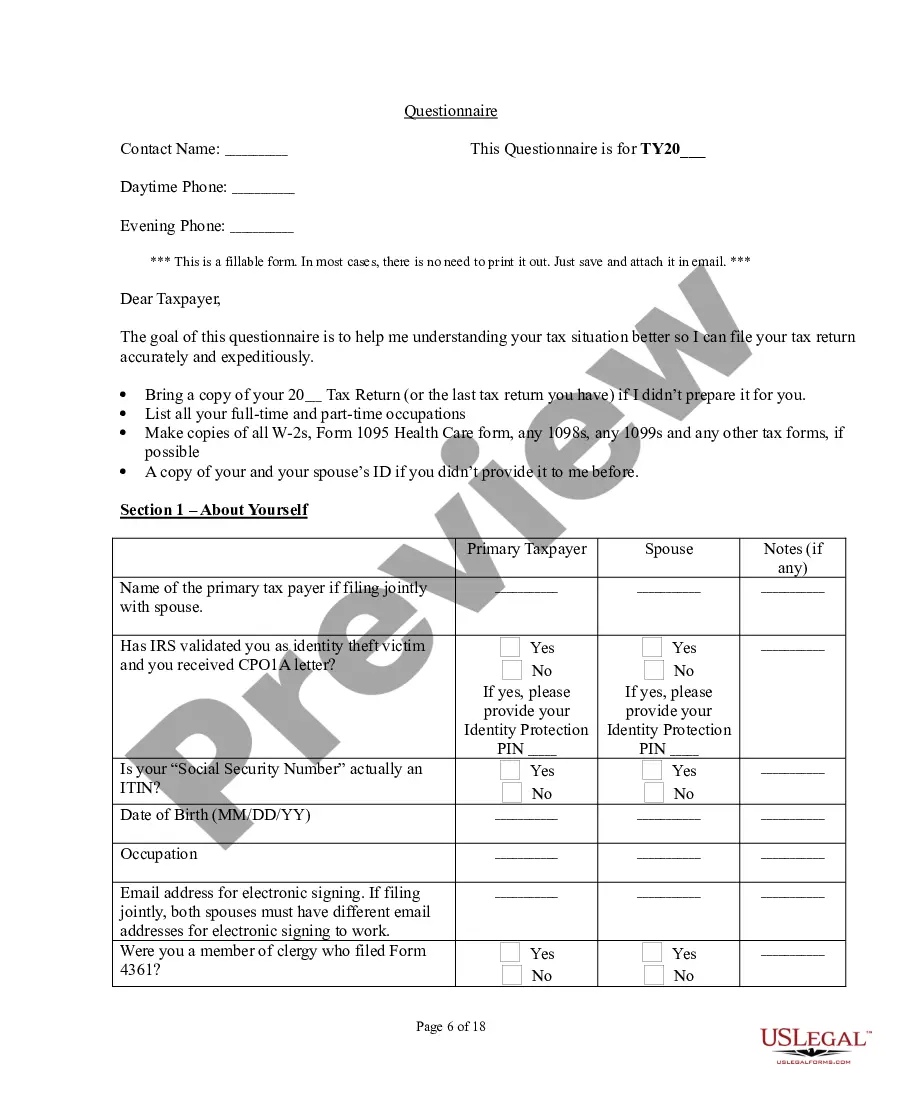

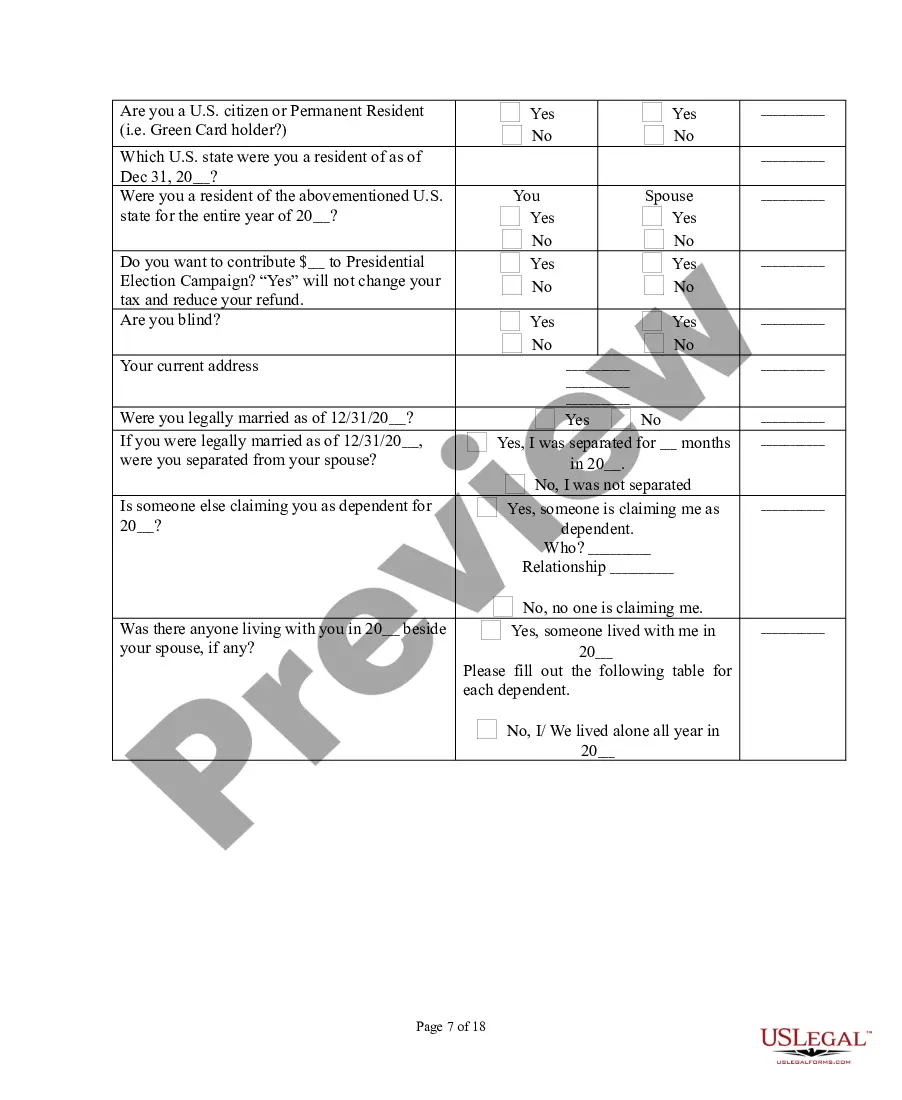

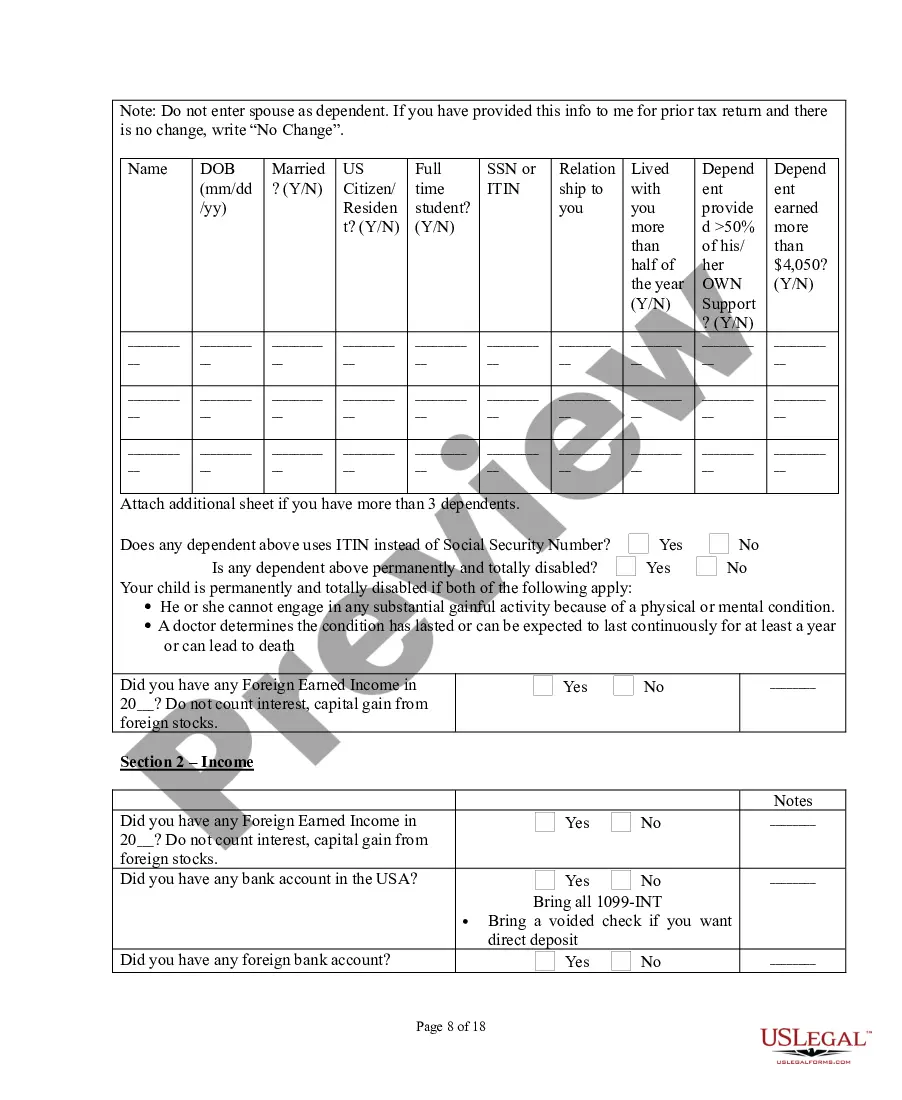

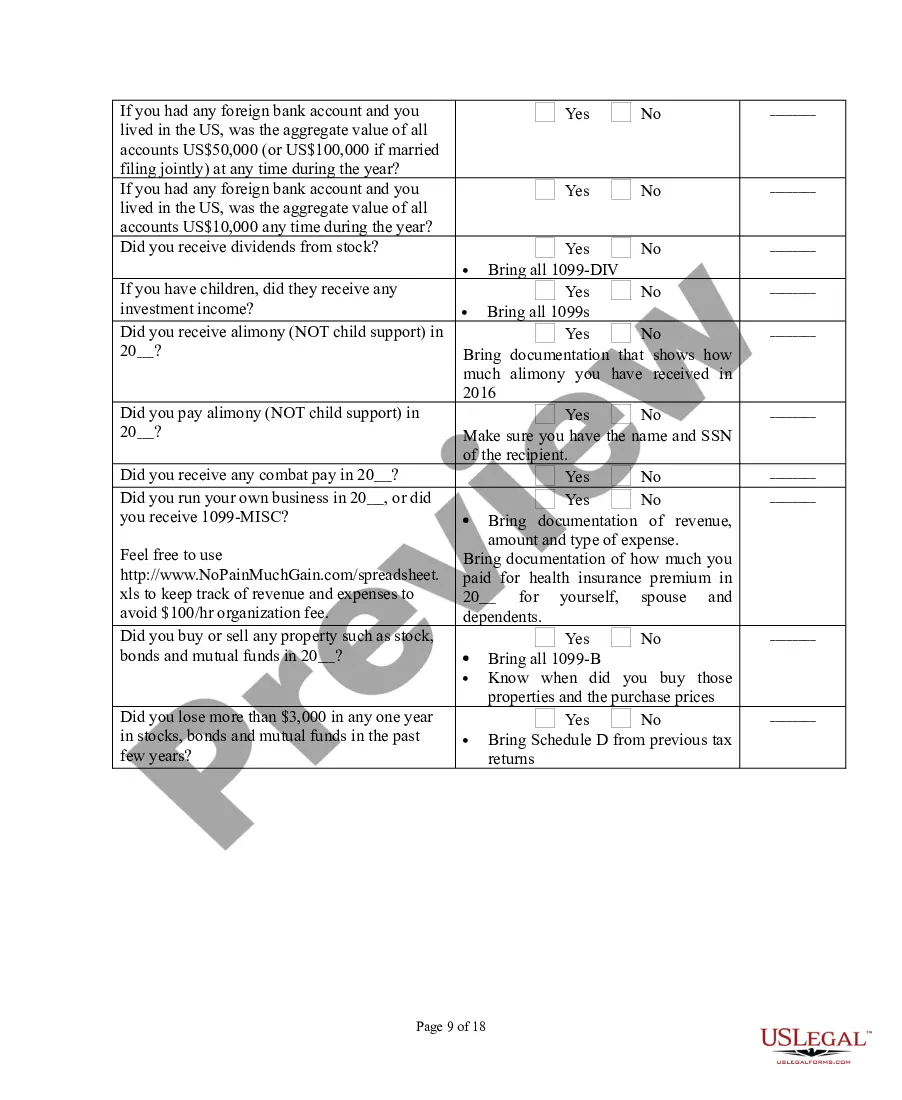

Tax Preparer: Disclosure and Service Agreement is a document that outlines the services offered by a tax preparer and the associated fees, as well as the terms and conditions for the services provided. It serves to inform the client of the tax preparer's professional responsibilities and discloses any potential conflicts of interest. The agreement outlines the services that will be provided, the fees for those services, the timeline for completion, and any other relevant information. It is also often used to document the tax preparer's representation of the client, including the scope of the representation. There are three types of Tax