Cease and Desist for Debt Collectors

Description Cease And Desist Letter To Debt Collector

How to fill out Desist Debt Collectors?

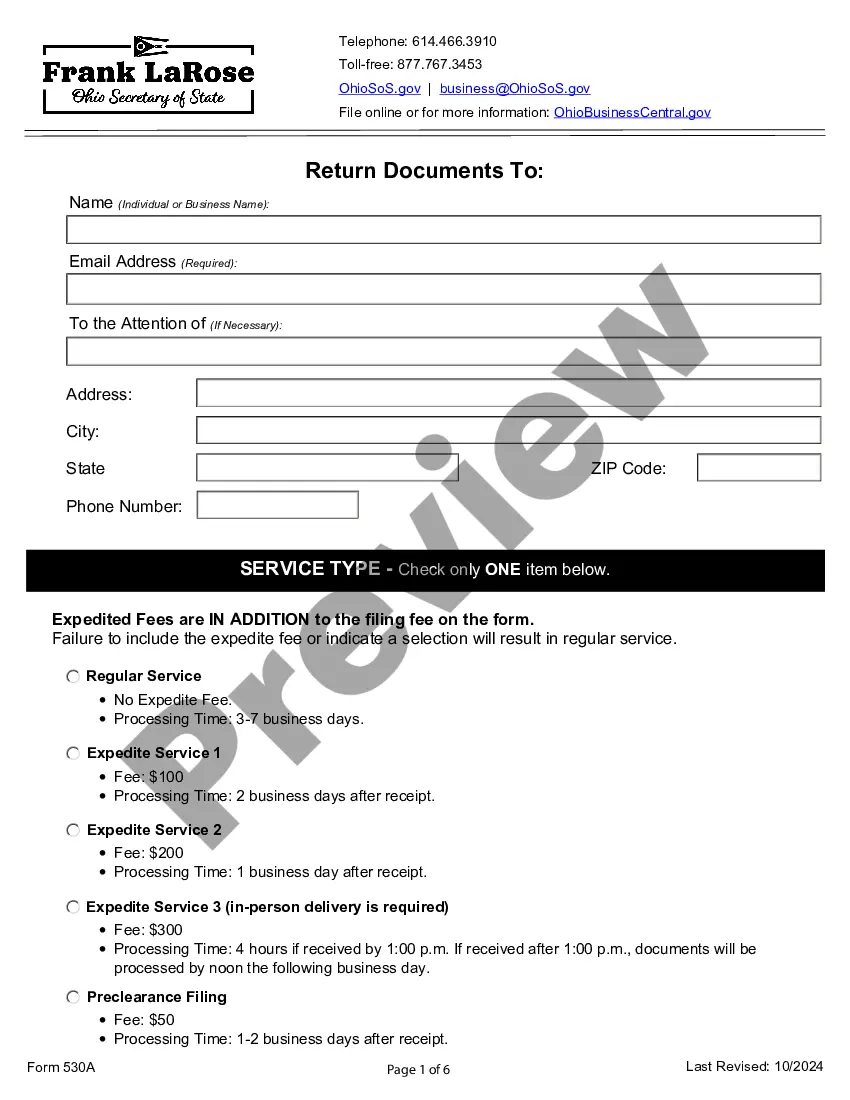

Use US Legal Forms to get a printable Cease and Desist for Debt Collectors. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms library on the web and offers affordable and accurate samples for consumers and attorneys, and SMBs. The templates are grouped into state-based categories and a few of them might be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to quickly find and download Cease and Desist for Debt Collectors:

- Check to make sure you get the correct template with regards to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Hit Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Use the Search field if you want to get another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Cease and Desist for Debt Collectors. Above three million users have used our service successfully. Choose your subscription plan and have high-quality forms within a few clicks.

Cease And Desist Letter Form popularity

Cease And Desist Debt Collection Letter Template Other Form Names

Cease And Desist Letter For Collections FAQ

If debt collectors keep contacting you via letters even after you have told them that the debt is not yours, then you can report them to the Financial Conduct Authority. Again, to reiterate, in the case of a legitimate debt, the best way to stop letters arriving at your home is to simply pay it.

RIGHT TO DISPUTE THE DEBT: Within 30 DAYS of receiving notice of the debt from the debt collector, you can send a letter to the debt collector disputing the debt and requesting the name and contact information of the original creditor.

If you want to negotiate directly with the creditor, ask the collection agency for the phone number of the collections department of the original creditor. Then call the creditor and ask if you can negotiate on the debt directly with the creditor.

