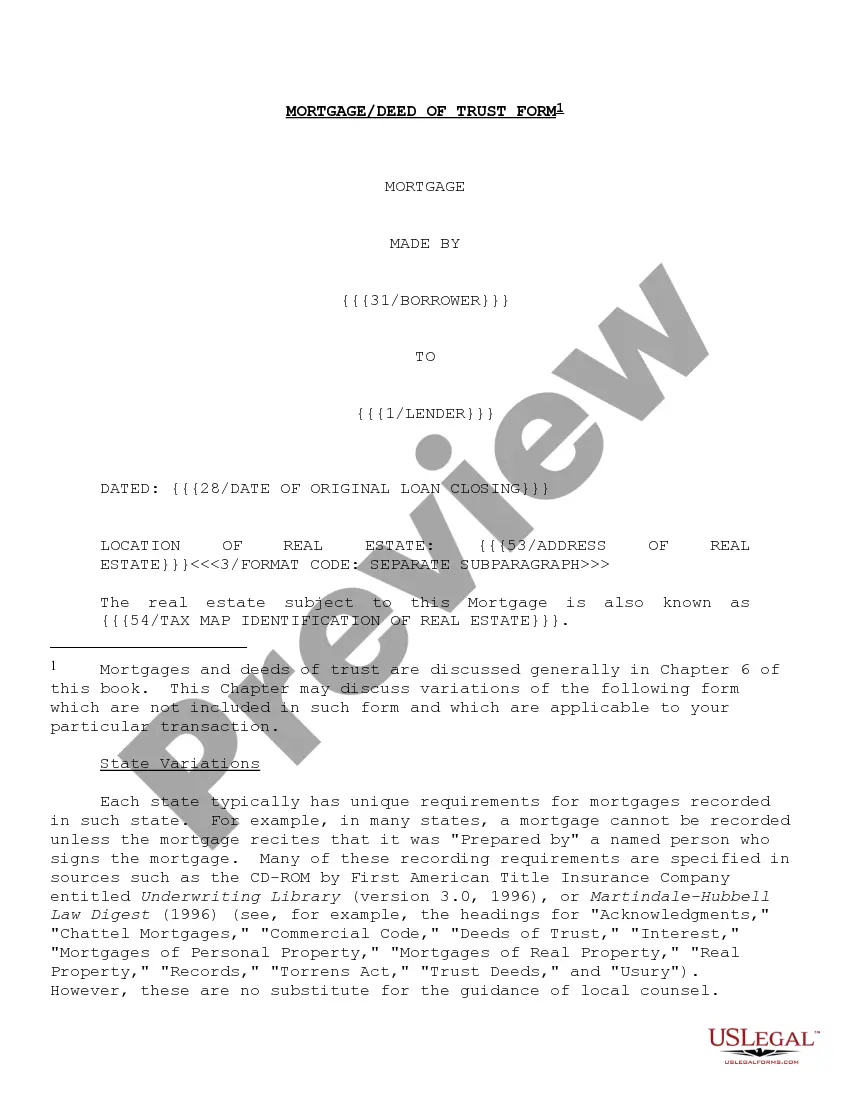

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

Form of Mortgage Deed of Trust and Variations

Description

How to fill out Form Of Mortgage Deed Of Trust And Variations?

When it comes to drafting a legal document, it’s better to leave it to the experts. Nevertheless, that doesn't mean you yourself cannot get a sample to use. That doesn't mean you yourself cannot get a sample to utilize, nevertheless. Download Form of Mortgage Deed of Trust and Variations straight from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. After you’re registered with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Form of Mortgage Deed of Trust and Variations quickly:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the suitable subscription for your requirements.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

When the Form of Mortgage Deed of Trust and Variations is downloaded you can fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

A mortgage, by definition, pledges the home as collateral for the loan. This is why mortgage lenders preferand often requirethat every borrower's name goes on the title.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

The basic difference between the mortgage as a security instrument and a Deed of Trust is that in a Deed of Trust there are three parties involved, the borrower, the lender, and a trustee, whereas in a mortgage document there are only two parties involved, the borrower and the lender.

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Power of sale and trustee's sale A deed of trust has a crucial advantage over a mortgage from the lender's point of view. If the borrower defaults on the loan, the trustee has the power to foreclose on the property on behalf of the beneficiary.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

A mortgage only involves two parties the borrower and the lender.A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid. In the event of default on the loan, the trustee is responsible for starting the foreclosure process.