Preparer: Disclosure and Service Agreements: 1. Tax Preparation Agreement: This agreement outlines the terms and conditions for tax preparation services, including the scope of the services, the associated fees, and any potential conflicts of interest. 2. Tax Representation Agreement: This agreement documents the tax preparer's representation of the client, including the scope of the representation and any associated fees. 3. Tax Return Preparation and Disclosure Agreement: This agreement outlines the services that will be provided and any associated fees, as well as any potential conflicts of interest. It also includes a disclosure of all relevant information about the tax preparer and their services.

Tax Preparer: Disclosure and Service Agreement

Description

How to fill out Tax Preparer: Disclosure And Service Agreement?

How much time and resources do you typically spend on drafting formal documentation? There’s a greater option to get such forms than hiring legal specialists or wasting hours searching the web for a suitable blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Tax Preparer: Disclosure and Service Agreement.

To acquire and prepare an appropriate Tax Preparer: Disclosure and Service Agreement blank, follow these simple steps:

- Look through the form content to ensure it meets your state requirements. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, find a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Tax Preparer: Disclosure and Service Agreement. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally secure for that.

- Download your Tax Preparer: Disclosure and Service Agreement on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us today!

Form popularity

FAQ

Key Takeaways. A Certified Public Accountant (CPA) is a licensed professional with advanced education and training in many areas of accounting and business. A licensed tax preparer doesn't need advanced degrees for basic tax prep, but they must show competence through a formal exam or IRS employment.

Any tax professional with an IRS Preparer Tax Identification Number (PTIN) is authorized to prepare federal tax returns. However, tax professionals have differing levels of skills, education and expertise.

The law REQUIRES paid tax preparers to sign your tax return by first and last name. No exceptions. Always verify they signed the "TAX PREPARER SIGNATURE" line on your state and federal tax returns.