Because the FDCPA is designed to protect debtors against third-party debt collectors, it doesn't apply to your original creditor or its employees.

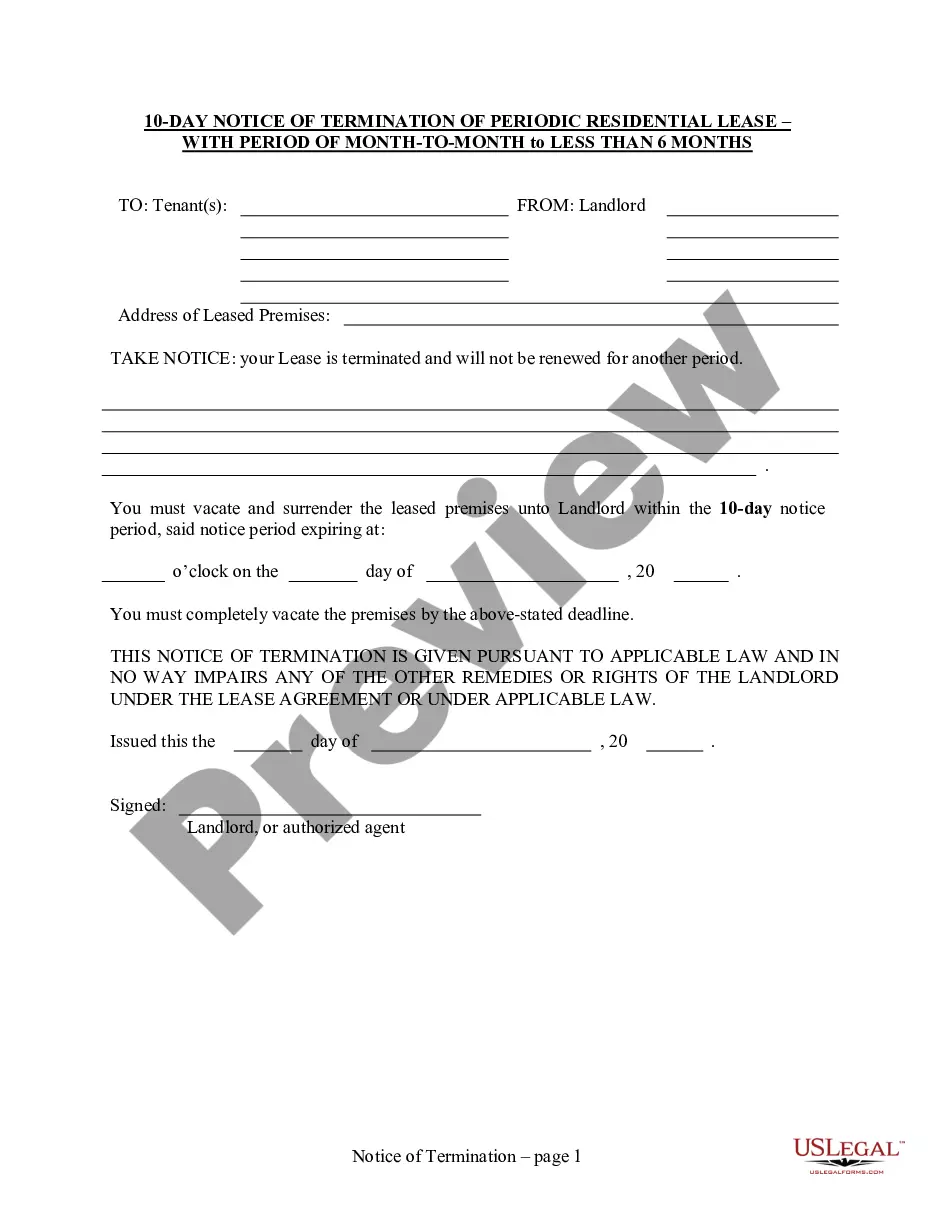

A cease and desist letter is a way to formally request that a debt collector stop contacting you about a debt. The Fair Debt Collection Practices Act (FDCPA) states that if you formally request that you no longer wish to be contacted by a collector, they must cease all further contact.

Refused Offers A creditor isn't required to negotiate a settlement offer with a debtor, according to the Federal Trade Commission, but does so at its own discretion. This applies to a collection agency as well.The agency can choose to refuse your settlement offer and instead request payment of the debt in full.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Cease and desist letters increase your chances of being sued The reaction is quite simple: when you send a cease and desist letter to a collection agency, collection attorney, or to your original creditor, you leave them only one way to effectively collect from you: filing a lawsuit.