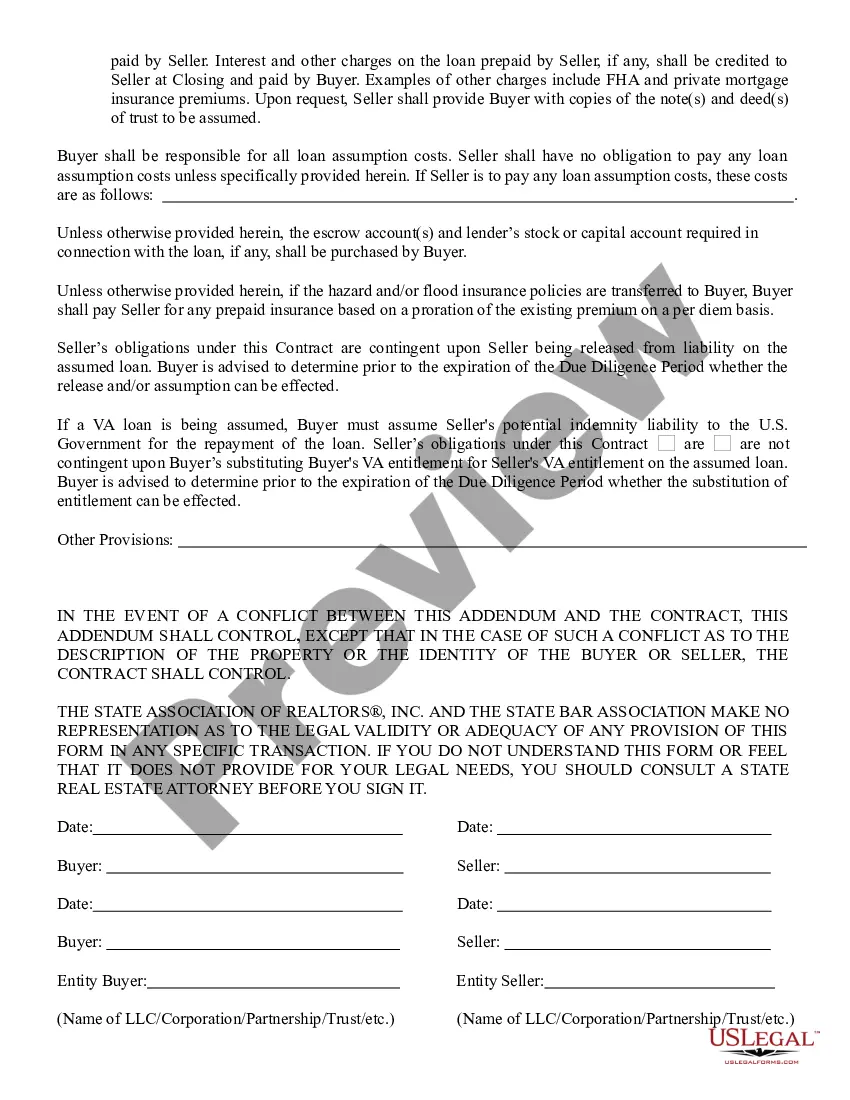

Real Estate Loan Assumption Addendum is a legal document that outlines the terms of a loan assumption agreement between a lender and a borrower. This document is typically used when one party wants to take over the loan of another party. It outlines the terms of the loan, including the amount of the loan, interest rate, loan term, and any other relevant conditions. It also outlines the rights and responsibilities of both parties, and the process for transferring the loan. There are two main types of Real Estate Loan Assumption Addendum: Qualified and Non-Qualified Loan Assumption Addendum. A Qualified Loan Assumption Addendum is used when the borrower has sufficient credit and income to qualify for the loan. It outlines the terms of the loan and the borrower's responsibility to make all payments on the loan. A Non-Qualified Loan Assumption Addendum is used when the borrower does not have sufficient credit or income to qualify for the loan. It outlines the terms of the loan and the lender's responsibility to assume the loan.

Real Estate Loan Assumption Addendum is a legal document that outlines the terms of a loan assumption agreement between a lender and a borrower. This document is typically used when one party wants to take over the loan of another party. It outlines the terms of the loan, including the amount of the loan, interest rate, loan term, and any other relevant conditions. It also outlines the rights and responsibilities of both parties, and the process for transferring the loan. There are two main types of Real Estate Loan Assumption Addendum: Qualified and Non-Qualified Loan Assumption Addendum. A Qualified Loan Assumption Addendum is used when the borrower has sufficient credit and income to qualify for the loan. It outlines the terms of the loan and the borrower's responsibility to make all payments on the loan. A Non-Qualified Loan Assumption Addendum is used when the borrower does not have sufficient credit or income to qualify for the loan. It outlines the terms of the loan and the lender's responsibility to assume the loan.