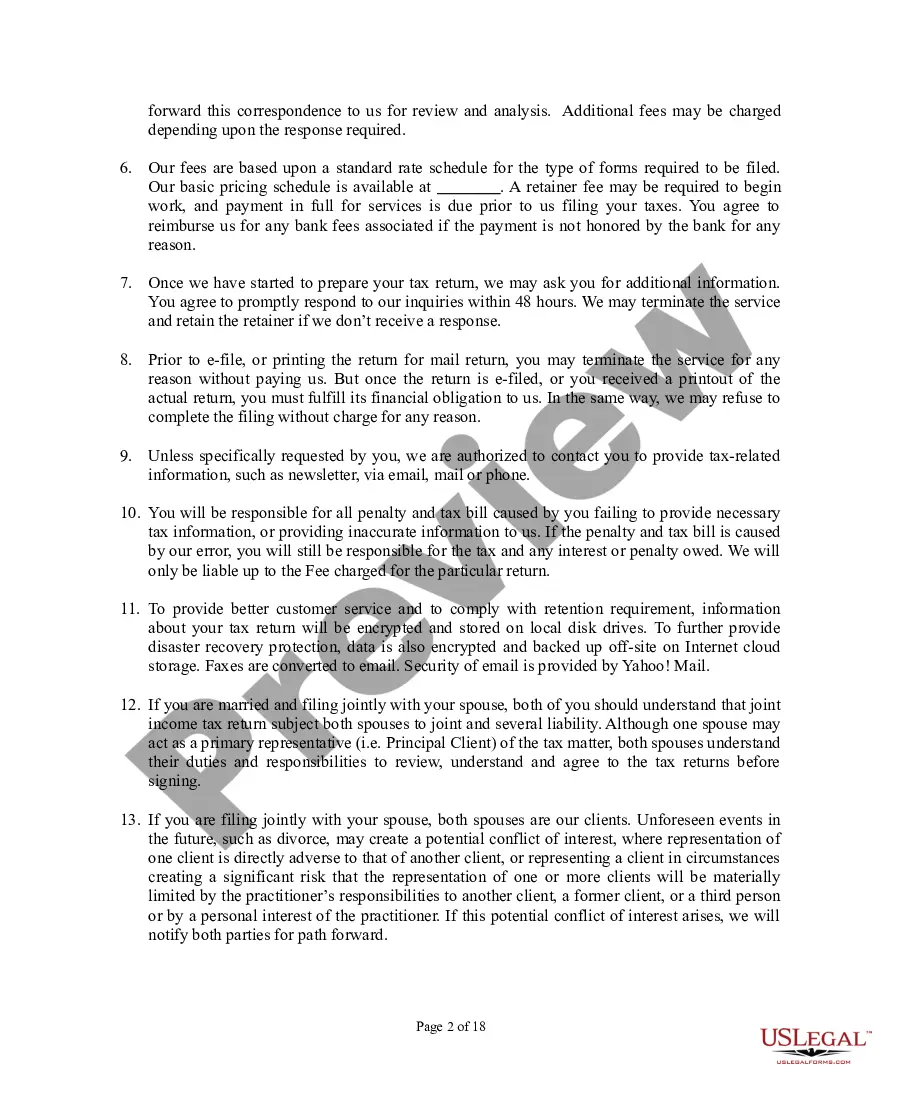

Under Internal Revenue Code (IRC) section 7216 and its concomitant regulations, a tax preparer must obtain the consent of a taxpayer before disclosing or using the taxpayer's tax return information when that consent is required.

The Four Due Diligence Requirements Complete and Submit Form 8867. (Treas. Reg. section 1.6695-2(b)(1))Compute the Credits. (Treas. Reg. section 1.6695-2(b)(2))Knowledge. (Treas. Reg. section 1.6695-2(b)(3))Keep Records for Three Years.

