Mortgage Demand Letter

Description

How to fill out Mortgage Demand Letter?

When it comes to drafting a legal form, it is better to delegate it to the experts. However, that doesn't mean you yourself can not get a template to utilize. That doesn't mean you yourself can not find a sample to utilize, however. Download Mortgage Demand Letter straight from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. As soon as you are registered with an account, log in, find a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have included an 8-step how-to guide for finding and downloading Mortgage Demand Letter quickly:

- Make sure the form meets all the necessary state requirements.

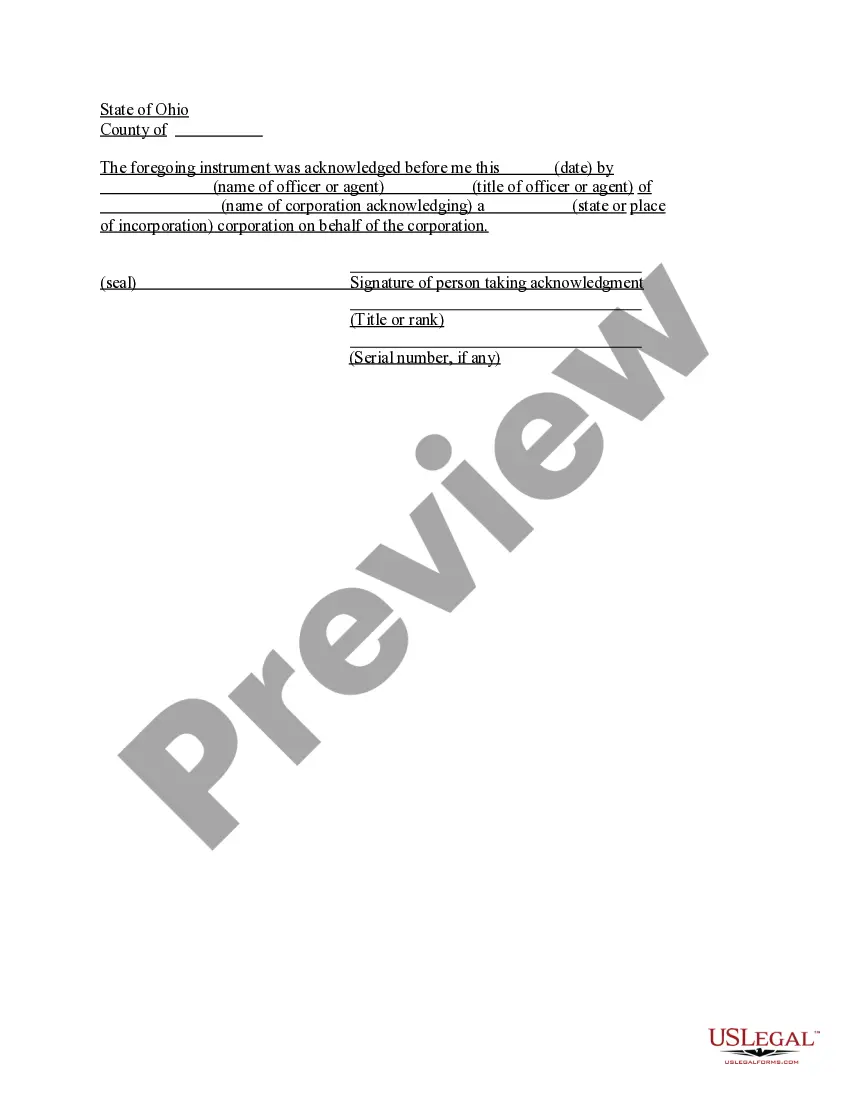

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the appropriate subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Mortgage Demand Letter is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

If two mortgage payments are missed, the bank or lender may issue the homeowner a so called Demand Letter.The Demand letter is a much more formal notice that if the loan is not paid and is brought current in a very short period of time, that the lender will proceed with filing the foreclosure at the local court.

No, a demand letter is not necessary prior to filing a superior court limited/unlimited jurisdiction lawsuit in California.

LETTER OF DEMAND BACKGROUND A demand generally amounts to a request for payment or a request to perform in terms of a legal obligation. A letter of demand is generally an initial step in the litigation process. In certain instances, a letter of demand is necessary to place the debtor in mora.

Involved parties information (the claimant and recipient's information) The date when the debt was incurred. If there is a dispute, the date when there was improper charging should be included.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

Although an attorney often writes the demand letter, you can also do it yourself in several cases:If you have a fairly simple legal issue and you want to go through the process yourself, without an attorney. If you want to clarify your thoughts on what happened and what you want.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.