7216 is a criminal provision enacted by the U.S. Congress in 1971 that prohibits preparers of tax returns from knowingly or recklessly disclosing or using tax return information. A convicted preparer may be fined not more than $1,000, or imprisoned not more than one year or both, for each violation.

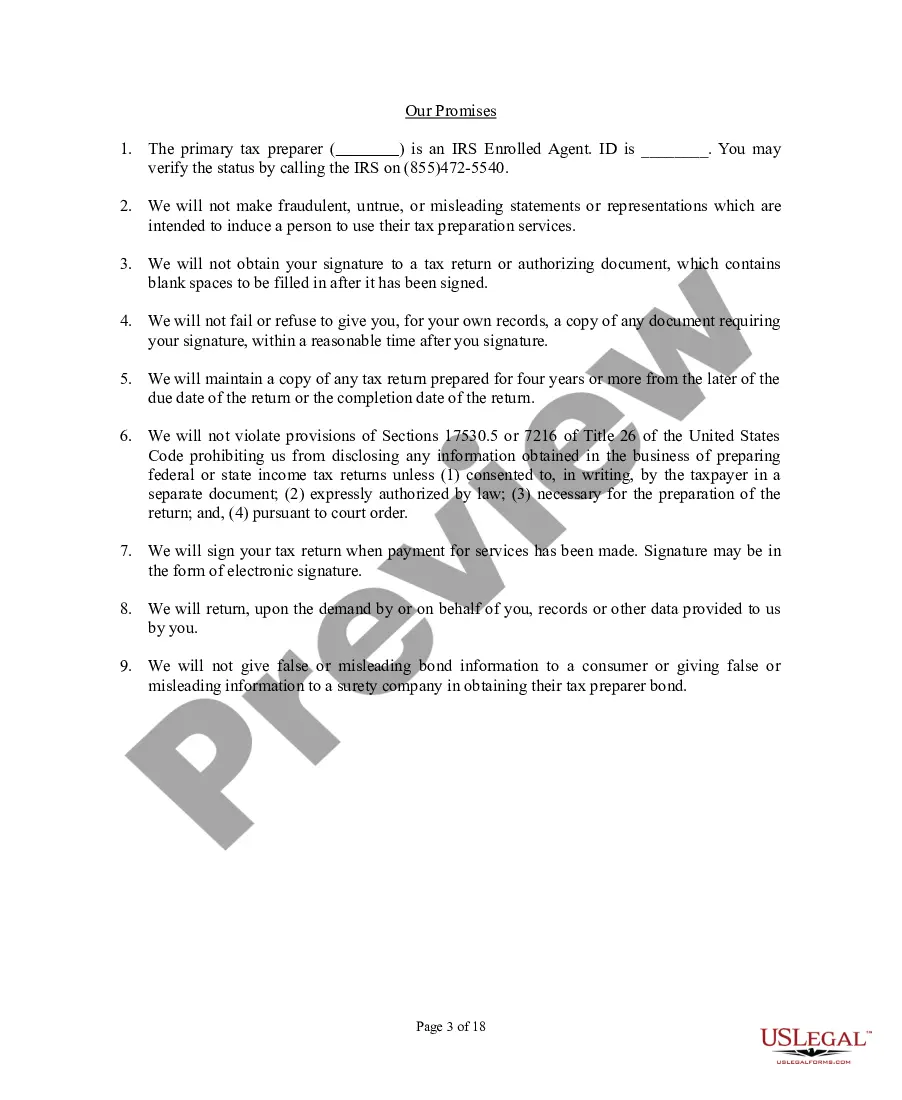

A tax preparer agreement form is an agreement between a taxpayer and a tax return preparer. It allows the taxpayer to request specific information from the preparer to be included in the tax return.

A tax preparer is an individual who prepares, calculates, and files income tax returns on behalf of individuals and businesses.